- The Ethereum average transaction fee has increased swiftly in recent weeks

- The daily activity and network growth have not kept pace

As an analyst with years of experience observing and dissecting the crypto market, I’ve seen my fair share of trends that seem to defy logic. However, the recent surge in Ethereum [ETH] transaction fees has left even this seasoned observer scratching their head.

The surge in optimism throughout the cryptocurrency market, triggered by Bitcoin‘s [BTC] breaking through the $64k mark, provided a boost to Ethereum [ETH].

Price increases extending above $64k spark optimism in the crypto market, as this level has served as a significant resistance point for Bitcoin over the past few weeks.

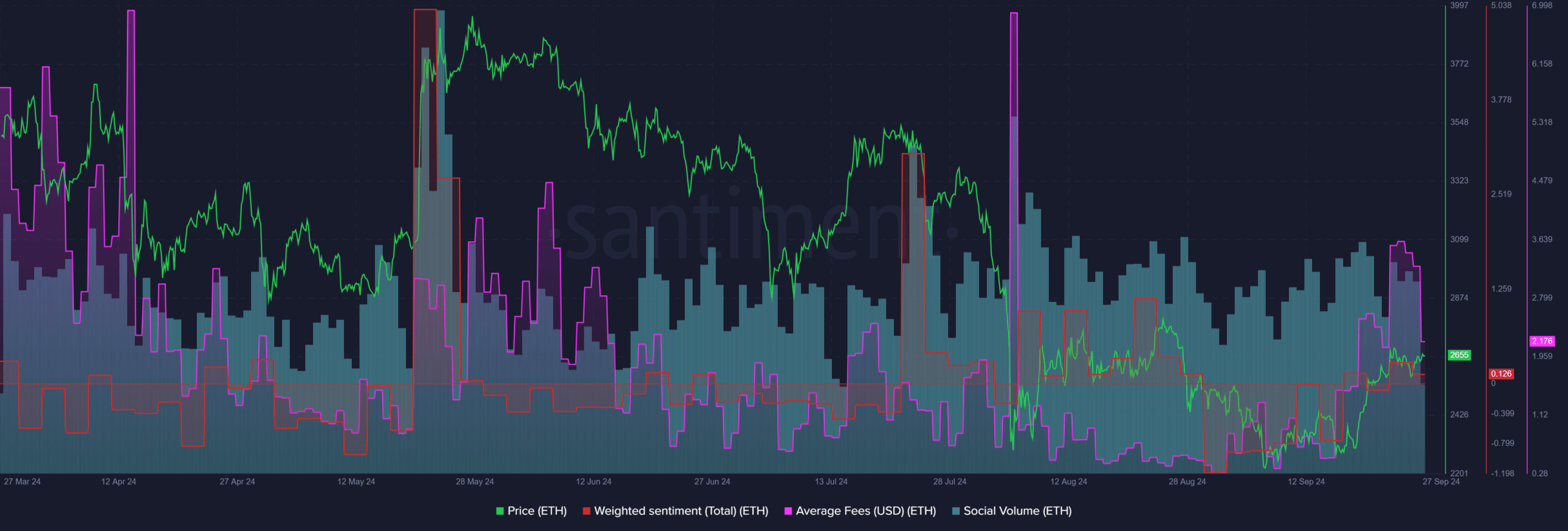

Over the past few weeks, the average transaction fee on Ethereum has increased nearly 12 times what it was in late August. This surge may be counterbalanced by the asset’s price growth, though, as users might find solace in that. However, a drop in Ethereum’s market dominance is another concerning factor, even considering its current price movement.

Ethereum fees have steadily trended higher

On X’s latest post, Santiment’s cryptocurrency data analysis team highlighted an interesting trend: the average transaction fee has been gradually rising for the past month.

In the same span, Ethereum’s value has risen by about 17.69% from its low on the 16th of September.

The consistent rise in prices may have drowned out talks about growing charges. However, a significant spike is evident when comparing the average fees from August 31st ($0.29) to September 24th ($3.61).

Over the last several days, the cost has dropped down once more, now averaging around $2.18. Meanwhile, the general public’s opinion on this matter has shifted positively.

This was good news for ETH investors, especially as the asset approaches the key resistance zone at $2.8k-$2.9k. Social media volume slightly increased in September, another minor victory for the bulls.

Transaction count up alongside the fees

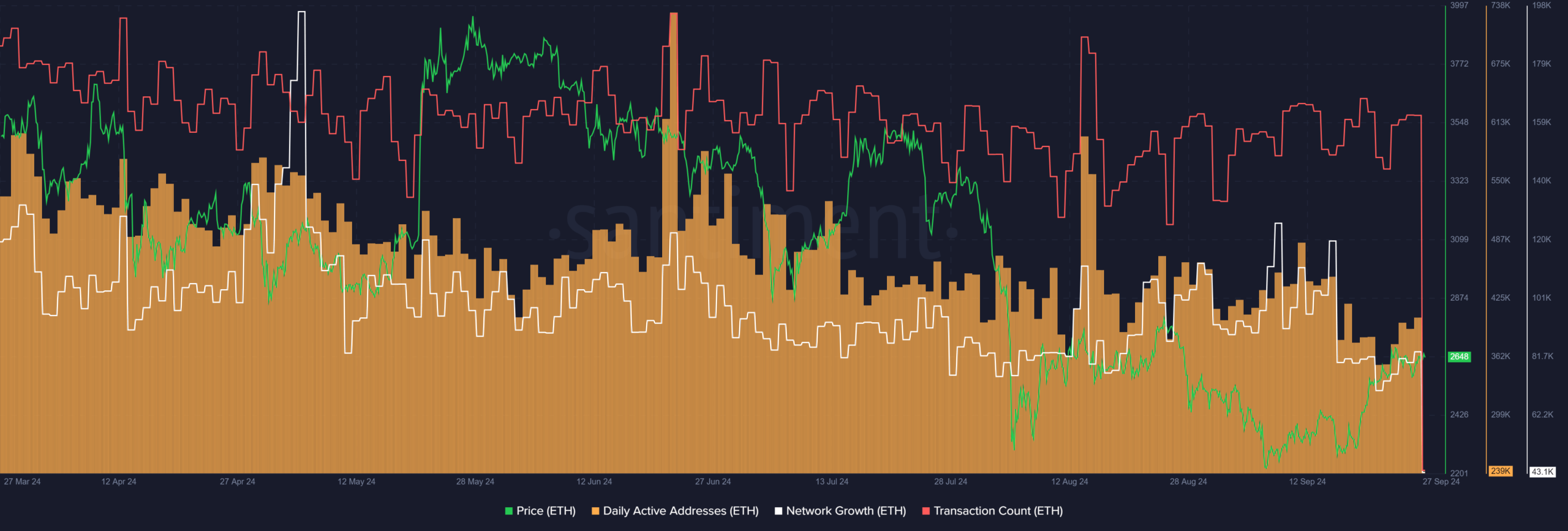

The network activity has not rapidly increased to explain the rising network fees.

Read Ethereum’s [ETH] Price Prediction 2024-25

In the last three weeks, while there’s been a 10% rise in transactions, the number of daily active addresses and network expansion have shown a decline instead.

It’s quite possible that the base fee increased in September compared to August due to an uptick in activities like NFT creation, or perhaps users opted to pay higher priority fees to expedite their transactions.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

2024-09-28 05:43