-

APT’s current pattern could set the stage for a significant price increase.

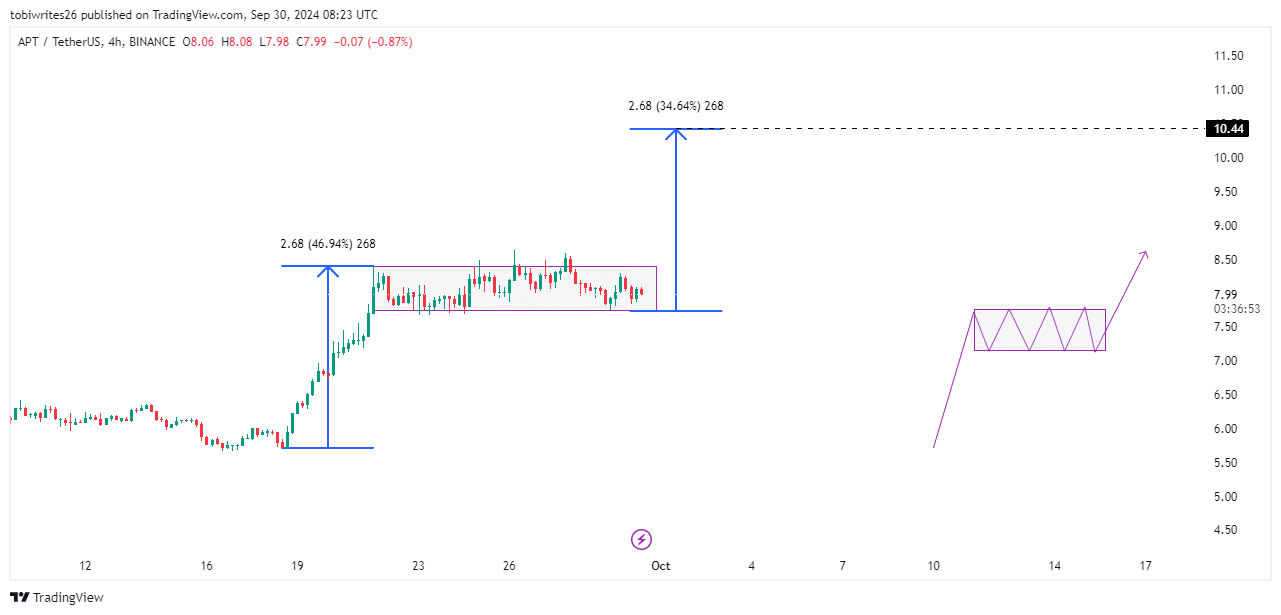

Should this classic bullish pattern persist, APT is projected to reach at least $10.44.

As a seasoned crypto investor with battle-scarred fingers from the volatile crypto market, I find myself cautiously optimistic about Aptos [APT]. The current consolidation phase, while seemingly stagnant, is often a precursor to significant price increases as history has shown us. However, I’ve learned the hard way that the market can be as unpredictable as a rollercoaster ride at Cedar Point.

As an analyst, I’ve observed a significant jump of 17.84% in Aptos (APT) prices earlier today, but at the moment of writing, the prices seem to be stabilizing. Over the past week, there’s been a relatively minor increase of 0.33%, yet within the last 24 hours, we’ve seen a slight drop of 0.53%.

Even with some conflicting indicators, AMBCrypto notes that the present pattern seems to resemble past bullish tendencies which often sparked market surges.

Ongoing accumulation signals a potential rally for APT

At the moment, APT appears to be going through a period of consolidation – a typical stage before a potential surge, based on historical trends shown on the graph. During this time, traders usually build their positions by purchasing more APT, hoping for a price increase in the near future.

Generally speaking, the upcoming price surge (rally) is likely to last as long or even longer than the prior one that was followed by a period of stability (consolidation). Under these conditions, it’s projected that APT will reach $10.44, resulting in an increase of approximately 34.64%.

If there’s a change in market trends, it might lead to a decrease in APT‘s price. This trend could be indicated if APT either dips or experiences sudden volatility outside of its current trading range (consolidation channel).

