- As at press time, Hedera had gained 14% this week.

- Hedera dominance and open interest are all rising.

As an analyst with over a decade of experience in the crypto market, I must say that Hedera [HBAR] is exhibiting some compelling signs as we head into Q4. After gaining 14% this week and showing a stable volume-to-market cap ratio, it’s clear that HBAR is ready to seize any broader market opportunities.

Hedera Hashgraph (symbol HBAR) appears to be picking up momentum, following the expected market upturn in the fourth quarter. This week, it surged by more than 14%, suggesting it’s well-positioned to benefit from a larger market surge.

At present, HBAR is being traded at around $0.061. This price suggests a minor decrease in the past 24 hours, possibly as a result of a corrective action following three successive days of increase.

Despite this, the price remains strong with a stable volume-to-market cap ratio of 2.13%. Its fully diluted market cap stands at $3 billion, with 37 billion HBAR in circulation out of a maximum supply of 50 billion.

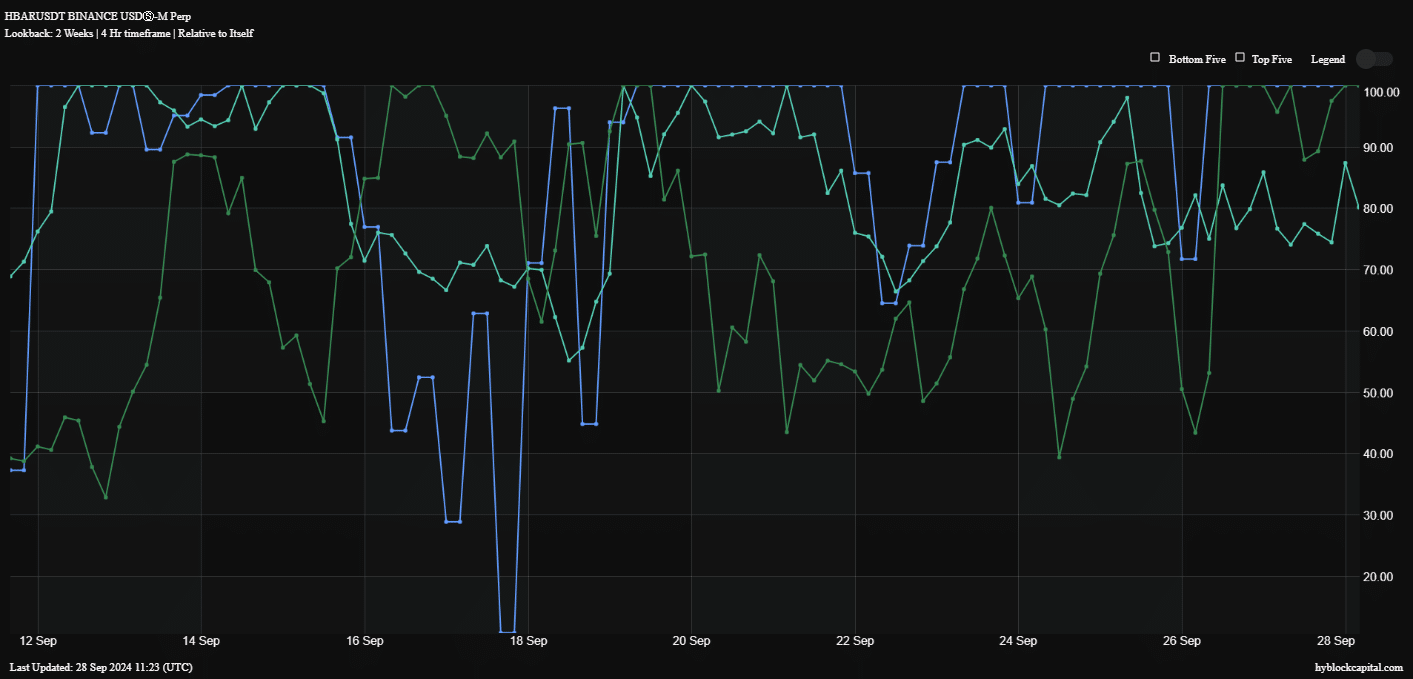

Hedera dominance and price action

The influence of Hedera in the market is steadily growing stronger, hinting at a promising opportunity for it to capitalize on the anticipated surge in the fourth quarter crypto market. This growth in influence stems from an expanding base of traders, investors, and financial institutions adopting it.

Over the last fortnight, there has been a noticeable increase in HBAR‘s price trajectory, pushing it towards a significant barrier at around $0.06. If HBAR manages to surpass this level, it could suggest a double bottom pattern, signifying a possible support point for Hedera’s price.

In simpler terms, the Moving Average Convergence Divergence (MACD) line has changed direction and is now indicating a positive trend for the HBAR/USDT pair. The graph also shows an increase in transaction volume and overall market strength for this specific pair.

Should HBAR surpass the $0.06 threshold and move towards the $0.10 barrier, there’s a possibility it could experience growth of approximately 65%. This increase might occur during the last quarter of the year.

Open interest, funding rates, and whale activity

The important figures such as open interest, funding rates, and whale activity indicate a positive trend, suggesting that markets like Hedera are poised for more upward movement in the future.

