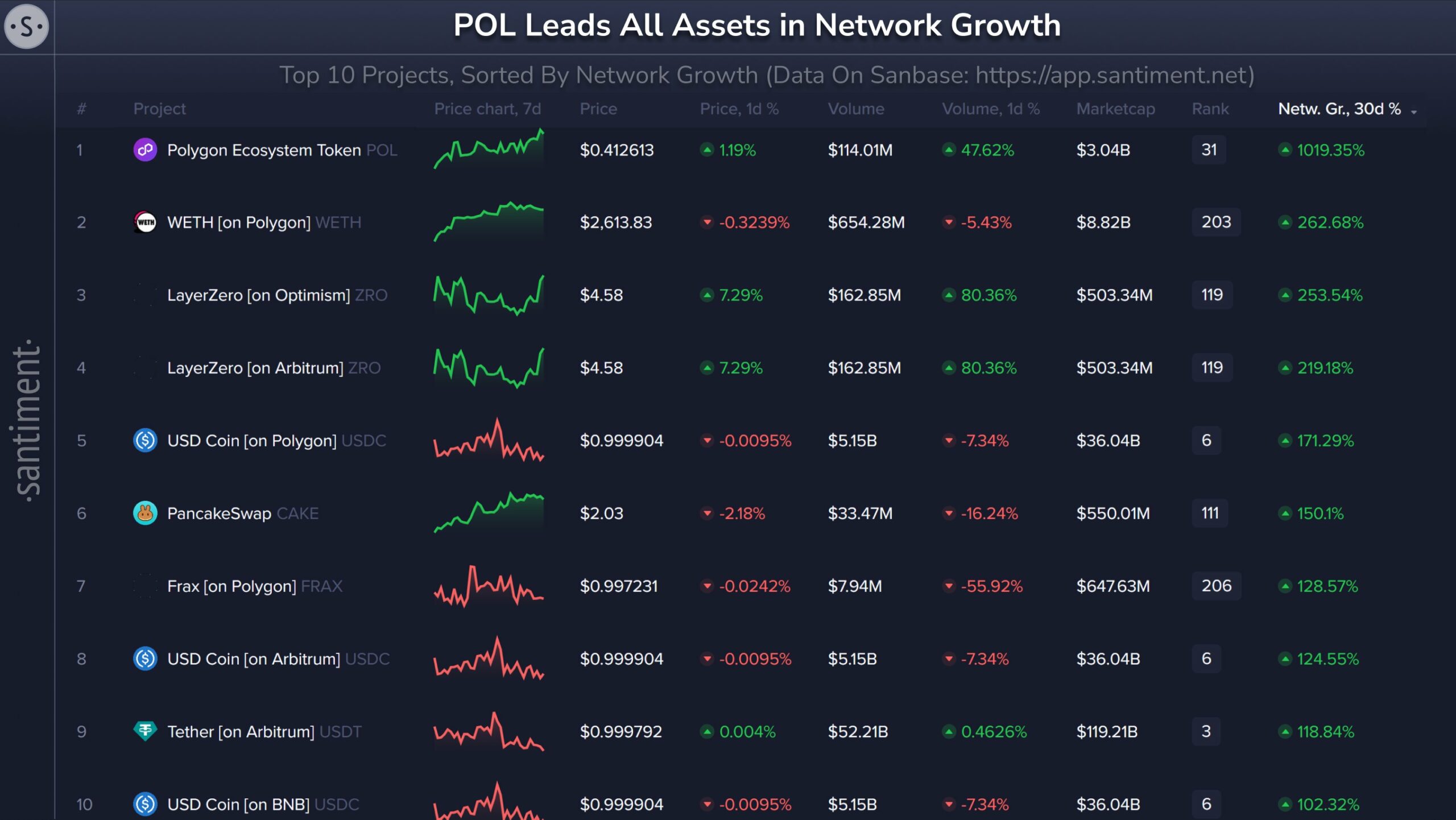

- Polygon leads all assets in network growth over the past 30 days.

