-

Ethereum dominance is declining despite overall market cap being on the rise.

ETH staying above all weekly moving averages signals strength.

As a seasoned crypto investor with battle scars from the 2017 bull run and the infamous crypto winter of 2018, I’ve learned to navigate the turbulent waters of this ever-evolving market with caution yet optimism.

In simple terms, Ethereum (ETH), the second most valuable digital currency after Bitcoin, is encountering difficulties in preserving its leading position within the wider cryptocurrency sector.

Over time, the combined value (market capitalization) of all non-stablecoin cryptocurrencies has generally risen. However, Ethereum’s proportion within this total market share has been decreasing.

At the moment, Ethereum holds a market dominance slightly over 15%, suggesting it may be at a significant juncture. As the value of ETH‘s market capitalization oscillates between $546 billion and $316 billion right now, its efforts to reassert its dominance cause some doubts.

An increase in the overall market value with Ethereum’s proportion decreasing might suggest a discrepancy, which typically foreshadows a shift or prolongation of the current trend. Despite this ambiguity surrounding whether Ethereum will ascend or descend further, it’s essential to consider other indicators as well!

ETH staying above weekly SMAs

Ethereum is maintaining a robust position with regards to its weekly moving averages, indicating a positive trend. Currently, ETH hovers above important moving averages such as the 8-day and 20-day moving averages, implying significant forward movement.

It’s positive to note that Ethereum seems to be on the mend, as it has rebounded following a significant drop when its value dipped down to $2,100.

As a cryptocurrency investor, I find it encouraging that Ethereum (ETH) has maintained its position above the Simple Moving Averages (SMAs). This suggests that the bullish trends in both the short-term and long-term on the weekly scale are still intact. Nevertheless, I urge caution as we move into Q4, a period expected to be marked by increased market volatility.

Even though Ethereum’s influence in the market has temporarily decreased, these signs suggest that Ethereum continues to trend upward.

Smart whales profiting

As a seasoned crypto investor, I’ve noticed that shrewd whales are skillfully leveraging market swings, which bolsters my optimistic perspective. I’ve personally witnessed some astute traders rake in substantial gains by purchasing Ethereum when prices dip.

