-

Bitcoin profitability warrants an assessment of the probability of sell pressure.

BTC’s recent data demonstrates a resurgence of confidence in its potential to push back above $70,000.

As a seasoned crypto investor with a decade-long journey under my belt, I find myself standing at a crossroads when it comes to Bitcoin (BTC). The recent surge above $64,000 is reminiscent of the exhilarating rides we’ve experienced before. However, I can’t help but recall the familiar resistance building up in this price range, a red flag that has tripped us more than once.

For approximately three weeks, Bitcoin (BTC) has seen bullish momentum, propelling its value over $64,000. This development follows a surge in optimism, leading some to question whether it’s advisable to cash out at the current level.

Although Bitcoin supporters have done well so far, the current price level has historically triggered selling activity.

In the past three days, there has been a noticeable accumulation of resistance forming above the $64,000 price point. Additionally, a staggering 84% of Bitcoin owners have moved into a profitable position when their holdings surpassed $63,000.

This implies that Bitcoin might experience a substantial drop if there’s another downturn (bearish event). However, a sequence of occurrences has led to optimism and anticipation that the value of Bitcoin could reach as high as $80,000 in the near future.

Many are now wondering which choice would be easier; to continue HODLing BTC or to take profits?

Are long term holders still optimistic?

Based on a current study by CryptoQuant, it appears that numerous long-term Bitcoin owners are choosing not to transfer their assets at the moment. This indicates that these holders may still be holding onto their gains rather than selling, potentially reducing the pressure for Bitcoin to be sold.

In the approaching days or weeks, there’s a possibility that it could continue its current price increase if demand pushes the cost higher.

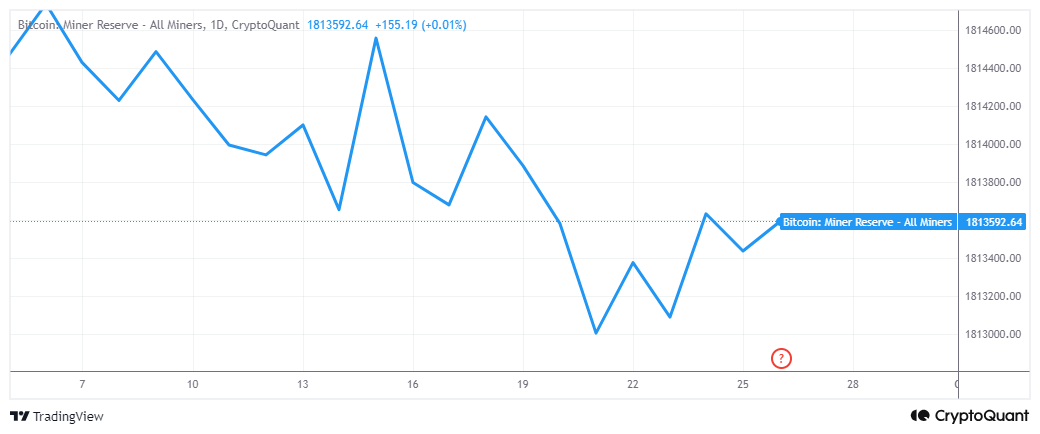

According to an analysis by CryptoQuant, it appears that miners might be giving up, or “capitulating,” which could potentially lead long-term Bitcoin holders to offload their coins. Interestingly, though, data from the blockchain indicates that miner reserves have been steadily increasing over the past five days.

The miner reserves uptick suggests that miners are also opting HODL their coins in anticipation of higher prices.

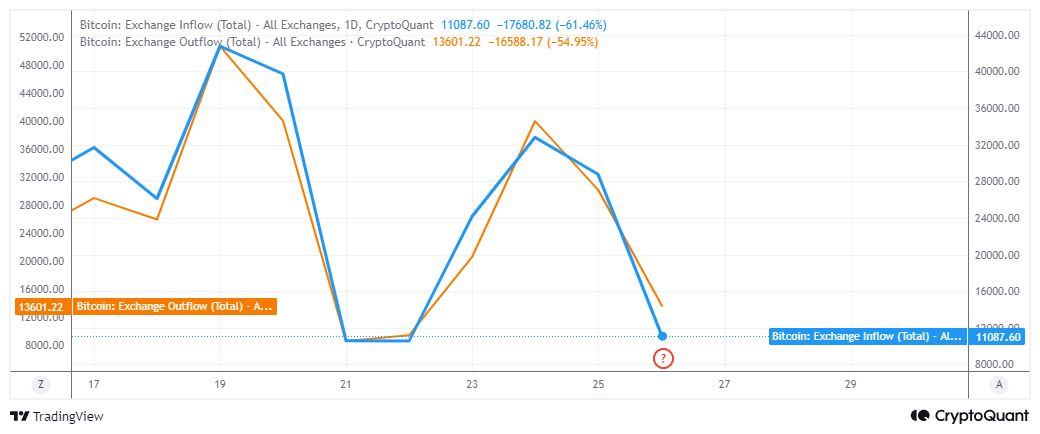

However, is there a possibility of immediate selling pressure? Although the current price seems to face some resistance, it’s worth noting that the flow of trades indicates more demand than selling activity.

Over the past 24 hours, a larger amount of Bitcoins, specifically 13,601 BTC, were withdrawn from exchanges as opposed to the previous 11,087 BTC that had been taken out.

It’s important to mention that the pace of exchanges has been decreasing over the past three days. Furthermore, this rate has dropped to levels similar to those where it previously changed direction, which might indicate a possible change in the near future.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

To summarize, past Bitcoin price movements showed significant selling forces at around $60,000. However, this is not evident in its recent surge above that figure.

This implies a rising sense of assurance, fueled by the promising influx of funds into the market.

Read More

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Masters Toronto 2025: Everything You Need to Know

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- Gold Rate Forecast

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

2024-09-27 12:07