-

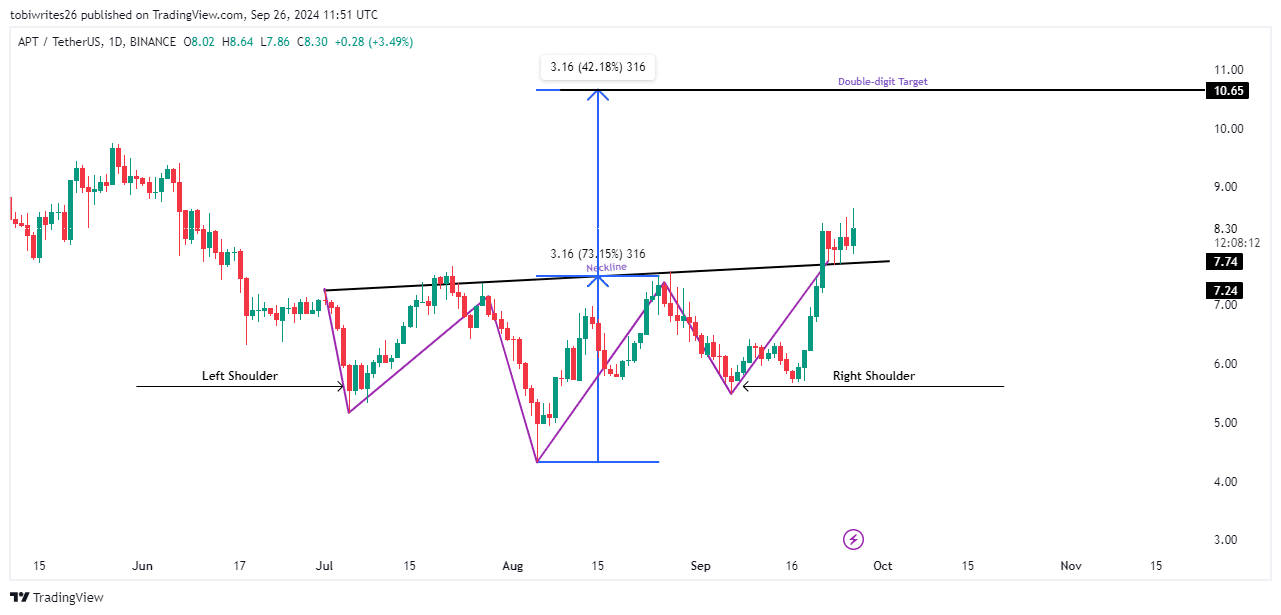

The appearance of an inverse head-and-shoulders pattern on APT’s chart positions it well for potential gains.

Initially, the market may see a period of accumulation, setting the stage for APT’s ascent into double-digit territory.

As a seasoned analyst with over two decades of market experience under my belt, I have seen countless patterns and trends unfold before my eyes. The current situation with Aptos [APT] is particularly intriguing.

Over the past seven days, Aptos (APT) has experienced significant expansion, climbing a substantial 29.98%. Yet, its rate of growth appears to have moderated within the last day, registering a more modest rise of 1.59%.

Although there’s a temporary slowdown, the chart analysis indicates that we might be in a period of stockpiling for APT. This could mean a significant increase in its price in the near future.

Why double-digit prices for Aptos is feasible

Previously, APT‘s price movements followed an upward-sloping triangle, a positive chart formation that AMBCrypto recognized as the early stage of a possible price surge – a forecast that has now proven accurate.

Based on recent developments, APT has displayed more positive indicators following the creation of an upside-down head and shoulder pattern, which is typically a sign of an upcoming strong upward trend.

Normally, the price of a rally tends to correspond with the gap between the peak (head) and the support level (neckline). For APT, if this pattern continues, it could potentially drive the trading price above $10.

Regardless of its continuous rise, the price trend for APT has been steady rather than swift, as traders unloading APT have led to a slight drop in the market.

Contrarily, AMBCrypto’s viewpoint presents an alternative angle, and the optimistic trend for the market remains valid.

