-

BNB made a bullish crossover after the 50-day MA moved above the 100-day MA.

If BNB breaks above $600 with high buying volumes, it could ignite a rally to $700.

As a seasoned analyst with over a decade of experience in the cryptocurrency market, I’ve seen my fair share of bullish crossovers and price movements. The latest development with Binance Coin [BNB] has caught my attention, and I must say, it looks promising.

Over the last month, Binance Coin (BNB) has mirrored the movements of Bitcoin (BTC). Similar to many other cryptocurrencies, BNB has experienced a substantial rebound, with its value increasing by approximately 9% over the past thirty days.

At the moment of reporting, BNB was priced at approximately $595, having been turned down once more from surpassing the $600 threshold. However, with indications pointing toward another potential surge above this resistance, there are multiple bullish signals emerging, suggesting a robust upward trend may be on the horizon for BNB.

BNB price outlook

BNB’s failure to break above $600 suggests that sellers are booking profits at this price.

After the 100-day EMA is surpassed by the 50-day Exponential Moving Average on the daily chart, it suggests there might be an impending breakout.

In simpler terms, this blend often indicates that the immediate pace is growing stronger relative to the extended trend.

Making this move might entice buyers seeking a buy indication on BNB, potentially leading to an increase in its price.

The volume histogram bars indicate that more shares are being bought compared to those being sold, signaling a higher volume of buying activity.

Additionally, the Chaikin Money Flow stands at 0.30, signaling robust buyer activity. Furthermore, this indicator has shown a significant upward shift, implying that the strength of the buying trend remains intact.

Should the current heavy purchasing activity persist, Binance Coin (BNB) might be poised for a significant surge, potentially exceeding the 100% Fibonacci level, which equates to around $700.

This week’s purchasing activity is expected to increase, given that Changpeng Zhao, the ex-CEO of Binance, will be released from prison on the 29th of September.

Prior to this occurrence, BNB‘s price trend may mirror the general market fluctuations. Potential volatile swings might lead to another test of the 0.786 Fibonacci level’s support (approximately $585).

Liquidation data shows THIS

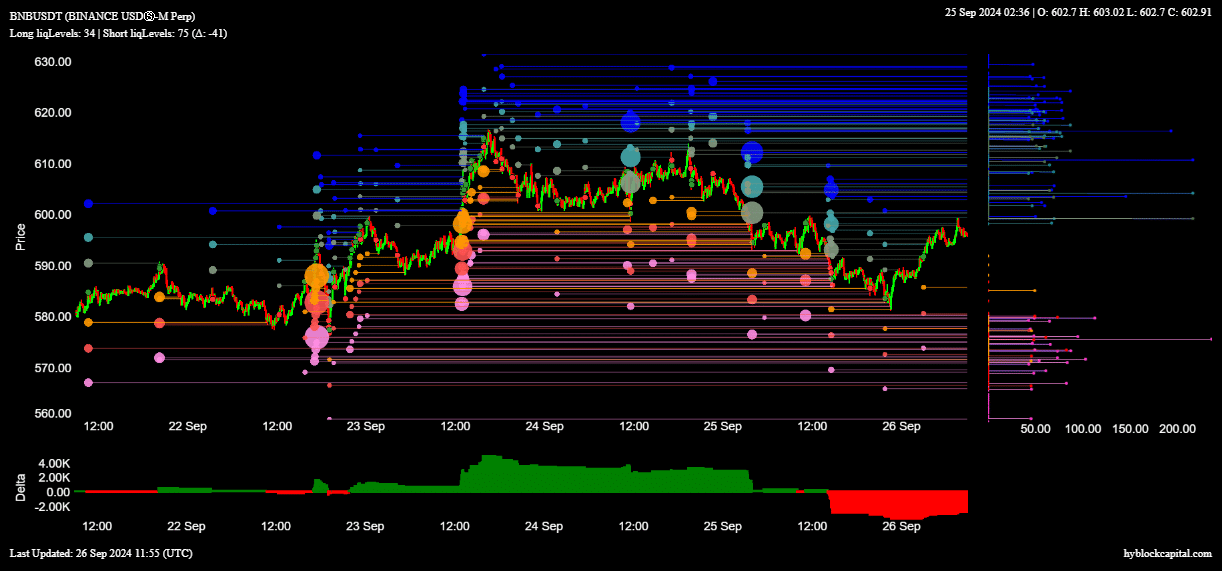

Examining the BNB liquidity map from Hyblock Capital reveals a surge in potential liquidation points, ranging approximately from $600 to $630.

