- Litecoin has broken above an ascending triangle pattern amid a rise in buying volumes.

- Exchange inflow data shows that sellers remain absent, suggesting confidence in the uptrend.

As a seasoned analyst with years of experience in the crypto market, I’ve seen my fair share of bullish and bearish trends. However, the current Litecoin [LTC] situation seems particularly promising. The breakout above the ascending triangle pattern amid rising buying volumes is a clear sign of strong bullish momentum.

Litecoin [LTC] is up 12% in the last 30 days and up by 5% in the last seven days. At press time, LTC traded at $69 with an over 16% rise in trading volumes per CoinMarketCap.

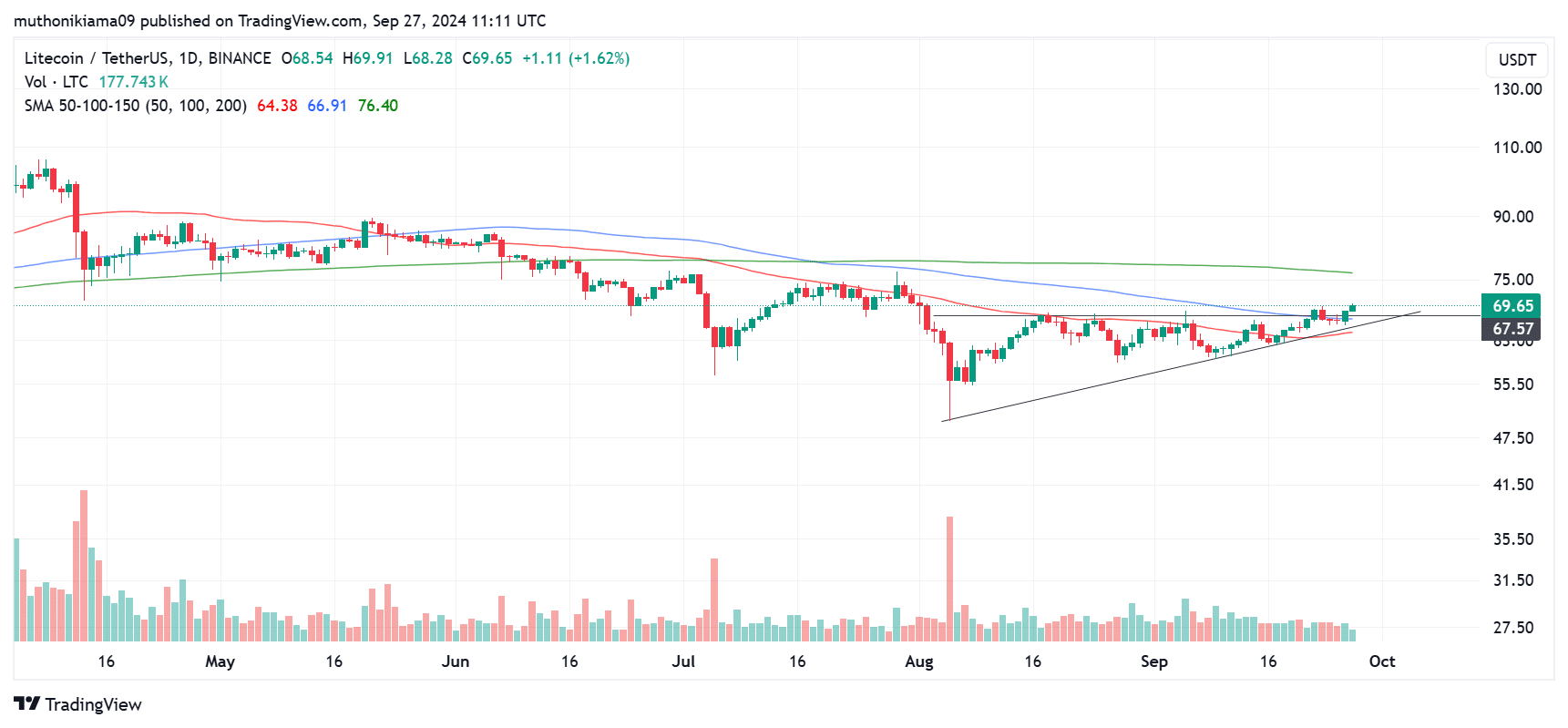

On the daily chart, Litecoin burst through an upward sloping triangle formation, surpassing a robust resistance level at approximately $67. This breakthrough implies a surge in positive, or bullish, energy for Litecoin’s price movement.

