-

Ethereum Futures surged 40% in volume as traders positioned themselves for potential price movements.

Profit-taking by investors limits a major ETH rally, despite increased outflows from exchanges.

As a seasoned crypto investor with over a decade of experience in this dynamic market, I find myself observing Ethereum’s [ETH] recent price movements with a blend of curiosity and cautious optimism. Having witnessed several bull runs and bear markets, I can say that the current volatility is not entirely unexpected.

The cost of Ethereum’s ETH token has been quite unpredictable lately, showing ups and downs, or highs and lows, over the past few weeks.

Initially dipping slightly under $2,600, Ethereum prices have indicated a bounce back and are currently being traded at $2,645.52 as we speak.

In the past day, the price has risen by 0.29%, but over the last week, it has dipped slightly by 0.12%. Currently, Ethereum’s market capitalization stands at approximately $318.46 billion, and its 24-hour trading volume exceeds $17.88 billion.

Key technical levels to watch

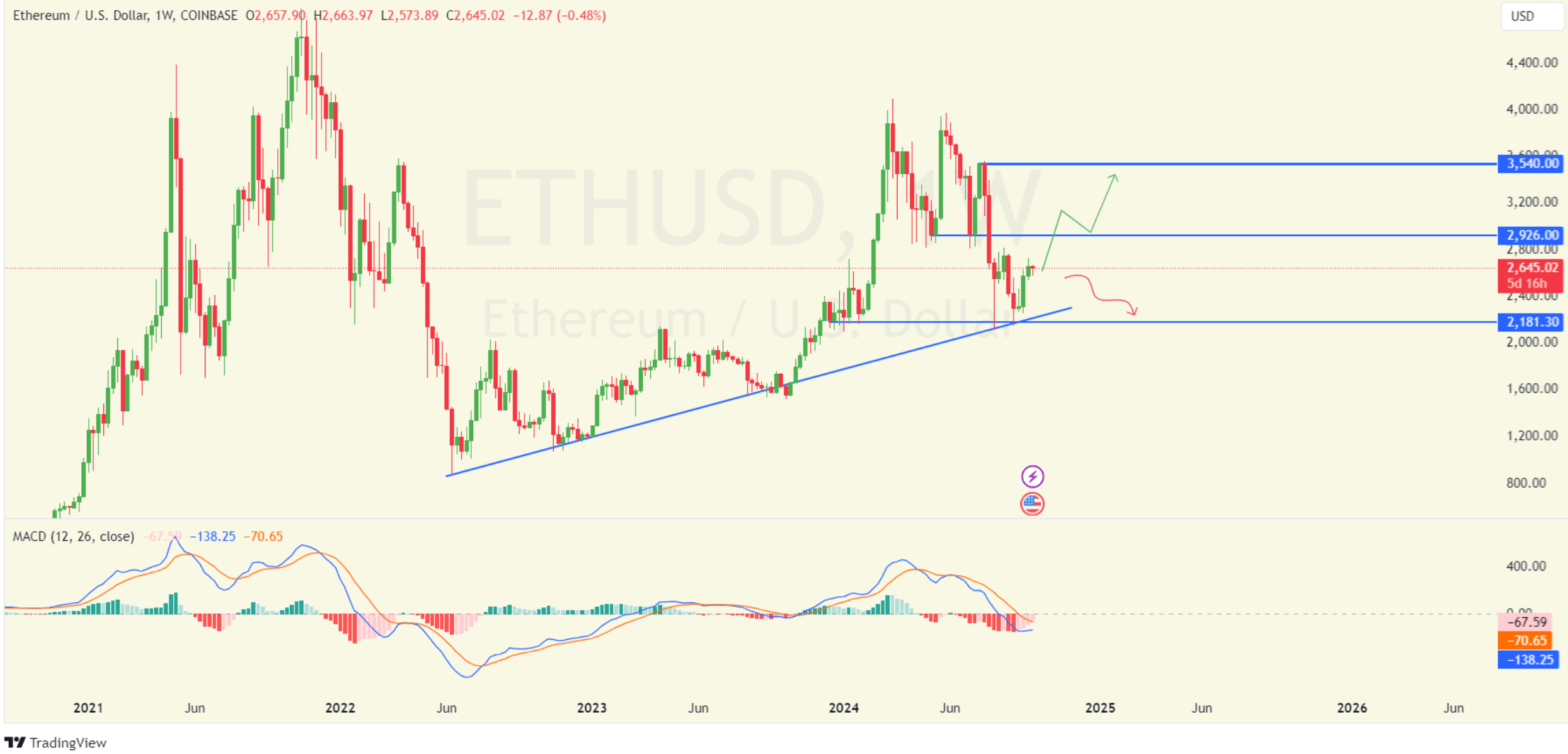

The cost of Ethereum is hovering close to a significant support point at around $2,181.30. This crucial point is bolstered by an upward sloping trendline that has been providing support for Ethereum since the middle of 2022.

If Ethereum falls beneath its current support level, there’s a possibility that the market might experience a downturn, which could result in additional decreases in price.

