- Ethereum on-chain activity reaches new highs.

- Ethereum sees an increase in involvement of traders on DEX.

As a seasoned analyst who has witnessed the crypto market’s rollercoaster ride since its inception, I must say that the recent surge in Ethereum [ETH] activity has me intrigued. The increase in on-chain activity and transaction fees is reminiscent of the early days of Bitcoin, where congestion was a constant issue due to high demand for transactions.

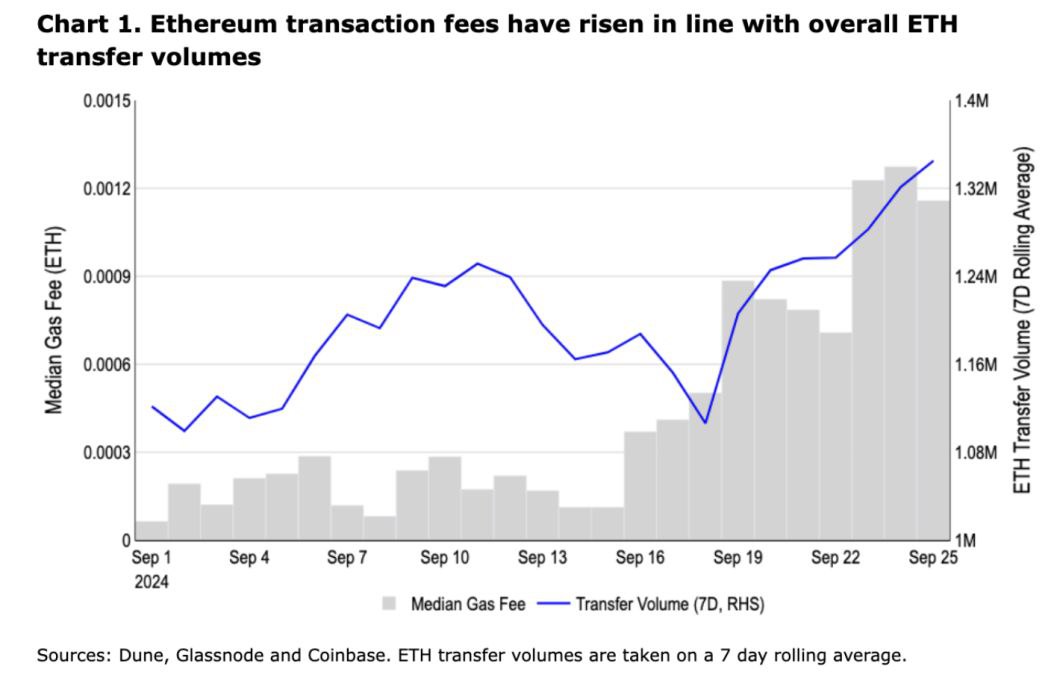

The popular smart contract platform, Ethereum [ETH], is experiencing a surge in on-chain transactions. This uptick is causing an increase in transaction costs, particularly since many investors are using Decentralized Finance (DeFi) services built upon the Ethereum network.

Ethereum (ETH) has been steadily climbing, following the general trend of the cryptocurrency market as it prepares for a potentially bullish last quarter of the year.

As Ethereum becomes more popular and handles a high volume of transactions, the escalating transaction fees have sparked worries, especially among those who are increasingly participating as traders.

As a researcher delving into the intricacies of blockchain technology, I’ve observed an upward trend in transaction fees that doesn’t seem to be linked to a single cause. However, two factors appear to play significant roles: the escalating volumes on decentralized exchanges (DEXs) and the increased utilization of the Ethereum network. These elements, undoubtedly, have contributed substantially to the observed increase in transaction fees.

Active addresses rising

A significant factor driving up transaction fees on the Ethereum network is the surge in activity among Ethereum accounts. The number of daily active accounts has skyrocketed by 29%, and the creation of new accounts has spiked by 43%.

Despite a 28% increase in zero-balance addresses, the number of active addresses remains at peak levels. This indicates an uptick in network activity, suggesting that more transactions are happening concurrently.

As the activity level in a network increases, it gets progressively harder to confirm transactions, leading to an upward trend in transaction costs.

