- Bitcoin price surge to the $72K level would liquidate $20 billion in short positions.

- Exchange net flow has surged by over 10%, and long position bulls remain dominant.

As a seasoned analyst with over two decades of experience in the financial markets, I can confidently say that the current Bitcoin [BTC] situation is reminiscent of a high-stakes poker game where the pot is rapidly growing larger. The $20 billion short liquidation event looming over the market is a clear indication that the bears are feeling the pressure.

As a researcher, I’m observing the mounting tension among Bitcoin [BTC] short sellers as we approach what seems to be an imminent massive liquidation event. According to a respected analyst, a 10.6% price hike would trigger a liquidation of approximately $20 billion in shorts if Bitcoin reaches $72,600.

Such a situation might trigger a wave of share repurchases, causing prices to escalate further, as investors rush to offset their losses by acquiring more shares.

In this high-pressure situation, the $72,600 mark serves as a crucial battlefield where both bullish and bearish investors have their substantial fortunes at play.

If Bitcoin breaks through this current barrier, it might trigger a domino effect that could potentially alter the overall market trends.

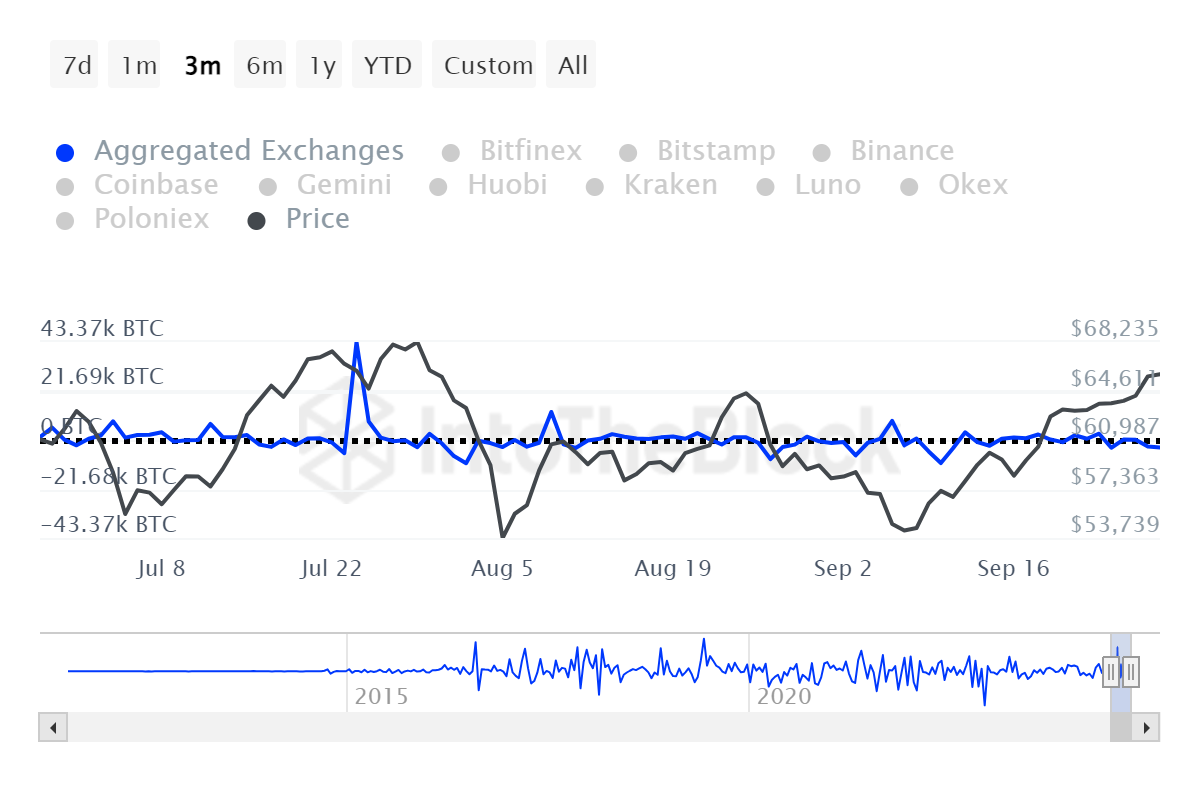

Bitcoin exchange net flow spikes by over 10%

Boosting the intensity even further, it’s been reported that Bitcoin exchange inflow has escalated by approximately 13% based on IntoTheBlock statistics. This figure signifies the volume of funds moving in and out of these exchanges.

Typically, a significant spike in this measure could suggest that investors are likely preparing for a substantial shift.

More Bitcoin might be heading into exchanges, gearing up for buying anticipation of a price rally.

The increase in net flow suggests that market participants are hopeful about a price leap over the resistance level, as long as it doesn’t encounter the $72,600 threshold first.

