-

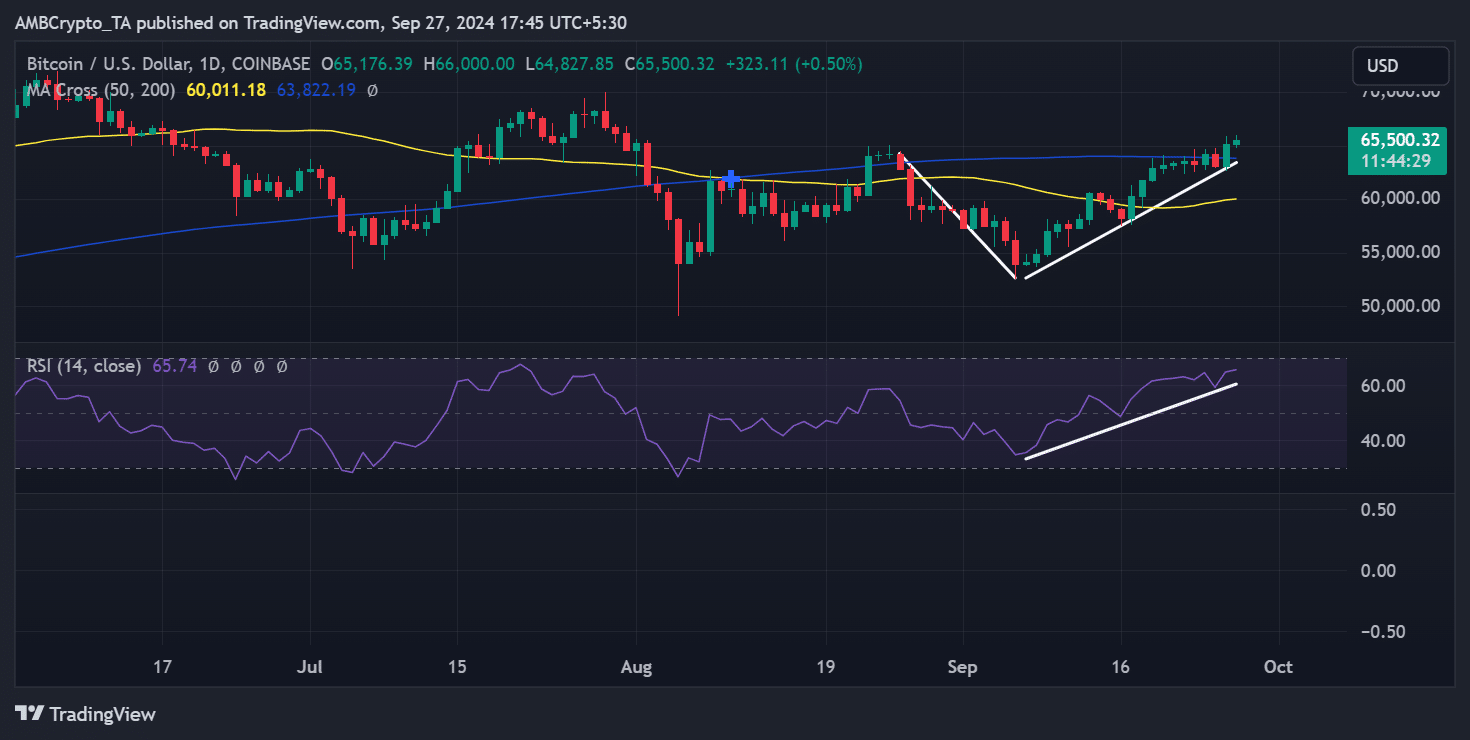

BTC broke its 200-day moving average, turning previous resistance into potential new support, signaling a bullish trend.

Rising market sentiment towards greed and increased BTC withdrawals from exchanges are key factors driving Bitcoin’s price up.