The surge in DEX volumes

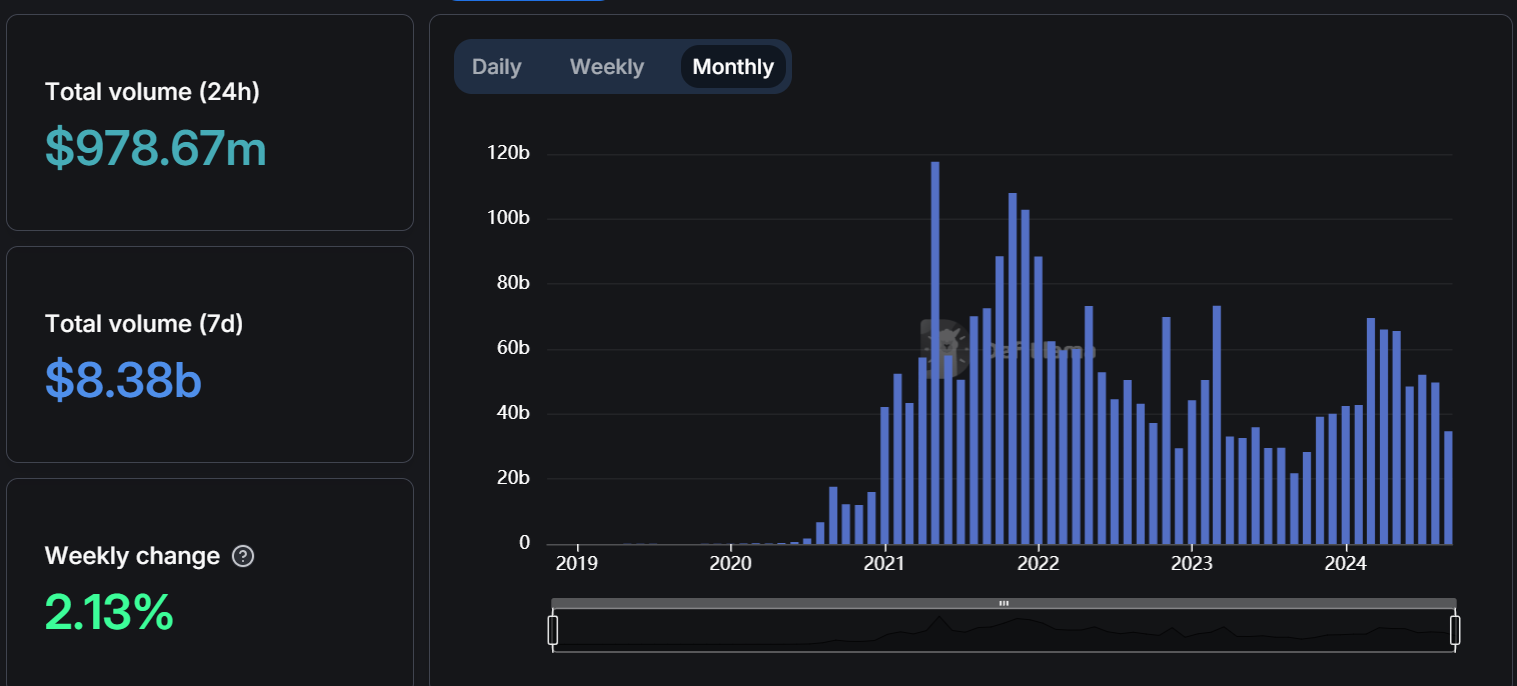

One reason Ethereum transaction costs have been going up recently is because of the significant growth in the trading volumes on Decentralized Exchanges (DEXs). In just the past 24 hours, over $978 million worth of ETH has been traded on these platforms, and the weekly volume reached an impressive $8.38 billion – a 2.13% increase.

The monthly bar charts suggest a consistent increase in Ethereum trades on Decentralized Exchanges (DEXs). Given that these platforms contribute significantly to Ethereum’s overall network activity, this growth results in more network congestion, thereby raising transaction fees.

