-

XRP maintained the $0.6 price level.

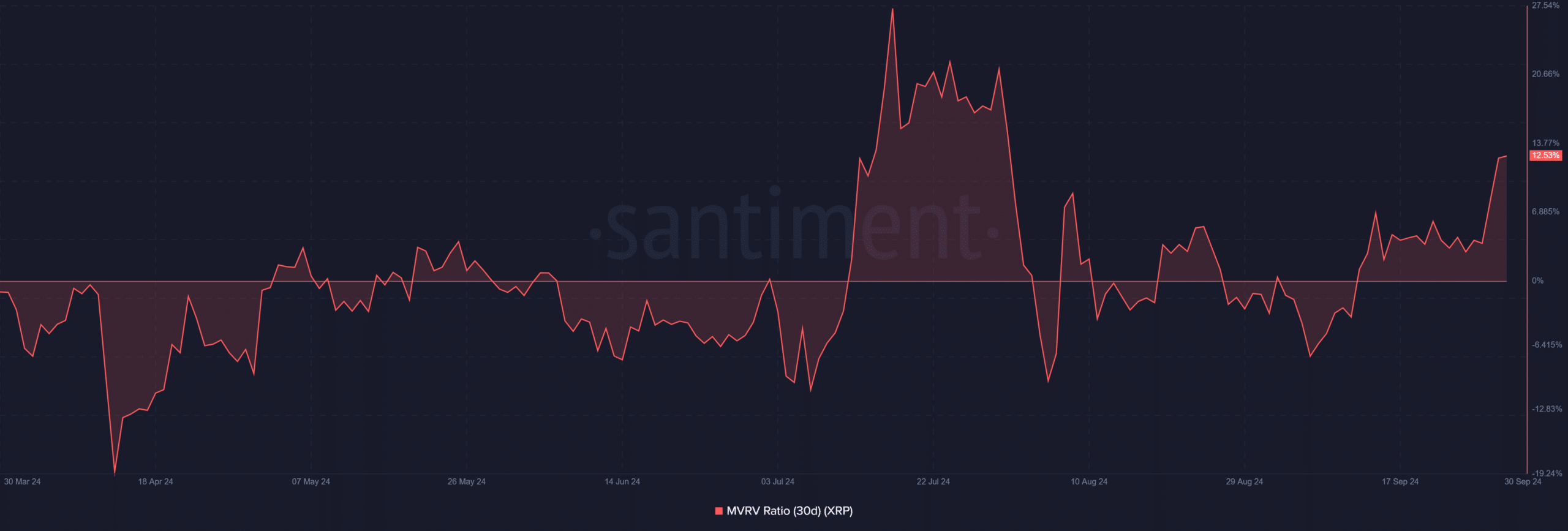

XRP’s MVRV ratio exceeded 12%, signaling profitable holders and potential for a market correction.

As a seasoned researcher who has witnessed numerous crypto market cycles, I find myself intrigued by the recent developments surrounding XRP. The consistent whale accumulation, combined with the breaking of significant resistance levels, suggests a bullish trend for Ripple’s digital token. However, it is essential to keep an eye on the rising MVRV ratio, which could signal a potential market correction in the near future.

After a substantial build-up of whales, Ripple‘s [XRP] has recently broken through crucial resistance thresholds.

Significant quantities of XRP have been acquired by major investors prior to the recent price surges, and current Short-Term Market Value to Realized Value (MVRV) figures indicate that these investors are now enjoying considerable gains.

