-

Wrapped Bitcoin dominates the DeFi ecosystem with a strong foothold.

Per AMBCrypto, AAVE has strategically maximized its benefits from the rising WBTC exposure.

As a seasoned crypto investor with a knack for navigating the digital asset landscape, I’ve seen my fair share of trends come and go. However, the meteoric rise of Wrapped Bitcoin (WBTC) within the DeFi ecosystem is nothing short of remarkable. With over $9 billion in TVL, it’s safe to say that WBTC has firmly established itself as a dominant player.

Wrapped Bitcoin (WBTC) continues to be the leading Bitcoin-related asset within Decentralized Finance (DeFi), boasting more than $9 billion in Total Value Locked (TVL). Interestingly, the amount of WBTC supplied on AAVE has hit a new peak, exceeding $2 billion.

This surge reflects the broader trend in DeFi, where bullish Bitcoin sentiment fuels increased WBTC activity.

Benefits of Wrapped Bitcoin

As a crypto enthusiast, I find it fascinating that developers have crafted Wrapped Bitcoin (WBTC) to connect the worlds of Bitcoin and Ethereum. With WBBITCOIN, users can enjoy the perks of both these powerful networks, making my investment portfolio more versatile and efficient.

Nevertheless, it’s worth noting that the Layer 2 DeFi platform called AAVE, operating within the Ethereum blockchain, has garnered the greatest advantages, currently holding approximately 37,000 WBTC, which equates to more than $2 billion in value.

Fundamentally, Wrapped Bitcoin is highly preferred by investors. Furthermore, factors such as enhanced liquidity and the need for BTC involvement in Decentralized Finance could potentially explain this rise.

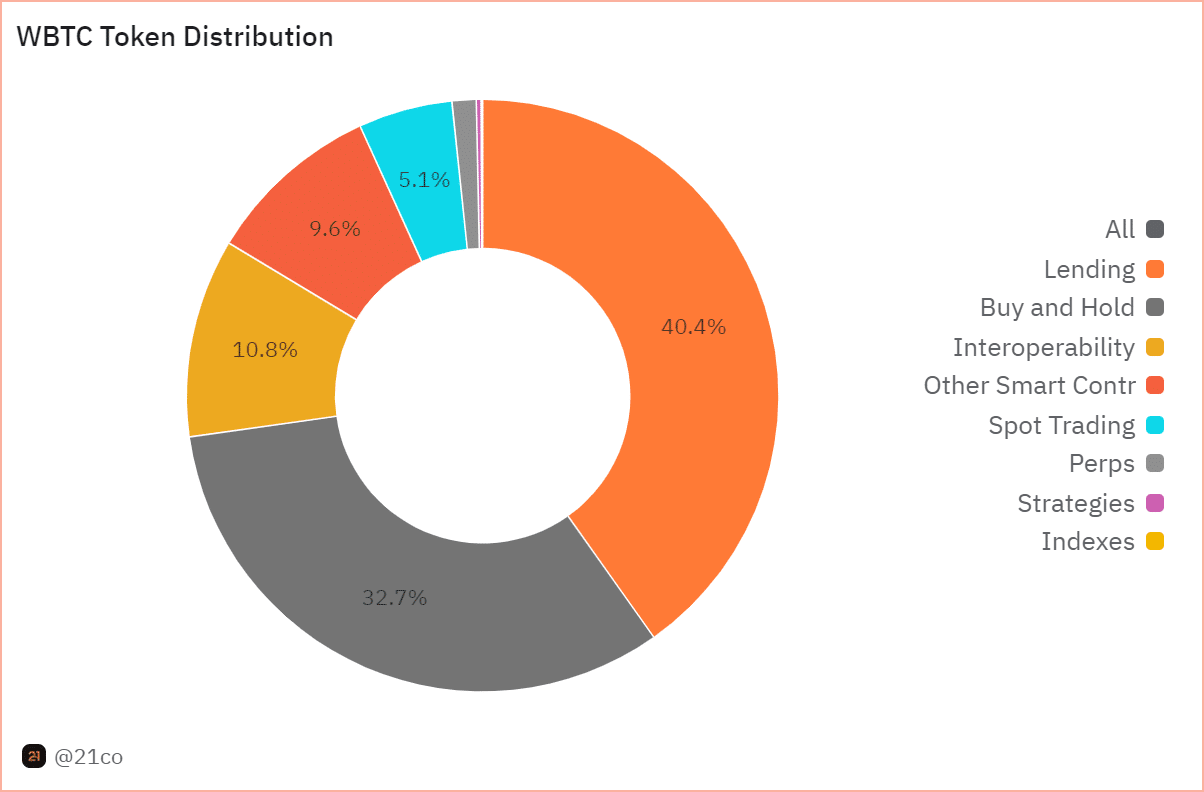

Source : Dune

On AAVE, a popular lending service, it’s clear why there’s such a high volume of Wrapped Bitcoin (WBTC). After all, WBTC represents nearly 40.4% of the entire lending sector. This high supply is justified due to its popularity among investors. With WBTC, Bitcoin holders can gain interest on their investments, maximizing returns without having to sell their BTC. Even better, they keep direct access to Bitcoin when it approaches significant resistance levels.

