- Solana’s short-term outlook was bullish even as it stared down a key resistance

- Network activity has soared in recent weeks, majorly driven by memecoins

As a seasoned researcher with a knack for deciphering market trends and a soft spot for Solana [SOL], I find myself rather bullish on the token’s short-term outlook. The recent surge in network activity, primarily driven by memecoins, is a telltale sign of growing interest and potential adoption. However, it’s important to remember that while we’ve seen such frenzy before, this time around seems less intense, much like a summer rain compared to the monsoon of April.

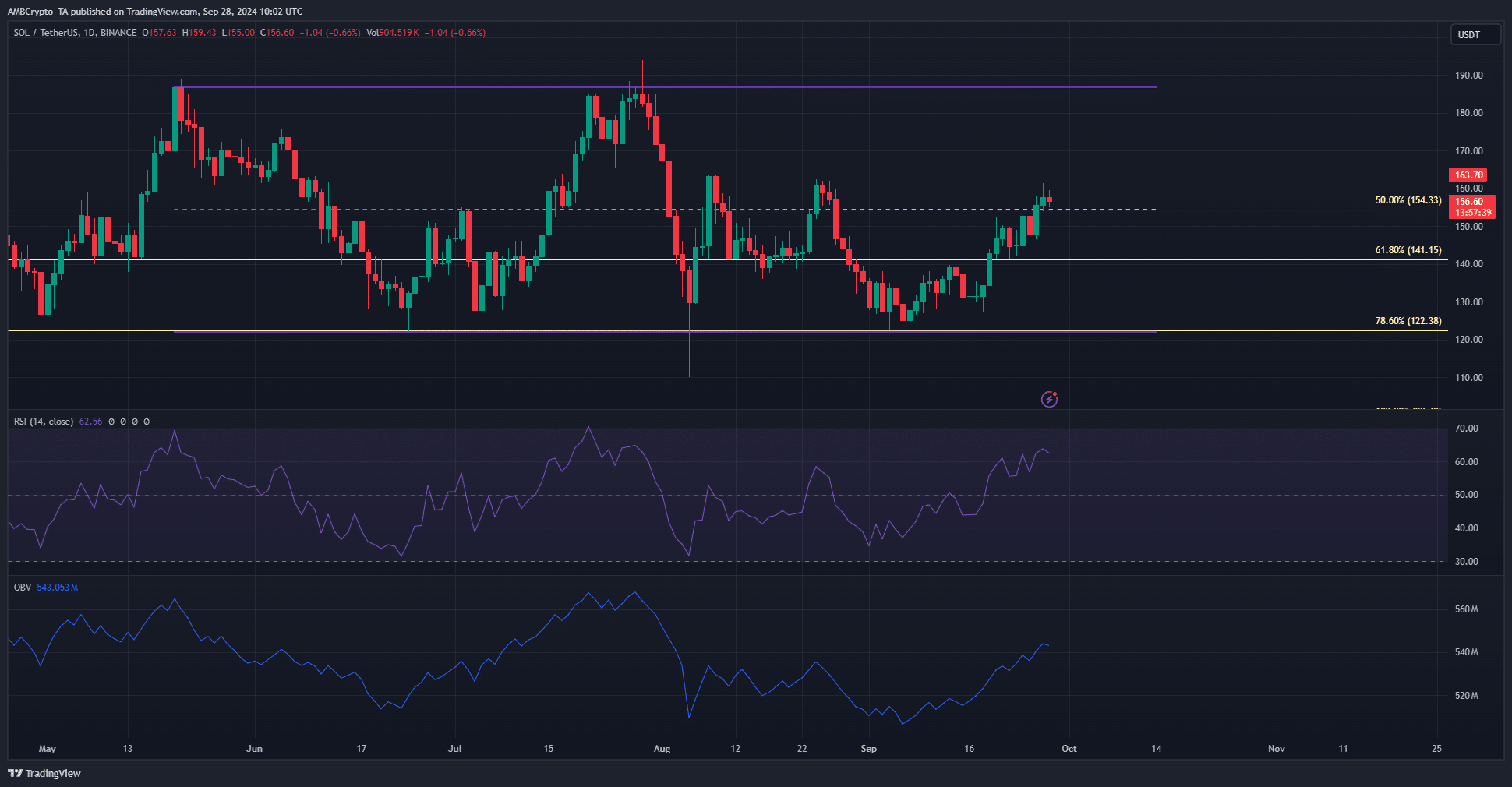

Starting from the 6th of September, when Solana [SOL] tested its range low at $120, it has experienced a price increase of approximately 30%. Currently, it’s hovering near a two-month resistance area between $162 and $165. Additionally, there is a positive short-term outlook towards the token, with many investors feeling bullish about Solana.

