- Uniswap sees a sharp decline in large transactions.

- Metrics signal a potential continued bullish momentum.

As a seasoned analyst with over a decade of experience in the crypto market, I’ve seen my fair share of bearish and bullish trends. The recent dip in large transactions on Uniswap might seem concerning at first glance, but it’s important to delve deeper into the numbers.

Uniswap’s [UNI] larger transactions have seen a noticeable drop, yet the overall market outlook maintains a positive vibe. Interestingly, there’s been an uptick in the number of holders as well as an increase in daily active addresses.

Regardless of a 64% decrease in significant transactions, the rise in the count of active wallets and a positive growth in the number of wallets holding cryptocurrency indicate that there’s still a lot of energy driving the upward trend.

Uniswap big dip, but not a slip

Uniswap has experienced a significant 64% drop in major transactions, which could suggest that big investors are adopting a more cautious approach or moving their business to different platforms.

Despite this decline, it doesn’t appear that the overall condition of the Decentralized Exchange (DEX) mirrors this. However, the Uniswap ecosystem remains robust and resilient in these circumstances.

Bullish momentum grows without a rush

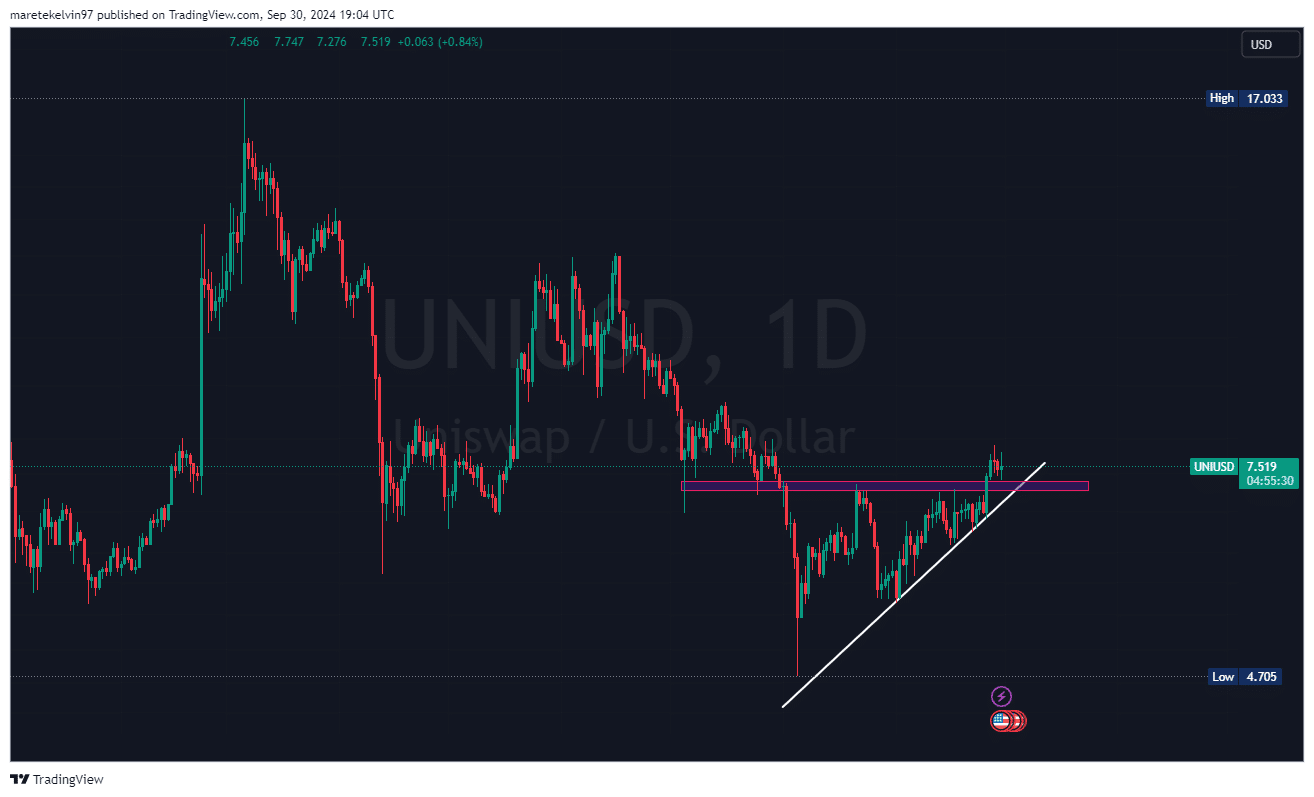

Despite a decline in larger trades, Uniswap’s price trend shows a bullish inclination. The token is experiencing an uptick in its graph, suggesting that the market opinion is turning favorable.

Investors are now paying closer attention to the positive setup on Uniswap, which may lead to additional price movement in the coming days.