In simpler terms, an increase in Bitcoin’s value leads to a potential rise in Wrapped Bitcoin’s (WBTC) collateral too. This could make WBTC more attractive for usage on lending platforms such as AAVE.

THIS is attracting WBTCs on AAVE

Previously discussed, Wrapped Bitcoin (WBTC) is useful for yield farming activities. In this process, individuals place their resources within DeFi systems to receive extra compensation. By doing so, people are motivated to transform their original Bitcoins into WBTC.

According to AMBCrypto, AAVE has cleverly implemented aspects that entice holders of Wrapped Bitcoin to use its platform.

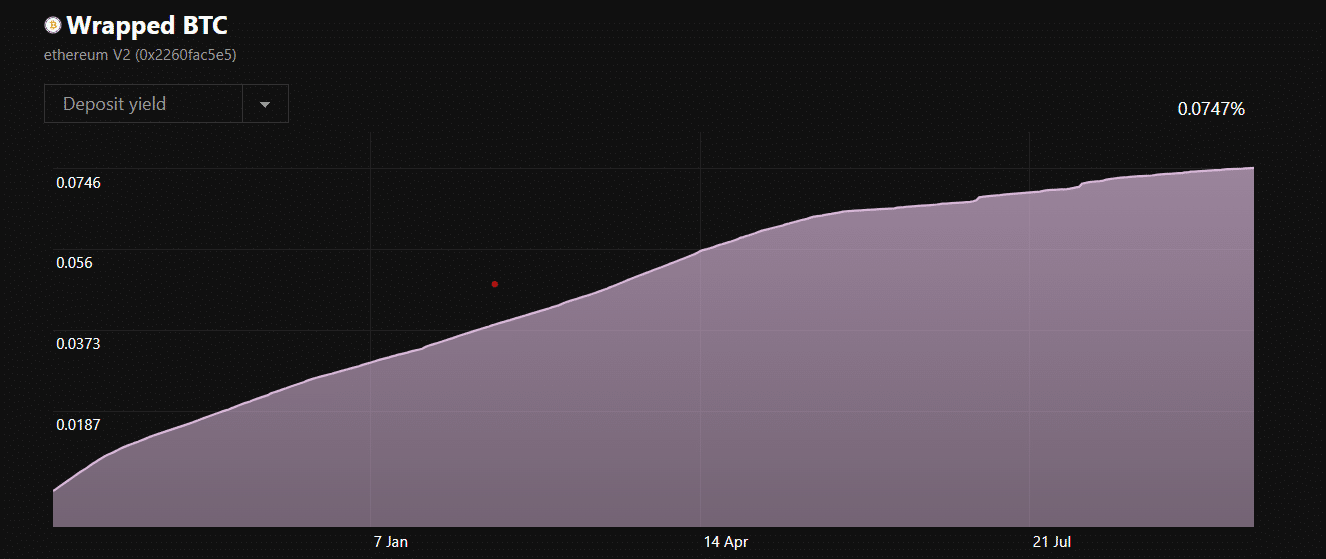

Over the past year, the return on WBTC deposits rose from 0.000489% to an impressive 0.0747%, representing a remarkable 15,196% growth in yield.

Source : Aavescan

Above all, every WBTC token is backed by one Bitcoin, ensuring that users can exchange their WBTC tokens for an equal value in Bitcoin at any time.

Furthermore, when they use Wrapped Bitcoin (WBTC) as security, users gain the ability to obtain other digital currencies or stablecoins as loans. This empowers them to multiply their Bitcoin investments by making use of it in diverse strategies.

Read Wrapped Bitcoin’s [WBTC] Price Prediction 2024 – 2025

To put it simply, an increase in WBTC availability on AAVE has occurred during a period of doubt about its storage management practices.

As a crypto investor, I can’t help but acknowledge the uncertainties that have been surfacing lately. However, amidst all this, Wrapped Bitcoin continues to be a preferred pick for many of us investors. And let me tell you, AAVE has truly capitalized on these circumstances, reaping the most substantial rewards.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-09-28 06:16