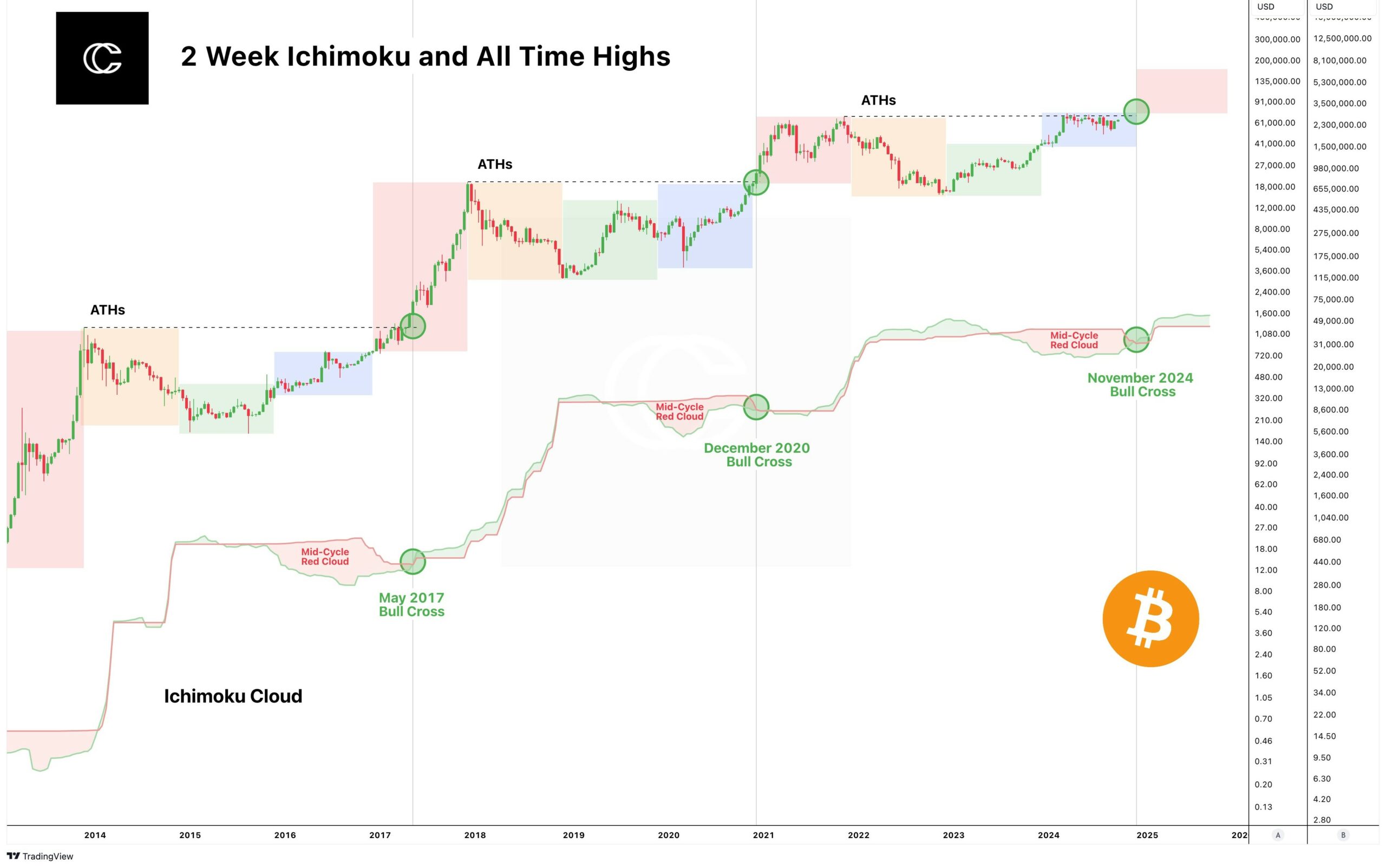

- The 2-week Ichimoku Cloud indicator has predicted potential Bitcoin highs in Q4

- Institutions and retail are getting heavily involved in Bitcoin

As a seasoned analyst who has witnessed the crypto market’s rollercoaster ride over the past decade, I am cautiously optimistic about the upcoming bullish cycle for Bitcoin. The historical patterns and current market dynamics suggest that we might be on the brink of another significant rally, with November potentially being the month to watch.

