-

POPCAT’s long/short ratio, at press time, stood at 0.91, indicating strong bearish sentiment

On-chain metrics and technical analysis suggested that bears are dominating POPCAT

As a seasoned crypto investor with battle-tested nerves and a portfolio that’s seen its fair share of market swings, I can’t help but feel a sense of déjà vu when I look at POPCAT’s current performance. The long/short ratio being as low as it is, and the bearish on-chain metrics are all too familiar signs that we might be heading for a potential price drop.

As a crypto investor, I’ve been keeping a close eye on POPCAT, the memecoin built on Solana. However, recent developments seem to suggest a potential price drop might be on the horizon. The daily chart and on-chain indicators are showing bearish signals. In fact, over the last few days, POPCAT has experienced a remarkable increase of more than 100%. While this surge is exciting, it’s crucial to consider these bearish signs before making any investment decisions.

It seems I’m observing a potential shift in market behavior, with traders and investors seeming to lock in their gains, which could be indicative of a bearish trend emerging.

POPCAT’s price momentum

Currently, POPCAT is close to $0.91 in value due to a decrease in price by more than 8% within the last day. Simultaneously, the trading volume has decreased by approximately 20%, suggesting potential apprehension about further price drops in the near future.

Technical analysis and key levels

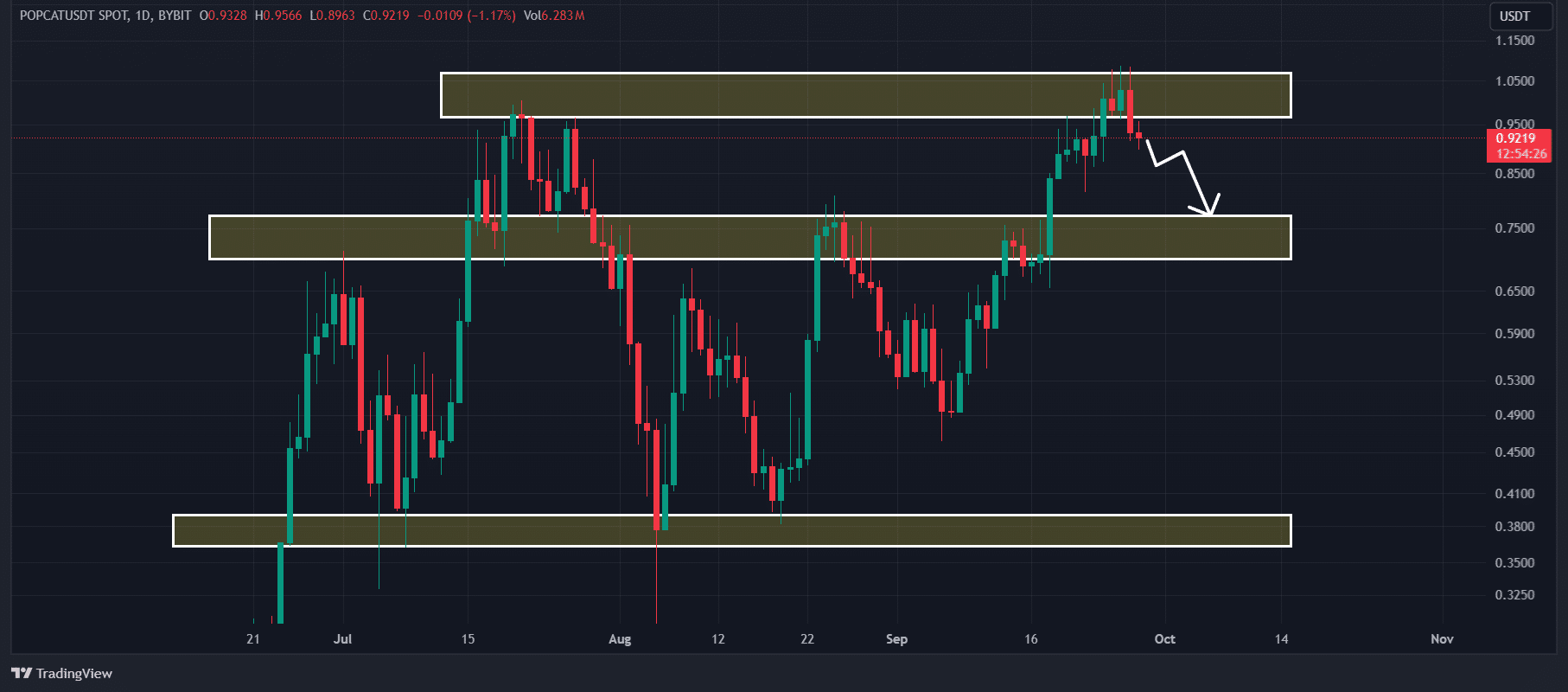

Based on the technical assessment provided by AMBCrypto, Popcat has shown bearish signs after breaking below a two-day period of consolidation at the resistance price point of $1, marked by a large red candle. In the context of technical analysis, a breakout from consolidation at a resistance level is generally interpreted as a bearish indicator.

