-

New Bitcoin investors are showing more resilience compared to past bearish trend.

New Bitcoin investors are sitting on minimal losses as BTC holds levels above $60,000.

As a seasoned researcher with years of experience tracking Bitcoin’s market trends, I find it fascinating to observe the resilience and confidence demonstrated by new Bitcoin investors. Compared to past bearish trends, these newcomers seem more unfazed by market volatility, perhaps due to their minimal losses as BTC holds steady above $60,000.

Bitcoin [BTC] has bounced back significantly following the U.S. Federal Reserve’s decision to lower interest rates by 0.5%.

Just now, Bitcoin surged to hit a new peak in over a month above $64,000. Although it has currently dipped slightly to trade at $63,685 as we speak, positive indications about further growth remain evident.

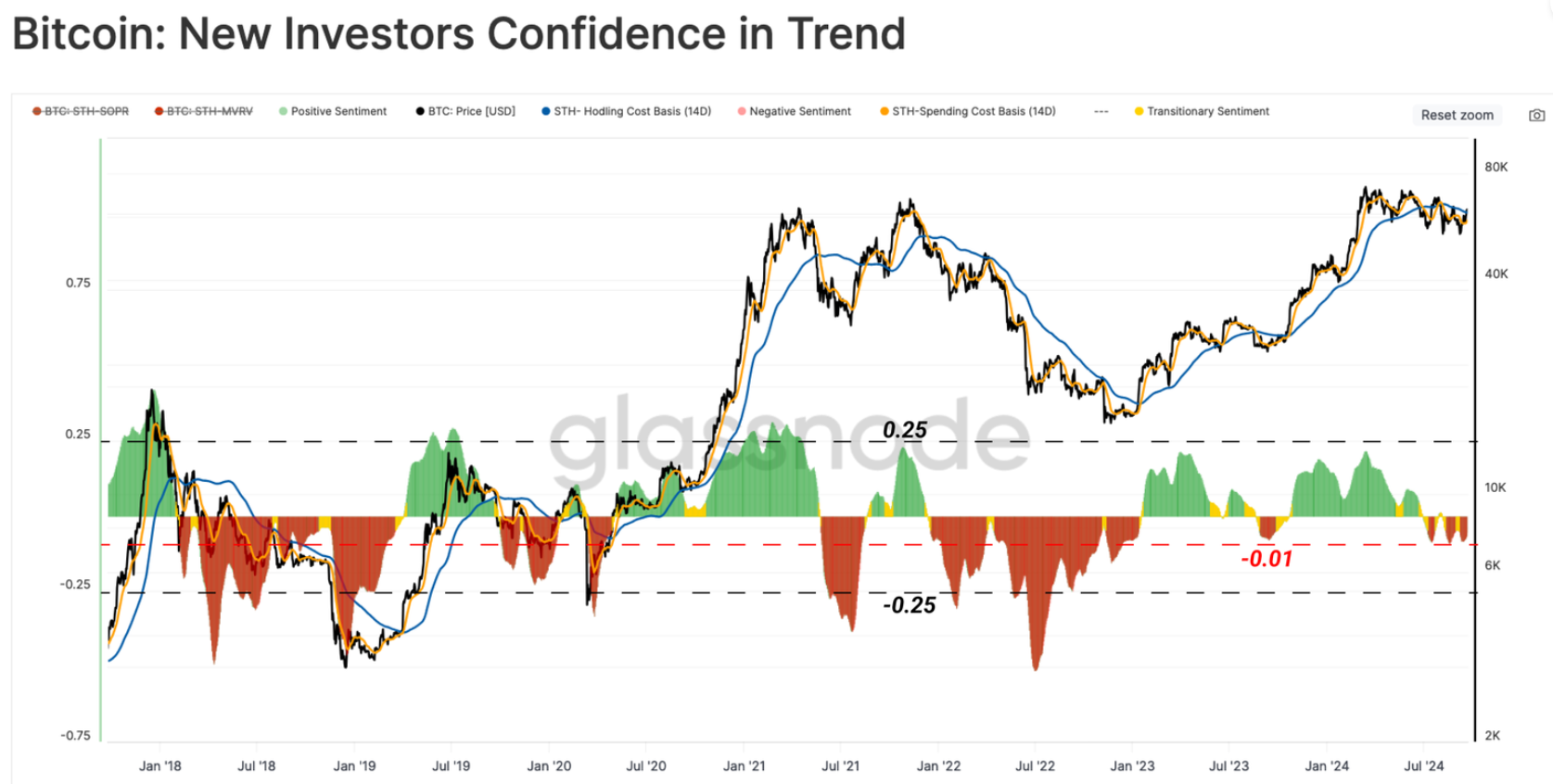

According to Glassnode, those who purchased Bitcoin within the last 155 days appear to have more “toughness” or ability to withstand market fluctuations compared to previous market trends.

New Bitcoin investor behavior

Quick-turn Bitcoin investors often lead to short-term price fluctuations because they’re quick to respond to changes in market prices.

Over the past five months, Bitcoin’s price has fluctuated from around $71,000 to as low as $49,000, indicating that many new investors who bought at higher prices may now be experiencing losses.

