-

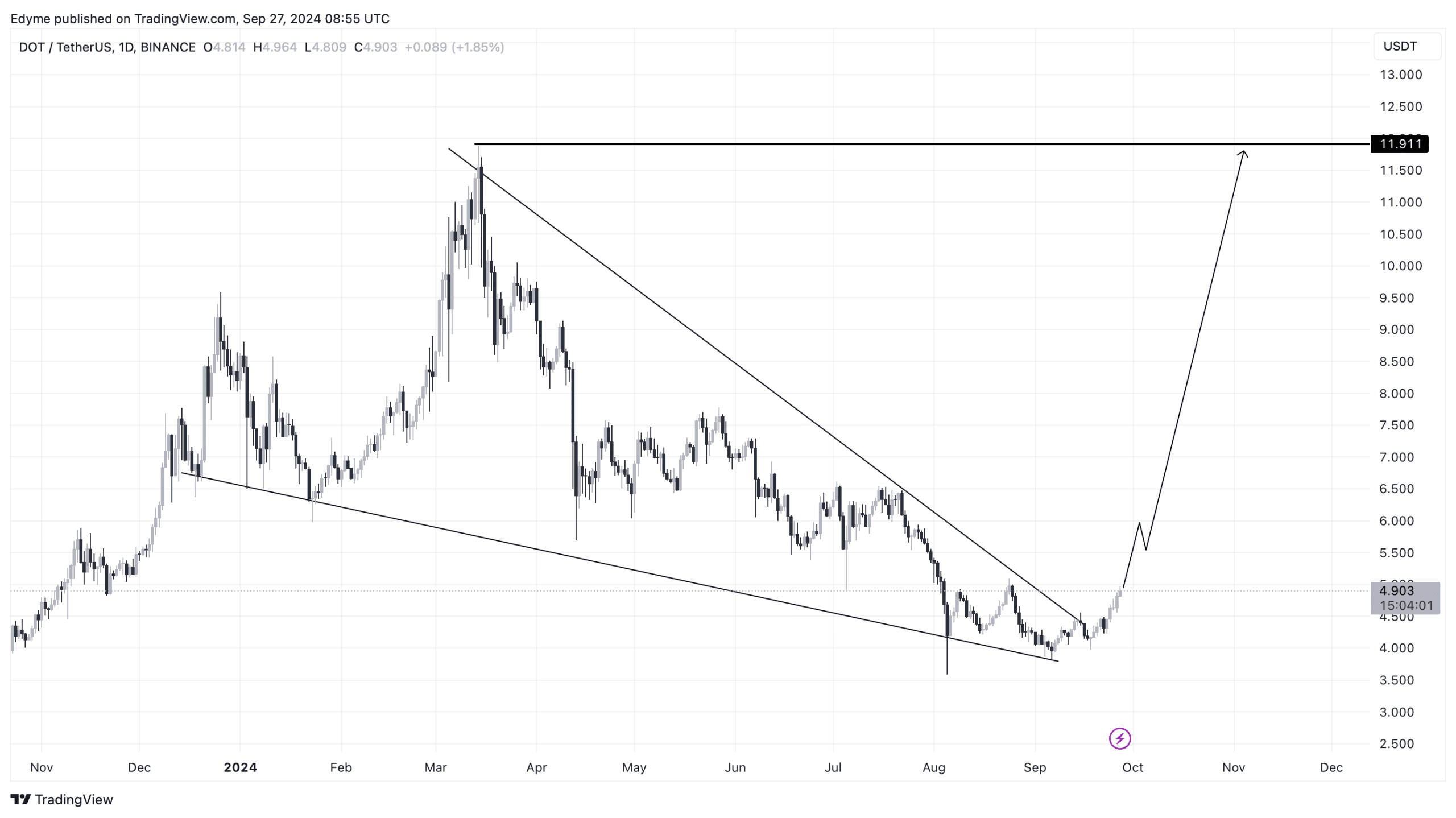

DOT breaks out of a falling wedge pattern and shows a bullish hammer candlestick, indicating a possible price rally.

Open interest rises, while RSI remains neutral, supporting potential upward movement without immediate risk of pullback.

As an analyst with over two decades of market experience under my belt, I find myself increasingly optimistic about Polkadot (DOT). The recent breakout from a falling wedge pattern and the appearance of a bullish hammer candlestick suggest that we might be on the cusp of a substantial rally.

Currently, Polkadot [DOT] is showing a consistent upward trend, with several successive weeks recording price increases.

Over the last fortnight, DOT has experienced a surge of 14.2%, with a further 11% growth in just the past seven days. Currently, this token is trading at $4.90, marking a 2.3% uptick in its value over the previous day.