Along with the breakout, there’s been an increase in demand, indicated by the green volume histogram bars, showing that buyers have overpowered sellers, implying a prolonged surge beyond this breakout level.

The bullish momentum is gaining strength after the price broke above the 100-day Simple Moving Average (SMA). If this trend continues, the next target for LTC will be the 200-day SMA at $76.

Technical indicators flip bullish

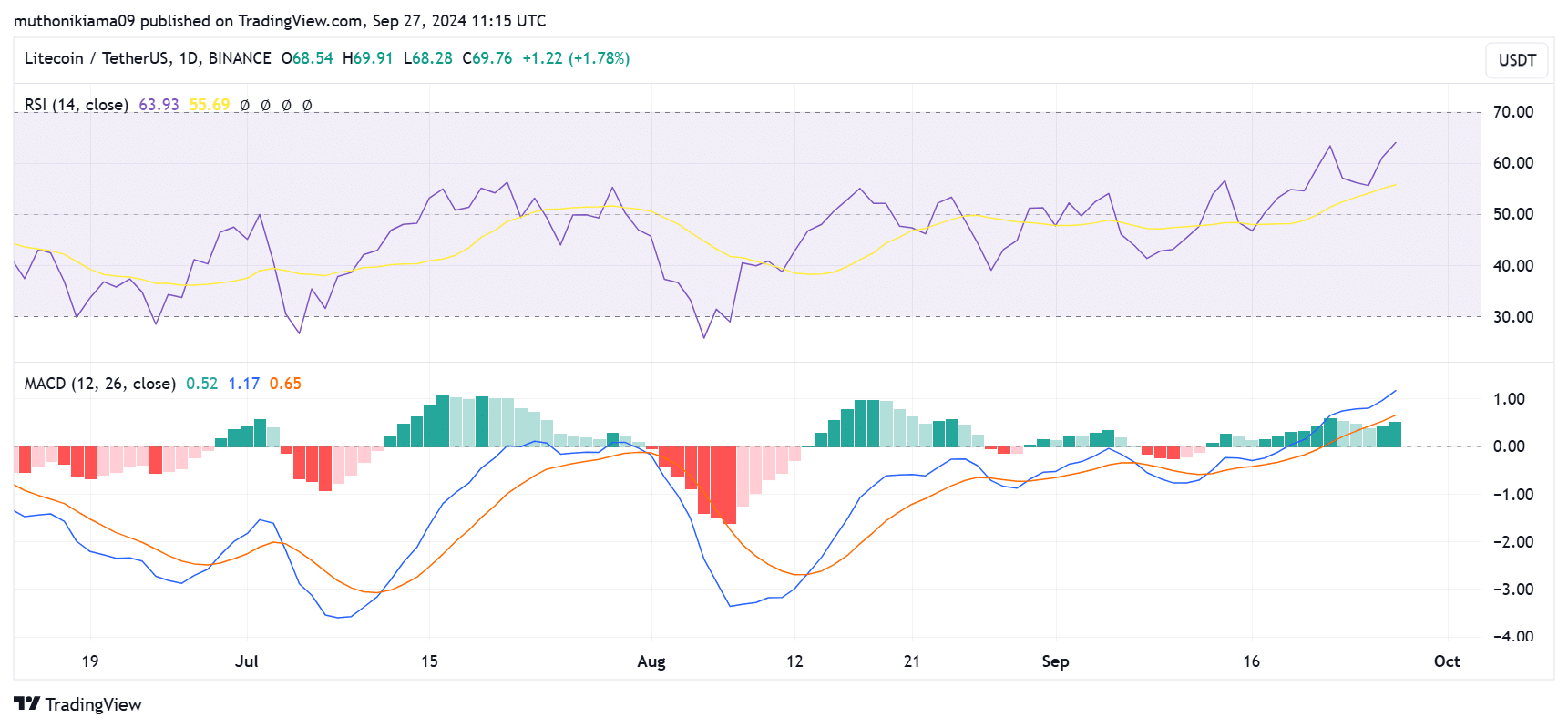

The Moving Average Convergence Divergence (MACD) indicator strengthens the bullish case for Litecoin. The MACD histogram bars have flipped green, and are positive. This indicates that the current uptrend is strong.