As a crypto investor, I’m observing a potential trend for POPCAT. Given its recent price fluctuations, it seems plausible that the value might dip by approximately 15%, which could bring the price down to around $0.78 over the next few days.

As I’m looking at my portfolio right now, it seems the RSI of this memecoin is indicating an overbought zone, hinting that a possible price correction might be on the horizon.

Bearish on-chain metrics

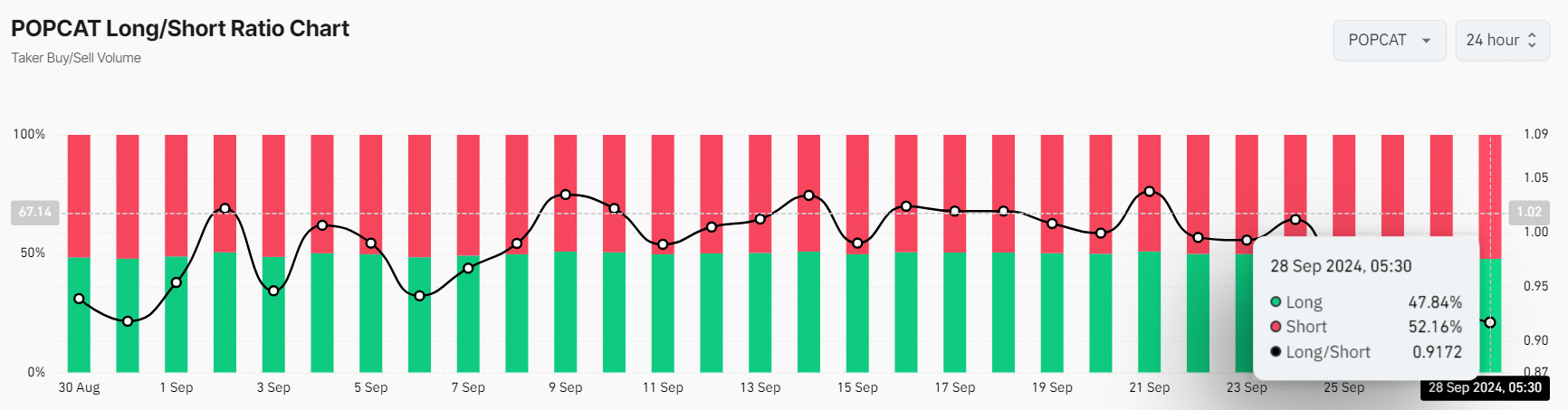

Beyond just observing the price movement, additional evidence from POPCAT’s on-chain indicators also reinforced a pessimistic viewpoint. As reported by the on-chain analytics provider Coinglass, POPCAT’s long/short ratio was 0.91 – a figure not seen since early September 2024. This low ratio suggests that traders are exhibiting significant bearish tendencies.

Moreover, it appears that the number of open positions in POPCAT’s Futures market has stayed constant during the last 24 hours. This suggests neither new positions are being established nor existing ones are being closed out, giving off a neutral prediction for this widely recognized memecoin.

Right now, as I’m typing this, around 52.16% of leading traders have taken short positions, compared to about 47.84% who have long positions. Given these on-chain statistics and technical analysis, it appears that bears are currently in control, which might cause the asset’s price to drop even more over the next few days.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Solo Leveling Arise Tawata Kanae Guide

- Jack Dorsey’s Block to use 10% of Bitcoin profit to buy BTC every month

- Gayle King, Katy Perry & More Embark on Historic All-Women Space Mission

- Flight Lands Safely After Dodging Departing Plane at Same Runway

2024-09-29 08:07