Based on the Investor Confidence in Trend indicator by Glassnode, short-term investors appear more confident than usual and seem to be deviating from their past behavior of panicking during downturns.

The change in feelings toward this matter may be due to the fact that the extent of losses experienced by this particular group has been comparatively minimal.

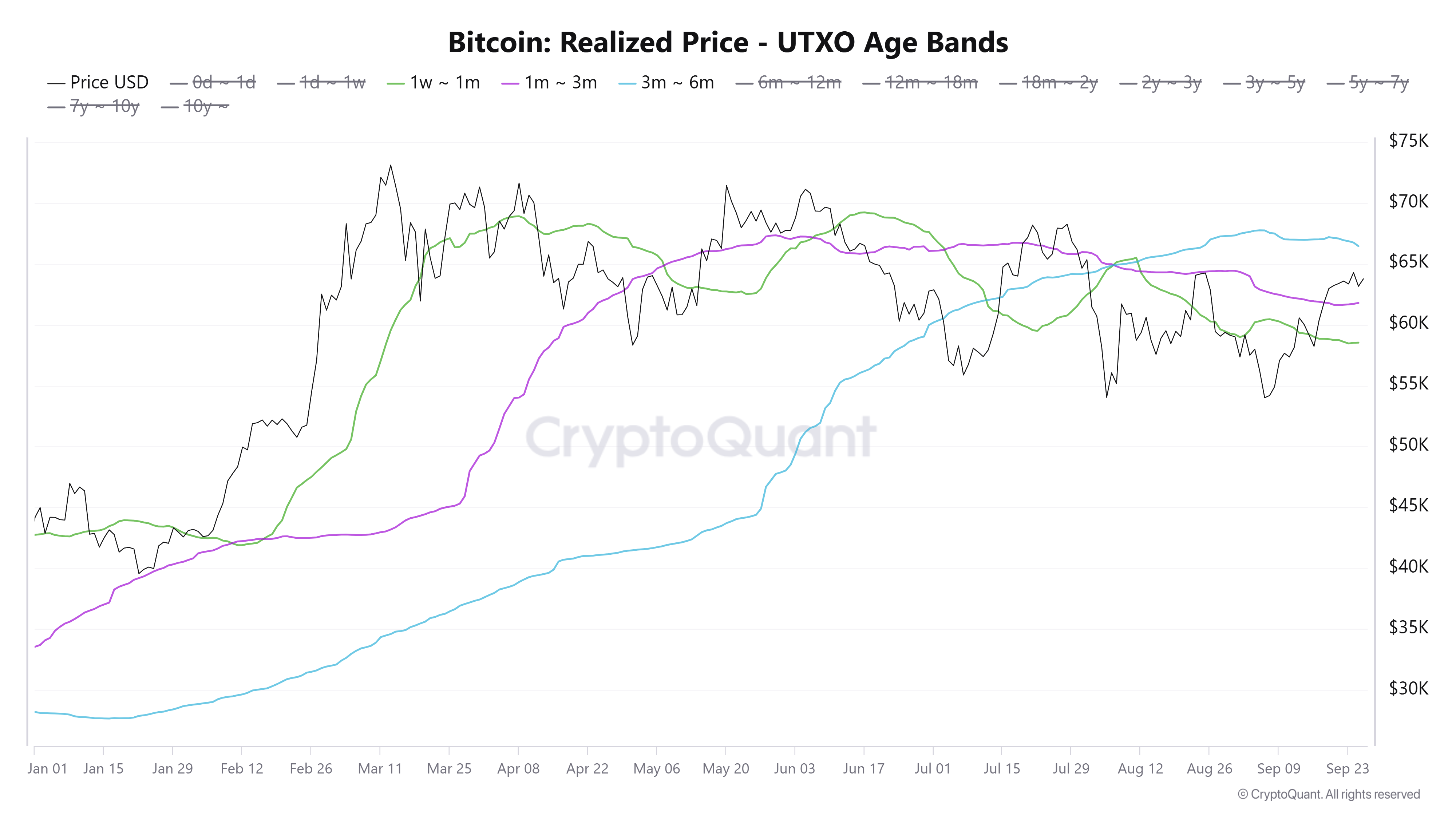

Analyzing the Bitcoin Realized Price Based on Holding Periods on CryptoQuant reveals that investors who bought Bitcoin within a span of 3 months have been selling at higher prices compared to what they initially paid, ever since the price surpassed $61,000.

Furthermore, individuals who’ve owned Bitcoin for around 3 to 6 months will recoup their initial investment when the value surpasses $66,500, suggesting a limited loss for short-term investors based on this information.

According to a previous study by AMBCrypto, the profitability of those holding Bitcoin for a shorter period might play a crucial role in pushing its price beyond $70,000.

