-

Altcoin season experienced a surge in value during the recent bull rally, driven by BTC testing the $66K.

However, a crucial factor is needed to trigger the onset of an altcoin season.

As a seasoned researcher with a knack for deciphering market trends and historical patterns, I find myself intrigued by the potential onset of the next Altcoin Season. The recent surge in altcoins’ value during the bull rally, driven by Bitcoin testing the $66K mark, is indeed an interesting development.

Bitcoin (BTC) may experience a possible price drop following its inability to maintain the $66,000 level. According to AMBCrypto’s assessment, the $61,000 level might function as the next line of defense, potentially signaling a significant low point.

As a seasoned analyst, I’ve observed that altcoin booms often occur following a downturn in the price of Bitcoin. If this historical trend continues, the present dip might serve as the catalyst for the impending Altcoin Season.

The next cycle could spark altcoin season

Right now, Bitcoin’s market dominance is at 57.37%, which is a noticeable drop from its recent high of 58.59% only ten days past. This decreasing control might suggest increasing faith in other cryptocurrencies, or altcoins.

Furthermore, this dip could spark renewed curiosity among coin holders, potentially paving the way for an upswing in the altcoin market.

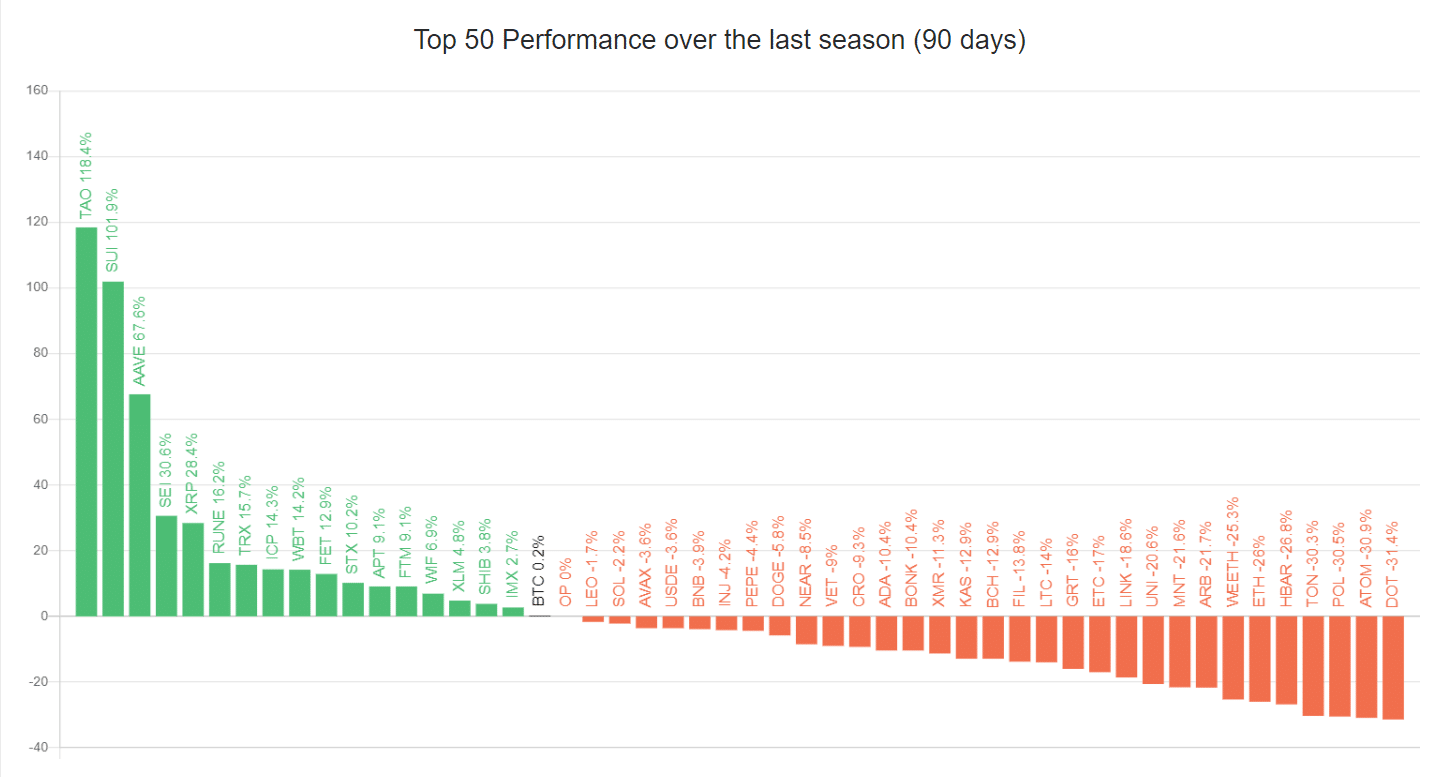

At present, 17 of the top 50 coins are ranked above Bitcoin, resulting in a 34% altcoin dominance.

As several alternative cryptocurrencies (altcoins) show signs of a bullish surge during the current market uptrend, it might take another cycle for the ideal conditions to develop that could spark the arrival of the next altcoin boom period.

It’s essential to stay informed about the approaching Bitcoin trend as it helps us predict when the price of Bitcoins might begin increasing. Put simply, understanding the upcoming Bitcoin cycle can give us a clue about when its value might go up.

Bitcoin consolidation might be the key

Though enthusiasm in the market suggests a positive beginning for Bitcoin in October, a closer look at the daily price graph paints a contrasting picture.

From my perspective as an analyst, should a mid-July style rally occur again, with Bitcoin bulls successfully defending the resistance at approximately $66,000 and pushing through to $68,000, it could potentially strengthen Bitcoin’s dominance once more. This increased dominance might cast a shadow over the potential for an altcoin season flourishing.

On the other hand, the significant decrease in Relative Strength Index suggests that the buying pressure has weakened. If Bitcoin experiences a period of stability, it might provide an opportunity for other leading cryptocurrencies to gain prominence.