The MACD line, along with being positive, is also rising above the signal line, indicating a stronger hold by the bulls over the market’s direction.

Examining the Relative Strength Index (RSI) line at 63 suggests that buyers are dominating sellers in the market. Moreover, since August, the RSI line has been forming higher peaks, indicating growing enthusiasm for LTC.

If buying interest stays strong and sellers remain hesitant, Litecoin might continue to rise in value.

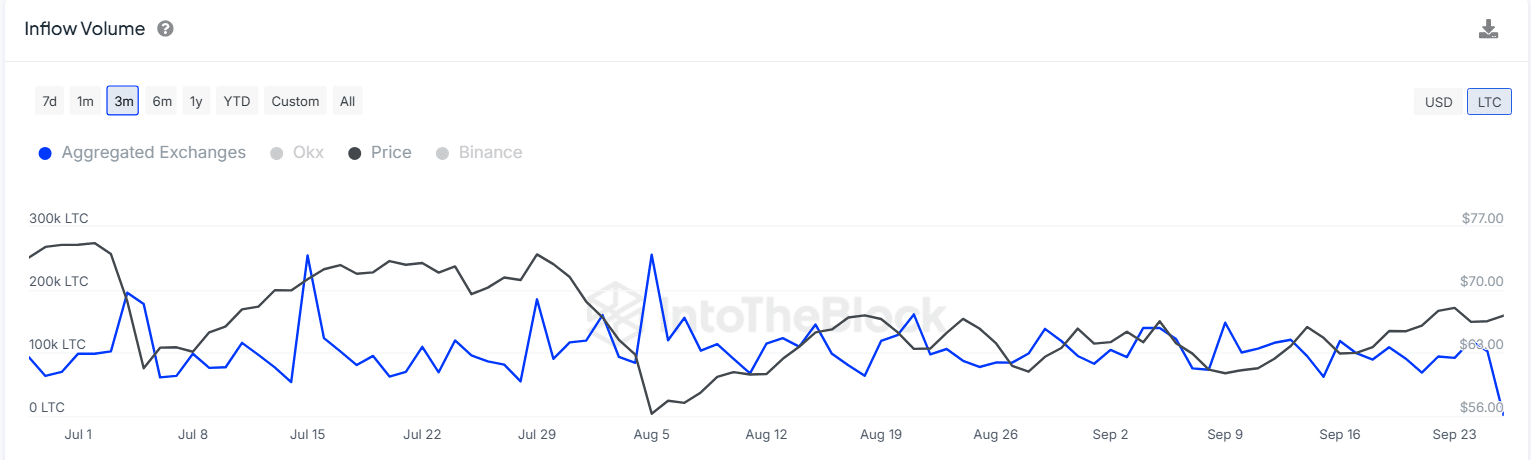

As a researcher examining exchange inflow data, I’ve observed a significant drop in inflows since Litecoin (LTC) surpassed the $66 mark. This decline may indicate a diminished desire to sell among investors, implying a growing confidence in the ongoing rally.