- Polygon’s transaction count stands at 2.61 million, with a trading volume of $80 million in the last 24 hours.

As a seasoned crypto investor with a knack for spotting promising opportunities, I can confidently say that Polygon (POL) is currently one of the most exciting projects in the blockchain space. Having closely followed its journey since the MATIC days, witnessing the smooth transition to POL and the subsequent surge in network growth has been nothing short of impressive.

Lately, the digital asset Polygon (POL) switched over from Matic, and the transition went off without a hitch. During this process, Matic tokens were swapped for an equal amount of POL tokens. This swap guaranteed that investors kept the same worth in their portfolios without experiencing any losses.

Over the past 30 days, Polygon has been at the forefront of asset expansion, exhibiting a remarkable 1,019% surge in newly created addresses.

Over the past period, there was a significant increase in Wrapped Ethereum (WETH) on Polygon by 263%, LayerZero (ZRO) on Optimism experienced a growth of 254%, LayerZero saw an increase of 219% on Arbitrum, and USD Coin witnessed a rise of 171% on Polygon.

These statistics highlight that Polygon not only dominates on its own network but also in cross-chain performance. Historically, rising network growth is an indicator of increased utility, which boosts the long-term market cap potential for projects.

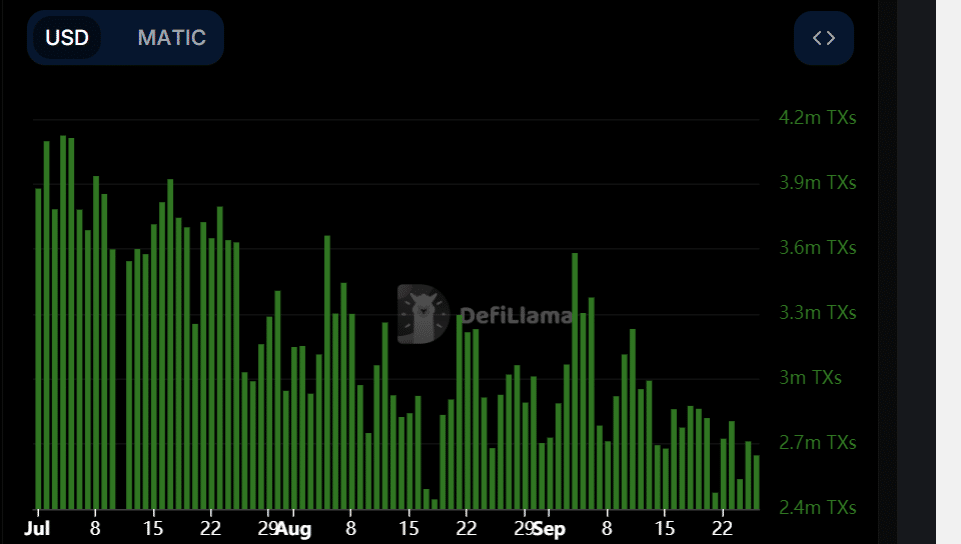

Polygon transaction count

Since the recent ecosystem update, there’s been a significant increase in the number of transactions on the Polygon network. Since July, this high transaction volume has remained consistent, albeit with slight decreases observed around mid-August.

Despite some potential challenges or setbacks, Polygon’s performance indicators remain robust. According to the most recent data from DefiLlama, Polygon has executed over 2.61 million transactions in the past day, with a trading volume of approximately $80 million.

Over the specified timeframe, approximately $660 million worth of POL tokens flowed in, and the number of active addresses swelled to 526,000. Moreover, the Total Value Locked (TVL) within the Polygon system climbed up to a staggering $1.08 billion, demonstrating heightened activity and interaction within its environment.

