- The Bitcoin Rainbow Chart and other key metrics signaled ‘BUY’ at press time.

- Market pundits expect bullish Q4 and 2025 — Should you hold on or jump in?

As a seasoned analyst with over two decades of experience in the financial markets, I have seen my fair share of bull and bear cycles. Based on the current market conditions and the various valuation metrics presented, it seems like Bitcoin (BTC) is offering a compelling buying opportunity for investors.

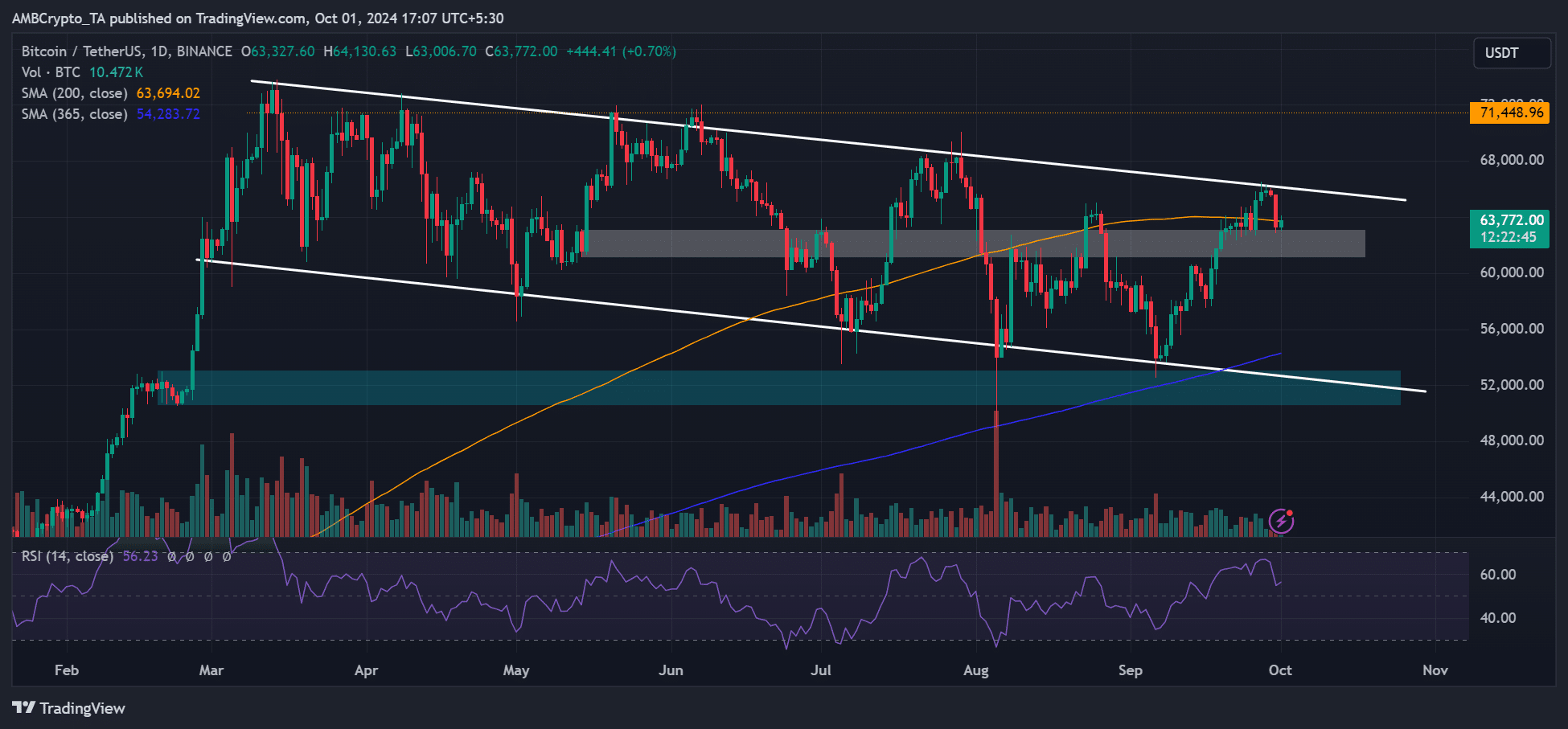

Bitcoin [BTC] has been consolidating within $60K—$70K for the past seven months. Despite the boring price action, the current BTC value was still a great buy opportunity ahead of a historically bullish Q4.