APT set to decline despite bullish signals

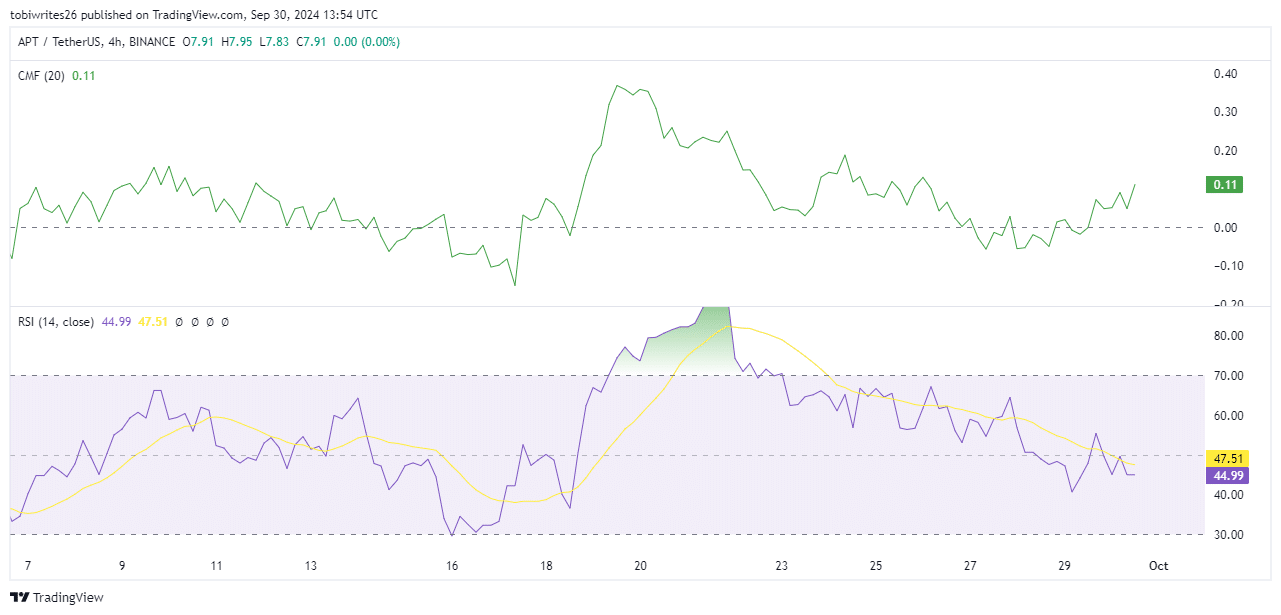

It was confirmed that the buildup phase for APT, indicating a bullish sentiment, was established by analyzing the Chaikin Money Flow (CMF). This tool helps in monitoring the movement of funds flowing into or out of an asset, essentially tracking liquidity inflows and outflows.

At present, the Cash Management Facility (CMF) is showing an upward trajectory, registering a value of 0.11. This figure signifies a substantial increase in liquidity as more and more traders are choosing to invest in APT by purchasing it.

An examination of the Relative Strength Index (RSI) indicates that APT may decline, possibly dropping back towards the lower boundary of its current trading range or even dipping briefly beneath it in what might be a “stop hunt” scenario. Following this potential drop, APT could find stability within the range prior to an anticipated uptrend.

APT’s decline appears imminent

According to AMBCrypto, there are several signs suggesting that APT could experience a significant drop or a sudden departure from its current consolidation pattern.

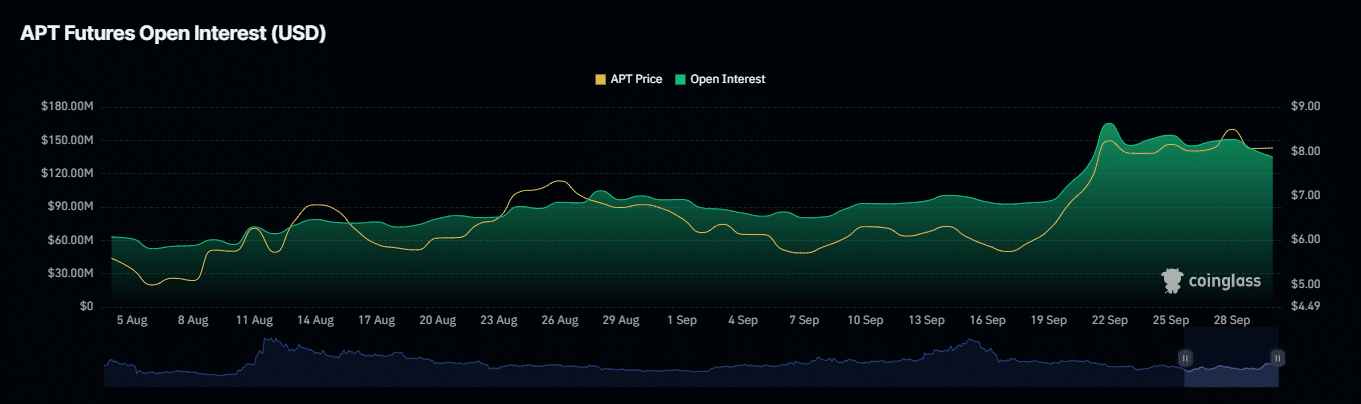

From my perspective as an analyst, it’s worth noting that the Open Interest has primarily trended downwards, dropping by 2.67% to stand at approximately $134.83 million at this moment. This decline indicates a decrease in traders who are speculating on a bullish move for APT, suggesting a more cautious outlook among market participants.

Read Aptos’ [APT] Price Prediction 2024-25

In the past day, a significant number of long traders have had to exit the market, resulting in the liquidation of approximately $333,300 in short positions.

If this metric progressively turns optimistic, it will likely lead to a rise in APT‘s price movement.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- SOL PREDICTION. SOL cryptocurrency

- Solo Leveling Arise Tawata Kanae Guide

2024-10-01 09:43