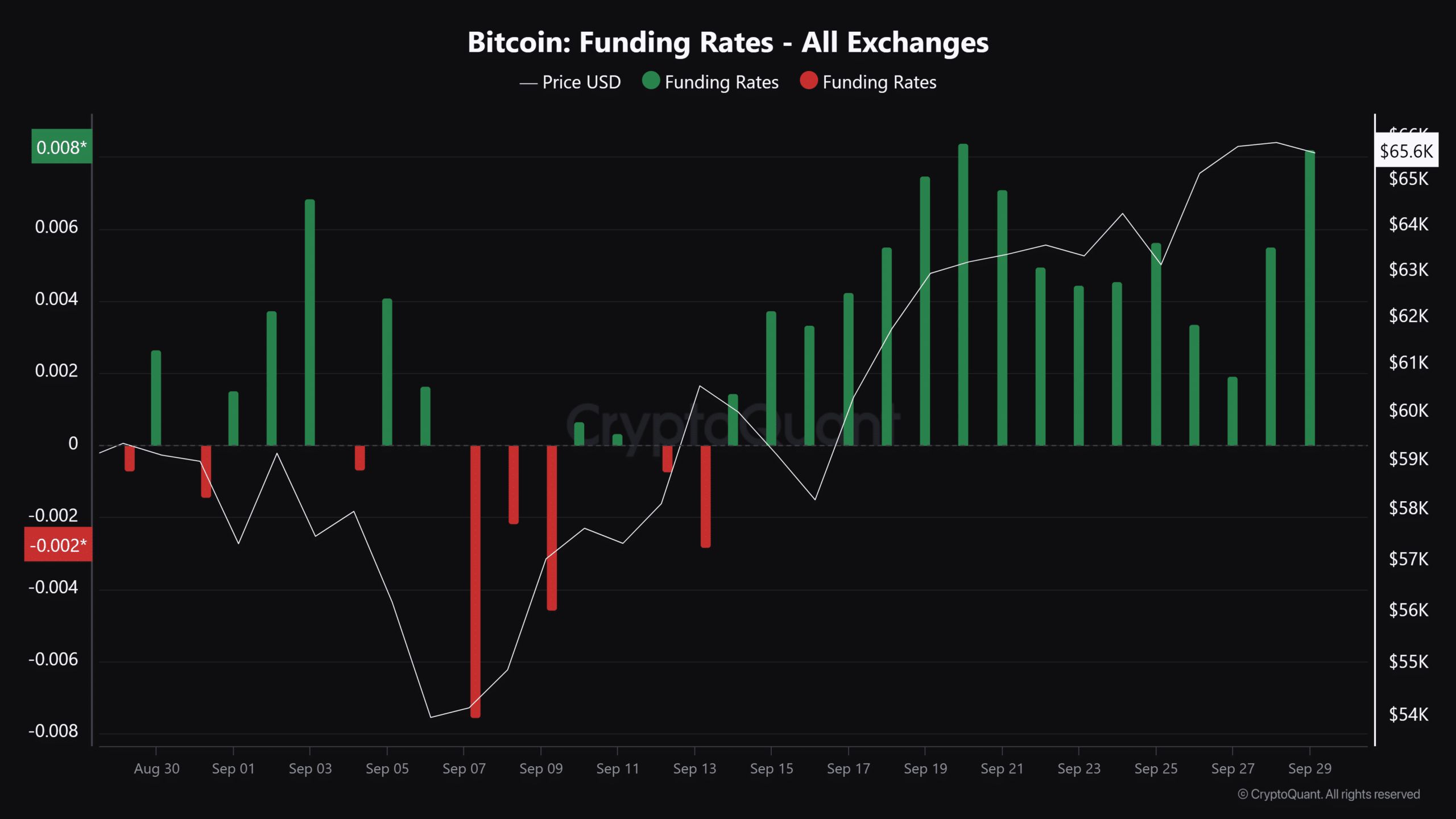

Long positions takers in control

According to CryptoQuant data, long position investors currently dominate the market.

In fact, they are willing to pay funding fees to short traders. This trend suggests that the Bitcoin bulls are in control, hence further supporting the notion of an imminent upward price movement.

Typically, when long position holders are willing to pay more to short sellers, it’s often a sign that they anticipate the price will increase in the near future.

This funding rate strengthens the optimistic perspective, since investors are preparing for an upward trend in price, should the value of Bitcoin go against them.

Bitcoin is at a key price movement that may liquidate billions in short positions. With the Bitcoin net flow up by over 10% and dominant long-position bulls, there are signs that the market might be planning for a breakout.

Should Bitcoin reach $72,600, it’s likely to ignite a massive margin call or liquidation situation. This could compel short sellers to cover their positions because the price might continue rising further.

Read More

2024-09-30 06:15