Ripple whales accumulate millions of XRP in days

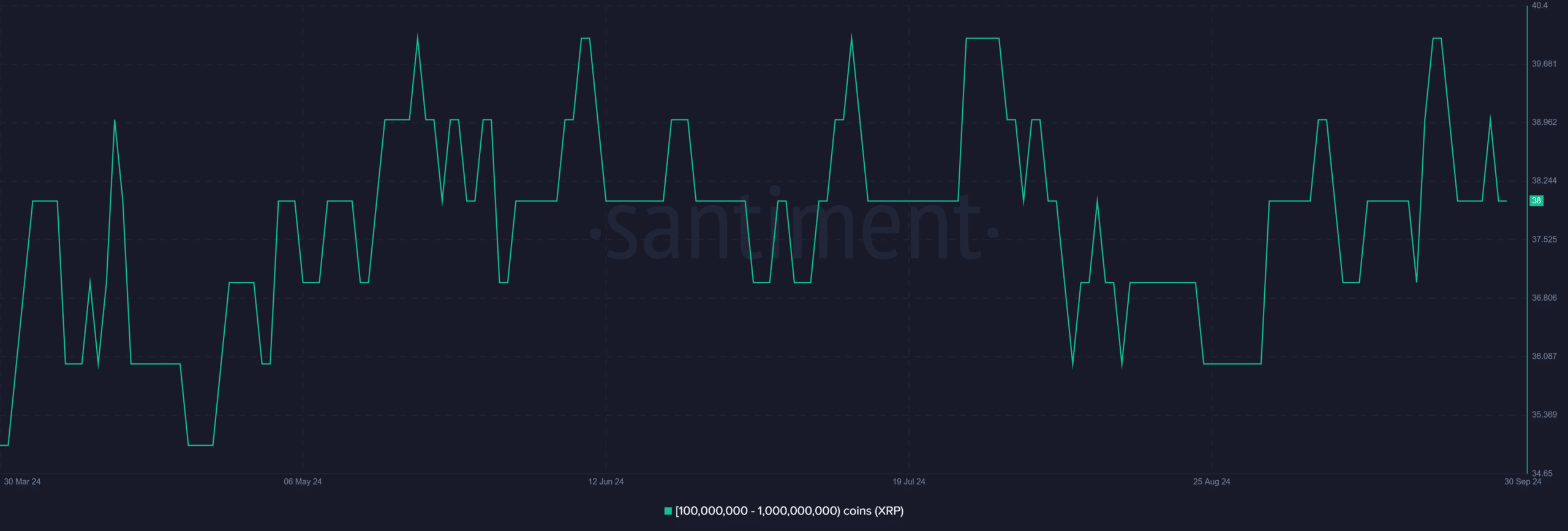

Over the last few days, there’s been a significant increase in the hoarding of Ripple by whale investors, as identified by a recent examination of wallets containing between 100 million and 1 billion Ripple.

These addresses have added close to 500 million XRP over the last ten days, a haul worth over $330 million at the current market price.

Furthermore, according to Santiment’s data, XRP currently ranks as the second most popular cryptocurrency, boasting a positive sentiment of approximately 55%.

Over these last few days, I’ve noticed an uptick in interest surrounding my crypto investments, particularly XRP. It seems this surge is closely tied to the impressive price rally XRP has seen over the past three days, placing it consistently among the most talked-about coins in the crypto space.