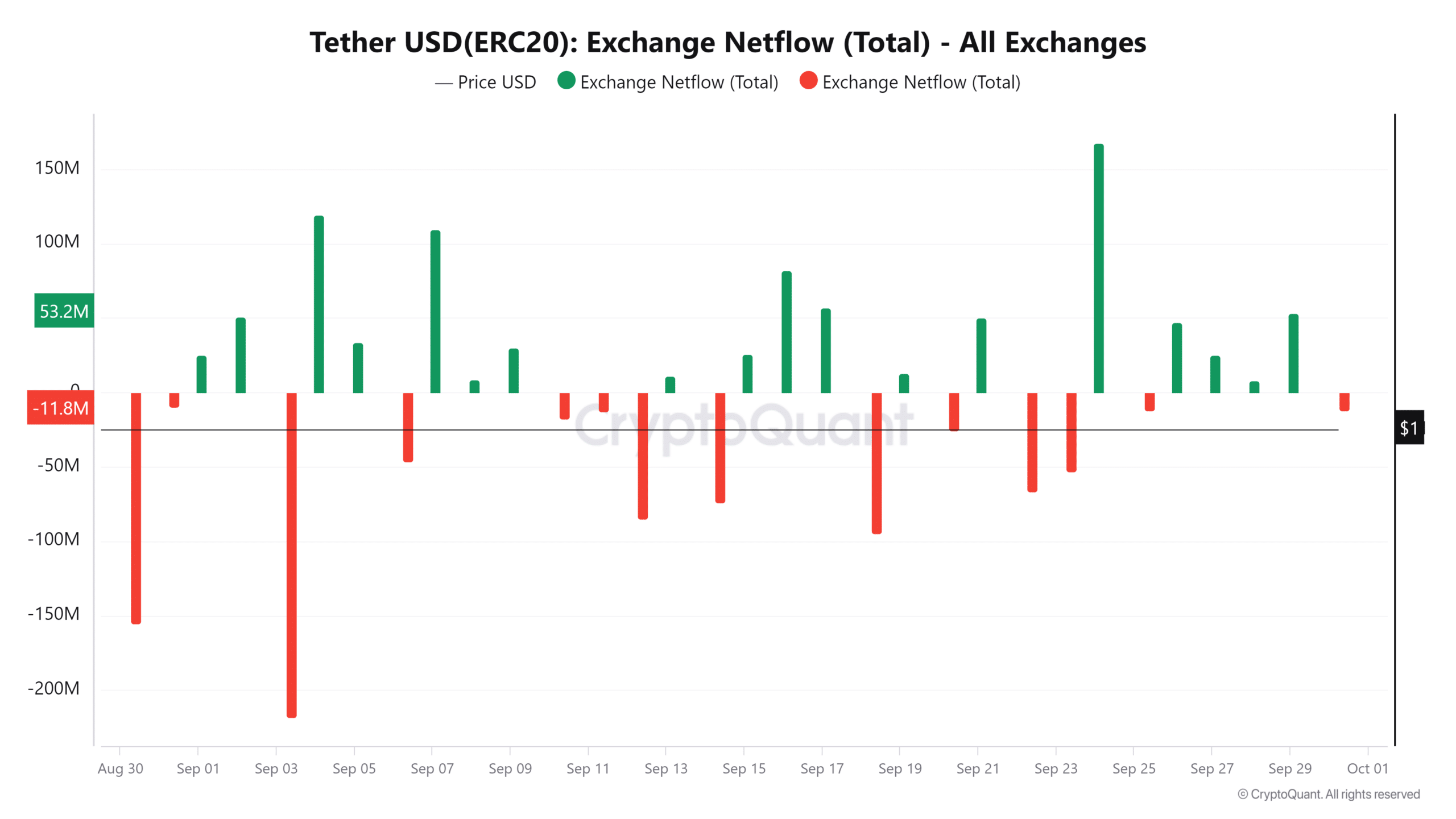

Further, an increase in USDT outflow indicates a trend of withdrawing more stablecoins off the exchanges.

Typically, these withdrawals occur at times when Bitcoin encounters a significant resistance level, causing investors to opt for USDT as a secure alternative.

Moreover, these investors consider altcoins as potentially profitable options during periods when they anticipate a drop in the value of Bitcoin.

Consequently, money moves towards alternative cryptocurrencies (altcoins), which are often perceived as more affordable options, particularly when market volatility increases.

In essence, should Bitcoin stabilize at or below the $64K mark, investors might choose to spread their investments across a variety of assets. This could lead to an uptrend for other cryptocurrencies.

The season may be within reach

Aside from market sentiment, AMBCrypto identified a hidden pattern in historical trends.

It’s worth noting that six years ago, when Bitcoin’s dominance reached its lowest point, a shift took place approximately 761 days later, signaling the beginning of an ‘altcoin era’.

In simpler terms, this pattern indicates that a similar sequence of events may herald the approaching altcoin boom.

To put it simply, when the influence of Bitcoin decreases (its dominance), there’s a possibility that the worth of alternative cryptocurrencies (altcoins) might increase again if past trends continue.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Previously discussed, the present market situation appears favorable for altcoins to experience a rise. This upward trend could be attributed to a decrease in Bitcoin’s influence, an increase in Tether (USDT) withdrawals, and a recurring market pattern pointing towards such an occurrence.

Essentially, it’s important to stay vigilant regarding these aspects. If Bitcoin (BTC) moves towards a period of stability or consolidation (which appears probable), it might initiate another altcoin rally.

Read More

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- PI PREDICTION. PI cryptocurrency

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Masters Toronto 2025: Everything You Need to Know

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

2024-09-30 18:16