- Long-term holders transitioning due to spot ETFs may indicate Bitcoin’s maturation and reduced volatility.

- Whale transactions are increasing, but new addresses remain stable, suggesting cautious market sentiment.

As a seasoned crypto investor with over a decade of experience in this wild and unpredictable market, I must say that the recent trends in Bitcoin (BTC) are quite intriguing. The fact that long-term holders are transitioning due to Spot ETFs suggests a maturation process for Bitcoin, which is a positive sign for those of us who believe in its potential as a store of value and a disruptor of traditional finance.

After an exhilarating leap beyond $64,000 last week due to the U.S. Federal Reserve’s rate cut announcement, I’ve noticed that my Bitcoin [BTC] investment has since found a steady ground around the $63,000 mark. Over the past few days, its value has been dancing within a narrow range, offering me some respite after the initial surge.

At the moment I’m observing, Bitcoin is roughly valued at around $63,728, representing a minor decrease of 0.1% over the past 24 hours. Instead of experiencing significant fluctuations, the price seems to be stabilizing or consolidating.

Bitcoin’s maturation and price stability

According to CryptoQuant’s latest findings, the evolving holding patterns among Bitcoin investors seem to be having a substantial impact on the direction of its market fluctuations.

According to Crypto Season Analyst, it appears that long-term Bitcoin investors are slowly transferring their holdings to other owners as they realize their profits, following the launch of Bitcoin Spot Exchange-Traded Funds (ETFs).

As per the report, part of this transition could be due to past Grayscale investors shifting towards Spot ETFs for their lower fees. These recent holders, who have exceeded the significant 155-day holding requirement, are now recognized as long-term investors.

As a researcher examining Bitcoin’s market trends, I’ve observed that moving from short-term to long-term holding has historically led to significant price fluctuations in Bitcoin. Yet, the increasing impact of Spot ETFs and their incorporation into conventional financial tools appears to exert a calming influence on Bitcoin’s volatility, suggesting a potential shift towards greater stability in its market dynamics.

According to Mevsimi’s examination, the continuous rise in long-term supply and concurrent fall in short-term supply indicate a shifting market dynamic. The price stability indicates that Bitcoin is maturing as an investment, demonstrating less volatility than it did in its initial stages.

As an analyst, I foresee that as Bitcoin exhibits more stability and lessens its price volatility, it could potentially draw in increased institutional investment. The ongoing maturation of Bitcoin points towards a possibility where this digital currency becomes more deeply ingrained within the global economy, making it more appealing to a wider spectrum of investors who are inclined towards assets offering greater stability and predictability.