In simple terms, Bitcoin (BTC) has regained its position as a leader in the cryptocurrency market, stirring excitement for an upcoming period of price growth and increased investment.

As we speak, a Bitcoin trade was occurring at approximately $66k, generating anticipation for potential fresh record highs (peaks) towards the end of this year. However, it’s crucial to delve into historical data. Specifically, focusing on the 2-week Ichimoku Cloud chart could be beneficial because it has effectively forecasted Bitcoin’s past peak records in previous market cycles.

Given that the ongoing cycle is advancing faster than expected, it’s likely unnecessary to hold off until moving averages intersect. Instead, the early indicators suggest the event might occur sooner, possibly forming a new peak in November.

There’s growing curiosity about whether November could see Bitcoin reaching record highs, given the increased scrutiny from both institutional investors and traders on this timeframe.

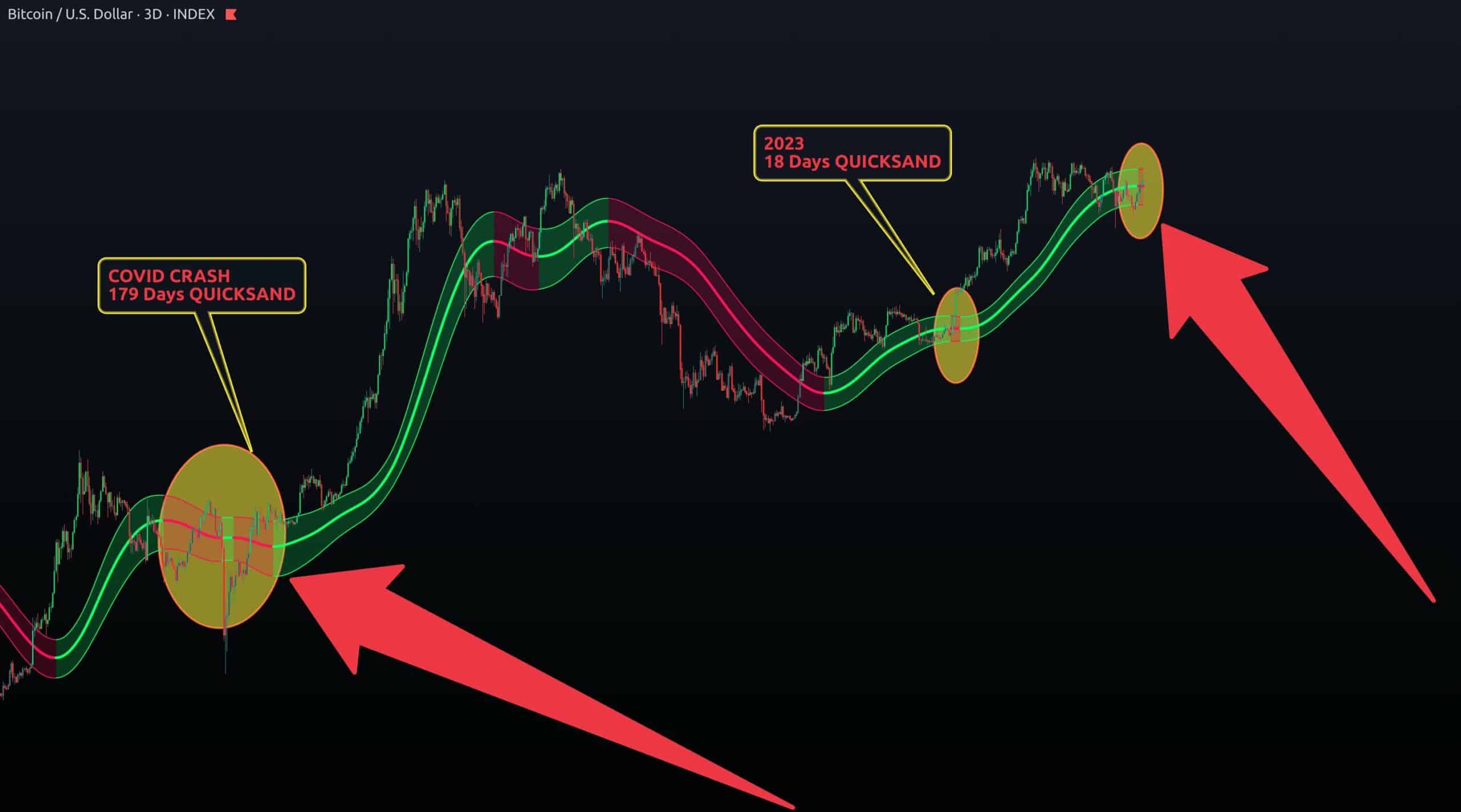

Covid19 crash pattern repetition

A significant indicator pointing towards this scenario is the recurrence of a pattern similar to that seen in 2019. The Gaussian Channel on the 3-day Bitcoin chart has recently turned red, which is a phenomenon that has transpired only twice before – during the COVID-19 market crash and during the second phase of Bitcoin’s past bull market.

Previously, when this specific trend cropped up amidst the pandemic of COVID-19, it triggered a substantial surge that took Bitcoin to unprecedented peaks. Should history mimic its past, Bitcoin might once again prepare for a significant upward leap, possibly reaching new heights in November.

Nevertheless, how events unfold within the market may dictate the final result, leaving uncertainty as to whether this trend will actually cause prices to rise.