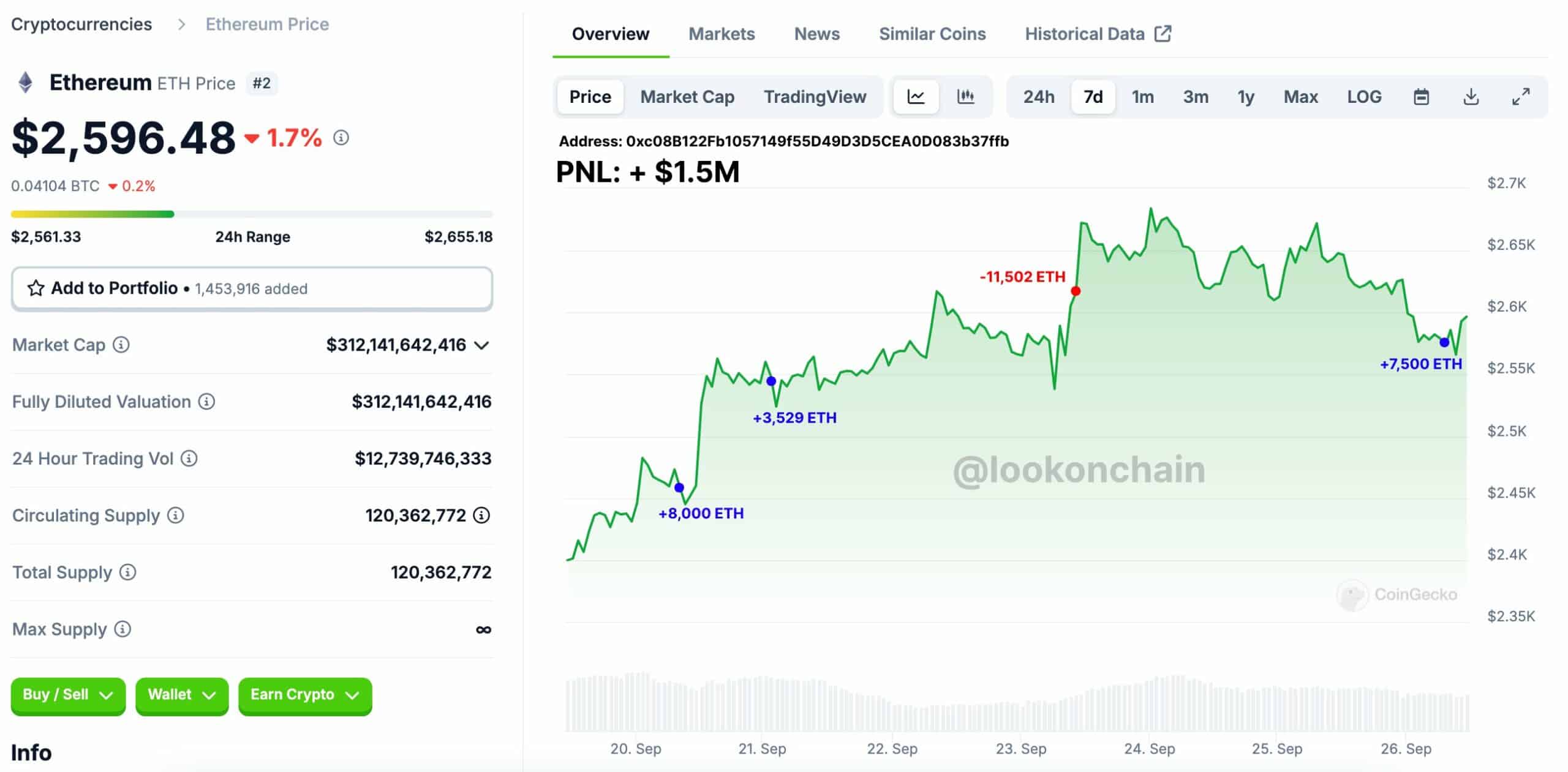

A particular whale, identified as 0xe0b5, has been persistently engaging in buy-and-sell strategies (also known as swing trading) with Ethereum (ETH), achieving a flawless 100% success rate over eight transactions since August 12th. This significant player has purchased approximately 10,000 ETH, valued at more than $26 million, and subsequently sold them at elevated prices, raking in over $1.56 million in profits.

0xc08B, a different whale, invested approximately 11,529 Ether (ETH) valued around $28 million at an average price of $2,485, and then sold it three days later for $2,618 per ETH, earning a profit of about $1.5 million.

These actions indicate that significant investors have faith in Ethereum’s ability to deliver greater profits, even amidst its ongoing challenges related to market dominance.

