-

ADA has surged by 13.73% on weekly charts.

Cardano fundamentals suggest the trend trend reversal is imminent.

As a seasoned analyst with over a decade of experience in the cryptocurrency market, I have seen more than my fair share of trends and shifts. The recent surge in Cardano [ADA] has caught my attention, but I must admit that I am cautiously optimistic about its sustainability.

According to previous reports from AMBCrypto, the digital currency Cardano (ADA) has seen a steady increase in value throughout the past week. This growth can be attributed to the recent recovery of the overall cryptocurrency market triggered by the Federal Reserve’s interest rate reductions last week.

Currently, at the moment, ADA is being traded at approximately $0.4018. This represents a 11.5% surge in value over the past month, with an additional 13.73% rise observed over the past week, further strengthening the upward trend.

Following a recent low of $0.303 earlier this month, the price of ADA has consistently shown an uptrend. This market situation has incited similar levels of optimism and doubt among members of the Cardano community.

As a researcher, I’ve taken note of Ali Martinez’s latest analysis, which expresses a degree of skepticism about an impending trend reversal in the cryptocurrency market.

The prevailing market sentiment

According to Martinez’s assessment, the TD Sequential indicator recently gave a sell warning on Cardano’s daily graphs. This could indicate a temporary correction is imminent.

When a “sell” signal appears on the daily charts, it often means the prices have been increasing significantly, potentially indicating that the market is nearing its limit. Consequently, many investors view this as a sign to cash out their earnings or get ready for a possible downturn or price drop.

Given the current indications, it seems we might see a brief market adjustment or dip (short-term correction) in Cardano’s price action. Following this, there’s a possibility that Cardano will try to resume its upward momentum again.

What ADA charts say

Instead of just relying on the clue given by Martinez regarding ADA‘s next step, it’s essential to examine what other signs or signals indicate as well.

Initially, the Price DAA disparity of Cardano has stayed below zero for the last seven days. Currently, the ADA‘s price DAA disparity stands at -45.63. When an asset exhibits this pattern, it indicates that prices are increasing while the number of active addresses is not following suit.

It seems like the rise in price isn’t backed up by an equivalent boost in user activity, implying a potential shift towards decreasing demand or waning market enthusiasm, suggesting a possible bearish reversal.

Consequently, this implies that the price surge might not last because it’s primarily fueled by a shrinking user count. This hints at a potential reversal in the price trend as the energy behind the increase seems to be dwindling, although the price drop may not be immediately visible yet.

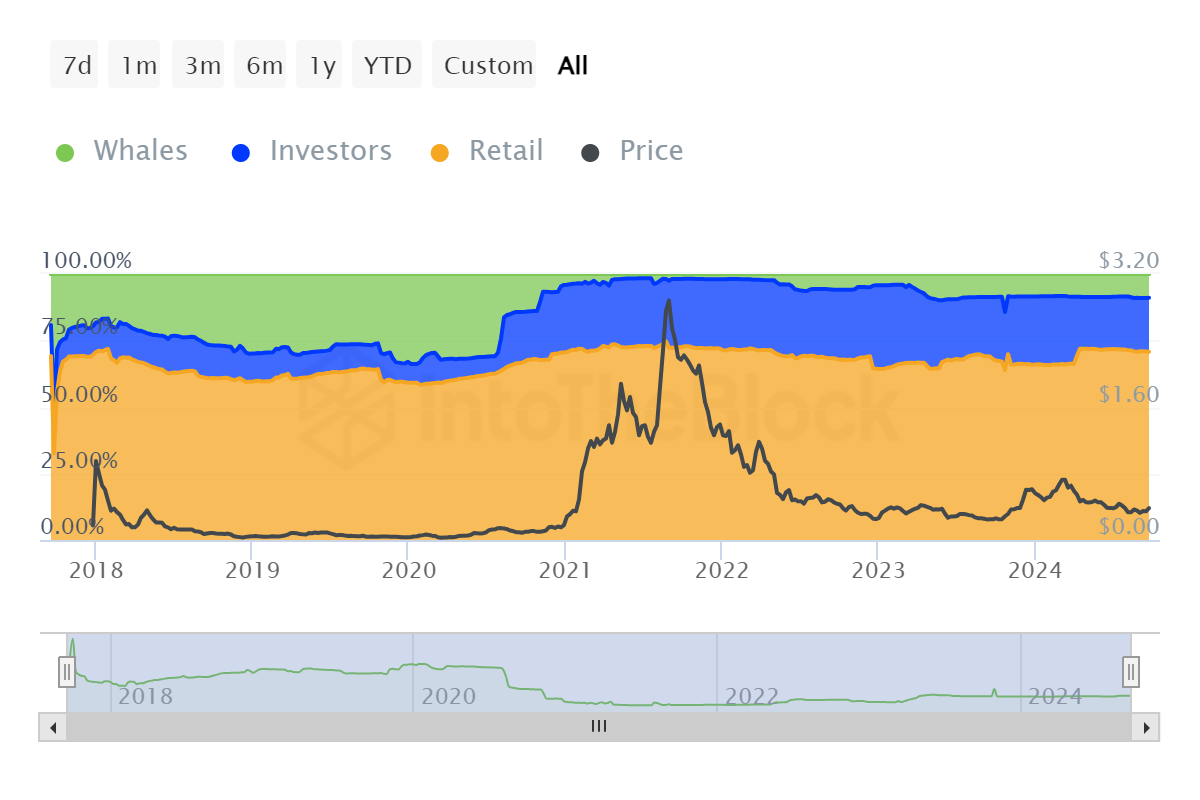

Furthermore, the ownership of Cardano’s tokens (ADA) is primarily held by a large number of retail traders, as evidenced by data from IntoTheBlock. It appears that retail traders control approximately 70.70% of the ADA tokens, while whales hold around 8.95%, and investors account for about 20.34%.

This is concerning especially because retail traders are more susceptible to emotional decision-making such as panic selling or FOMO. This leads to higher price volatility.

Read Cardano’s [ADA] Price Prediction 2024–2025

Similarly, retail traders tend to trade based on current trends and hype instead of focusing on long-term values. This could suggest that the market might not have the long-term steadiness derived from large investors like whales and institutions.

While ADA has seen an increase in value recently, there are signs that it could see a dip due to weak fundamentals not favoring a continuous rise. If this happens and the price corrects, ADA may fall back to its significant support point at approximately $0.345.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Everything Jax Taylor & Brittany Cartwright Said About Their Breakup

- The Battle Royale That Started It All Has Never Been More Profitable

- Michael Saylor’s Bitcoin Wisdom: A Tale of Uncertainty and Potential 🤷♂️📉🚀

- Chainlink: Checking LINK’s 20% drop amid a 4x jump in fees

- Your Friendly Neighborhood Spider-Man Boss Teases Surprising Doc Ock Detail

- How to get tickets to see Kendrick Lamar and SZA on their Grand National world tour

- Best Axe Build in Kingdom Come Deliverance 2

- Meghan’s Sweet Kids Tribute in Latest Vid!

2024-09-29 10:16