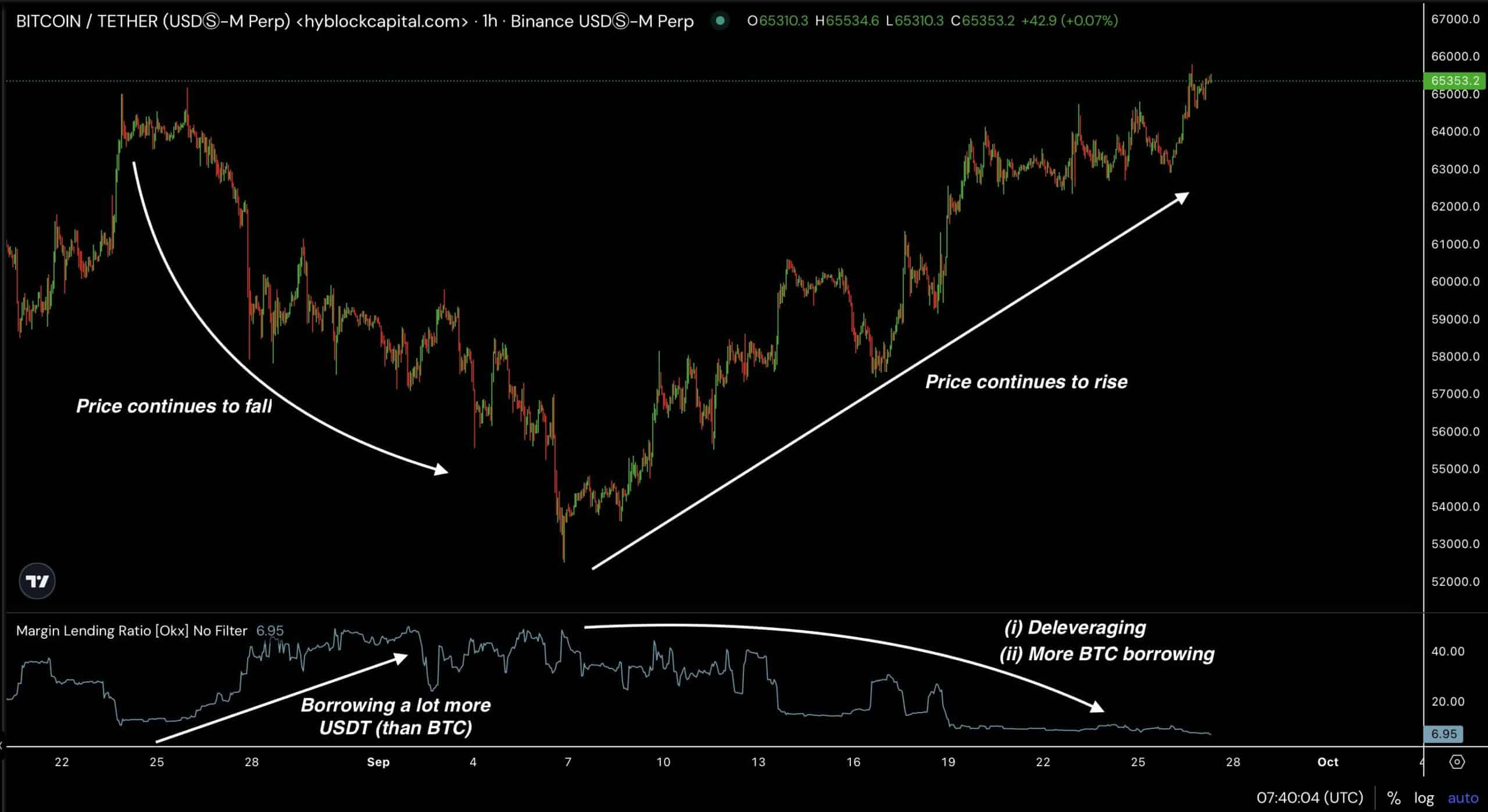

Potential impact of heavily borrowed USDT

A potential reason for Bitcoin’s possible increase could be the influence of heavily utilized Tether (USDT). Traders have been taking out substantial loans in USDT to purchase Bitcoin. Contrary to expectation, this practice initially resulted in a drop rather than an increase in price, leading many over-extended traders to suffer losses.

In simpler terms, when the market behaves like this, it usually signals a big increase is coming up. This happens especially when individual investors are forced to sell due to liquidations. If the present pattern persists, it could pave the way for Bitcoin to reach unprecedented heights, possibly in November.