APT’s short-term fall will benefit a rally

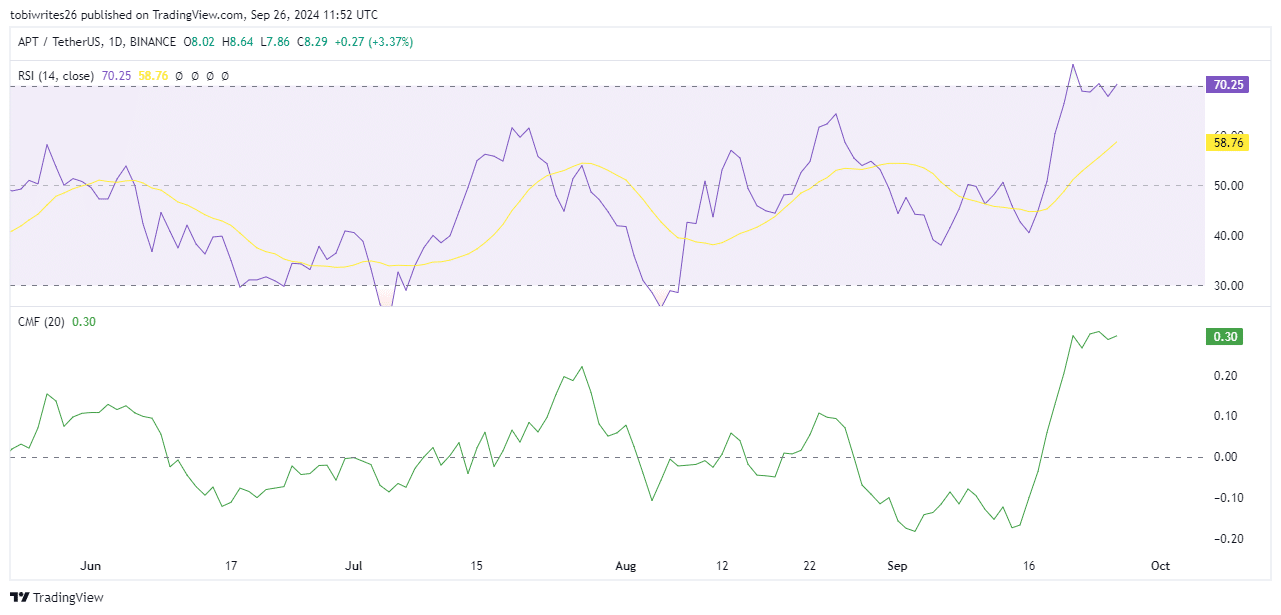

The indicators, Relative Strength Index (RSI) and Chaikin Money Flow (CMF), suggest that APT‘s pace or momentum is starting to decelerate.

The RSI recently peaked at 74, indicating an overbought condition, but has since adjusted to 70.25.

This uptrend indicates that there’s a period in which market participants seem to be buying more APT units, likely in expectation of a potential price increase in the near future.

During this stage, the increase in holdings is also supported by the Chaikin Money Flow (CMF). This indicator measures the volume-weighted balance between accumulation and distribution. Currently, it’s showing a positive reading of 0.30, suggesting that there’s persistent buying interest.

Currently, the increasing pattern in the Crypto Market Finder (CMF) indicates that the current drop in APT‘s price might present an opportune time for investors to buy APT at reduced prices, with the expectation of another price surge following.

Market participants seek lower prices for APT

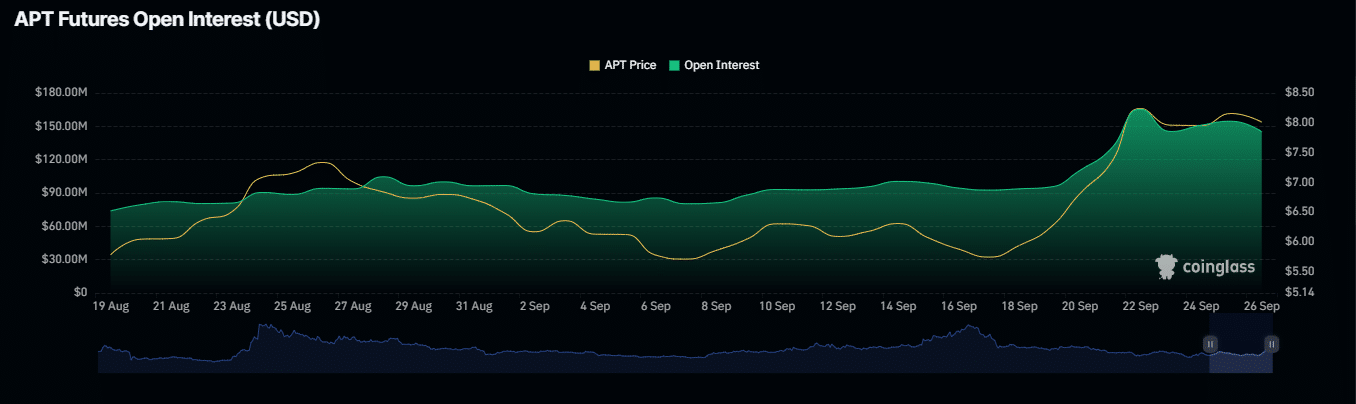

Based on data from Coinglass, the open interest in APT has dropped from its peak of $154.45 million on September 25th to $145.02 million, suggesting a collective push aimed at reducing APT’s price.

Read Aptos’ [APT] Price Prediction 2024–2025

Despite this decrease, OI has experienced a 1.66% increase, suggesting that bulls are gradually entering the market by opening more long positions.

Should the climb in open interest persist, it suggests that APT might be moving past its accumulation stage and preparing for an upward surge towards prices in the double digits.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Gold Rate Forecast

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Solo Leveling Arise Tawata Kanae Guide

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- Jack Dorsey’s Block to use 10% of Bitcoin profit to buy BTC every month

- Elden Ring Nightreign Recluse guide and abilities explained

2024-09-27 03:35