- Bitcoin saw increased demand in the United States.

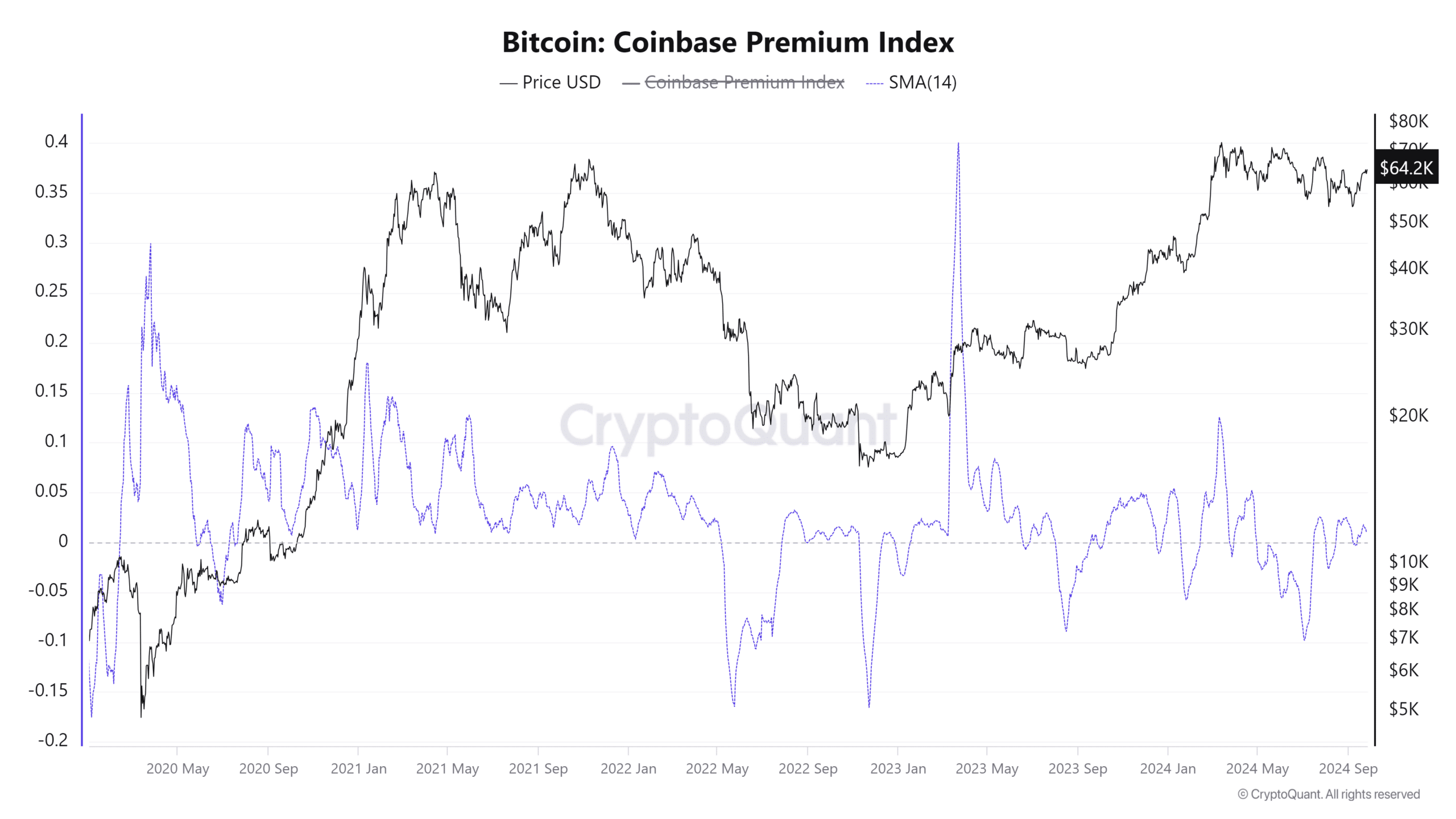

- The Coinbase Premium was still near the zero mark.

