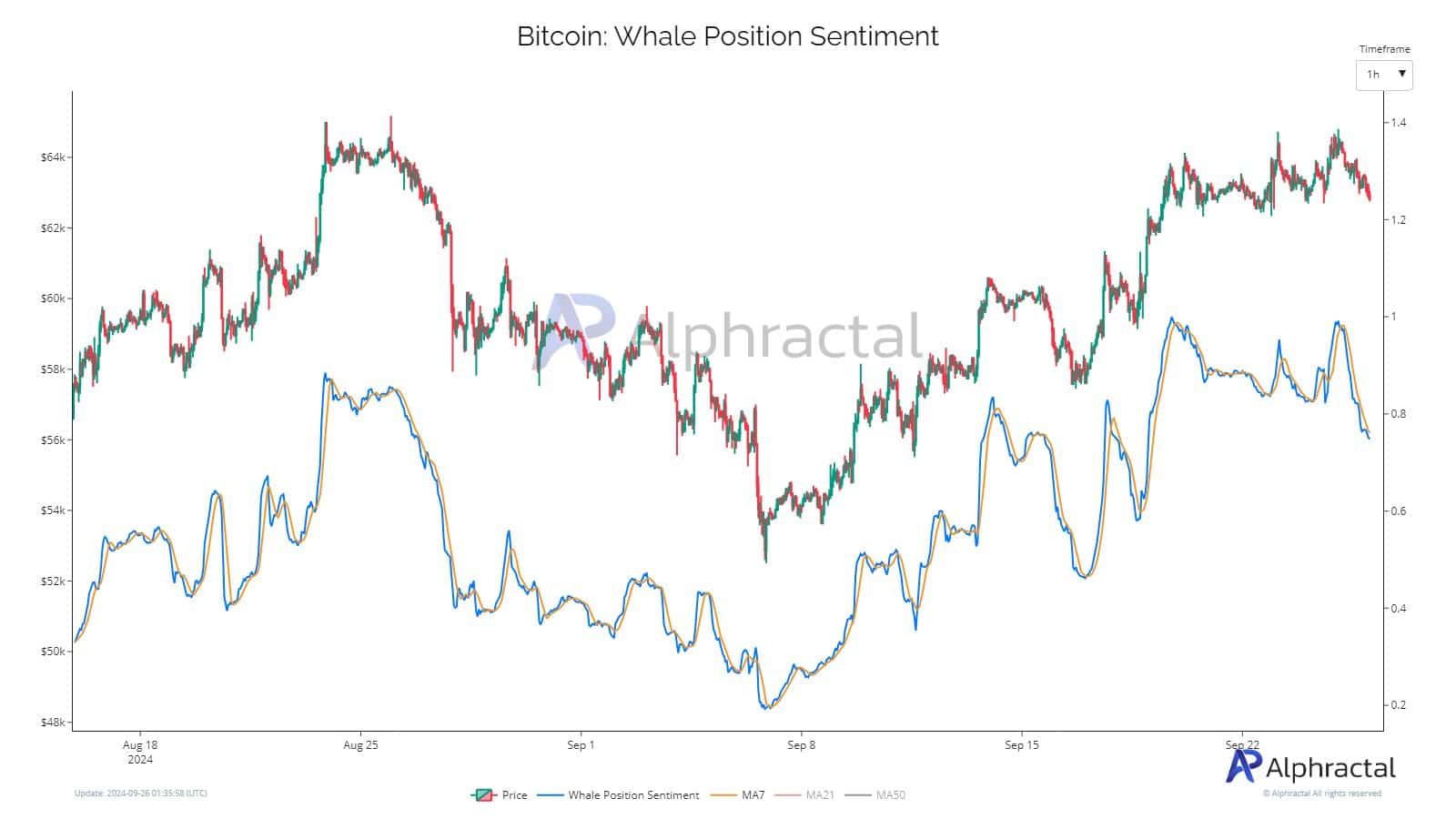

- Bitcoin whales resumed shorting as price approached $65K.

