- Polygon’s Ahmedabad hardfork boosts network activity with a 20.59% rise in active addresses.

- Despite bullish fundamentals, exchange inflows and a 57.93% short ratio signal caution ahead.

As a seasoned analyst with over two decades of experience in the ever-evolving world of crypto, I have seen more than my fair share of bull runs and bear markets. The recent Polygon (POL) Ahmedabad hardfork has certainly piqued my interest, as it seems to be driving a flurry of activity on the network.

The latest update on Polygon’s [POL], known as the Ahmedabad hardfork, has sparked enthusiasm due to its successful launch on the primary network.

By incorporating essential improvements in protocol via PIP-30, PIP-36, and PIP-45, Polygon aspires to expand contract sizes from 24 KB to 32 KB, thereby enhancing the performance and efficiency of its plasma bridge.

Currently, the price of POL stands at $0.4346 – an uptick of 3.88% over the past 24 hours. This increase suggests a favorable response from the market to recent upgrades. However, it’s worth pondering whether these advancements will foster long-term growth or if the current market excitement is fleeting.

On-chain data: Bulls are in motion

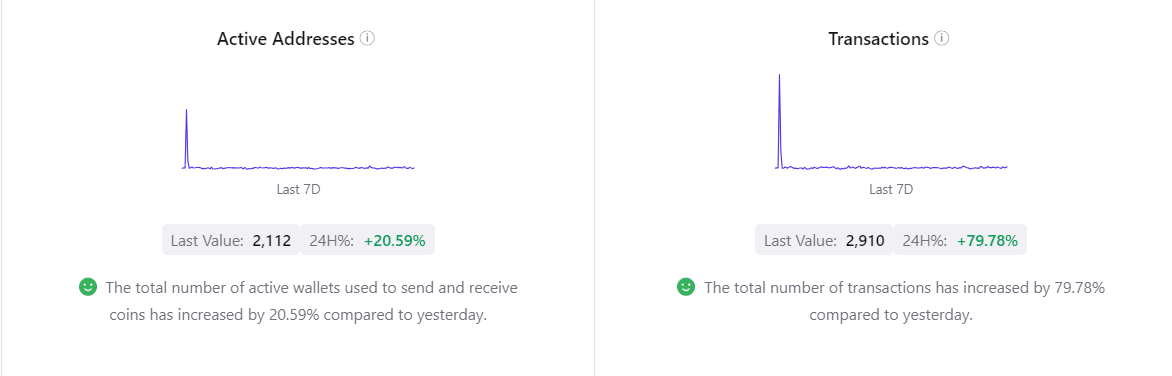

Over the last 24 hours, data recorded on-chain has provided valuable insights into the impact of the Ahmedabad hardfork. The number of active addresses has surged by approximately 20.59%, currently standing at 2,112. This surge indicates a significant boost in network activity, suggesting that users are increasingly engaged.

Furthermore, the number of transactions surged by a significant 79.78% over the past day, totaling approximately 2,910 transactions, as indicated by CryptoQuant’s data.

As a result, the heightened level of activity shows that the network is now more user-friendly and capable of handling larger volumes, leading to increased engagement. It seems that the hardfork has sparked substantial growth in the network.

Exchange netflow: A red flag?

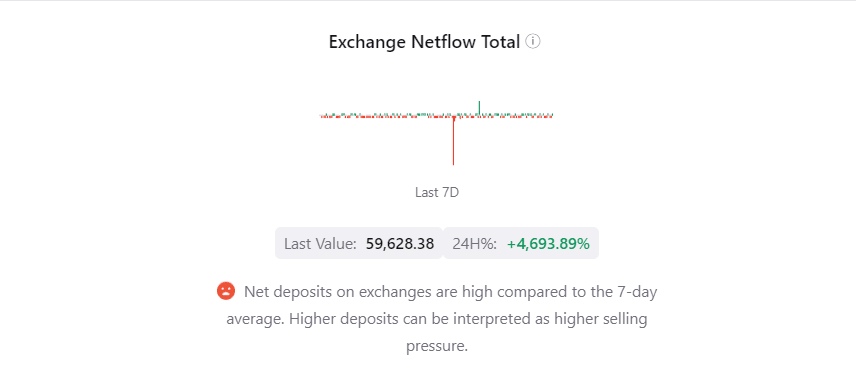

However, despite the encouraging on-chain data, exchange netflow reveals a more cautious outlook.