As a seasoned crypto investor with a knack for spotting market trends and navigating through turbulent waters, I’ve witnessed Bitcoin’s rollercoaster ride over the years. Today, I find myself elated as BTC has finally managed to break its long-standing 200-day moving average, turning previous resistance into potential new support – a bullish sign that has me feeling optimistic about our beloved digital gold.

Bitcoin (BTC) has at last surpassed its extended moving average, a barrier that had historically served as a ceiling. This upward momentum sustained in the last 24 hours has left numerous investors pondering: What’s causing Bitcoin to rise today?

Bitcoin breaks key resistance

During the most recent trading period, Bitcoin experienced a notable surge of more than 3%, raising its value approximately to $65,177.

Currently, the upward trend continues slightly, yielding a minimal increase of around 0.8%, pushing the price up to roughly $65,400.

In simpler terms, a key indicator that previously resisted price increase for the cryptocurrency is now preparing to offer support – this could be a positive signal indicating potential growth in the future.

It appears that Bitcoin has experienced a rise of more than 11% so far this month. While it may seem like its daily fluctuations are insignificant, the general direction shows an upward trajectory.

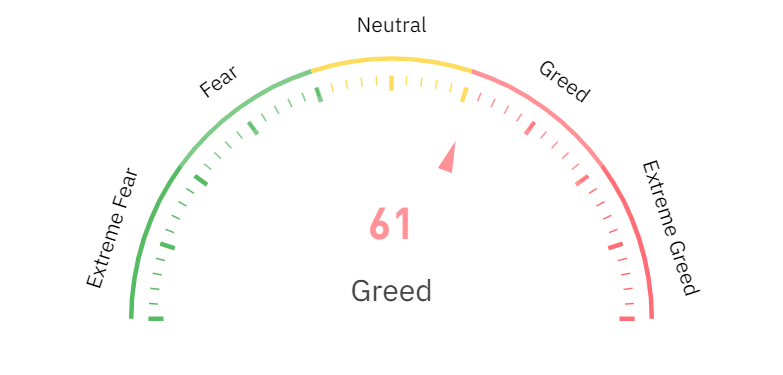

Bitcoin sentiment shifts to greed

One factor contributing to Bitcoin’s rise today is a change in investor attitudes, as optimism has grown since the Federal Reserve made its initial interest rate reduction in over four years.

Furthermore, the U.S. market is looking forward to a speech by Federal Reserve Chairman Jerome Powell, which has the potential to strongly influence Bitcoin and other digital currencies.

Furthermore, data from Coinglass suggests that Bitcoin’s sentiment level climbed approximately to 65%, which signals that the market is now in the “greed” stage. This change in investor feelings is a significant contributor to Bitcoin’s recent price surge.

Additionally, traditionally, Bitcoin (BTC) has not performed well in the month of September. However, this year seems to buck that trend. The recent surge could also be due to the expectation of a more favorable pattern usually seen in October.