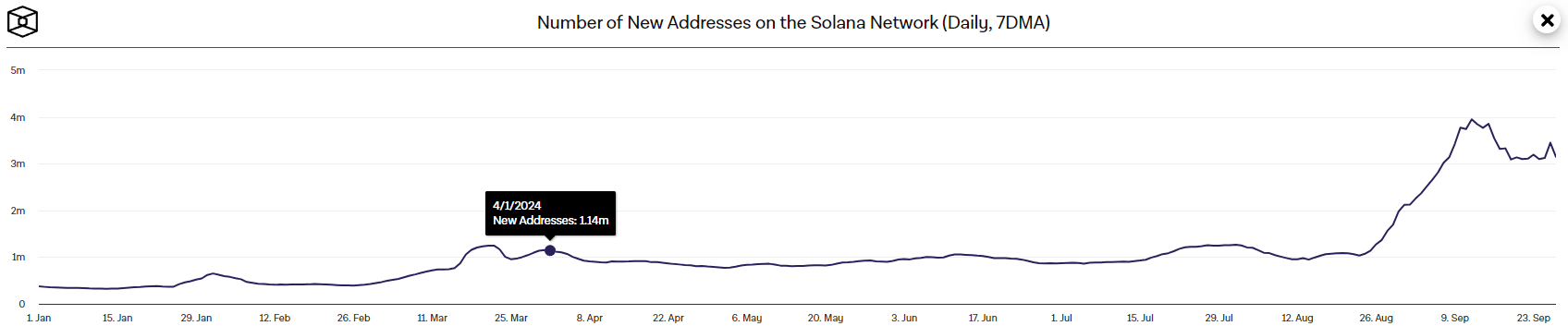

The level of on-chain activity appears to be increasing, according to a recent AMBCrypto report. This increase seems to be driven mainly by the growing popularity of mem coins based on SOL, though it hasn’t reached the same intensity as seen in April yet.

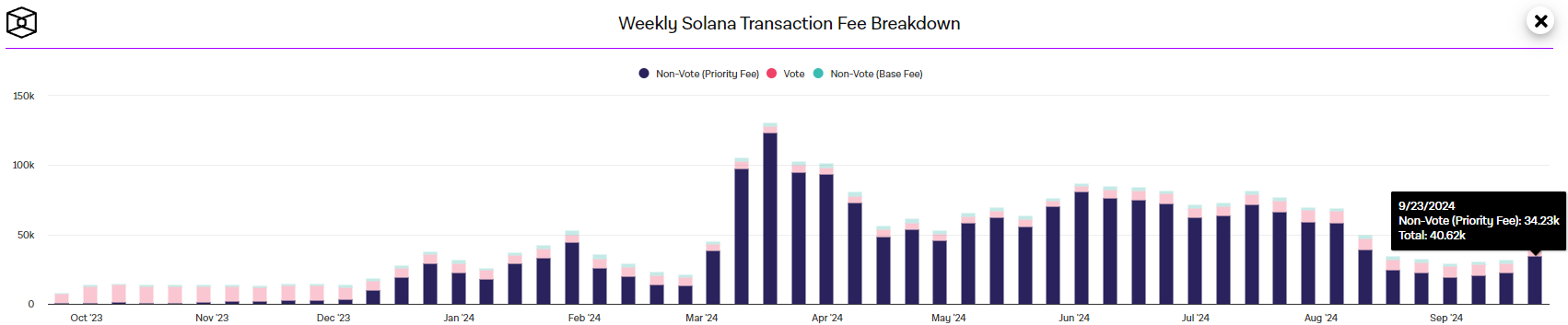

Clues from SOL’s transaction fee trends

Between April and September, the daily average of new addresses joining the Solana network saw a significant surge. By April, it stood at approximately 1.14 million. However, come September 9th, this figure reached an impressive 3.95 million. Notably, the swift growth observed in August persisted into September as well.

In simpler terms, the daily inflows continued to be favorable, and according to AMBCrypto’s analysis, the meme coin market segment is a major contributor to this ongoing positive trend.