ETH staking flows

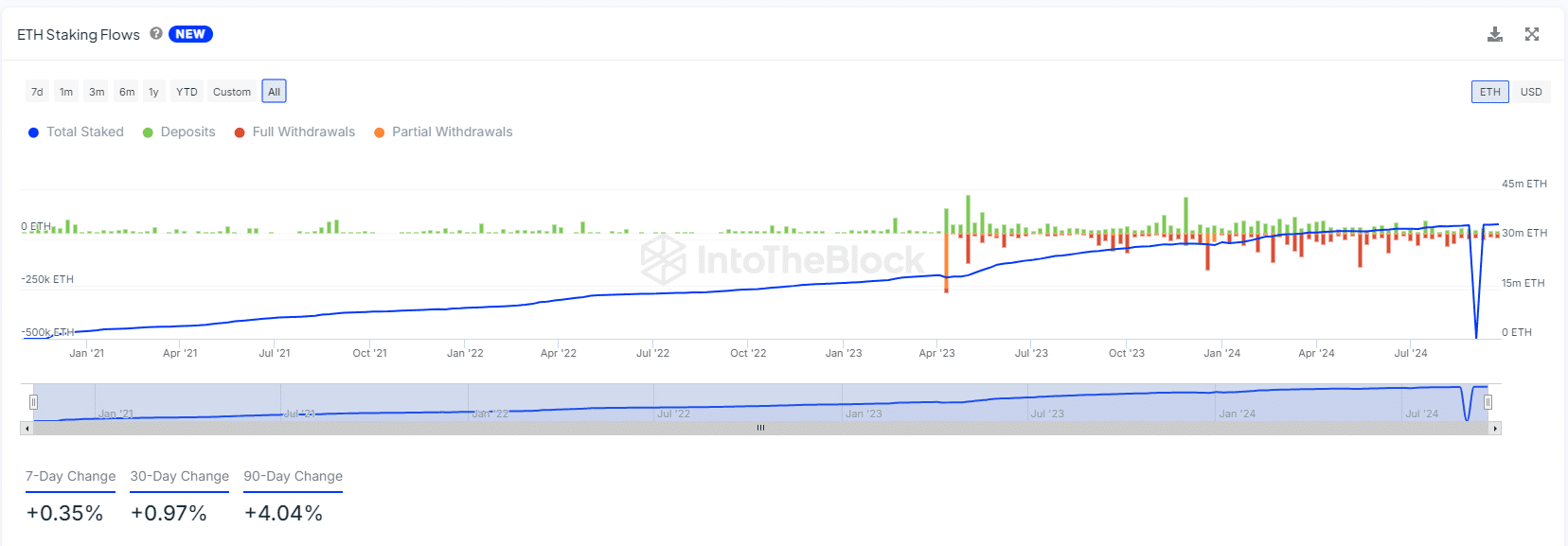

As a researcher, I’ve observed that the ongoing adjustments in Ethereum (ETH) staking dynamics are significantly influencing transaction fees. In periods of market downturn, ETH outflows have been predominant, mirroring the decreasing value of ETH. This shift in staking patterns seems to be a contributing factor to the rising fees within the Ethereum network.

On the other hand, there’s been a change as withdrawals are now roughly equal to deposits, suggesting growing enthusiasm for staking. This surge in staking actions results in a rise of transactions within the Ethereum network, intensifying the load and causing transaction fees to climb higher.

After experiencing a significant drop during the recent market downturn, the amount of Ethereum locked in staking has once again reached its maximum historical level. As more individuals participate in this process, it contributes to network congestion, which in turn increases transaction fees.

Read Ethereum’s [ETH] Price Prediction 2024-25

As a crypto investor, I’ve been noticing an intriguing trend with Ethereum – its soaring price and escalating transaction fees are clear indicators of heightened activity on its network. It’s fascinating to see that metrics like active addresses, DEX volumes, and ETH staking are all contributing significantly to these recent price surges and fee spikes.

As the wider cryptocurrency sector is expected to experience growth during the last quarter, Ethereum might continue to rise in value, despite users encountering escalating transaction costs.

Read More

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- Jujutsu Kaisen Reveals New Gojo and Geto Image That Will Break Your Heart Before the Movie!

- We Ranked All of Gilmore Girls Couples: From Worst to Best

- PI PREDICTION. PI cryptocurrency

- Why Tina Fey’s Netflix Show The Four Seasons Is a Must-Watch Remake of a Classic Romcom

- How to Get to Frostcrag Spire in Oblivion Remastered

- Disney Cuts Rachel Zegler’s Screentime Amid Snow White Backlash: What’s Going On?

- First U.S. Born Pope: Meet Pope Leo XIV Robert Prevost

- Whale That Sold TRUMP Coins Now Regrets It, Pays Double to Buy Back

- Kylie & Timothée’s Red Carpet Debut: You Won’t BELIEVE What Happened After!

2024-09-30 01:11