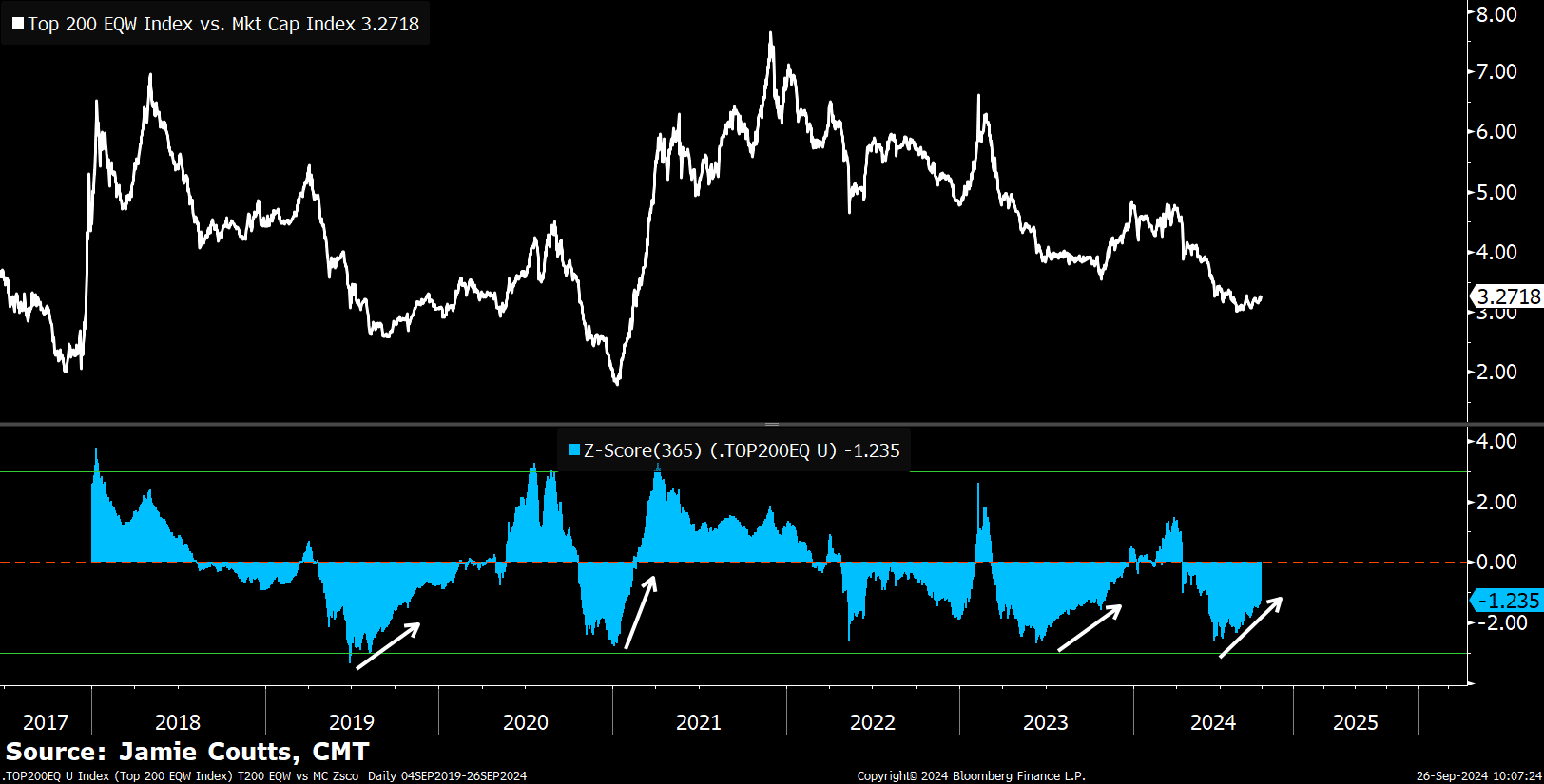

Crypto market breadth improving…

It appears that the wider cryptocurrency sector is exhibiting positive trends as well. The comparison between the Crypto Top 200 index and the Equal Weight index has been useful in gauging market sentiment.