As a crypto investor, I’ve been noticing an ongoing surge in the price of DOT, and it seems this trend might be about to escalate. Technical indicators are pointing towards a potential major uptrend, which has me quite excited about my investment in DOT.

The $11 rally potential

Analyzing the technical aspects suggests that the recent increase in DOT‘s price might be due to it breaking free from a falling wedge formation, which is often interpreted as a positive sign in financial markets.

A falling wedge pattern emerges when prices consistently decrease within a gradually narrowing range, often signaling an impending increase after the narrowing trend breaks upwards, suggesting a possible shift in the downward trend.

Now that DOT has broken out of this wedge, further upward momentum is anticipated.

Even if the price of DOT is currently under $5, a breakthrough could lead it to reach prices over $11, as this pattern would be fully validated by such an upward movement.

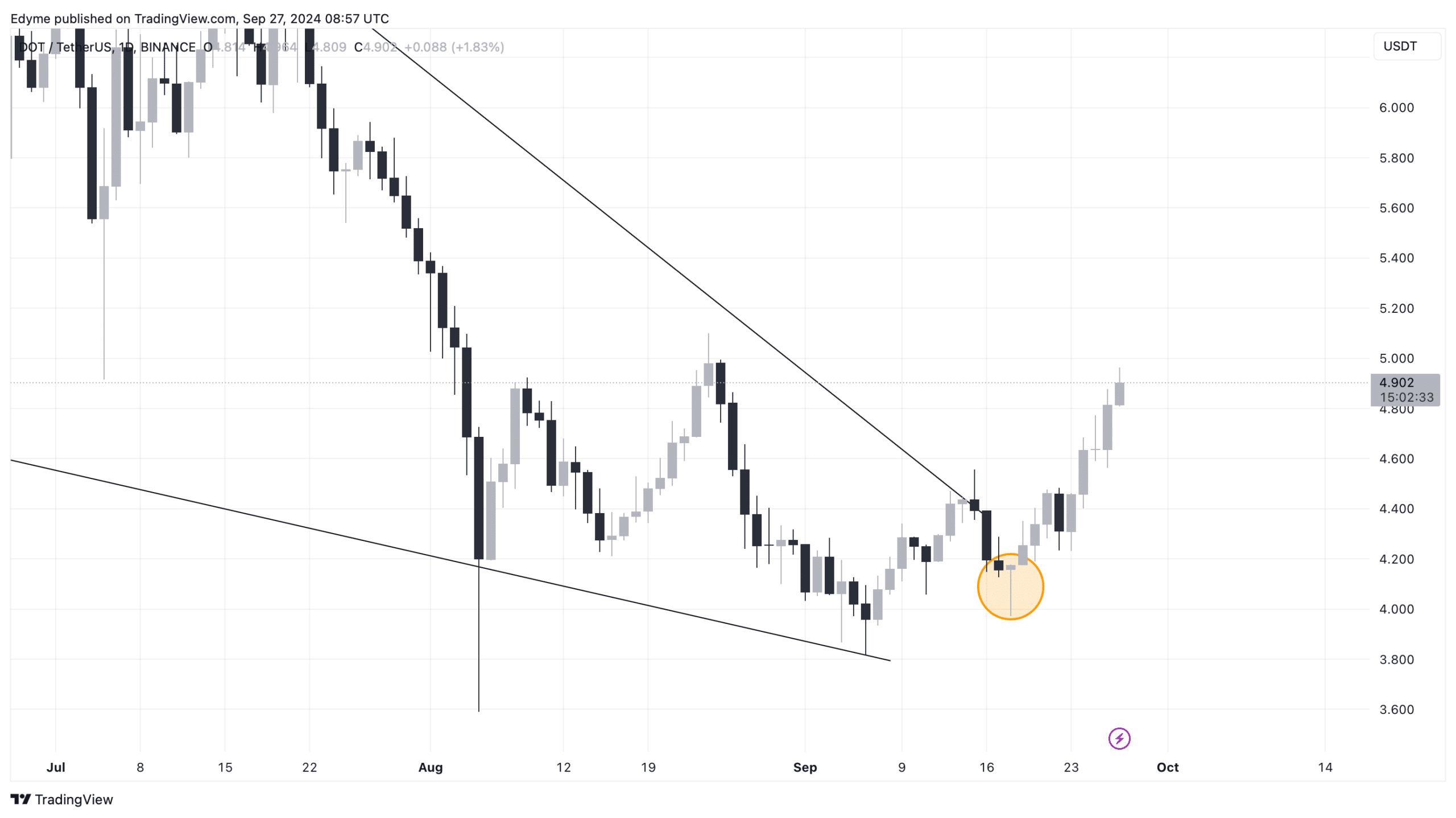

As an analyst, I find myself reinforcing my bullish stance on DOT, given the emergence of a hammer candlestick pattern in its daily chart. This technical pattern often signals a potential reversal and could indicate that the downtrend may be coming to an end.

