-

AAVE’s breakout above $153.98 resistance level sparks strong buying interest and new cycle highs.

Technical indicators suggest AAVE’s bullish trend may continue, with $200 and $261 in sight.

As a seasoned researcher with years of experience tracking digital assets, I’ve seen my fair share of market movements. However, the recent breakout by AAVE caught my attention and sparked curiosity. The token’s relentless bullish trend has been impressive, to say the least.

In a recent development, Aave’s [AAVE] value has surpassed the significant barrier at $153.98, marking a substantial jump. This surge has catapulted the token to fresh record levels in this cycle, sparking increased demand among buyers.

At the moment of publication, AAVE was showing robust growth with its price standing at $168.64. This surge was fueled by a rise in trading activity and positive technical signals suggesting optimism among investors.

After the latest surge, AAVE had been aiming for the $200 mark, a significant psychological and technical barrier that acted as strong resistance.

As a crypto analyst, I, Daan Crypto Trades, propose that should AAVE manage to break through its current level, it might potentially aim for approximately $261.18. This figure corresponds with past peak levels that were attained back in early 2022.

This outlook reflected the market’s current bullish sentiment, driven by robust buying pressure.

In simpler terms, the historical pricing trends within the present trading range imply that sudden price fluctuations could occur as AAVE tests out fresh price ranges.

Given that the trading token is currently surging above crucial moving averages, it suggests a robust continuation of the bullish momentum. If present market circumstances hold steady, there might be more upward movements to follow.

Continued bullish momentum

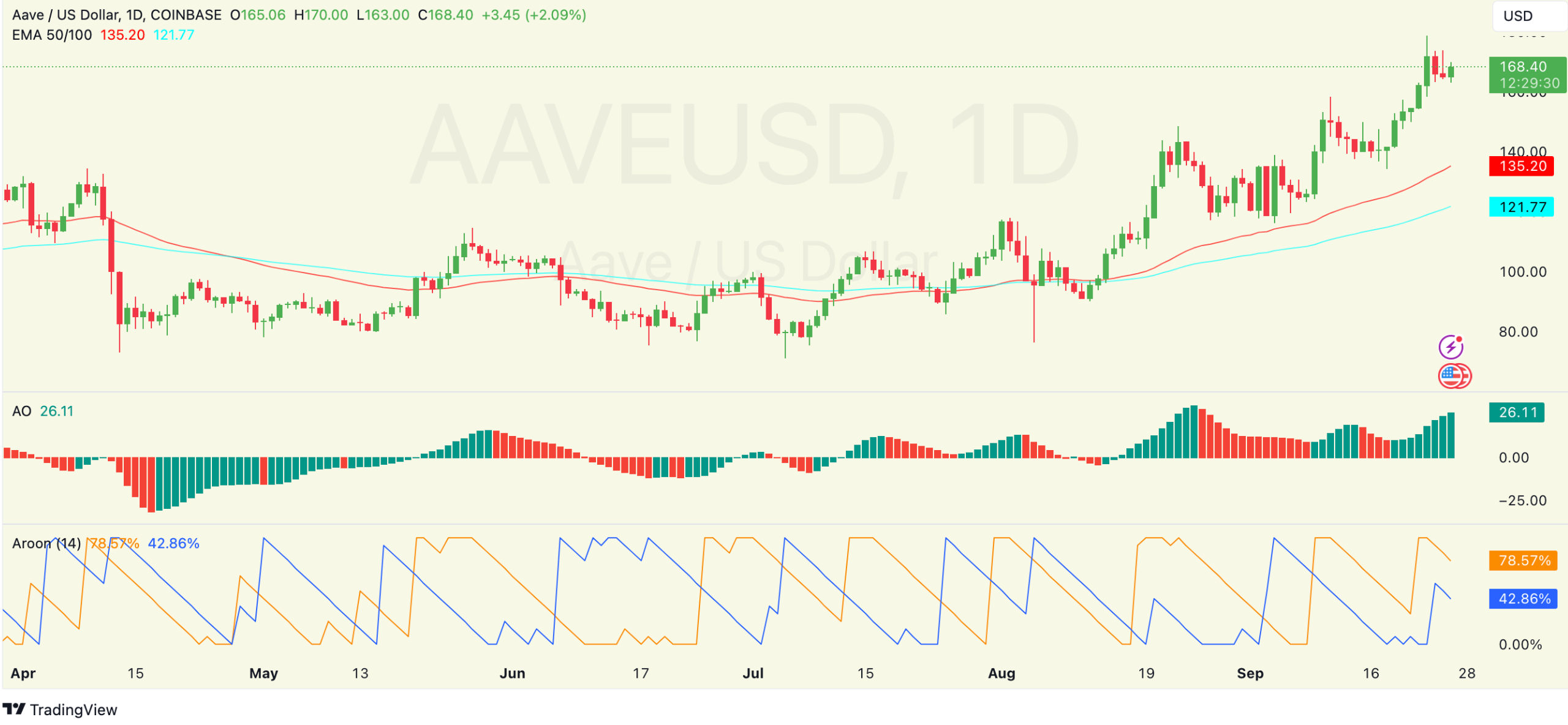

The strong upward trend of AAVE is highlighted as it sits above not just one, but two key moving averages: the 50-day Exponential Moving Average (EMA) at approximately $135.20 and the 100-day EMA at around $121.77.

During AAVE‘s recent surge, these technical barriers have functioned effectively as a foundation for its price increase, further strengthening its trend of moving higher.

The token’s price persistently remains higher than its moving averages, emphasizing the robustness of the ongoing upward trend.

At the current moment, the Awesome Oscillator (AO) stands at 26.11, and the growing green bars indicate a strengthening bullish trend, hinting at increased optimism in the market.

The market momentum tracker, designed to gauge investor optimism, persisted in displaying a bullish outlook, bolstering the persistent increase in prices.

The growth of green sections in the bar graph suggested a significant buying demand, coinciding with AAVE‘s recent price increase.

Will AAVE’s run continue?

In the future, we observed that the Aroon Oscillator, which helps us understand market directions, strongly favored bullish indications.

42.86% for the Aroon Up, represented by blue, suggests that we’ve recently hit significant highs, while the Aroon Down, shown in orange, stands at 78.57%. This means that at the moment, bullish signals are stronger than bearish ones.

In this arrangement, a powerful bullish trend was evident in the market, as it seemed that the sellers were gradually losing their grip.

With rising trade volumes and optimistic investor feelings, these technical indicators seem to point towards AAVE‘s recent surge as potentially initiating a prolonged uptrend.

In simple terms, AAVE saw a trading volume of approximately $295 million in the last 24 hours, which represents a 0.85% rise in value from the previous day. Over the course of the last seven days, this cryptocurrency has experienced an increase of about 16.74%.

Read Aave’s [AAVE] Price Prediction 2024–2025

15 million AAVE tokens currently in circulation contribute to a market capitalization of approximately $2.5 billion, underscoring its expanding influence within the Decentralized Finance (DeFi) sector.

With AAVE showing signs of growth, investors are closely monitoring if it will hit the $200 mark and if the positive trend will persist.

Read More

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Gold Rate Forecast

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

2024-09-26 23:04