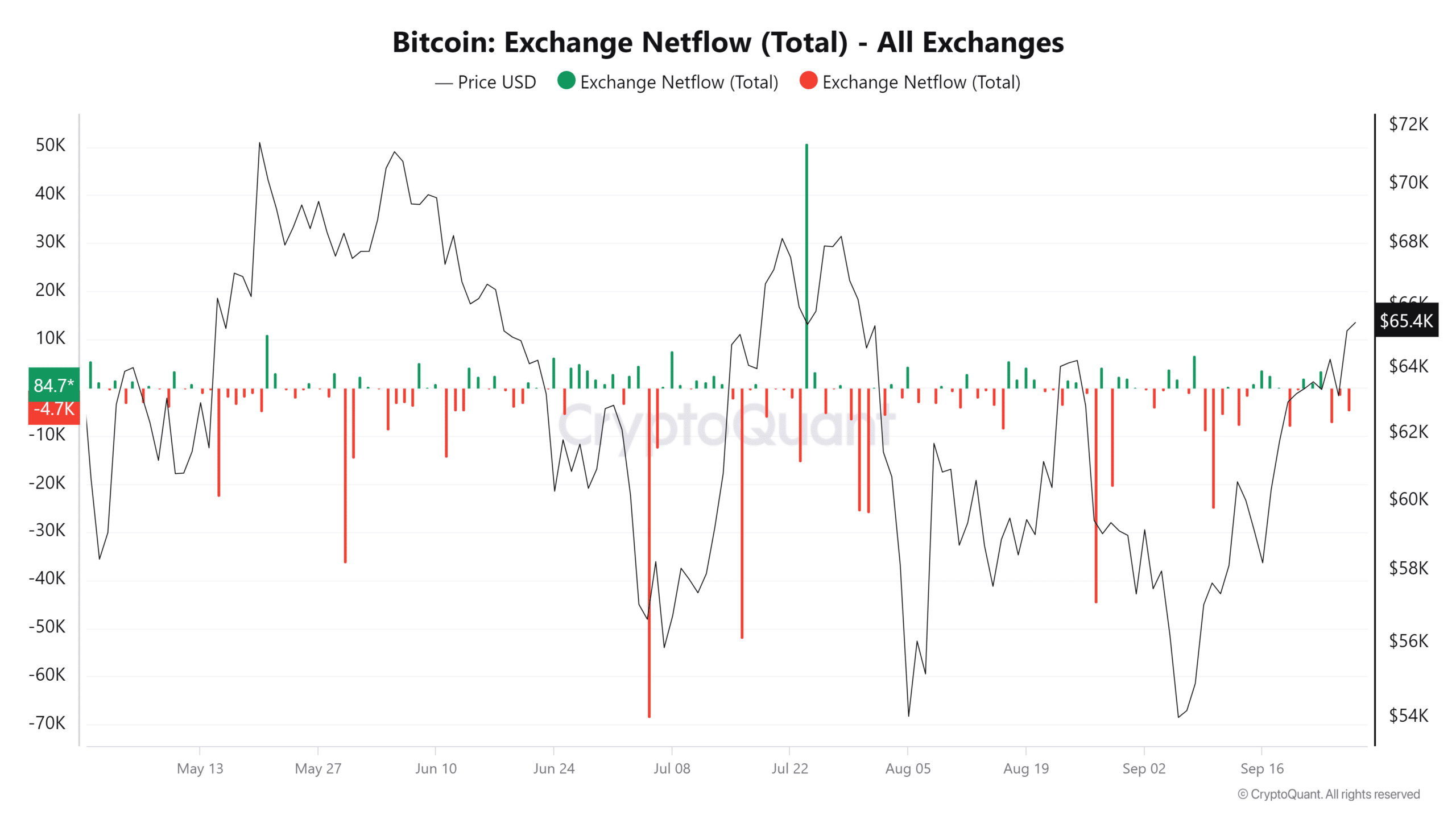

More Bitcoin leaving exchanges

Another factor explaining why Bitcoin is up today is the movement of BTC off exchanges.

Based on data from CryptoQuant, there’s been a trend of more Bitcoin being taken out of exchanges than put in, recently. This could indicate that owners are choosing to store their digital assets in personal wallets instead of selling them.

During an increase in price, a negative outflow of funds (netflow) often serves as a favorable sign. This suggests that investors anticipate further price growth and are less likely to dispose of their Bitcoin. Consequently, reduced selling pressure might boost the price of Bitcoin even higher.

Conclusion

The latest increase in Bitcoin’s value may be due to crossing significant barriers of resistance, a growing optimistic outlook among traders that leans towards greed, and an uptick in individual investors taking their Bitcoins off exchanges.

Today’s rise in Bitcoin can be attributed to these specific reasons, which could potentially drive further growth in the near future.

Read More

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- PI PREDICTION. PI cryptocurrency

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

2024-09-28 03:03