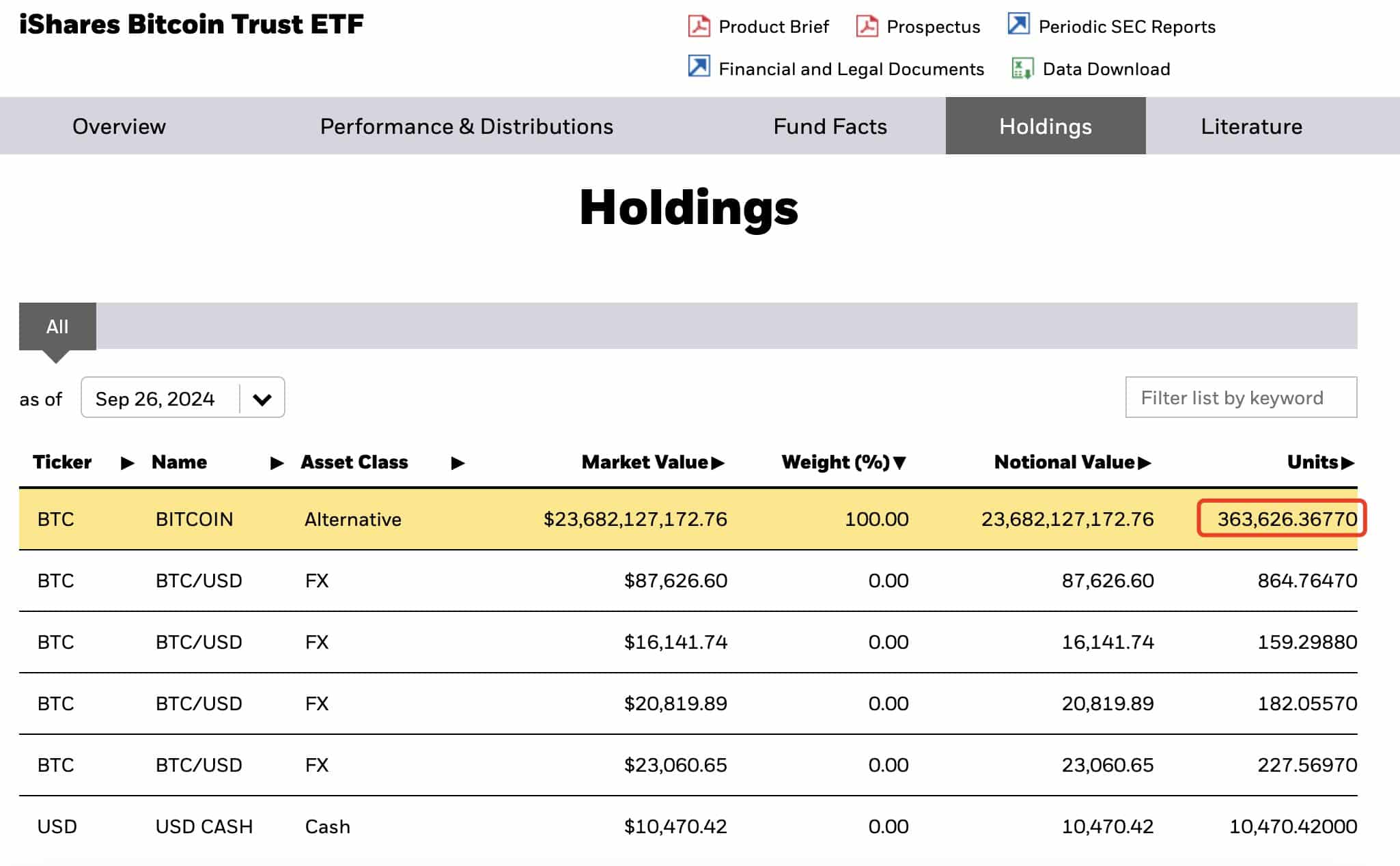

Blackrock continues to buy BTC

Additionally, the ongoing acquisition of Bitcoin by BlackRock strengthens the optimistic perspective on the cryptocurrency market. This week, BlackRock (IBIT) bought approximately 4,460 Bitcoins, valued at around $289 million, boosting its total holdings to over 362,000 Bitcoin.

After that, there was an additional acquisition of 1,434 Bitcoin valued at around $94.3 million. More recently, they have also bought 5,894 Bitcoin, increasing their total Bitcoin holdings to approximately 363,626 BTC. The current value of these holdings is estimated to be about $23.68 billion.

BlackRock’s continuous investment in Bitcoin suggests they anticipate considerable price growth, which could occur as early as November.

Considering the alignment of past trends, current market movements, and backing from institutions, there’s a possibility that Bitcoin’s value may reach unprecedented levels soon. The prospect of a price surge looks promising, so traders and investors are keeping a close eye on upcoming events as we move towards November.

Should these elements align, there’s a strong possibility that Bitcoin could break previous record highs not just once, but consistently throughout the remainder of the year, potentially settling into higher price brackets permanently.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Florence Pugh’s Bold Shoulder Look Is Turning Heads Again—Are Deltoids the New Red Carpet Accessory?

- Quick Guide: Finding Garlic in Oblivion Remastered

- Katy Perry Shares NSFW Confession on Orlando Bloom’s “Magic Stick”

- Disney Quietly Removes Major DEI Initiatives from SEC Filing

- How to Get to Frostcrag Spire in Oblivion Remastered

- How Michael Saylor Plans to Create a Bitcoin Empire Bigger Than Your Wildest Dreams

- Elon Musk’s Wild Blockchain Adventure: Is He the Next Digital Wizard?

- Unforgettable Deaths in Middle-earth: Lord of the Rings’ Most Memorable Kills Ranked

2024-09-28 22:15