-

Chainlink’s price shows bullish signs after breaking resistance; next targets are $19.14 and $20.00.

LINK’s rising transactions and bullish MACD signal growing market interest, but momentum remains cautious.

As a seasoned researcher with years of experience analyzing the cryptocurrency market, I find myself constantly impressed by the resilience and adaptability of projects like Chainlink [LINK].

Based on its recent movement, Chainlink (LINK) appears to be exhibiting a positive trajectory by surpassing an important downward trendline, indicating a possible prolongation of its rising trend.

As I check the market right now, LINK is trading at $12.79, marking a 4.50% rise in the last day. Over the course of the past week, it has climbed an impressive 9.73%.

As a researcher delving into the world of digital assets, I find myself examining Chainlink (LINK), a cryptocurrency with a circulating supply of approximately 630 million units. This quantity, when multiplied by its current market price, yields an impressive market capitalization of around $8.02 billion. Furthermore, over the past 24 hours, there has been a robust trading volume of roughly $565.3 million for this cryptocurrency.

Key resistance levels to watch

For now, LINK aims to maintain its progress above the $13.00 threshold, a move that would continue the positive trend in its price movement.

Reaching the $19.14 barrier could be a promising sign of more power, potentially pushing prices up to $20.00 and possibly even higher if the demand keeps growing.

These levels are seen as critical milestones that could define LINK’s near-term price trajectory.

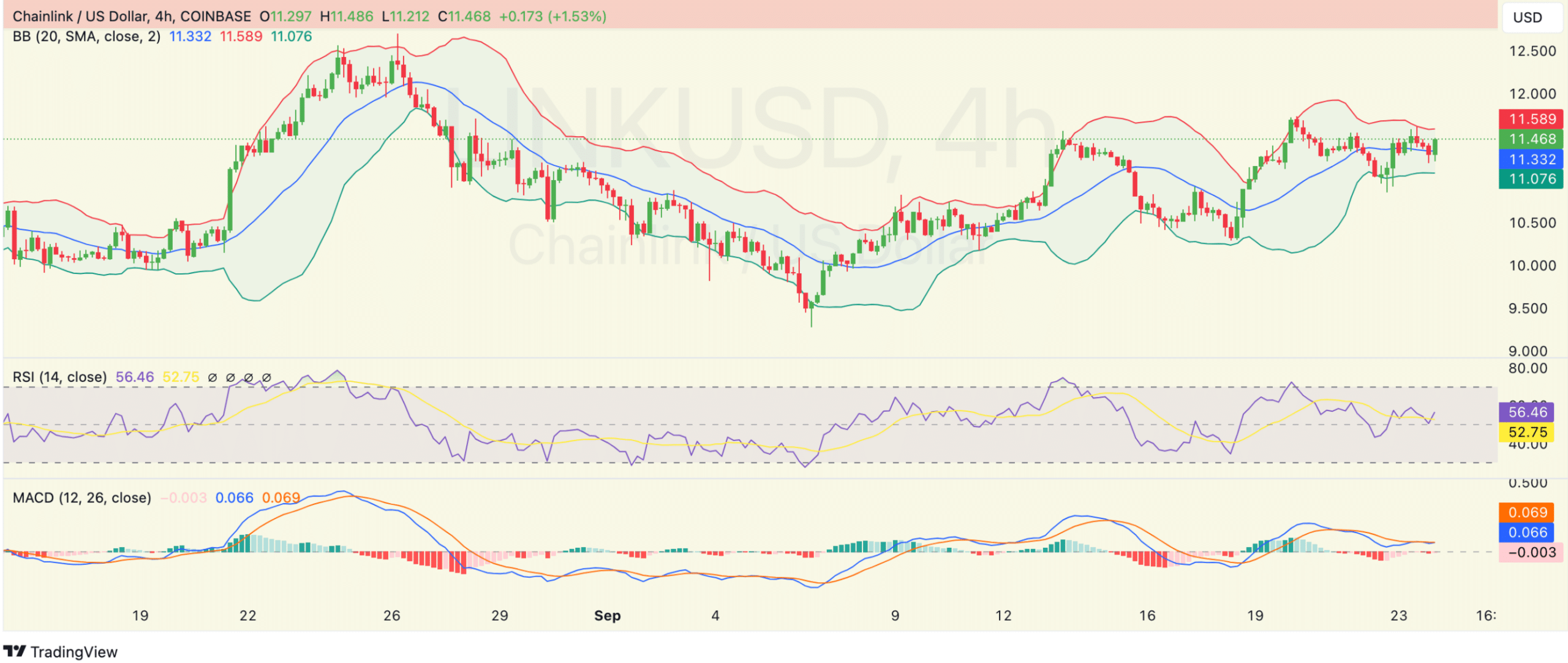

Technical indicators on the 4-hour chart suggest that LINK is trading near the upper Bollinger Band at $11.589, indicating short-term bullish momentum.

