-

WIF experiences significant growth due to a confirmed breakout from a descending channel, suggesting bullish momentum.

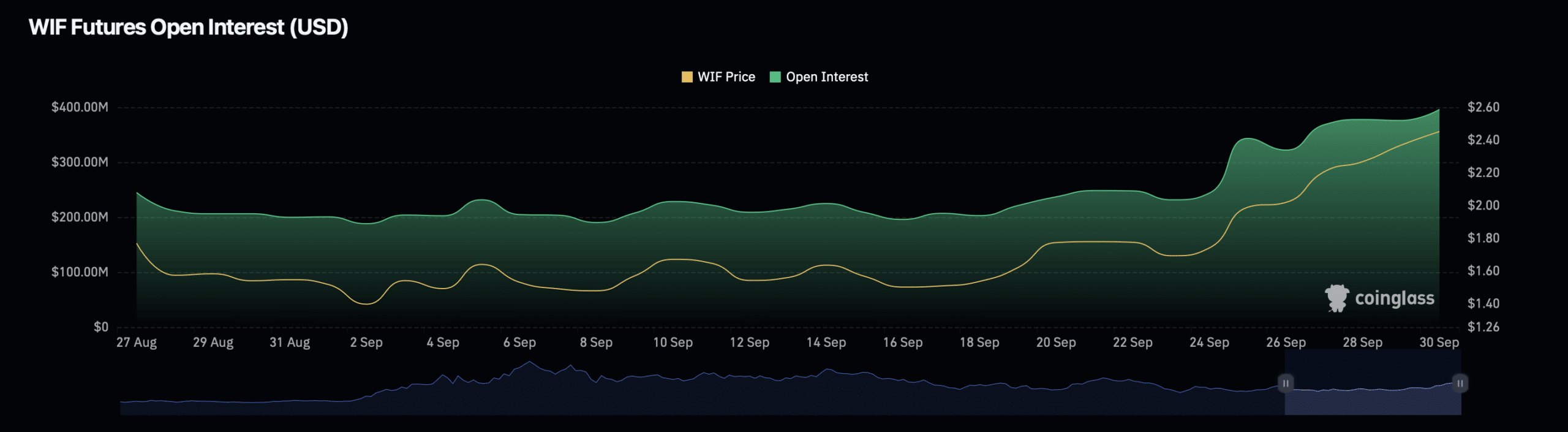

Open Interest and trading volume surge, pointing to potential sustained price gains in the short term.

As a seasoned analyst with over two decades of experience observing the cryptocurrency market and its intricacies, I find myself increasingly intrigued by the performance of WIF (dogwifhat). The recent surge in its price and the strong technical signals hint at an exciting future for this memecoin.

A popular meme-based cryptocurrency, DogeWHAT (WIF), has recently gained attention due to its positive response as the broader crypto market slowly recovers.

Over the past week, WIF has shown a surge of 42%, outpacing many other digital assets.

It appears that optimism remains high, as WIF has increased by an additional 5.4% over the past day, raising its current trading value to approximately $2.43.

In the midst of the current market dynamics, cryptocurrency expert Captain Faibik from platform X has offered insights into Wallet Investment Fund’s (WIF) pricing trends.

Faibik’s examination suggests a promising outlook for WIF, with its recent success being attributed to substantial technical indicators that may point towards continued expansion.

WIF technical breakout and its implications

In a recent update, Captain Faibik examined the technical diagram for WIF, implying that the memecoin could potentially continue its bullish trajectory.

In simpler terms, Faibik pointed out that the trend for WIF (What Is Fiat?) has clearly moved upward after breaking through a downward-sloping channel observed on the daily chart.

He stated,

The Downward Trending Channel’s Upturn on the Daily Graph has been validated, potentially leading us towards a new record high.

Thus, WIF could be set for further upward momentum, with an all-time high on the horizon.

In simpler terms, a descending channel occurs when the price of an asset decreases while being bounded by two sloping lines that move downward. This pattern is identified by repeated instances of lower peaks (highs) and lower troughs (lows).

The asset’s price spikes above its upper trendline, signifying a burst or escape from the continuing downtrend.

The advancement clearly shows that buyers have taken charge, and it suggests an escalating energy, possibly predicting substantial growth in value.

Potential uptrend continuation?

To truly understand if the current upward trend will continue, it’s essential to examine the fundamental aspects of WIF (Whatever-It-Fits).

A key metric in this analysis is WIF’s Open Interest, which provides insight into the number of open positions in the Futures market for the asset.

As an analyst, I’m observing a substantial growth in the Open Interest of WIF, which now stands at approximately 4% higher, translating to a market value of around $389.70 million as we speak.

Furthermore, there’s been a significant increase in the Open Interest volume, boosting it up by 43.78% to a worth of approximately $1.78 billion.

This rise in Open Interest and volume indicates growing market activity and interest in WIF.

Generally speaking, an increase in Open Interest usually means that more money is being invested in the derivatives market related to a particular asset. This trend can frequently indicate growing anticipation of changes in the asset’s price.

Read dogwifhat’s [WIF] Price Prediction 2024–2025

An increase in Open Interest together with a higher asset price usually indicates that traders are making optimistic wagers (bullish bets) on the asset, predicting it will keep rising.

Furthermore, as Open Interest increases, it might suggest higher market liquidity, which improves trading possibilities for WIF. This increased liquidity may draw in additional traders, thereby amplifying the asset’s price fluctuations.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Gold Rate Forecast

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- SOL PREDICTION. SOL cryptocurrency

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- Solo Leveling Arise Tawata Kanae Guide

2024-10-01 04:08