- At press time, Worldcoin navigated through a critical demand zone, signaling potential for further gains.

- Market sentiment continued to strengthen this bullish outlook, adding multiple factors that support the stability of the demand zone.

As a seasoned crypto investor with a knack for spotting trends and understanding market dynamics, I find myself intrigued by Worldcoin’s (WLD) current situation. The recent retracement into a key demand zone is not just a simple correction but a potential opportunity for further gains.

In the last day, Worldcoin [WLD] experienced a minor dip of 2.38%, but it’s important to note that over the past month, its overall performance has been impressive, racking up a significant increase of 27.86%.

Remarkably, when prices consistently rise for a long time and then experience a small decrease, it often signifies a period of market consolidation or pullback.

This pattern suggests that WLD is gearing up to resume its upward trajectory.

Retracement into demand zone

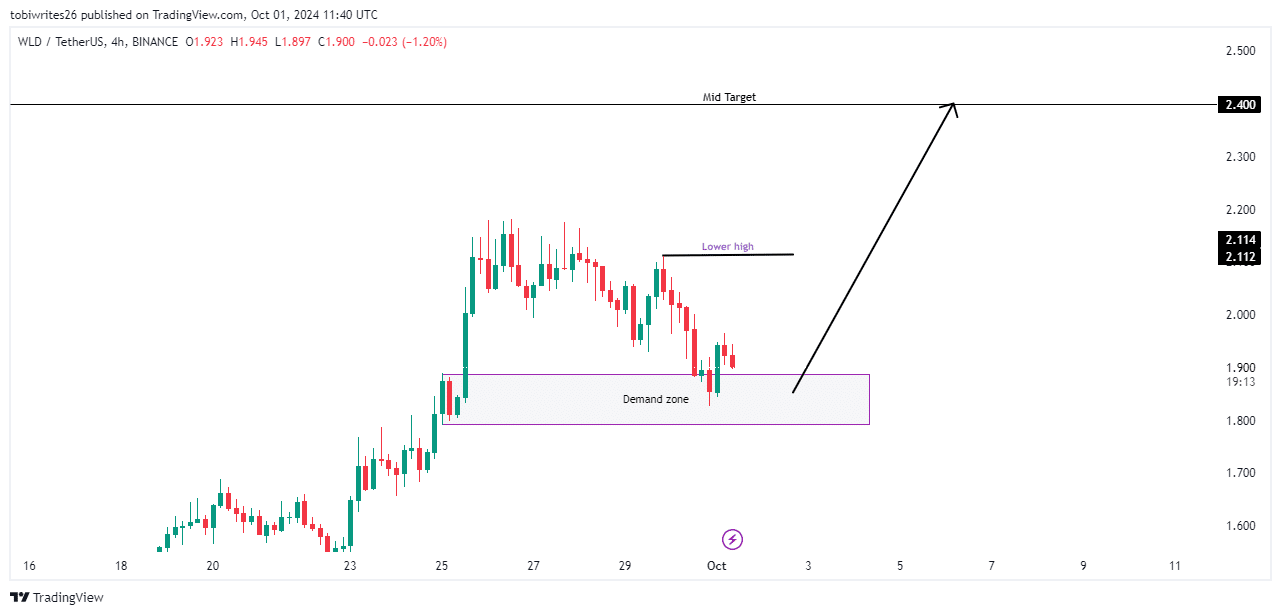

WLD’s recent downward movement, or retracement, has positioned it back into a key demand zone.

In this area, you’ll often find a high number of buy orders, suggesting that the market’s active players tend to be interested in buying when prices reach these specific points.

As a crypto investor, I’m eagerly watching WLD‘s price movement. The significance of this key demand zone will become apparent when WLD breaks the current resistance level of 2.112 on the 4-hour chart, indicating a bullish trend.

Reaching this goal could steer Worldwide Ltd towards hitting an intermediate objective of $2.4, which might continue its growth trajectory up to $3.0.

Instead, if the trading happens below this demand zone, it could put WLD at risk, possibly causing a drop towards 1.511. This descent might further escalate due to increased selling pressure, potentially reaching its lowest point predicted for 2024.

