-

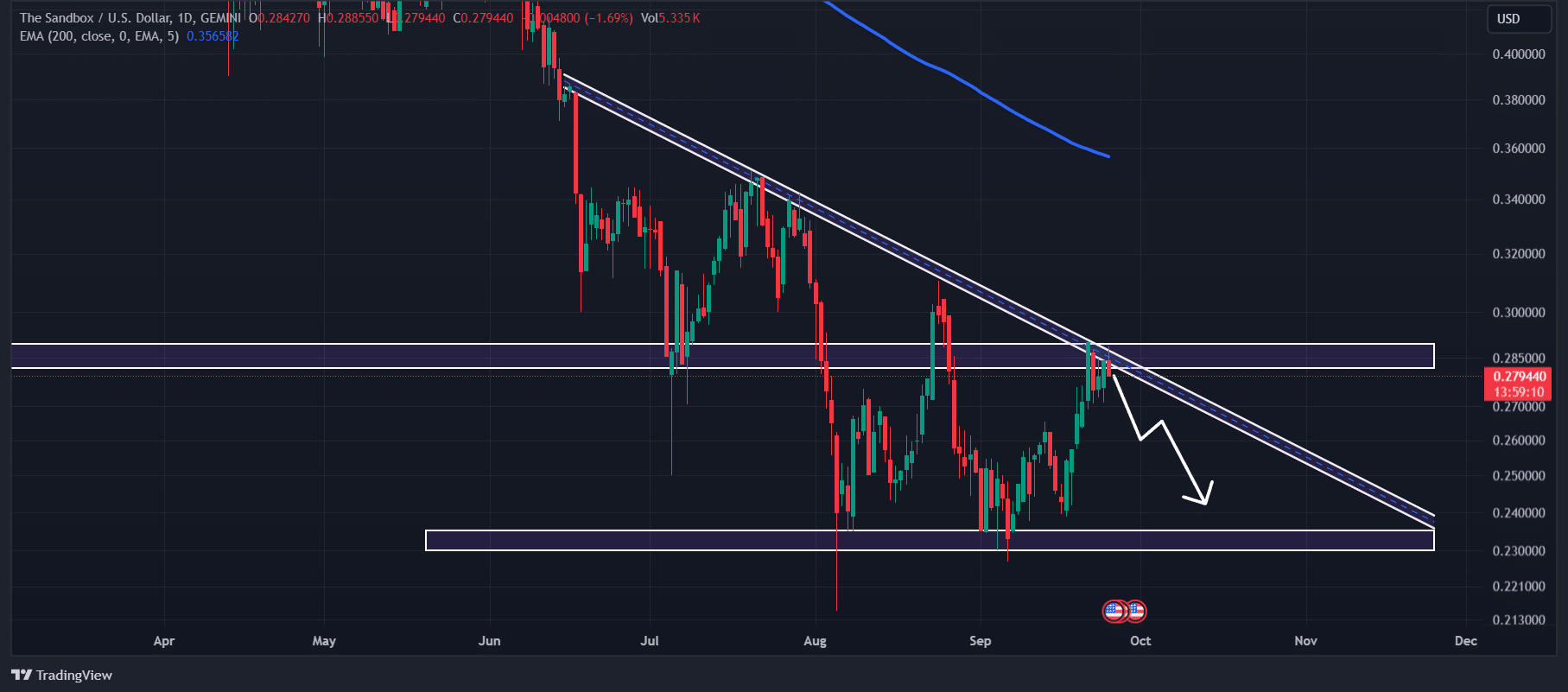

SAND could decline by 15% to reach the $0.231 level unless it breaks above the $0.29 level.

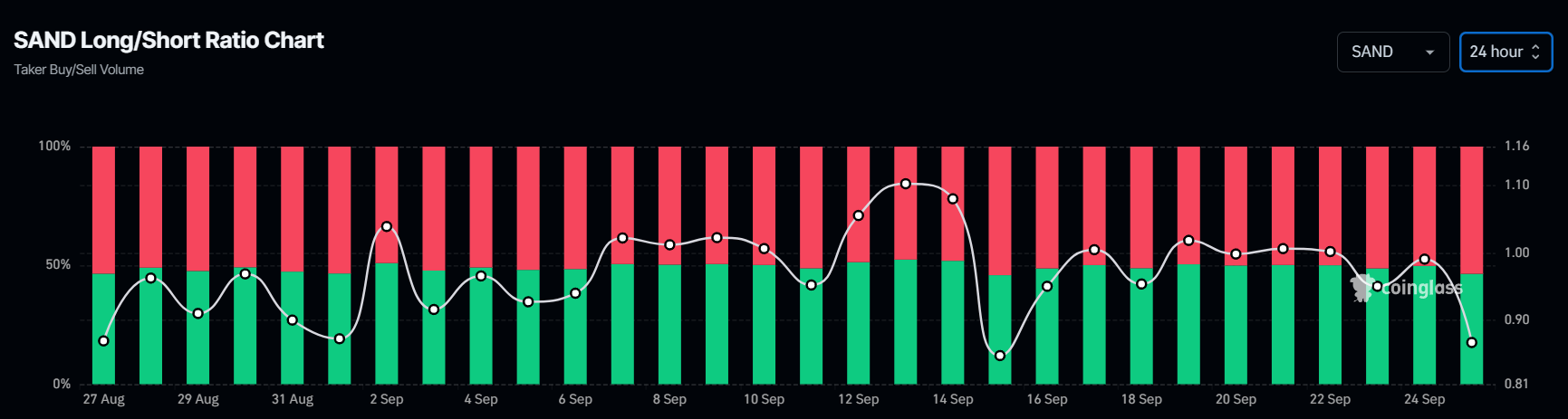

The token’s Long/Short Ratio was 0.84 at press time, indicating bearish market sentiment.

