- The early release of Changpeng Zhao was supposed to be a bullish trigger.

- The exchange token showed signs of a potential price retracement.

As a seasoned researcher with a knack for deciphering market trends, I’ve seen my fair share of bullish triggers that didn’t quite pan out as expected. The early release of Changpeng Zhao, the charismatic CEO of Binance, was one such event that sparked enthusiasm among cryptocurrency enthusiasts on social media. However, the price action of BNB told a different story.

Once again, Binance Coin (BNB) reached the upper limits of its 10-week price range. The early release of Binance’s former CEO, Changpeng Zhao, from jail could potentially ignite a surge of optimism among investors.

There was increased optimism about BNB on social media platforms, but the price didn’t show significant movement. After CZ’s “gm” tweet, BNB experienced a 3.9% drop over the following six hours. This decline, coupled with the approach of resistance levels in the long-term chart, has sparked discussions about potential future direction for the exchange token.

Range breakout likelihood

Over the past nearly three months, the price range for this asset fluctuated between $464 at its lowest and $604 at its highest, with the average or pivotal point being $535. This crucial level has acted as both a platform of support and a barrier of resistance in recent times. Towards mid-September, BNB tested this level again as support before surging by approximately 12.7%, reaching its highest points within the range.

Every day, the Relative Strength Index (RSI) stayed in the bullish region, exceeding the neutral 50 level. However, it demonstrated a bearish pattern, known as divergence. The RSI created a lower peak while the price continued to rise, suggesting that a potential pullback might occur.

Furthermore, the OBV failed to reach the levels of July’s peak. Similarly, in mid-August, BNB encountered resistance at the $600 mark. Collectively, these technical indicators suggested that it was more probable for BNB to be rejected from its upper range limits.

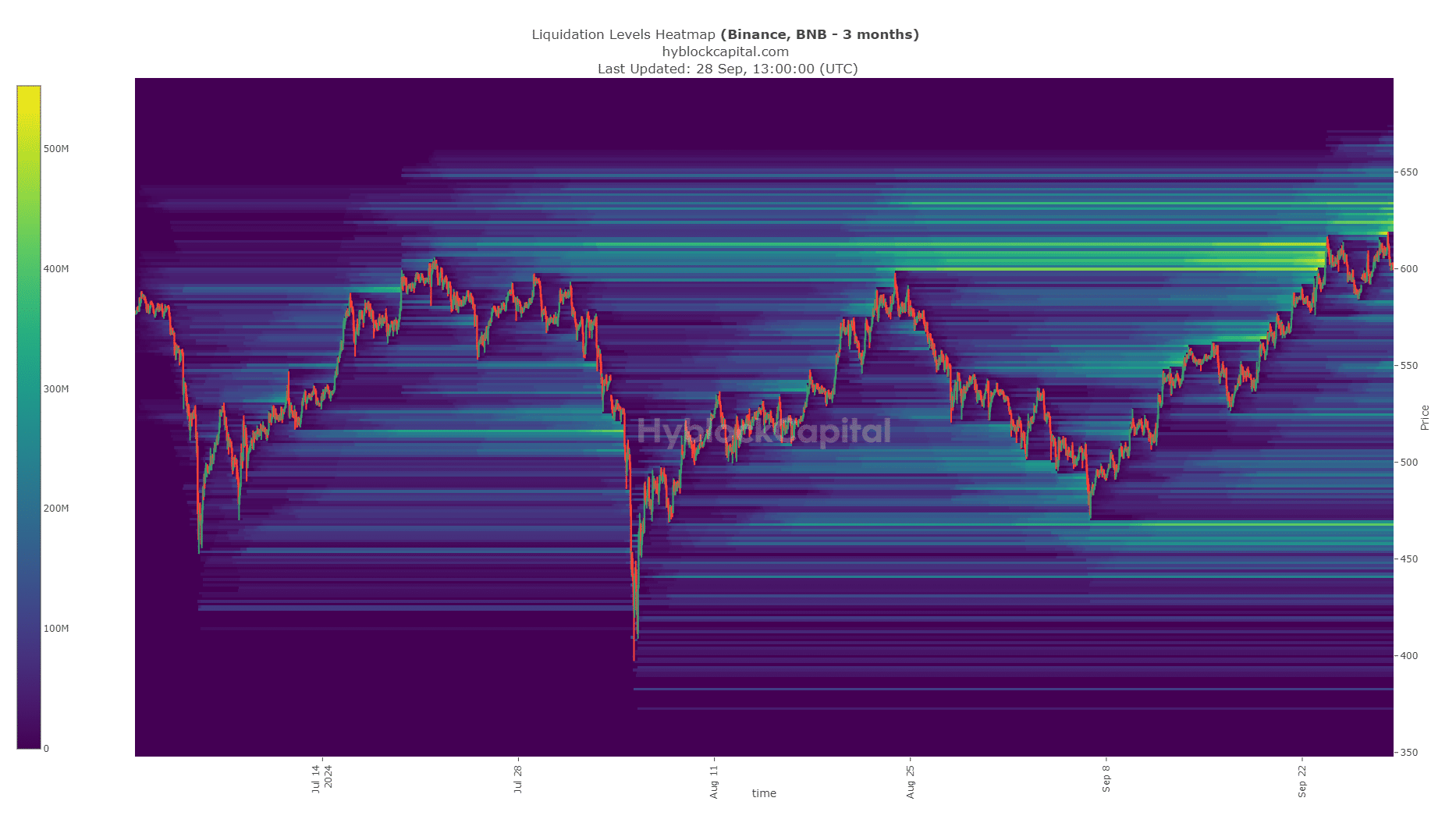

Liquidation levels highlight the $635 zone as price target

As a researcher, I observed that during a 3-month period, the price exhibited a magnetic pull towards the range of $621-$635. Previously, the $600-$614 region had acted as an attractive zone for prices, which subsequently retreated to $585 following this attraction.

Read Binance Coin’s [BNB] Price Prediction 2024-25

It’s quite plausible that a false surge beyond the range’s peak at $635 might occur, followed by a dip. Traders ought to get ready to cash in their gains as BNB nears these prices and patiently wait for a decline and a chance to purchase.

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- PI PREDICTION. PI cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- PGA Tour 2K25 – Everything You Need to Know

- New Mickey 17 Trailer Highlights Robert Pattinson in the Sci-Fi “Masterpiece”

- Cynthia Erivo’s Grammys Ring: Engagement or Just Accessory?

2024-09-29 09:11