Bitcoin fundamental outlook

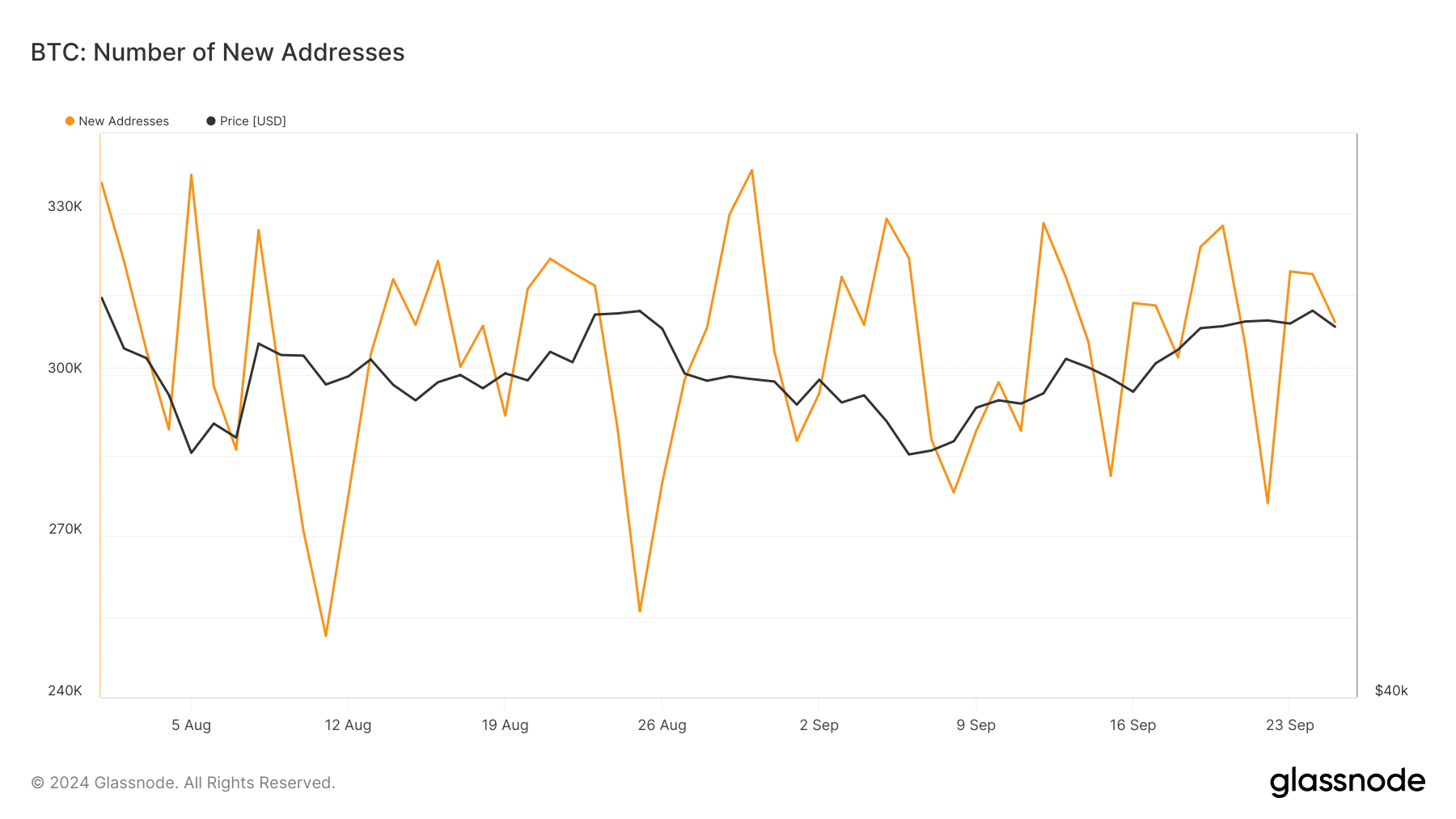

Despite this trend towards maturity, examining Bitcoin’s fundamental metrics is crucial in understanding its current and future potential. One such key metric is the number of new addresses.

According to Glassnode’s data, the creation of new Bitcoin wallets has stayed fairly steady over the last month, fluctuating between approximately 250,000 and 390,000 new accounts.

A consistent pattern in creating new addresses generally suggests a solid user base. However, if there’s no substantial increase, it might mean that investors’ excitement hasn’t led to a surge of new market entrants just yet.

It’s possible that even though there might be expectations of an upward trend in the next quarter for Bitcoin, it seems that potential investors are showing more caution and hesitation instead.

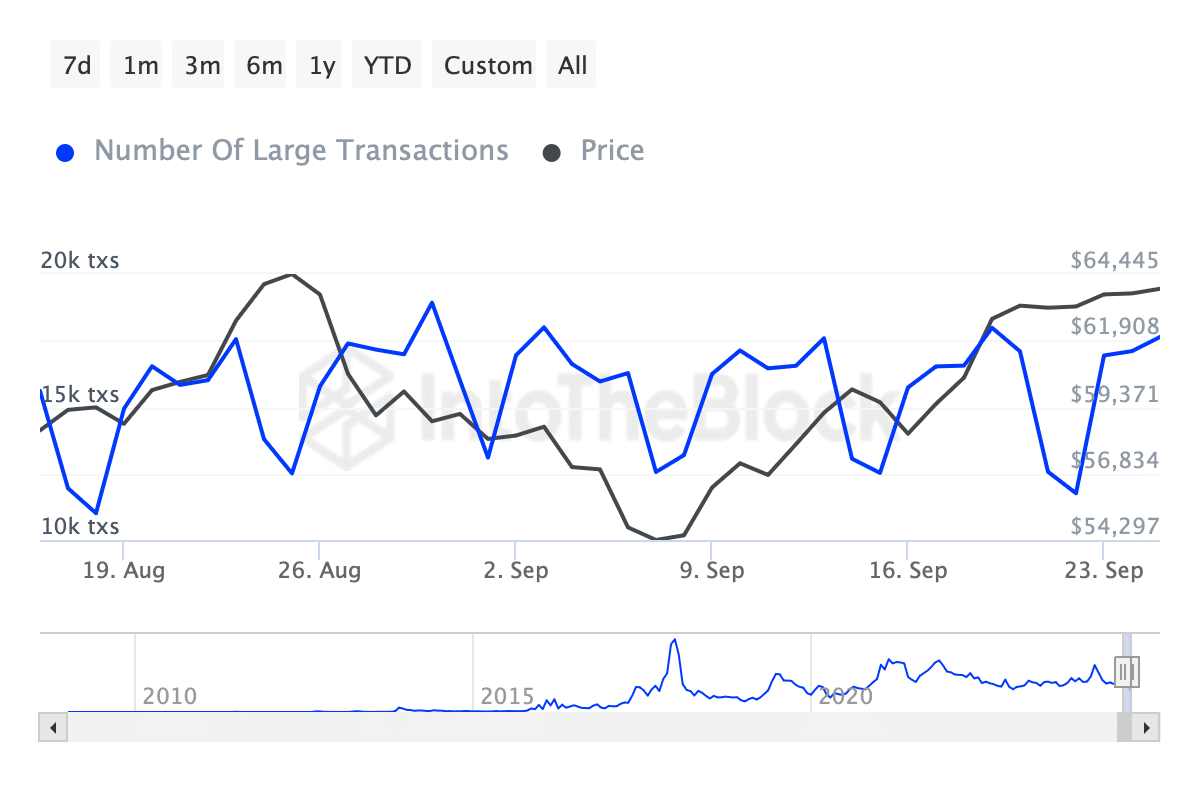

Although the increase in new addresses has leveled off, there’s been a significant rise in large transactions, specifically those exceeding $100,000.

Based on information from IntoTheBlock, the number of whale transactions has risen significantly over the past month, climbing from about 11,000 to more than 17,000. This surge may indicate a rise in activity among large-scale investors or wealthy individuals, which could potentially impact market trends and contribute to an upward trend (bullish momentum).

Read Bitcoin’s [BTC] Price Prediction 2024–2025

More frequent whale transactions usually suggest a rising curiosity among individuals who tend to exert considerable impact on market trends.

Time will tell if this pattern continues to boost prices, or if it’s a sign of long-term investors cashing out.

Read More

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- WCT PREDICTION. WCT cryptocurrency

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- New Mickey 17 Trailer Highlights Robert Pattinson in the Sci-Fi “Masterpiece”

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Studio Ghibli Creates Live-Action Anime Adaptation For Theme Park’s Anniversary: Watch

- Sea of Thieves Season 15: New Megalodons, Wildlife, and More!

2024-09-26 19:36