Technical analysis identifies a ‘hammer pattern’ as a signal of potential price reversal. This pattern is distinguished by a tiny body and a significantly extended lower wick, indicating that buyers managed to raise the price again following a prolonged phase of selling pressure.

This is generally interpreted as a positive sign for potential price increases.

Observing the emergence of this pattern following DOT‘s escape from the falling wedge lends extra support to the idea that the market is optimistic, making it more probable for a substantial price surge in the short run.

Fundamental outlook on DOT

Despite the positive indications from technical signals, it’s essential to consider if DOT‘s core attributes can sustain this bullish trend. To make an informed judgment, let’s scrutinize some crucial aspects instead.

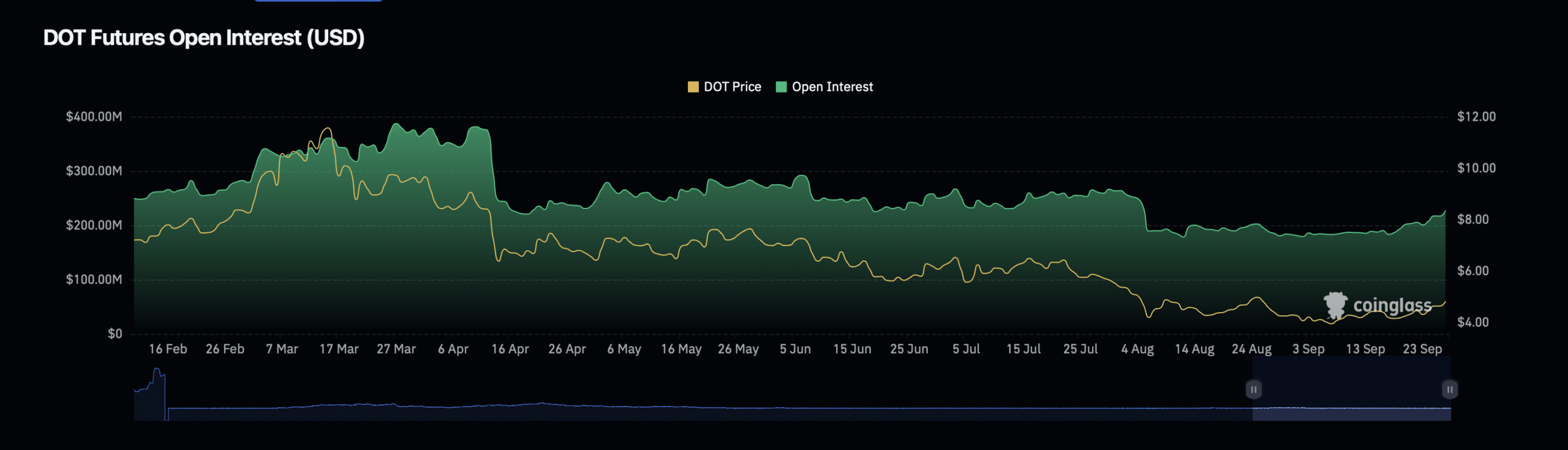

According to data from Coinglass, the Open Interest for DOT, which represents the combined amount of active derivative contracts, has increased by approximately 3.20%, now standing at a total of around $233.03 million.

An increase in Open Interest often indicates heightened market action and trader engagement.

As an analyst, I noticed that while the overall market seems to be surging, the Open Interest volume for DOT has experienced a 15.16% drop, currently sitting at approximately $190.48 million.

As an analyst, I’ve noticed an increase in Open Interest alongside a decrease in trading volume. This could suggest that there’s an uptick in the creation of derivative positions, yet the overall trading activity seems to be softening. It might indicate that investors are adopting a more cautious stance, potentially due to uncertainty in the market.