Conversely, the price at $11.332 functions as an immediate support for LINK. Dropping beneath this point might steer LINK towards the lower band at $11.076.

This arrangement exhibits a harmonious blend, indicating both a keen buying inclination and a possible downturn if the support doesn’t hold up.

Moderate bullish momentum, confirmed

The Relative Strength Index (RSI) was at 56.46, slightly above the neutral 50 level, suggesting moderate bullish momentum.

This suggests that although there’s potential for additional price hikes, the current demand isn’t exceptionally robust, implying a potential short-term stabilization period might occur.

The RSI level indicates that LINK‘s price might continue to rise, but it could encounter obstacles unless there’s a more substantial effort from the buyers.

In simpler terms, the Moving Average Convergence Divergence (MACD) graph suggests a slight increase in bullish momentum as the MACD line is currently hovering slightly above its signal line, at approximately 0.069.

This arrangement indicates a modest yet optimistic trend, implying that further increases may occur if the trends keep separating.

On the other hand, since the Moving Average Convergence Divergence (MACD) and its signal line are close together, it’s important to exercise caution because a sudden change in momentum might occur.

Positive trends

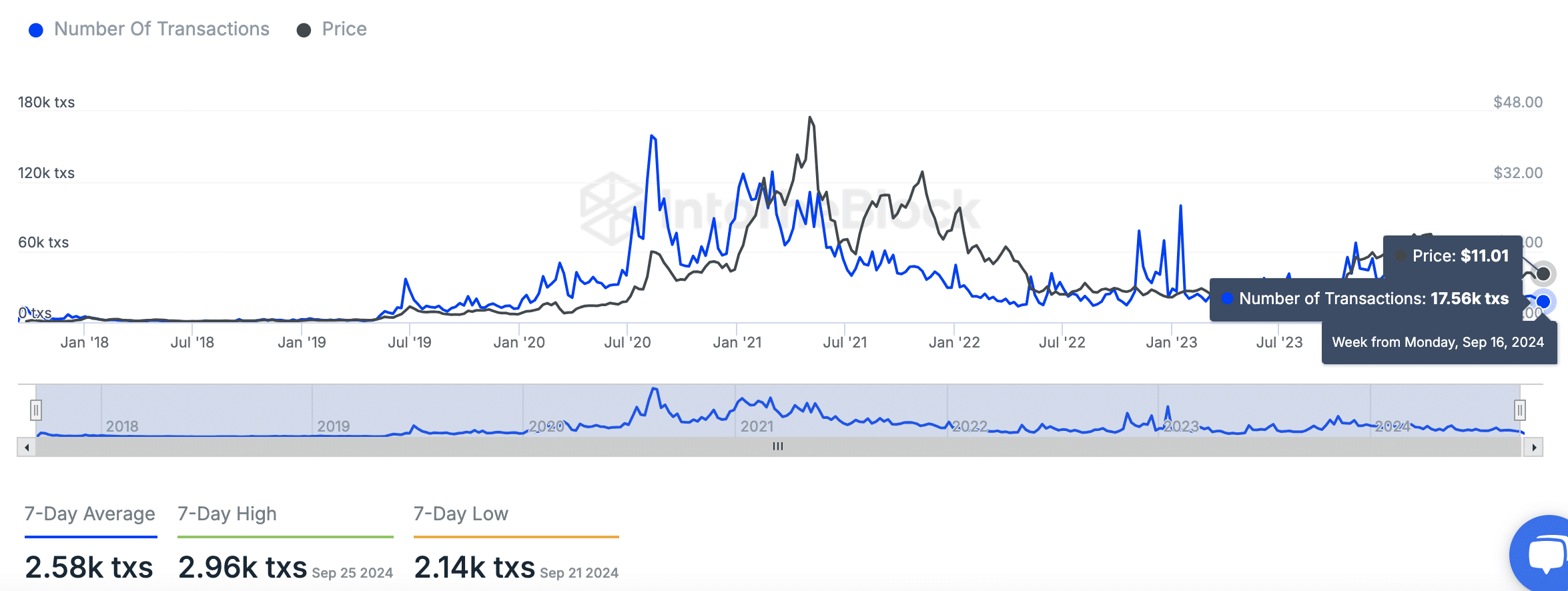

Data from blockchain transactions indicates a significant jump in Chainlink’s activity over the past week. Specifically, there were around 17,560 transactions during the week starting on September 16th – a substantial increase compared to the typical weekly average of approximately 2,580 transactions.

Although the surge suggests a rising curiosity, the current transactions at this moment are still lower than the peaks reached in the middle of 2021.

Read Chainlink’s [LINK] Price Prediction 2024–2025

Derivatives data from Coinglass reflected increased market activity, with trading volume rising 14.57% to $420.62 million and Open Interest up 6.94% to $204.09 million.

The trends clearly highlight an increasing interest in the market of LINK, which strengthens its current price fluctuations and future projections.

Read More

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

2024-09-27 14:16