Despite a significant rise in newly added addresses, the weekly transaction fees remained lower compared to April 2024. This period coincided with the surge of meme coins on the Solana network, followed by a more subdued summer that saw many meme coins lose much of their initial gains.

The priority fee was one-third of its highest point in April, indicating that the hype around meme coins hasn’t yet affected the Solana network significantly. However, while Q4 2024 is expected to be positive for the market, not everyone may be pleased with a potential resurgence of meme coins.

Assessing the sentiment behind the token

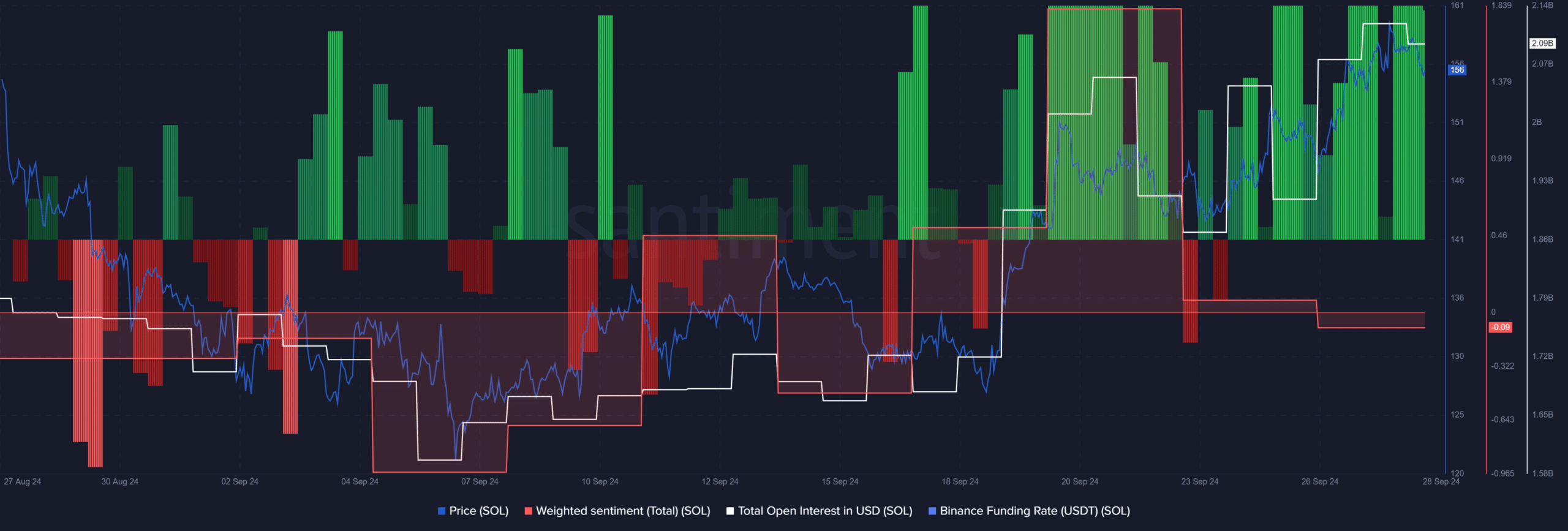

As an analyst, I observed a surge in network activity, which was accompanied by increased whale activity – a phenomenon that appears to be enticing long-term investors to maintain their positions. A closer look at short-term sentiments reveals a dominant presence of bullish sentiment within the Futures market.

Realistic or not, here’s SOL’s market cap in BTC’s terms

Over the last few weeks, the funding rate has increased significantly and Open Interest has been climbing steadily since mid-September, coinciding with a shift in market sentiment following Bitcoin‘s [BTC] surge above $60k. Yet, at present, social media activity shows a somewhat negative trend over the past ten days, suggesting a mixed outlook.

Read More

- PI PREDICTION. PI cryptocurrency

- How to Get to Frostcrag Spire in Oblivion Remastered

- How Michael Saylor Plans to Create a Bitcoin Empire Bigger Than Your Wildest Dreams

- Kylie & Timothée’s Red Carpet Debut: You Won’t BELIEVE What Happened After!

- S.T.A.L.K.E.R. 2 Major Patch 1.2 offer 1700 improvements

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- We Ranked All of Gilmore Girls Couples: From Worst to Best

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Quick Guide: Finding Garlic in Oblivion Remastered

- WCT PREDICTION. WCT cryptocurrency

2024-09-28 21:11