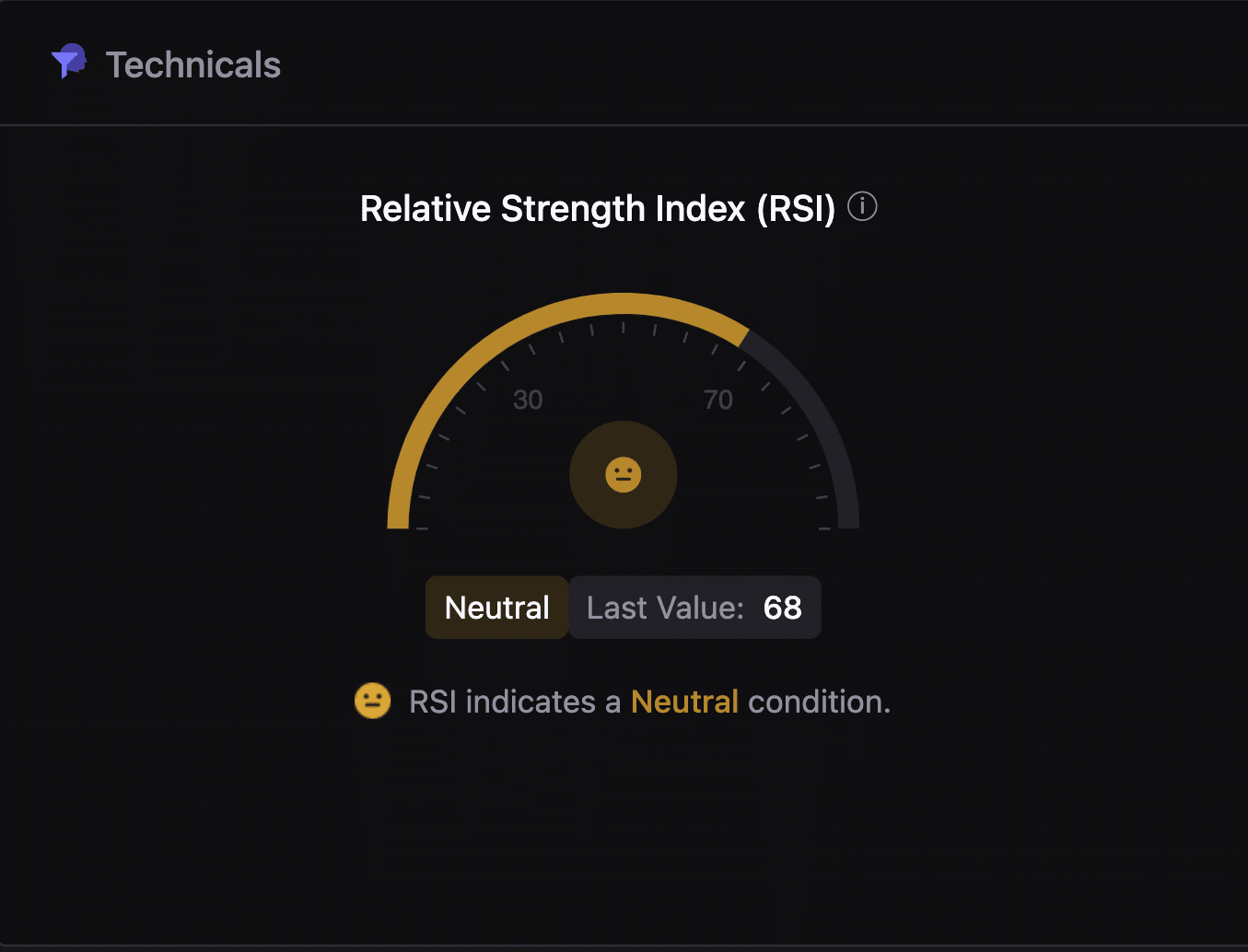

Another critical factor to consider is the Relative Strength Index (RSI), a momentum oscillator that measures the speed and change of price movements.

At the present moment, the Relative Strength Index (RSI) for DOT, as indicated by CryptoQuant’s data, stands at 68. Since this number is less than the overbought level of 70, it implies that the asset is currently in a neutral state.

Read Polkadot’s [DOT] Price Prediction 2024–2025

Generally, when RSI (Relative Strength Index) is less than 70, it suggests that the price may continue to rise as it hasn’t yet reached the level that might cause an overbought situation leading to a potential decrease.

Therefore, the RSI (Relative Strength Index) remaining neutral suggested the possibility of further price increases in DOT, which is consistent with the technical trends visible on its chart.

Read More

- Disney’s Animal Kingdom Says Goodbye to ‘It’s Tough to Be a Bug’ for Zootopia Show

- Why Tina Fey’s Netflix Show The Four Seasons Is a Must-Watch Remake of a Classic Romcom

- Hut 8 ‘self-mining plans’ make it competitive post-halving: Benchmark

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- Taylor Swift Denies Involvement as Legal Battle Explodes Between Blake Lively and Justin Baldoni

- Jujutsu Kaisen Reveals New Gojo and Geto Image That Will Break Your Heart Before the Movie!

- The Weeknd Shocks Fans with Unforgettable Grammy Stage Comeback!

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Elevation – PRIME VIDEO

- S.T.A.L.K.E.R. 2 Major Patch 1.2 offer 1700 improvements

2024-09-27 19:36