- The Bitcoin Golden Cross could signal an opportunity for a breakout to $65K.

- However, several conditions need to align for this cross to materialize in the long term.

As a seasoned researcher with years of experience navigating the complex and volatile world of cryptocurrencies, I’ve seen my fair share of bull runs and bear markets. The recent Bitcoin price action has me intrigued, to say the least. The Golden Cross is indeed a promising signal, but it needs more than just a cosmic alignment to materialize in the long term.

After a week of persistent efforts, Bitcoin (BTC) optimists have managed to push past the resistive bearish pressure and reached a peak of $64,825 for the day.

As someone who has closely followed the cryptocurrency market for several years now, I can attest that the recent price movements of Bitcoin have been particularly intriguing. In March, when it reached an all-time high (ATH) of $73K, many investors were optimistic about a potential breakout to even higher levels. However, my personal experience has taught me that the market is unpredictable and can change direction swiftly. This was evident in August when bears reasserted their dominance, preventing Bitcoin from reaching its predicted target of $68K. As I continue to monitor the market closely, I am eager to see how this dynamic plays out in the coming months.

Currently, Bitcoin is valued at $63,687 following another unsuccessful effort to maintain its support. What could potentially disrupt this pattern and lead to a break in the cycle?

Bitcoin Golden Cross needs long term assurance

On the daily price chart, Bitcoin’s 50-DMA has crossed above the 200-DMA, signaling a Golden Cross.

Historically speaking, this pattern has consistently served as a dependable indicator for predicting Bitcoin’s price movements. When the short-term average line goes over the long-term one, it frequently suggests a powerful surge in value.

During the final week of August, the short Moving Average almost touched the long Moving Average, suggesting a possible surge in bull market.

Instead, as short positions saw a revival, the crossover failed to occur, resulting in a significant reversal and a retreat back to the $55K support level.

If a comparable situation arises again, there’s a possibility that the trend might switch to a Death Cross, indicating a potential downturn in the market. So, what factors might need adjustment to prevent this bearish forecast?

Turning down BTC short control is crucial

Generally speaking, traders usually view a Golden Cross as an indication to buy, anticipating potential increases in the asset’s price.

Considering this perspective, AMBCrypto examined the speculative market to determine if traders were strategically arranging their positions to profit from the cross.

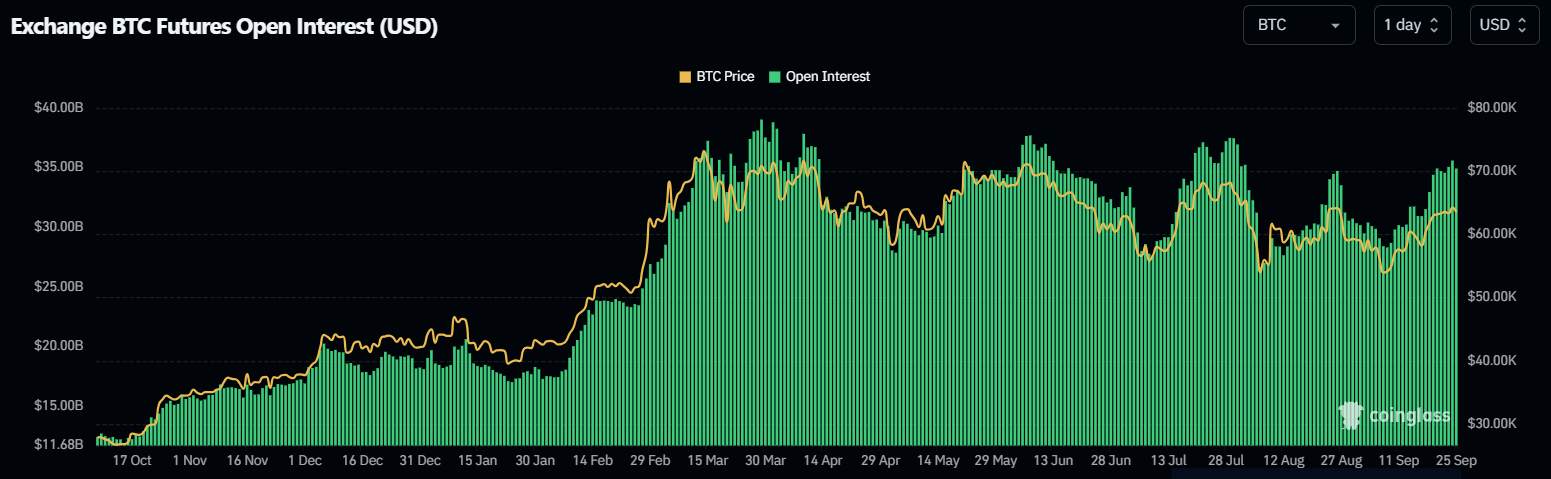

Typically, when Open Interest (OI) increases, it often happens at the same time as Bitcoin approaching important resistance points.

In simpler terms, each high point is marked by an increase in futures investors buying Bitcoin (going long), but this trend often concludes with them selling off their positions, leading to a significant drop in Bitcoin’s value.

Interestingly, although Oil’s peak patterns resemble those of the market, Bitcoin’s price hasn’t echoed this trend. This discrepancy might suggest that there could be a renewed dominance of short positions in the market.