If the cost of BNB increases significantly and gets near the liquidation thresholds, it might lead to a “short-squeeze” scenario. In this situation, traders who have shorted BNB are compelled to close their positions by purchasing BNB. This action could potentially spark additional price growth.

These possible liquidations also show that $600-$630 is a strong resistance zone. Therefore, if BNB manages to break above these levels, it could signal a strong shift in market sentiment in favor of bulls.

Read Binance Coin’s [BNB] Price Prediction 2024–2025

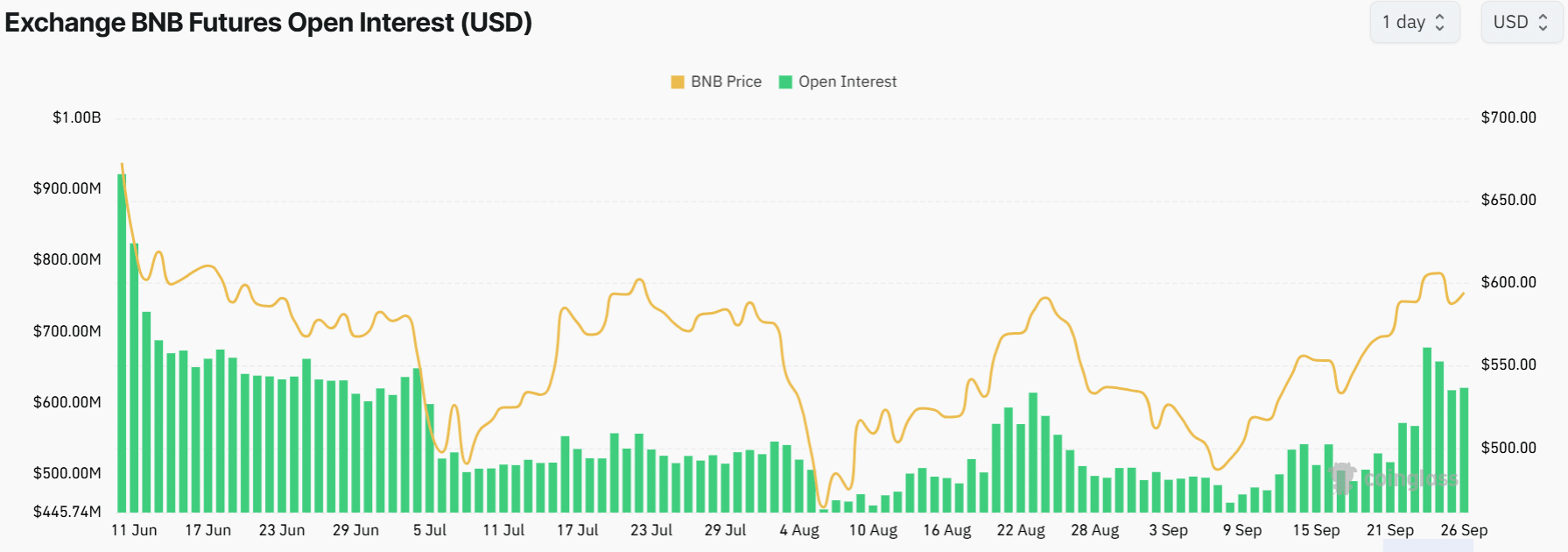

At the present moment, as reported by Coinglass, the Cryptocurrency Futures market is maintaining a significant level of interest in BNB, with an Open Interest currently valued at approximately $620 million.

Since then, it has dipped somewhat from its three-month peak of $677 million, which was reached on the 24th of September.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- Upper Deck’s First DC Annual Trading Cards Are Finally Here

- Michael Saylor’s Bitcoin Wisdom: A Tale of Uncertainty and Potential 🤷♂️📉🚀

- Has Unforgotten Season 6 Lost Sight of What Fans Loved Most?

- The Battle Royale That Started It All Has Never Been More Profitable

- SUI’s price hits new ATH to flip LINK, TON, XLM, and SHIB – What next?

- EastEnders’ Balvinder Sopal hopes for Suki and Ash reconciliation: ‘Needs to happen’

- McDonald’s Japan Confirms Hatsune Miku Collab for “Miku Day”

2024-09-27 07:35