Shift in the Futures market

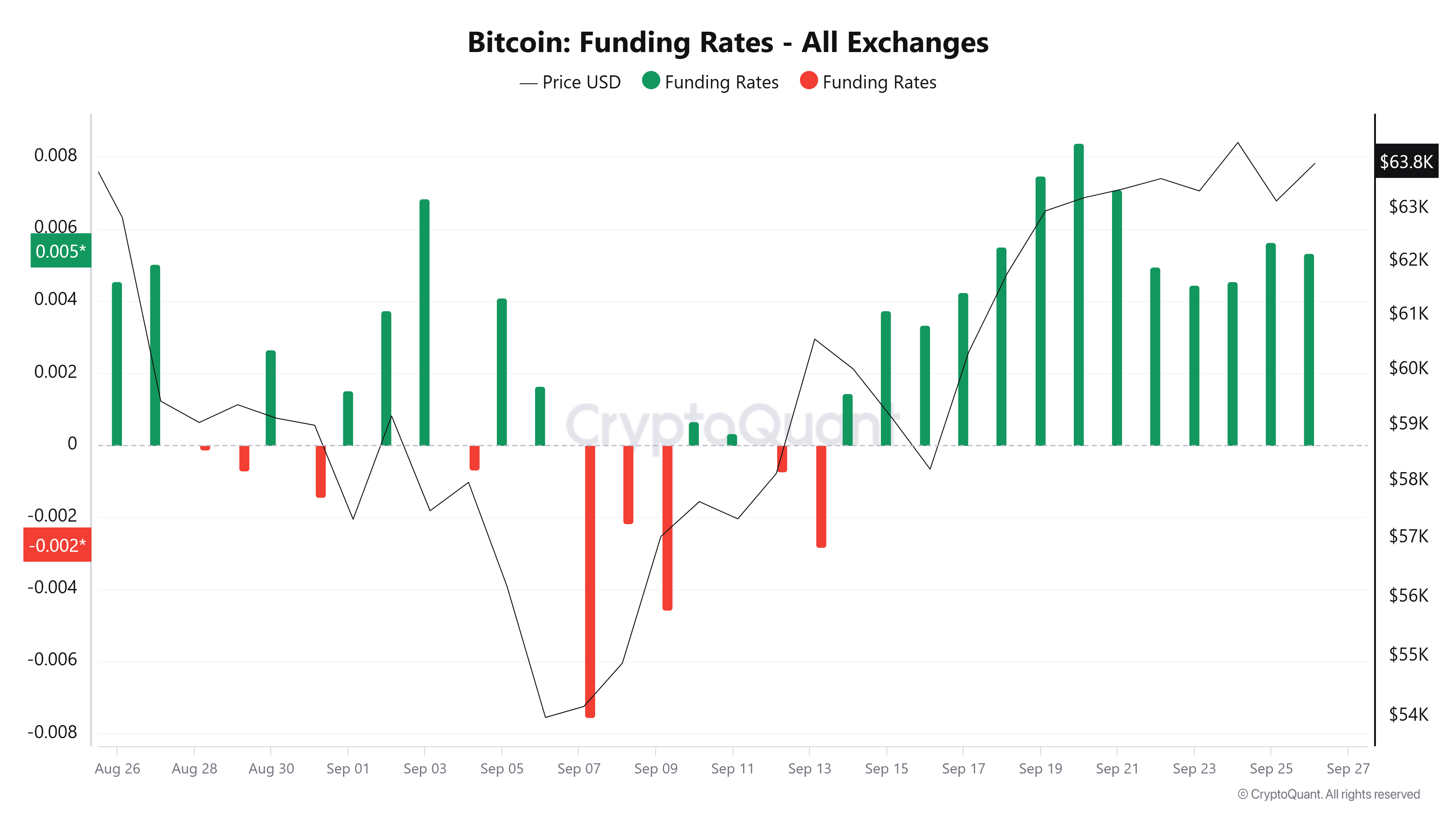

As a researcher studying the dynamics of Bitcoin Futures markets, I’ve noticed an increase in market activity since Bitcoin (BTC) surpassed the $60,000 mark on the 17th of September. Interestingly, this surge has corresponded with a significant rise in Funding Rates, which have predominantly been positive since then.

In simpler terms, there are more traders who anticipate prices will rise (long traders) compared to those who believe prices will fall (short sellers). This situation indicates a positive or optimistic outlook on the market (bullish sentiment), as these long traders are even willing to pay extra money to keep their positions open.

Data from Coinglass further shows a bullish bias as long traders dominate.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

As of the current report, about half (52%) of the traders have taken a long position, compared to slightly less than half (47%) who have short positions. This suggests that more traders anticipate the prices to rise rather than fall.

The positive sentiment is also seen in the Bitcoin Fear and Greed Index which has recovered from a state of fear to neutral, further shedding light on market confidence.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- How to Get to Frostcrag Spire in Oblivion Remastered

- Quick Guide: Finding Garlic in Oblivion Remastered

- ANKR PREDICTION. ANKR cryptocurrency

- DOOM: The Dark Ages Debuts on Top of Weekly Retail UK Charts

- This School Girl Street Fighter 6 Anime Could Be the Hottest New Series of the Year

- Isabella Strahan Shares Health Journey Update After Finishing Chemo

- K-Pop Idols

- LINK PREDICTION. LINK cryptocurrency

2024-09-26 22:15