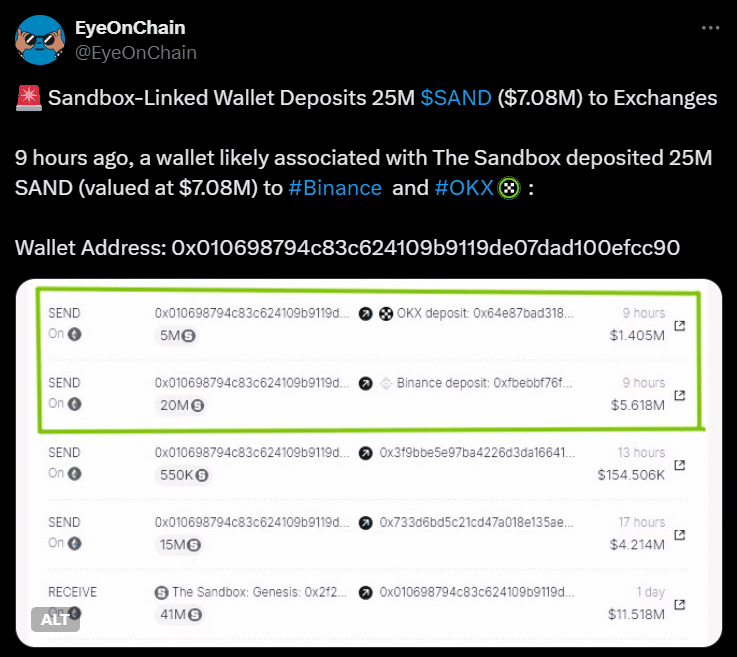

As an analyst with over a decade of experience in the cryptocurrency market, I have seen my fair share of token dumps and subsequent price declines. The recent 25M SAND dump by the wallet address “0x010” linked to The Sandbox is a clear red flag that should not be ignored.

Following some significant gains recently, The Sandbox (SAND) seems primed for a potential drop in price due to the large number of tokens being sold on centralized exchange platforms.

Wallet dumps 25M SAND

On the 25th of September, the analytical firm Eyeonchain posted on their platform (previously known as Twitter) that the wallet associated with The Sandbox (“0x010”) transferred 25 million tokens, valued at approximately $7.08 million, to Binance and OKX.

The article mentioned that this wallet was credited with approximately 41 million SAND, which equates to around $11.32 million from The Sandbox. Moreover, it appears that a substantial amount of these tokens have been transferred to cryptocurrency exchanges, suggesting a possible mass selling event.

The Sandbox: price momentum

Regardless of the substantial drop, Sandbox (SAND) hasn’t shown significant price fluctuations during the recent hours. Currently, at the moment of writing, SAND is being traded around $0.281, and it has experienced a minor 1% increase in its value over the last day.

In that same timeframe, there was a 21% increase in trading activity, suggesting more engagement from both traders and investors.

Based on AMBCrypto’s examination of technical indicators, SAND showed bearish signs at the current moment, with its price falling below the 200-day Exponential Moving Average (EMA), suggesting it was moving downward.

The 200 Exponential Moving Average (EMA) is a tool employed by traders and investors to assess whether the trend of a particular asset is going up or down.

Moreover, the value of the asset appeared poised for a turnaround at a significant resistance point of $0.288 as reported.

Given its past price trends and the recent sell-off of the token, it’s quite likely that the value of SAND may drop by approximately 15% to hit around $0.231 over the next few days.

If SAND continues trading below the $0.29 mark, its pessimistic projection is likely to persist. However, should it rise above this point, there’s a possibility that the prediction could falter.

Bearish on-chain data

The pessimistic viewpoint was reinforced by the analysis of on-chain data. At the point of this writing, the Long/Short Ratio for SAND stood at 0.84, suggesting that the majority of traders were adopting a bearish stance in the market.

Read The Sandbox’s [SAND] Price Prediction 2024–2025

Furthermore, there was a 4.2% rise in Open Interest for its Futures within the last 24 hours, suggesting that traders are placing more bets on short positions rather than long ones, indicating a bearish sentiment.

As I currently analyze market trends, it appears that approximately 54.14% of leading traders have adopted a ‘short’ position strategy, whereas around 45.86% are holding ‘long’ positions. This implies that ‘bears’, or those anticipating a price decrease, seem to be in the majority at this moment. Consequently, there could potentially be increased selling pressure on the asset over the coming days.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- SOL PREDICTION. SOL cryptocurrency

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- Despite Bitcoin’s $64K surprise, some major concerns persist

2024-09-25 22:15