- The bot tracker indicator says there is increased buy-side bot activity.

As a seasoned analyst with years of experience navigating the volatile world of cryptocurrencies, I find myself cautiously optimistic about Bitcoin’s current position. While whales resuming short positions as BTC neared $65K has sparked some concerns, I see potential in the overall market structure.

The market closely follows the fluctuations in the value of Bitcoin (BTC), being the largest cryptocurrency, since its movements have a significant impact on the general performance of the entire crypto market.

Over the past few days, I’ve noticed a trend among whale traders – they’ve begun to take short positions on Bitcoin when it approached $65K. This action has stirred some apprehension within the crypto community, as it suggests that these large investors anticipate a possible decline before any substantial increase might occur.

The Whale Position Sentiment, which monitors the behavior of large investors (whales) in different trading platforms, has recently displayed a decline, suggesting an increase in short positions. Historically, this change in sentiment tends to have a significant impact on Bitcoin’s market trends.

As a researcher studying Bitcoin dynamics, I understand that for the cryptocurrency to maintain its bullish momentum and steer clear of bearish territory, it is crucial that it holds steadfastly above the Short-Term Holder Realized Price – specifically, $62K. This significant level acts as a vital benchmark, signaling the persistence of the current trend.

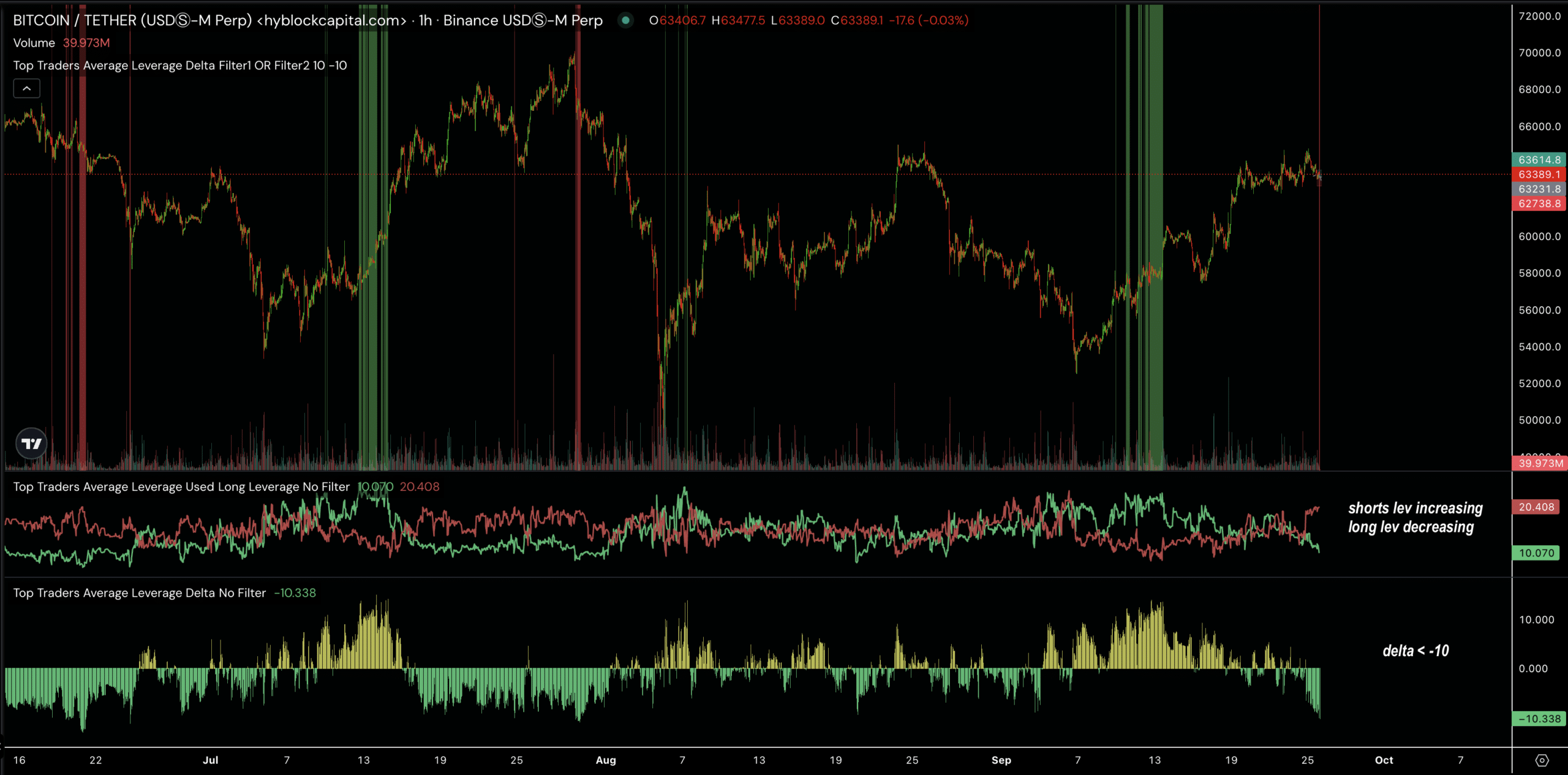

Average leverage delta

The decrease in positive feelings towards whales (significant investors) has led to a decline in Bitcoin’s average difference between the amount of long (buy) and short (sell) positions held by these whales, causing it to fall below -10. This indicates that currently, short (selling) positions are more prevalent in the market compared to the previous situation where long positions were dominant.

Despite the movement of whale positions, the average leverage delta isn’t signaling a bearish trend quite yet. Bitcoin remains stable above the $63K mark, reinforcing its position at the 200 exponential moving average.

Even with whale activity, it’s possible that Bitcoin could continue to rise under specific circumstances…

