-

XRP surges and breaks out of a symmetrical triangle despite SEC case appeal speculations.

Exchange outflows have dropped, but the long/short ratio suggests uncertainty in market.

As a seasoned crypto investor who has weathered many market storms, I can confidently say that the recent surge in XRP price is a breath of fresh air. After navigating through the murky waters of regulatory uncertainty and technical resistance, XRP’s breakout from the symmetrical triangle is a testament to its resilience and potential for growth.

Regardless of ongoing speculation about potential appeals from the SEC, XRP successfully surpassed the resistance level of a symmetrical triangle at around $0.605. This suggests that the broader trend for XRP’s price has been positive.

The split suggests a rise in purchasing energy, as market players are taking advantage of the market’s upward surge. The strength of XRP amidst regulatory pressure is stirring up enthusiasm amongst investors.

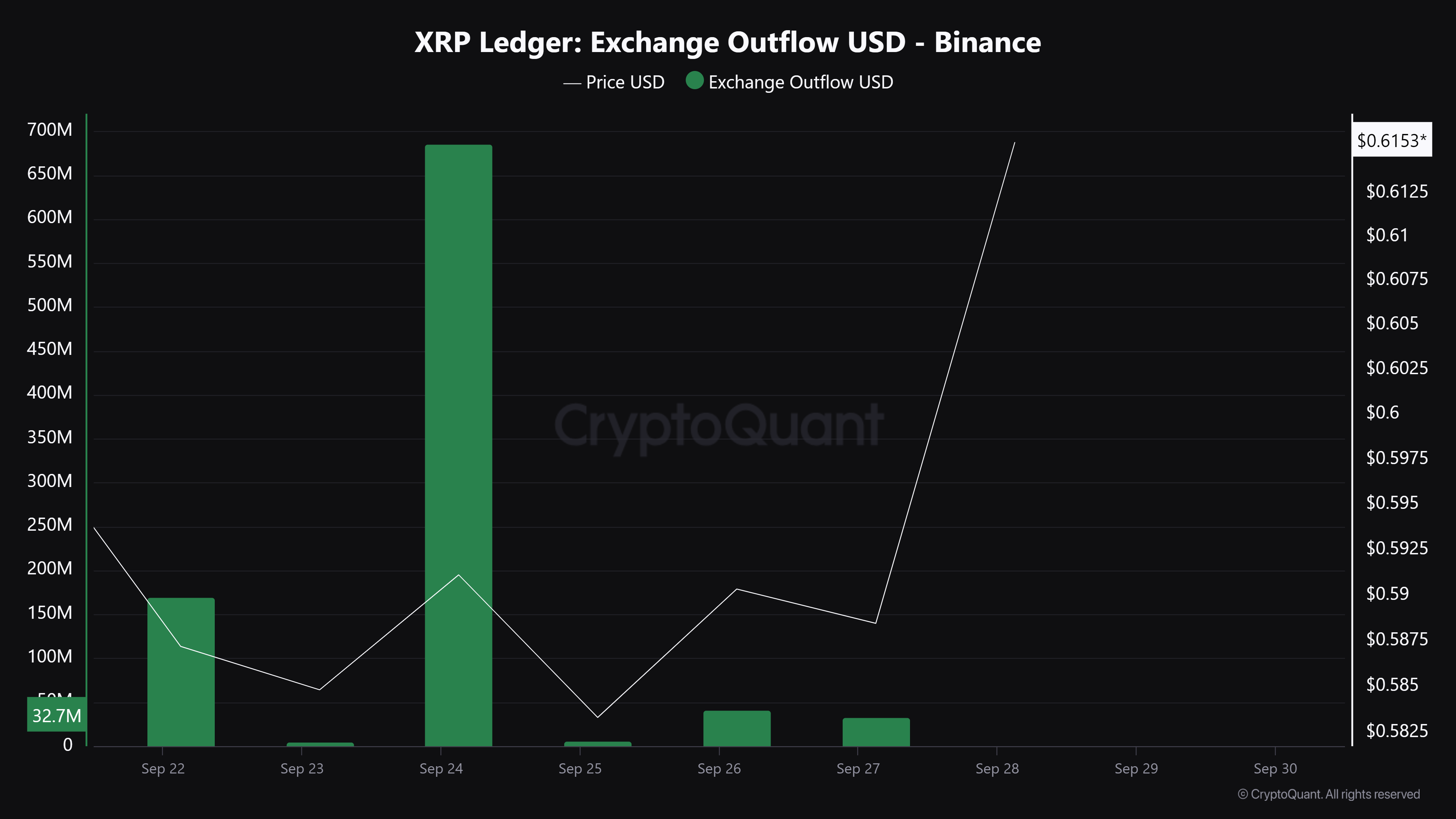

XRP exchange outflows drop after 24 September exodus

Based on AMBCrypto’s examination of XRP withdrawal activity from various platforms, it appears that there’s been a substantial movement of XRP away from exchanges. This trend suggests a potential change in investor attitudes towards the altcoin.

Over the past period, I’ve noticed a significant change in the flow of XRP – the outflows from exchanges have noticeably decreased. This shift could indicate an increase in confidence among Ripple holders, as they seem more inclined to keep their holdings rather than withdrawing them from the exchanges.

This situation could continue driving up prices, as there are less coins circulating for trade, thereby reducing demand-side tension.

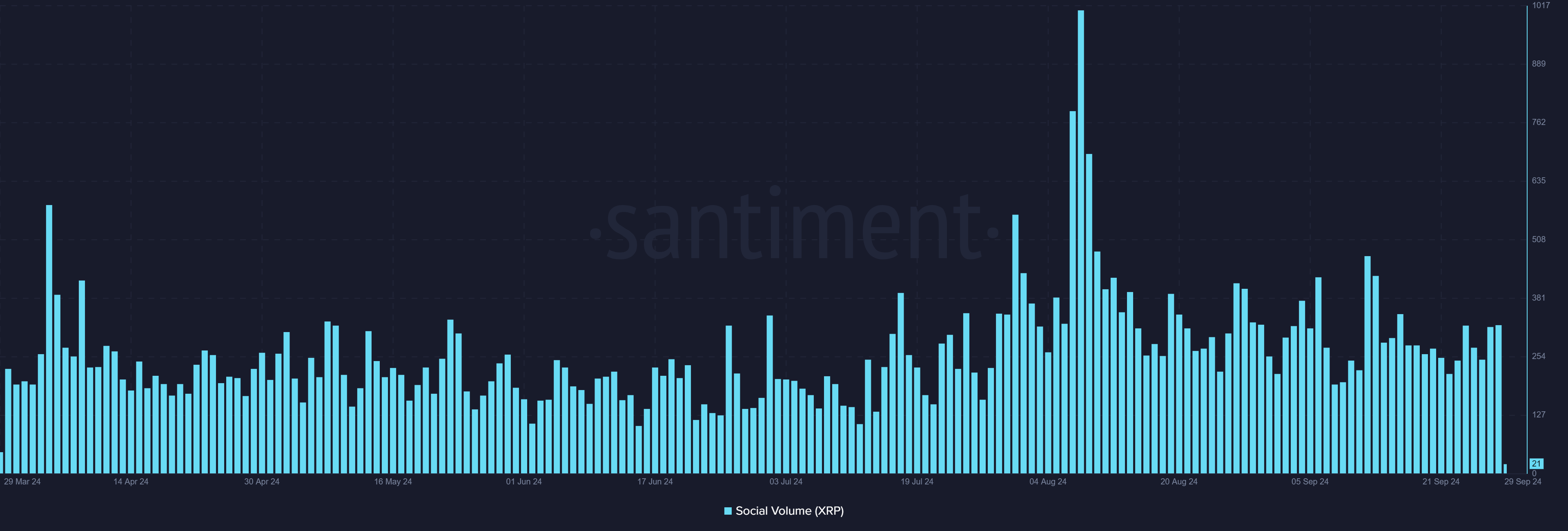

As a result of the significant surge in outflows on the 24th of September, XRP has dominated the social media landscape. The social activity surrounding it has steadily risen since that time.