WLD is unlikely to fall

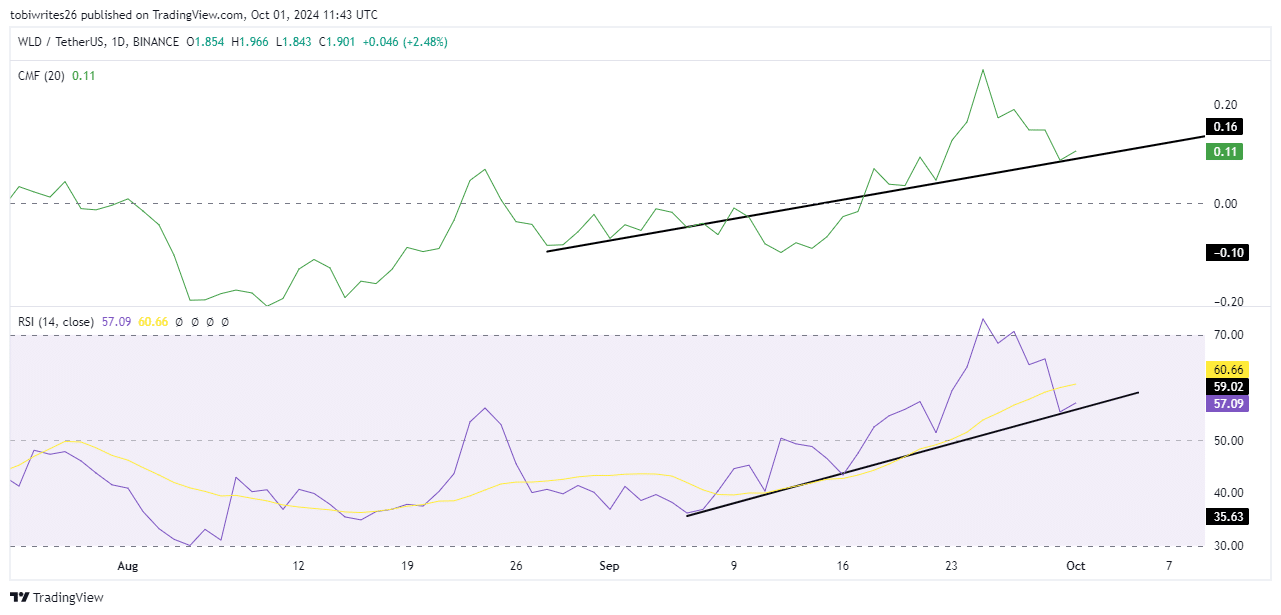

Based on AMBCrypto’s examination, the Chaikin Money Flow (CMF) and the Relative Strength Index (RSI) suggest a bullish trend for WLD. This could potentially cause additional price rises as the trading day continues.

The direction of the Chaikin Money Flow has changed, now moving in an upward trajectory following contact with a significant historical support trendline. This transition suggests that investors are becoming more optimistic about the market, as they are progressively pouring more resources into WLD tokens.

Just like the Relative Strength Index (RSI) that evaluates market momentum and predicts trends, it follows a similar trajectory. Currently, the RSI has bounced back from its support level, indicating a strengthening optimistic viewpoint.

Based on these favorable signs and WLD being a significant area for high demand, it’s quite probable that its price will keep rising.

THIS can cause a potential surge

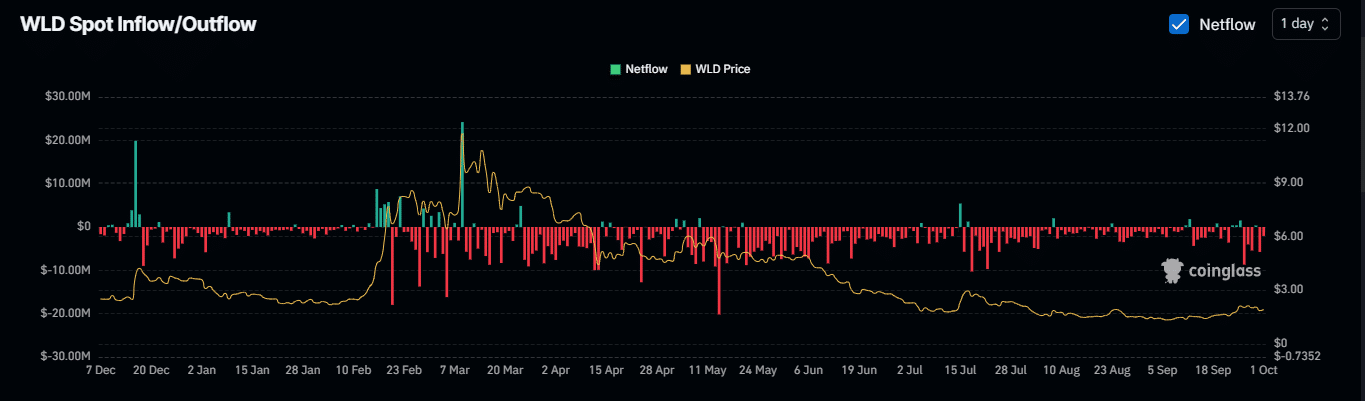

As per Coinglass, the flow from Exchange WLD to net has been unfavorable for the past 24 hours and this trend is especially significant when looking at the last seven days.

This pattern shows an increasing level of trust from WLD owners, implying a positive perspective since they are choosing to retain their assets off exchanges.

Read Worldcoin’s [WLD] Price Prediction 2024–2025

Yesterday, an amount equivalent to $1.97 million was taken out from various exchanges, while over the course of the last seven days, a cumulative sum of approximately $7.71 million has been withdrawn from the market.

These substantial withdrawals are building up the expectation for a potential bullish run in WLD. Should this withdrawal pattern persist, it seems probable that WLD prices may continue to rise.

Read More

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- PI PREDICTION. PI cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Masters Toronto 2025: Everything You Need to Know

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

2024-10-01 19:36