XRP breaks key resistance levels

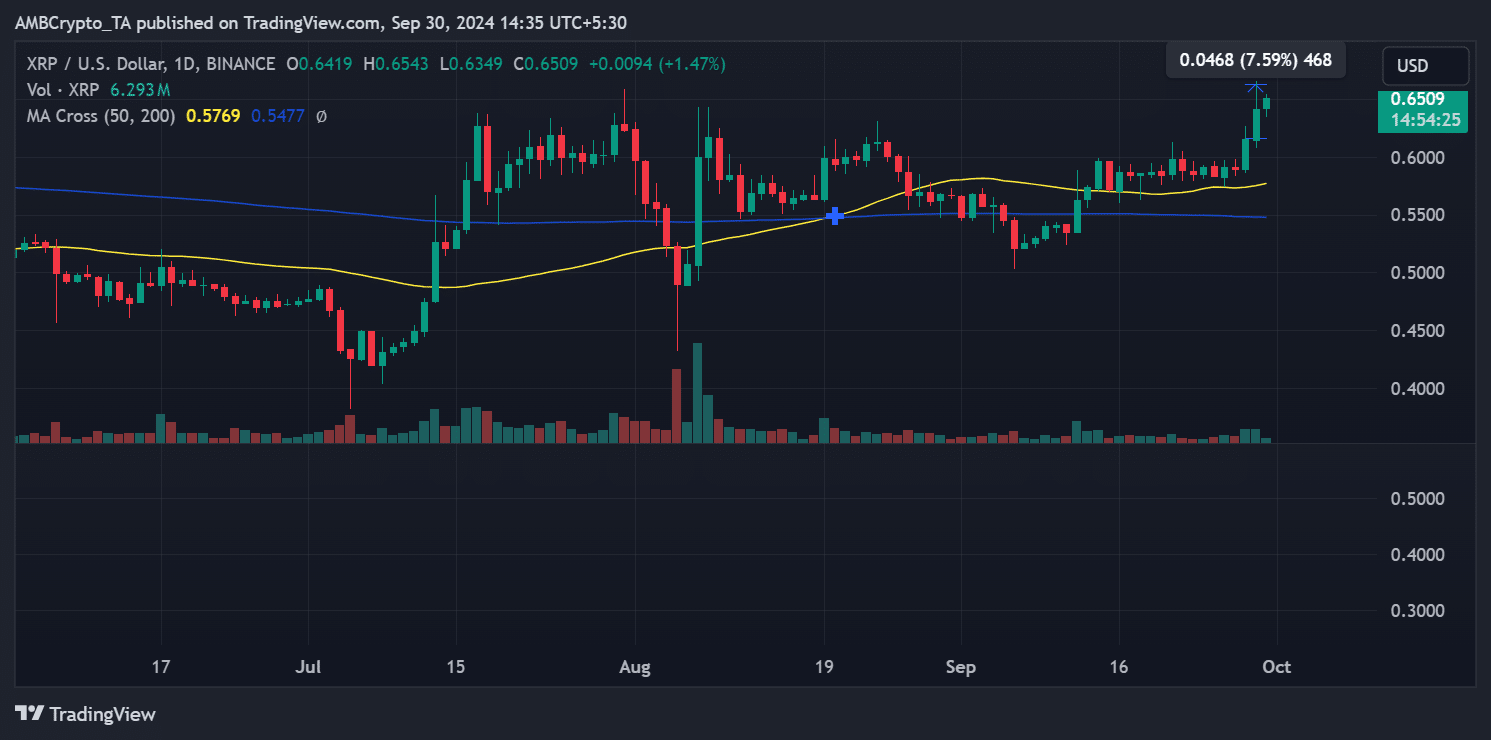

XRP experienced substantial price surges, overcoming the prior obstacles at $0.58 and $0.57 that were once strong areas of support.

Over the past three days, XRP has climbed by more than 7%, according to price analysis tools.

XRP was trading around $0.65, marking its first retest of this level since March.

Nevertheless, there’s some doubt about whether XRP can sustain its current pace and break through the $0.6 resistance, given that in the past, XRP has typically retreated following such a rise.

Ripple holders see profits as MVRV rises

For approximately a month now, the MVRV (Market Value to Realized Value) ratio for Ripple has remained positive, signifying that its holders have experienced profits since September 12th.

On or about the 27th of September, the MVRV experienced a significant jump, rising from approximately 3.7% to more than 12%, and it is now at 12.53%.

The increase in MVRM indicates that numerous XRP investors, particularly those with large wallets, have accumulated substantial gains. This trend hints at potential overpricing in the immediate future, but it could also mean a market adjustment is imminent.

Conversely, whales and short-term traders have already profited from their purchases during the price increase.

Read Ripple’s [XRP] Price Prediction 2024-25

Lately, the increase in Ripple’s price can be attributed to significant buying from large investors (whales) and breaching crucial resistance thresholds, causing XRP to attempt reaching its highest price point since March.

Given the MVRM ratio suggesting a possible overvaluation, there might be increased market volatility coming up.

Read More

- OM/USD

- Jellyrolls Exits Disney’s Boardwalk: Another Icon Bites the Dust?

- Carmen Baldwin: My Parents? Just Folks in Z and Y

- Solo Leveling Season 3: What You NEED to Know!

- Despite Strong Criticism, Days Gone PS5 Is Climbing Up the PS Store Pre-Order Charts

- Jelly Roll’s 120-Lb. Weight Loss Leads to Unexpected Body Changes

- Beyond Paradise Season 3 Release Date Revealed – Fans Can’t Wait!

- Disney’s ‘Snow White’ Bombs at Box Office, Worse Than Expected

- Moo Deng’s Adorable Encounter with White Lotus Stars Will Melt Your Heart!

- Joan Vassos Reveals Shocking Truth Behind Her NYC Apartment Hunt with Chock Chapple!

2024-09-30 20:08