80% of the contracts for HBAR are currently active, showing a high level of investor engagement. Meanwhile, the funding rates suggest that those holding long positions are being compensated by those with short positions, implying a generally optimistic outlook among traders.

Furthermore, the gap between whales and retail investors buying HBAR is particularly wide now, implying that big investors are acquiring HBAR more rapidly than small individual traders. This pattern hints at a potential increase in the price of HBAR.

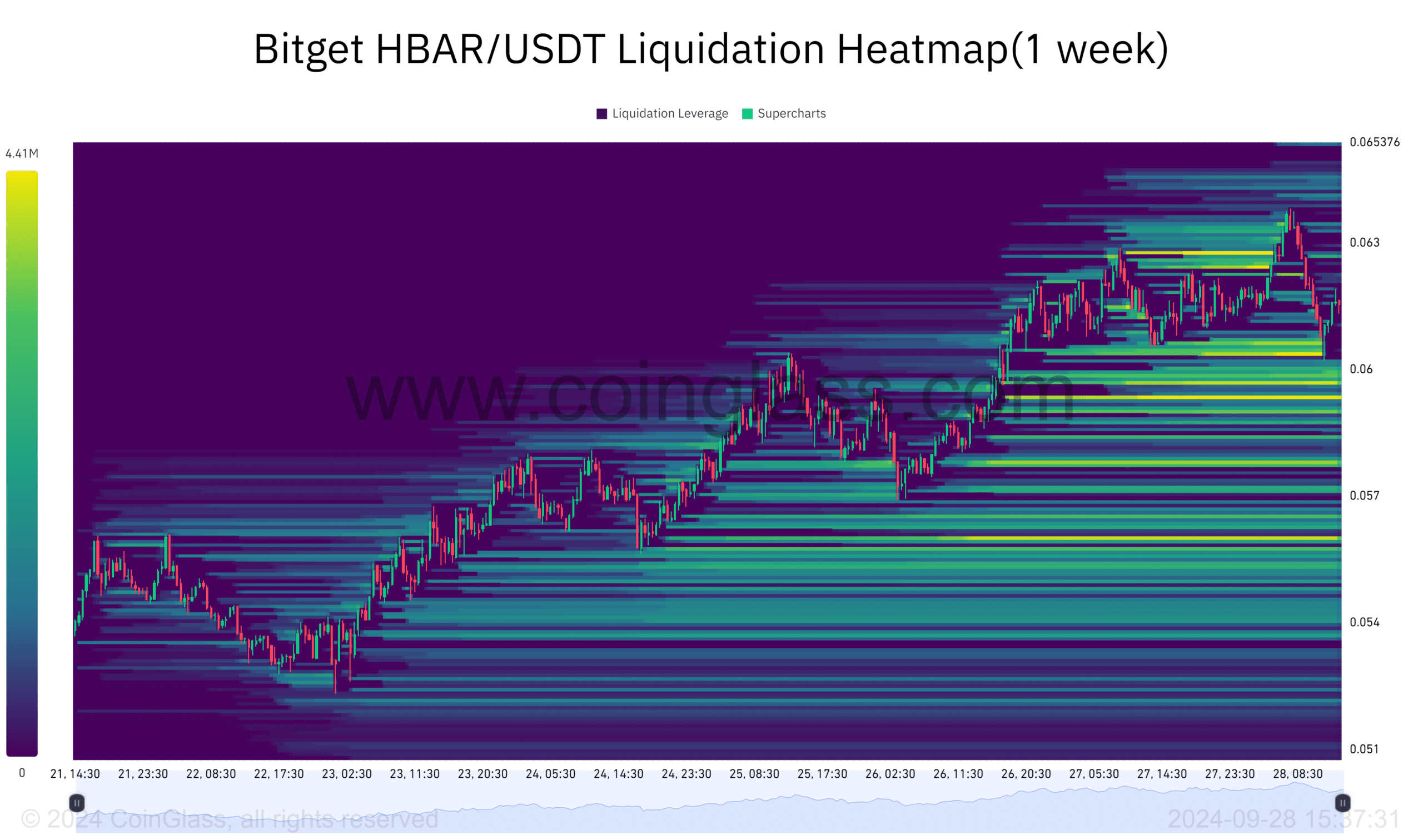

Liquidation levels

Examining the HBAR/USDT liquidation points on Bitget reveals that an order worth $2.25 million will be activated when the price reaches approximately $0.0627. This suggests that market players are aiming for high liquidity spots, leading to a strong possibility of the price trending towards this specific level.

As a crypto investor, if the price of HBAR manages to breach the resistance level at $0.0627, it could potentially propel towards the next target at $0.0638. This move would be backed by approximately $1.31 million worth of orders waiting in the wings. As we approach these liquidity zones, the upward momentum for HBAR might gain strength, increasing the chances of a significant 65% increase in value.

As more people embrace it, positive technical indications, and significant trading volume zones suggest that HBAR could experience considerable growth in the near future.

If the current trend persists, it’s possible that the value of HBAR might escalate to around $0.10, potentially boosting its price as we approach the anticipated bullish Q4 market surge.

Read More

2024-09-29 12:07