Conversely, Ethereum is encountering obstacles near $2,926. If it manages to surpass this barrier, it might push the price upwards, aiming for approximately $3,540.

If buying momentum strengthens, the price might even test previous highs around $4,000.

For optimistic investors, the rising trajectory will significantly impact their trust in the market.

Ethereum Futures surge amid volatility

For Ethereum, the Moving Average Convergence Divergence (MACD) signaled a negative outlook as the MACD line and the signal line fell below the zero mark, suggesting a potential downward trend.

If the MACD line starts to rise (indicating positive movement), this might indicate a shift in direction, lending credence to a potentially optimistic outlook for Ethereum within the next few weeks.

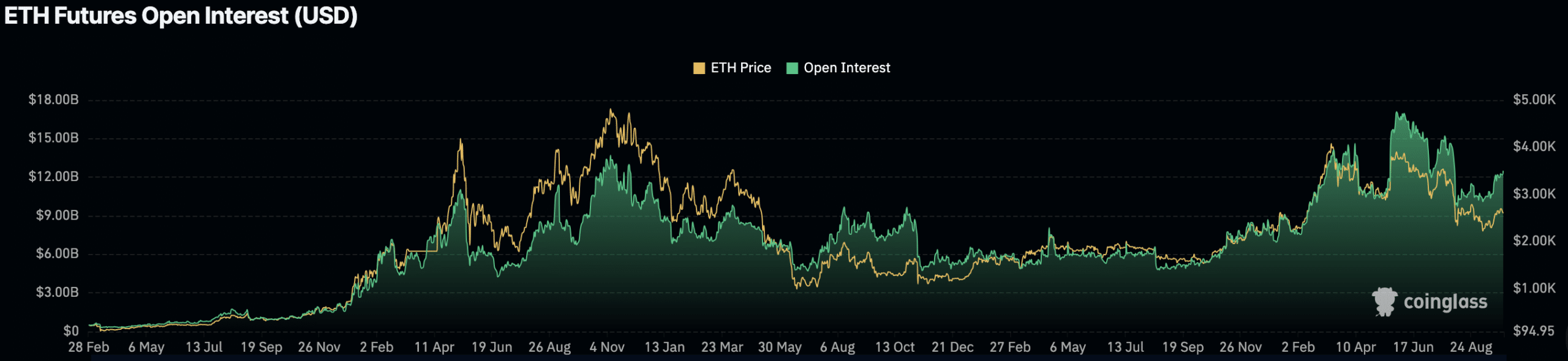

Recent futures data from Coinglass revealed increased activity in the Ethereum market. Open Interest in ETH futures has risen by 2.94%, now standing at $12.66 billion, indicating growing trader interest.

Moreover, the Futures trading volume on Ethereum has increased by 40.39% to hit a record of $25.63 billion, and the volume for Options has skyrocketed by an impressive 258.39%, amounting to $564.17 million.

As a researcher, I’ve noticed an uptick in activity within Ethereum Futures trading, implying that market players are strategically preparing for anticipated price fluctuations.

Profit-taking, not accumulation

Based on an evaluation by AMBCrypto, it’s been observed that there has been a rise in Ethereum withdrawals from centralized platforms since late July. This trend could indicate that certain investors are amassing more of the cryptocurrency.

Yet, the buildup wasn’t as significant as it was in February or November of 2023. In the past fortnight, there have been multiple days with net inflows, suggesting that certain investors may have chosen to cash out their gains.

As an analyst, I’ve noticed that although the quantity of these withdrawals isn’t substantial enough to indicate a mass exit, it does underscore a segment of the market choosing to capitalize on their recent profit-making opportunities by cashing out.

Read Ethereum’s [ETH] Price Prediction 2024–2025

Based on the analysis of netflows data, it seems like there’s some buildup, but it might not be enough to trigger a significant bull run for Ethereum in the immediate future.

Rather than holding onto their Ethereum for long-term growth, it appears that many investors are cashing in on its success, having accumulated profits since March 2024.

Read More

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- S.T.A.L.K.E.R. 2 Major Patch 1.2 offer 1700 improvements

- Disney Cuts Rachel Zegler’s Screentime Amid Snow White Backlash: What’s Going On?

- Jujutsu Kaisen Reveals New Gojo and Geto Image That Will Break Your Heart Before the Movie!

- Hut 8 ‘self-mining plans’ make it competitive post-halving: Benchmark

- Taylor Swift Denies Involvement as Legal Battle Explodes Between Blake Lively and Justin Baldoni

- The Weeknd Shocks Fans with Unforgettable Grammy Stage Comeback!

- Why Tina Fey’s Netflix Show The Four Seasons Is a Must-Watch Remake of a Classic Romcom

- Disney’s Animal Kingdom Says Goodbye to ‘It’s Tough to Be a Bug’ for Zootopia Show

- Assassin’s Creed Shadows is Currently at About 300,000 Pre-Orders – Rumor

2024-10-01 16:08