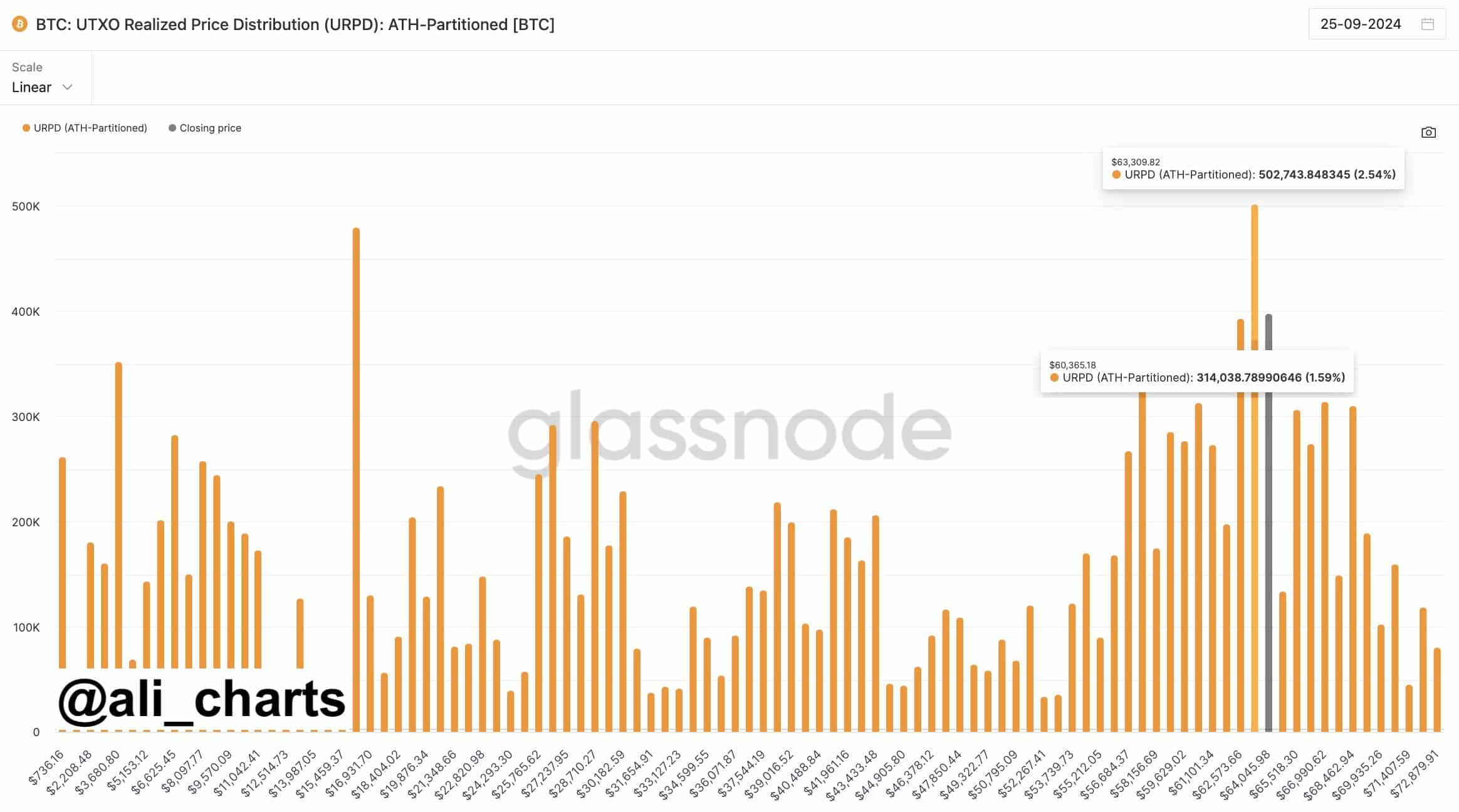

UTXO realized price distribution

One key sign pointing towards Bitcoin’s future trend is the UTXO Realized Price Distribution (URPD), which highlights that the $63,000 region stands as a significant support area. Notably, this area encompasses the $65,000 barrier as a potential resistance level.

Should Bitcoin sustain its position above $63,000, there’s a possibility it may surge past $65,000. On the flip side, if Bitcoin falls below this crucial support level, a downturn towards $60,000 could occur before any further rise takes place. The market is closely monitoring this area to predict Bitcoin’s future trajectory.

Bitcoin bot tracker indicator

Additionally strengthening the optimistic perspective on Bitcoin is the Bot Accumulation Indicator. This instrument monitors high-speed trading behavior akin to bots in the market, suggesting that these automated systems are building up long positions.

Boosts in trading bot activity on the buy-side tend to coincide with price increases. If Bitcoin dips slightly to $60,000, this could lure bigger investors to purchase at reduced prices, which might propel BTC back up to around $65,000, potentially yielding substantial profits for major holders.

Although whales are once more selling Bitcoin when it approaches $65,000, the broader market setup stays solid. If Bitcoin maintains its position above crucial points like $62,000 and $63,000, further profits could be on the horizon.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Based on the behavior of bots and other on-chain signs, it seems we’re looking at a positive perspective for Bitcoin’s market trend. This suggests that any temporary price drops might not last long before Bitcoin resumes its upward trajectory again.

Pay attention to these vital points of potential price fluctuations (support and resistance levels) to help predict the market’s future actions more accurately.

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- Sea of Thieves Season 15: New Megalodons, Wildlife, and More!

- PI PREDICTION. PI cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- McDonald’s Japan Confirms Hatsune Miku Collab for “Miku Day”

- Buckle Up! Metaplanet’s Bitcoin Adventure Hits New Heights 🎢💰

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- PGA Tour 2K25 – Everything You Need to Know

2024-09-26 15:04