As a seasoned analyst with over two decades of experience in the financial markets, I’ve seen enough market cycles to know that patterns often repeat themselves, albeit not always perfectly. The current state of Bitcoin (BTC) in the United States is intriguing.

In simpler terms, the value of Bitcoin (BTC) might experience temporary fluctuations as a result of upcoming option expirations towards the end of the week. Moreover, according to a recent analysis by AMBCrypto, an increase in Bitcoin holdings on exchanges may lead to increased selling activity.

According to the MVRV indicator, Bitcoin appears to be facing a significant barrier. Overcoming this resistance might spark a robust upward price movement, similar to the one seen in October of last year, once the 155-day moving average is breached.

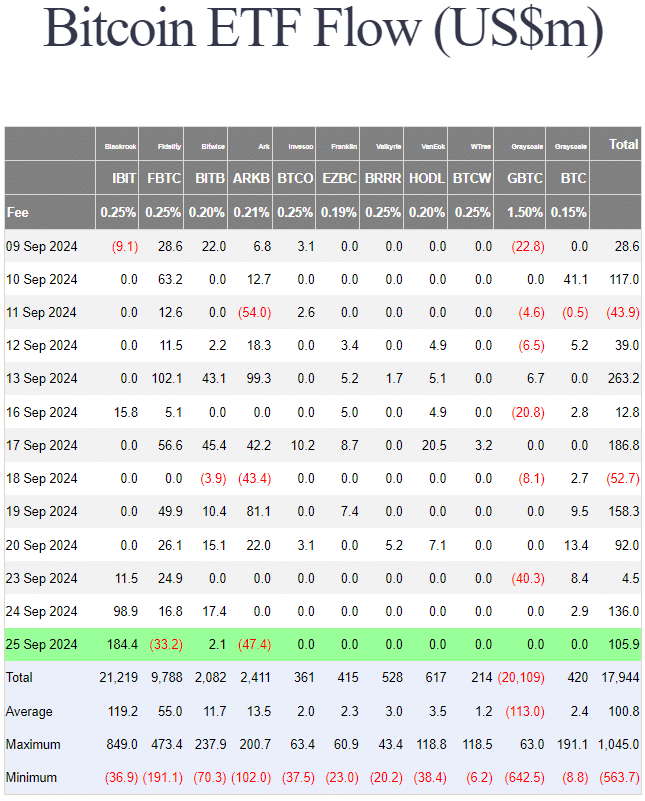

Over the past fortnight, the direction of Bitcoin spot ETF inflows has been upward, indicating growing optimism among individual investors about potential price increases.