Daily ETH burnt increases

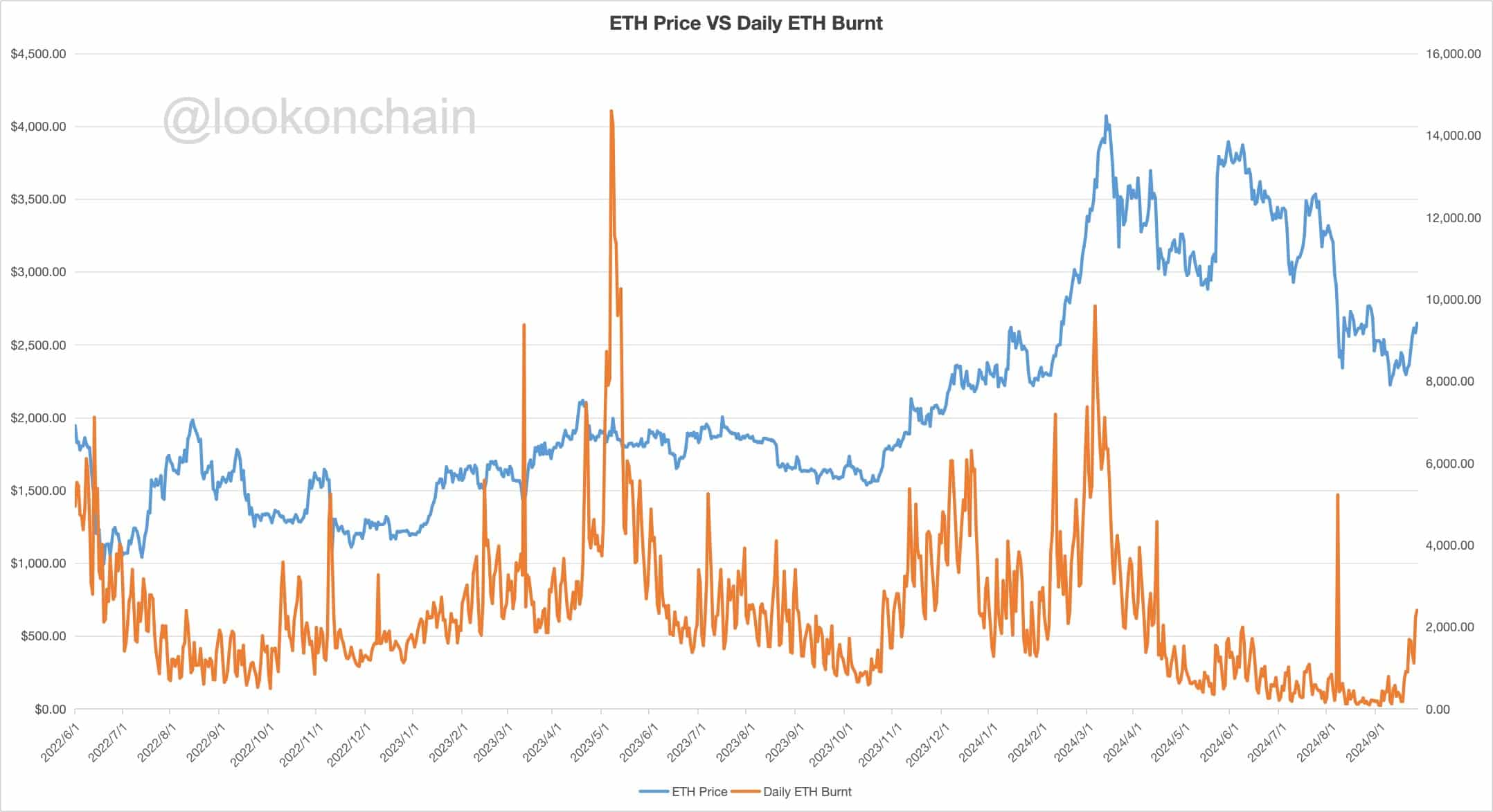

Furthermore, there’s been a significant surge of 163% in the daily Ethereum burn rate over the last week, offering another encouraging indicator for potential increases in Ethereum’s value moving forward.

In simpler terms, the graph comparing ETH price and daily ETH burn reveals a consistent trend where an uptick in ETH burning occurs prior to price increases, specifically in January and October of 2023.

By incinerating Ethereum (ETH), we’re gradually decreasing its total quantity. If demand stays consistent, this scarcity could potentially boost ETH’s market price. With an increase in the burn rate, there’s a corresponding rise in the probability of ETH’s value going up.

Read Ethereum’s [ETH] Price Prediction 2024–2025

In spite of the present difficulties facing its market supremacy, Ethereum’s robust performance on crucial technical indicators, increased whale involvement, and escalating burn rate are strong indications that Ethereum’s value is likely to keep increasing.

A positive outlook suggests that Ethereum (ETH) could experience a bullish trend ahead, despite the fact that its market supremacy might be waning.

Read More

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

2024-09-27 04:08