Liquidation data and Funding Rates

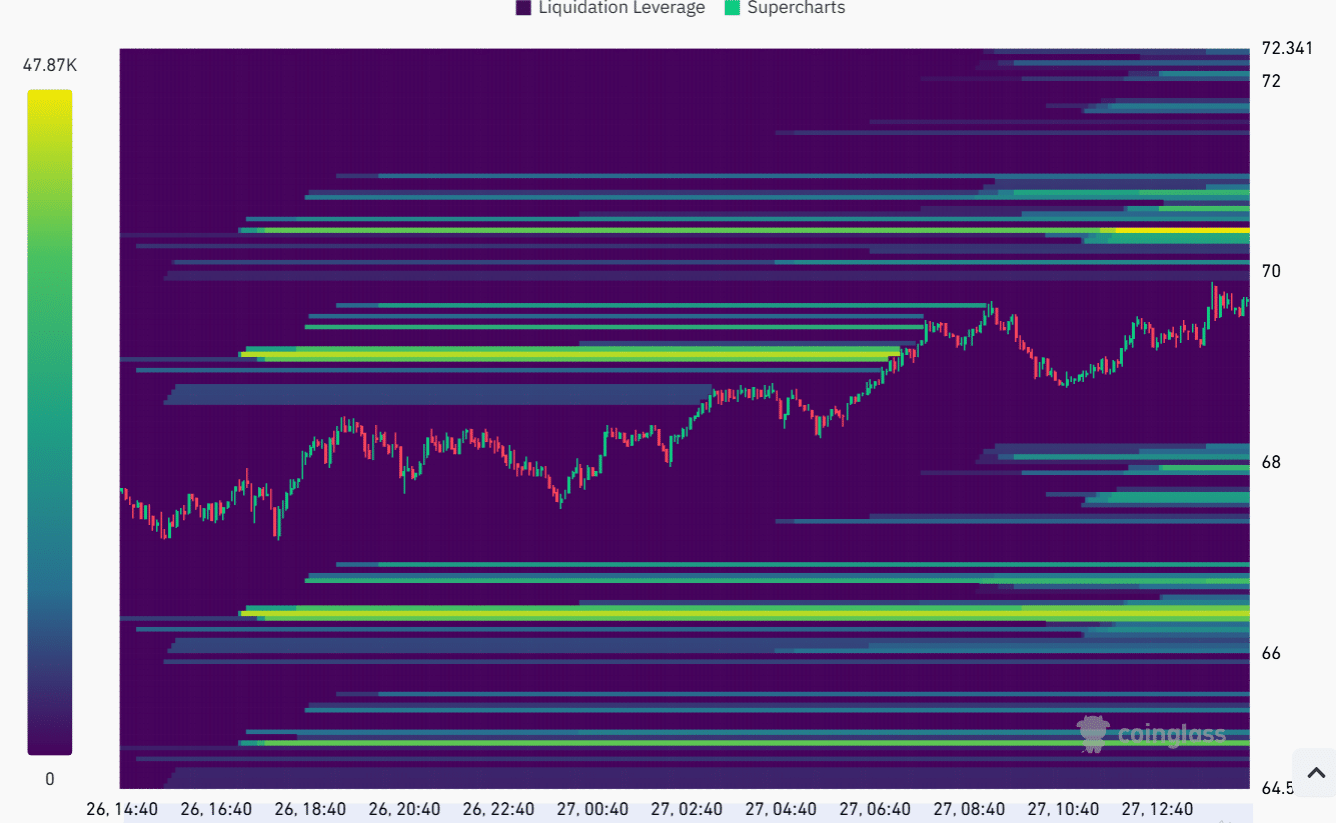

As Litecoin approaches the region above $70, which is known for its substantial trading volume, it’s important to note that such areas often serve as robust barriers to further price increase. This is because there’s a significant amount of sellers looking to offload their coins at these levels, making it tough for the price to rise any higher.

Should Long Term Contract (LTC) persistently increase and reach that particular region, it might instigate price fluctuations. Yet, if an abundance of purchase orders bolsters the upward trend, Long Term Contract could potentially surpass this zone.

Read Litecoin’s [LTC] Price Prediction 2024–2025

A look at Funding Rates on Coinglass also shows that there is positive sentiment around Litecoin.

Over the last week, Long Term Contract (LTC) Funding Rates have generally risen, indicating that most traders are taking a long position and anticipating further price growth.

Read More

- PI PREDICTION. PI cryptocurrency

- How to Get to Frostcrag Spire in Oblivion Remastered

- We Ranked All of Gilmore Girls Couples: From Worst to Best

- How Michael Saylor Plans to Create a Bitcoin Empire Bigger Than Your Wildest Dreams

- Kylie & Timothée’s Red Carpet Debut: You Won’t BELIEVE What Happened After!

- S.T.A.L.K.E.R. 2 Major Patch 1.2 offer 1700 improvements

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- PS5 Finally Gets Cozy with Little Kitty, Big City – Meow-some Open World Adventure!

- Florence Pugh’s Bold Shoulder Look Is Turning Heads Again—Are Deltoids the New Red Carpet Accessory?

- WCT PREDICTION. WCT cryptocurrency

2024-09-28 07:35