Uniswap daily growth indicates market flow

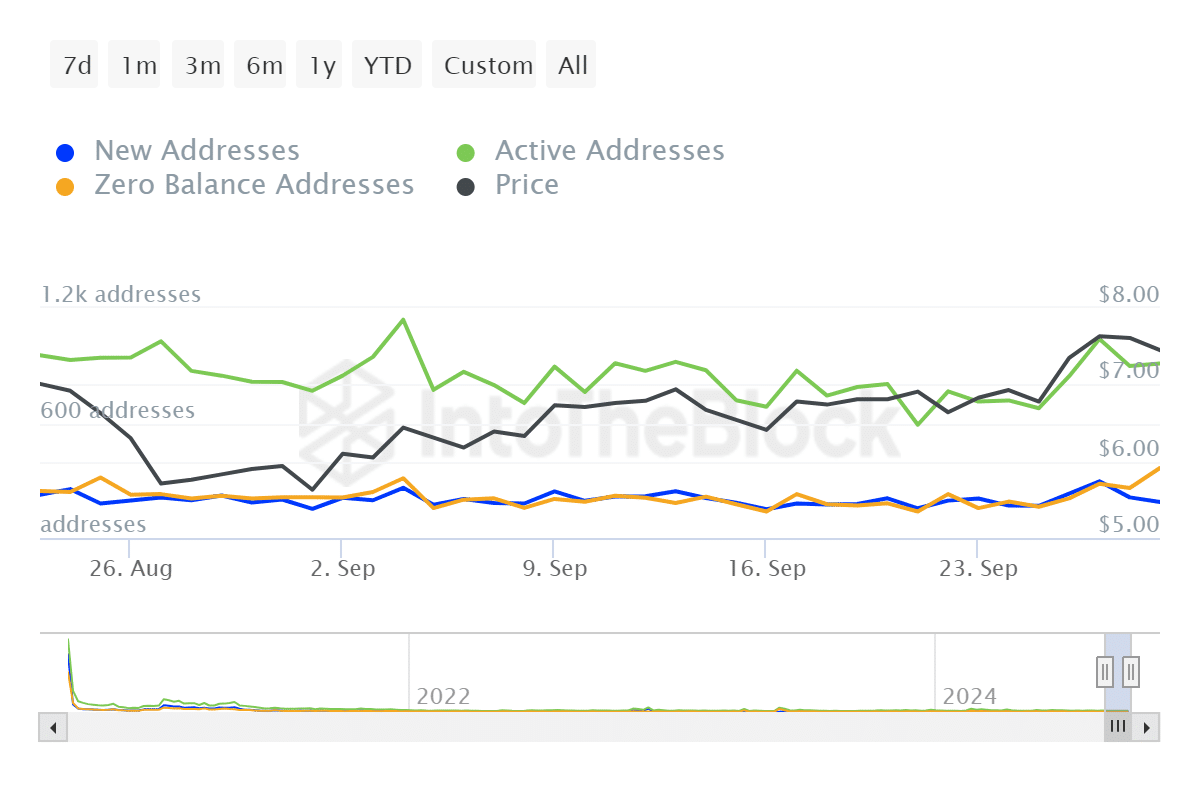

Over the past day, Uniswap has experienced a 2% rise in daily active users, suggesting an uptick in user engagement.

This further indicates that market participation is becoming more interactive with the exchange.

As the user base expands, there’s usually a larger amount of activity within the system, which can potentially lead to increased liquidity and a stronger likelihood for price increases.

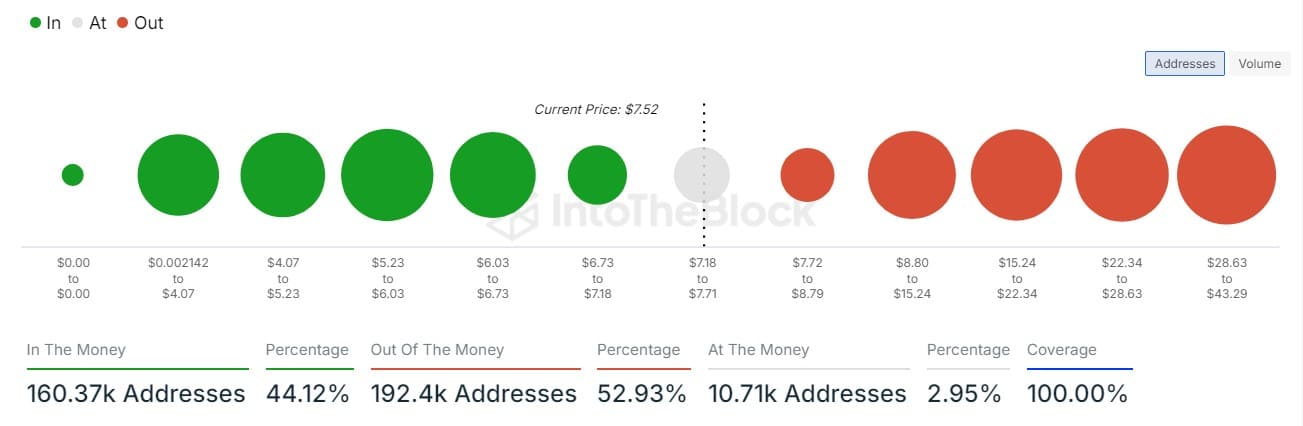

Holding addresses in profit fuel optimism

Approximately four out of ten holding addresses for Uniswap are currently showing a profit, which boosts overall market confidence in its success.

The substantial profits indicate a robust standing for numerous Uniswap token holders, potentially boosting their faith in the token’s long-term prospects.

Given our present configuration and the ongoing bullish trend, these indicators seem to suggest a continued movement upward.

Though the number of large transactions on Uniswap is declining, it does not eradicate a bullish outlook.

It appears that a rising count of daily active wallets and a substantial number of users realizing profits hint at the possibility that Uniswap’s upward price trend may continue.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- SOL PREDICTION. SOL cryptocurrency

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- Despite Bitcoin’s $64K surprise, some major concerns persist

2024-10-01 13:43