As reported by CryptoQuant, there’s been a significant increase of approximately 4,693.89% in deposits to exchanges, amounting to about 59,628.38 Polygon (POL) at the current moment. This substantial influx could indicate potential selling pressure.

historically, big stockpiles have come before major sell-offs, suggesting that certain investors may be planning to cash out following the recent price increase.

Therefore, it seems prudent to exercise caution in the coming days since there might be an uptick in selling activity, potentially affecting the token’s near future returns.

Long/short ratio: Bears still lurking

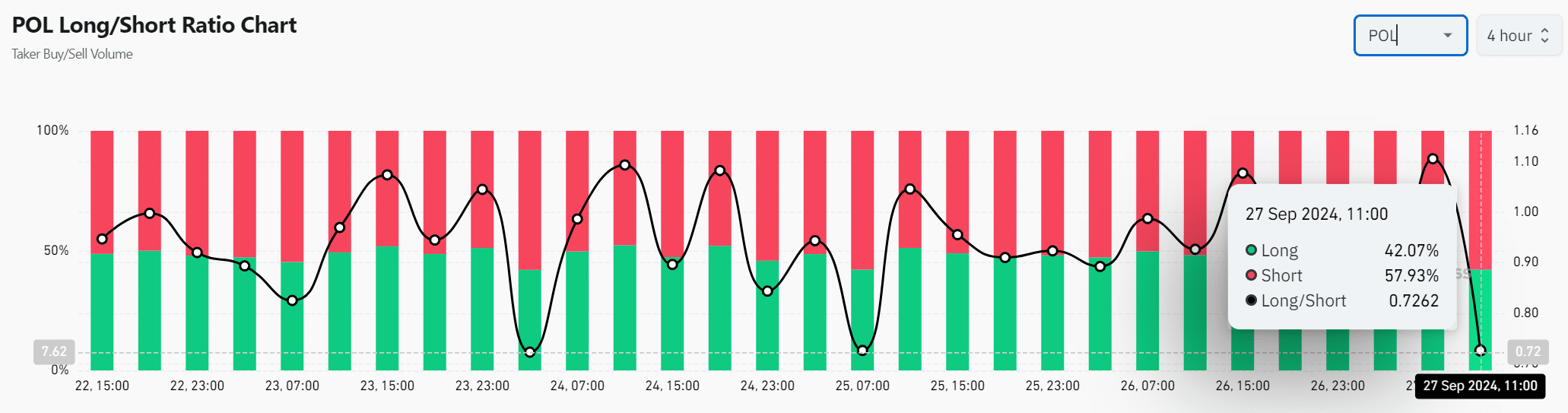

Additionally, the long/short ratio introduces an extra level of intricacy into the scenario at hand. Presently, approximately 57.93% of traders have taken a short position, as opposed to 42.07% who are long.

Therefore, despite the bullish on-chain activity, many market participants remain wary of a potential correction.

The general feeling among investors is one of hesitation, leading them to protect their investments by taking precautions against potential declines.

Bulls in charge, but stay vigilant

The Ahmedabad hardfork clearly sparked a favorable reaction within the Polygon community, as evidenced by the significant increase in active addresses, transactions, and value, suggesting robust underlying development.

Given the substantial inflow of exchanges and a pessimistic outlook in the futures market, I’m remaining cautious for now.

As a researcher observing market trends, while the bullish sentiment seems prevalent at the moment, I urge caution. A temporary market adjustment or correction may yet materialize in the near future, so it’s crucial for investors to stay attentive and prepared.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Quick Guide: Finding Garlic in Oblivion Remastered

- BLUR PREDICTION. BLUR cryptocurrency

- How to Get to Frostcrag Spire in Oblivion Remastered

- This School Girl Street Fighter 6 Anime Could Be the Hottest New Series of the Year

- Isabella Strahan Shares Health Journey Update After Finishing Chemo

- Apple Watch Series 10 UK release date, price and when you’ll be able to pre-order

- Pauly Shore Honors “One of a Kind” Richard Simmons After His Death

- Everything Jax Taylor & Brittany Cartwright Said About Their Breakup

2024-09-27 22:16