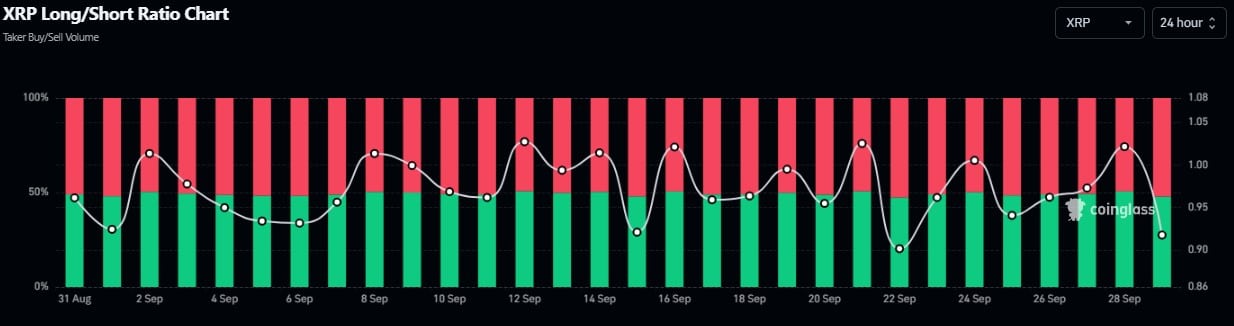

Long short ratio falls as XRP market sentiment shifts

Although XRP is performing well, the overall market signs aren’t entirely optimistic. The long/short ratio has experienced a substantial decrease.

As a seasoned trader with years of experience under my belt, I’ve learned that changes in market indicators can often signal shifts in sentiment and trading behavior. The recent drop in the long/short ratio for XRP caught my attention, as it suggests fewer traders are currently betting on its price increase. This could be due to the ongoing uncertainty surrounding the SEC appeal, which is weighing heavily on the crypto market. I’ve seen similar patterns before, and I believe it’s wise to tread cautiously when trading XRP until we have more clarity about the SEC’s decision. My advice would be to keep a close eye on developments and perhaps consider alternative investment opportunities in the meantime.

As a researcher, I’m grappling with the intriguing paradox unfolding in the market. On one hand, there’s an upward price trend that suggests optimism, but on the other, I sense a more cautious sentiment among traders. In simpler terms, it seems like the market is sending me two different messages at once.

Amid a surge in prices that seems to contradict a more cautious attitude among traders, the market is sending ambiguous messages.

Is your portfolio green? Check the Ripple Profit Calculator

As an analyst, I must admit that I didn’t foresee the recent surge in XRP‘s price. Given the persistent regulatory uncertainties and technical obstacles we’ve been facing, it was unexpected for this rally to occur.

Regardless of the differing opinions among investors, there’s an equal measure of caution prevalent. Whether this ongoing surge continues hinges on a combination of technical factors and developments regarding the SEC in the near future.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- How to Get to Frostcrag Spire in Oblivion Remastered

- ANKR PREDICTION. ANKR cryptocurrency

- Quick Guide: Finding Garlic in Oblivion Remastered

- This School Girl Street Fighter 6 Anime Could Be the Hottest New Series of the Year

- Isabella Strahan Shares Health Journey Update After Finishing Chemo

- DOOM: The Dark Ages Debuts on Top of Weekly Retail UK Charts

- Badminton’s Huang Yaqiong Wins Olympic Gold Moments Before Engagement

- 2 Astronauts Stuck in Space After 8-Day Mission Goes Awry

2024-09-29 11:03