In July, this index showed a very pessimistic view towards altcoins, but it’s currently climbing up in tandem with global liquidity levels. Precedently, similar pattern changes have been associated with robust phases in the cryptocurrency market.

Due to the fast expansion within the Polygon network and its increasing dominance in the market, it presents an excellent opportunity for long-term profits.

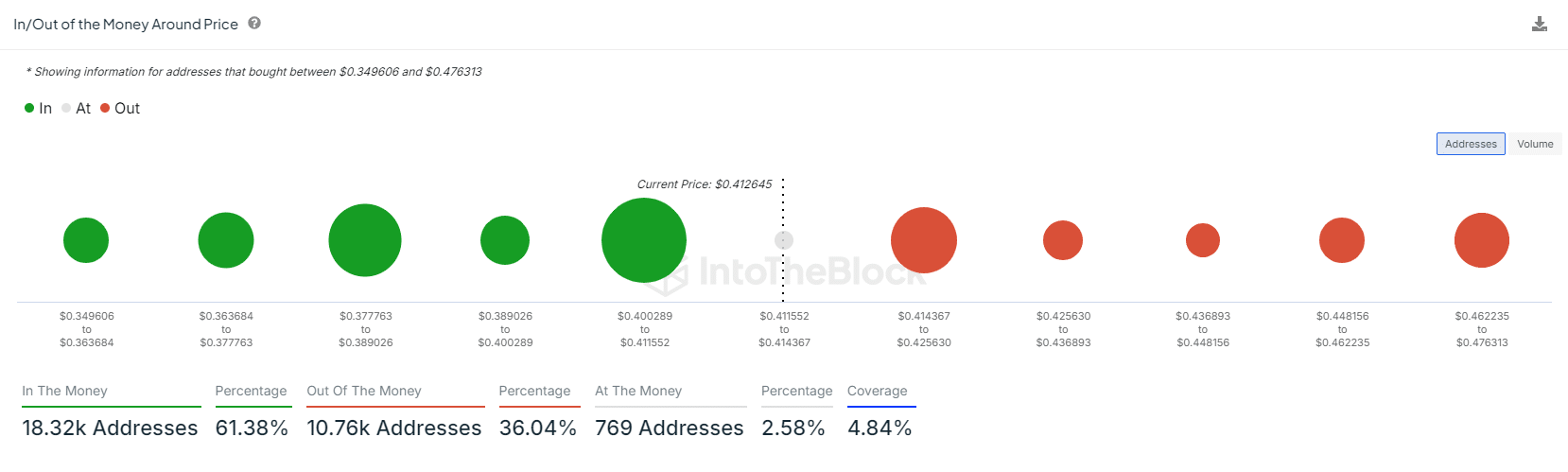

In/out of the money around price

When examining the “in-the-money” or “near the money” criterion, data shows that a significant number of profitable wallets are found in this price range. Specifically, about 7,030 wallets lie between $0.4002 and $0.4116.

Approximately two-thirds (66.42%) of Pol address holders currently have their investment in profit, equating to about 18,320 individual addresses. Conversely, a little over one-third (33.56%) of the addresses, which translates to around 10,760 addresses, are experiencing losses. Additionally, approximately 2.58% of the addresses, or roughly 769 addresses, are neither in profit nor loss.

The data suggests that Polygon’s future outlook is robust, as numerous holders are currently reaping benefits from its price levels. This implies a firm base for potential future expansion.

Given the proper alignment of these key performance indicators, Polygon (POL) appears poised for an upward trend in its pricing. This optimistic outlook is bolstered by accelerated network expansion, heightened transaction activity, and a promising long-term investment prospect.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Gold Rate Forecast

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- New Mickey 17 Trailer Highlights Robert Pattinson in the Sci-Fi “Masterpiece”

2024-09-26 21:11