On the fifth straight day, Bitcoin enthusiasts have been trying to drive BTC prices beyond $65,000, and there’s been a notable rise in long-term investment positions.

If the current brief market control continues, prolonged selling might lead to another market drop, possibly causing Bitcoin’s price to fall below $60K again before a new rally emerges.

THIS adjustment can make a difference

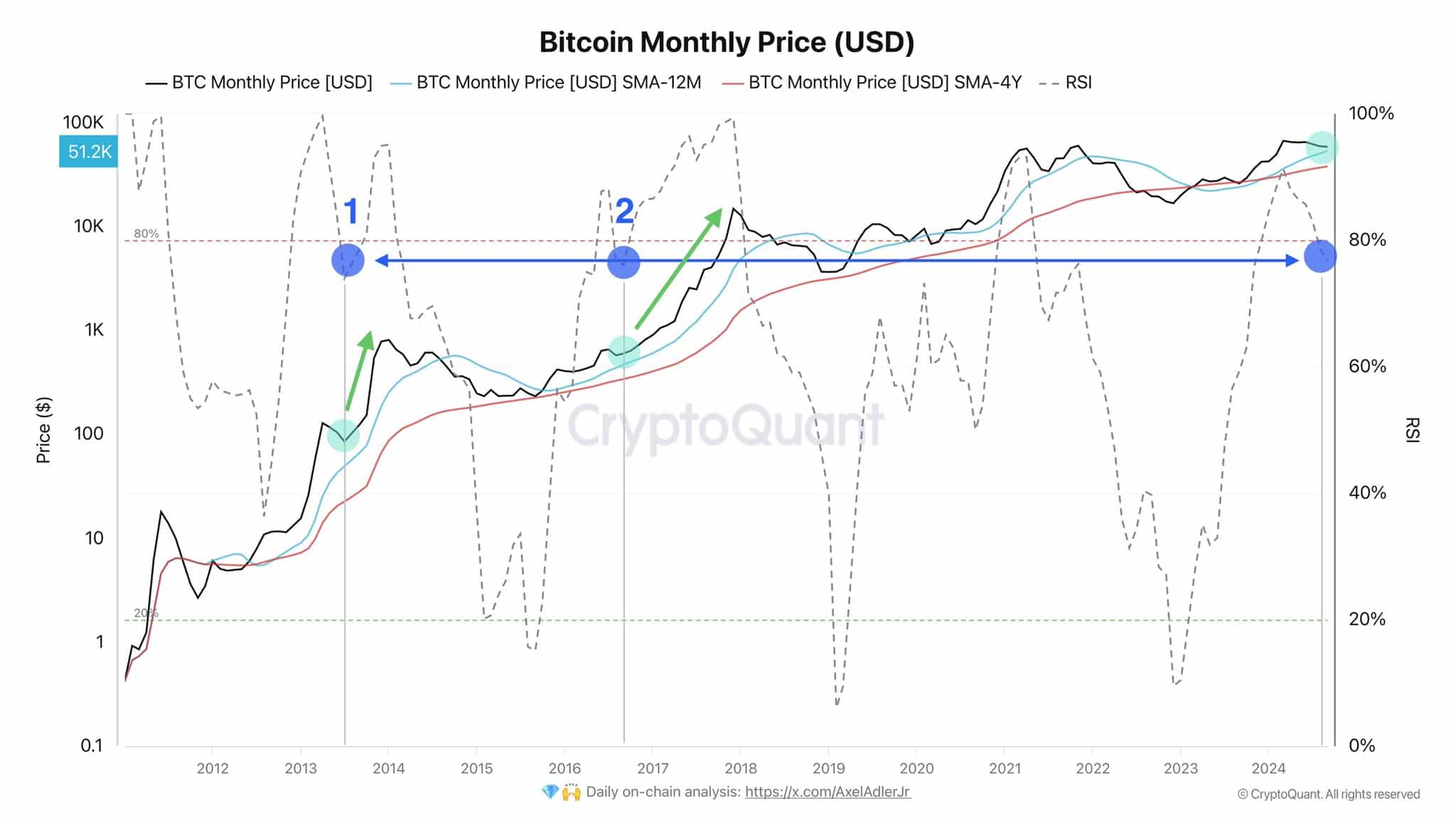

Looking at a monthly perspective, the Relative Strength Index (RSI) has dropped below 80%, indicating potential signs of a temporary price reduction in Bitcoin. According to AMBCrypto’s analysis, this could be due to the market being oversold, which typically triggers renewed buying interest.

Source : CryptoQuant

historically, during bullish market phases, significant decreases in the RSI (Relative Strength Index) have often signaled potential opportunities for price increases, encouraging investors to take advantage of what appear to be discounted assets.

Read Bitcoin’s [BTC] Price Prediction 2024-25

In simpler terms, having a decrease of at least 10% in Open Interest (OI) could help bring about the Golden Cross more quickly, but for long-term resilience, it’s crucial that the market reduces its Open Interest for Bitcoin. This reduction would make Bitcoin less vulnerable to manipulation through short control.

In the near future, it’s not likely that Bitcoin will quickly surpass $65K, even if it stays above $64K for a while.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-09-26 01:12