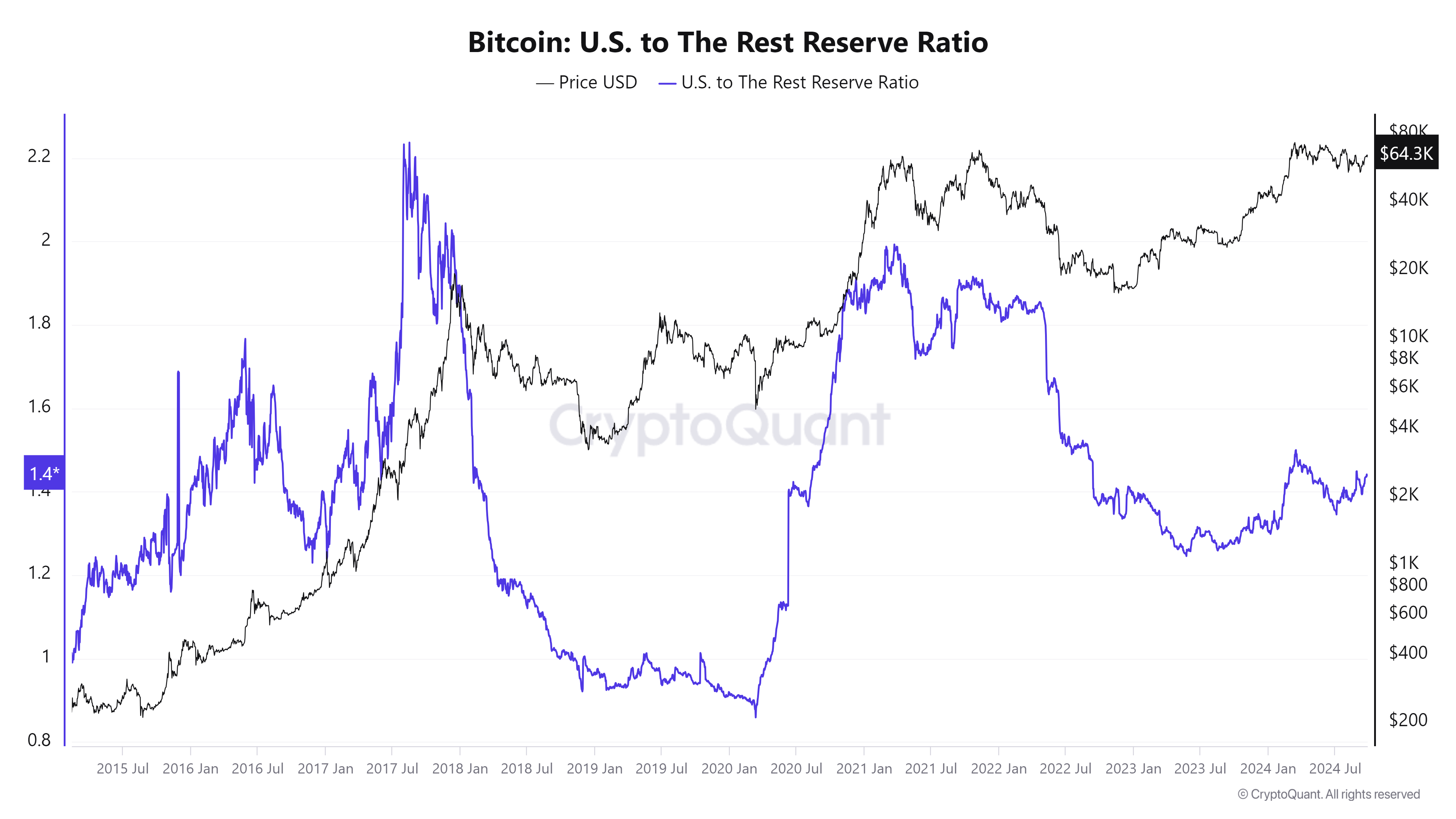

The 30-day net change in holdings also turned positive, Ki Young Ju noted in a post on X.

Spot ETF spurs rising buying pressure in the United States

The leader of CryptoQuant, both founder and CEO, noted that the percentage of Bitcoins held in the United States was increasing, possibly due to growing interest in a Bitcoin exchange-traded fund (ETF). This trend, while gradual, has been consistent for approximately the last fourteen months.

Over the last two market cycles, an accelerated growth in the U.S. reserve ratio occurred roughly several months prior to Bitcoin reaching its peak during a bull market trend.

If the trend continues again, a swift rise in the U.S. reserve ratio might serve as a precursor hinting towards a possible Bitcoin bull market.

Around 4-6 months prior to reaching its peak, it tends to show a significant decrease. Although this doesn’t automatically mean the same pattern will occur during this period, it’s another factor investors should monitor closely.

Bitcoin Coinbase premium showed demand has not peaked

The spot ETF flows, and the reserve ratio, showed demand from the United States was on the rise.

On the other hand, examining the Coinbase Premium Index indicated that the demand wasn’t robust enough to trigger a significant increase in price.

During periods of increasing Bitcoin value (a bull run), it’s common for Coinbase, a significant cryptocurrency trading platform accessible to American investors, to have a higher price for Bitcoin compared to other markets. This trend was observed during the Bitcoin surge that occurred between 2020 and early 2021.

Read Bitcoin’s [BTC] Price Prediction 2024-25

It also applied to the rally that began in October 2023 and continued till March 2024.

A lower Coinbase premium doesn’t contradict the conclusions from earlier data, but instead supports the notion that a bull market hadn’t started just yet.

Read More

- Gold Rate Forecast

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

2024-09-27 06:15