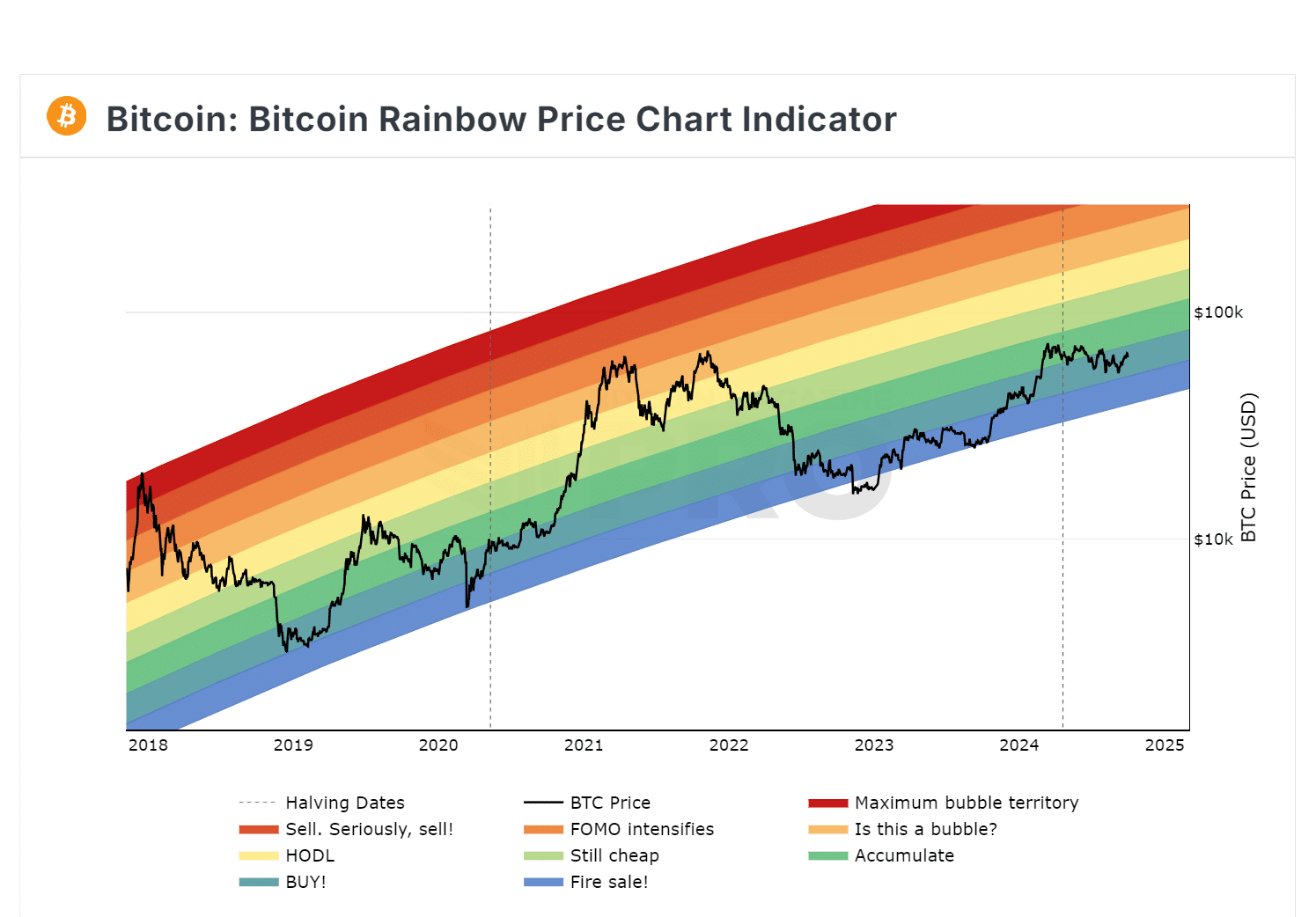

According to the Bitcoin Rainbow Chart, BTC’s current value was still within the ‘buy’ zone.

Indeed, given it’s currently March, and following a period of decline, this asset has been comfortably situated within the ‘accumulation’ and ‘purchase’ regions.

To clarify, the Rainbow Chart evaluates Bitcoin’s value using past price data and represents this information graphically by employing a spectrum of rainbow hues.

As a crypto investor, I keep a close eye on the color bands because when they are lower, it suggests that Bitcoin might be undervalued, potentially offering an excellent opportunity for investment. Conversely, higher color bands indicate a heated market, possibly signaling overvaluation and potential corrections.

Is BTC still discounted?

Other key valuation metrics also signaled that BTC was relatively ‘cheap’ at press time value.

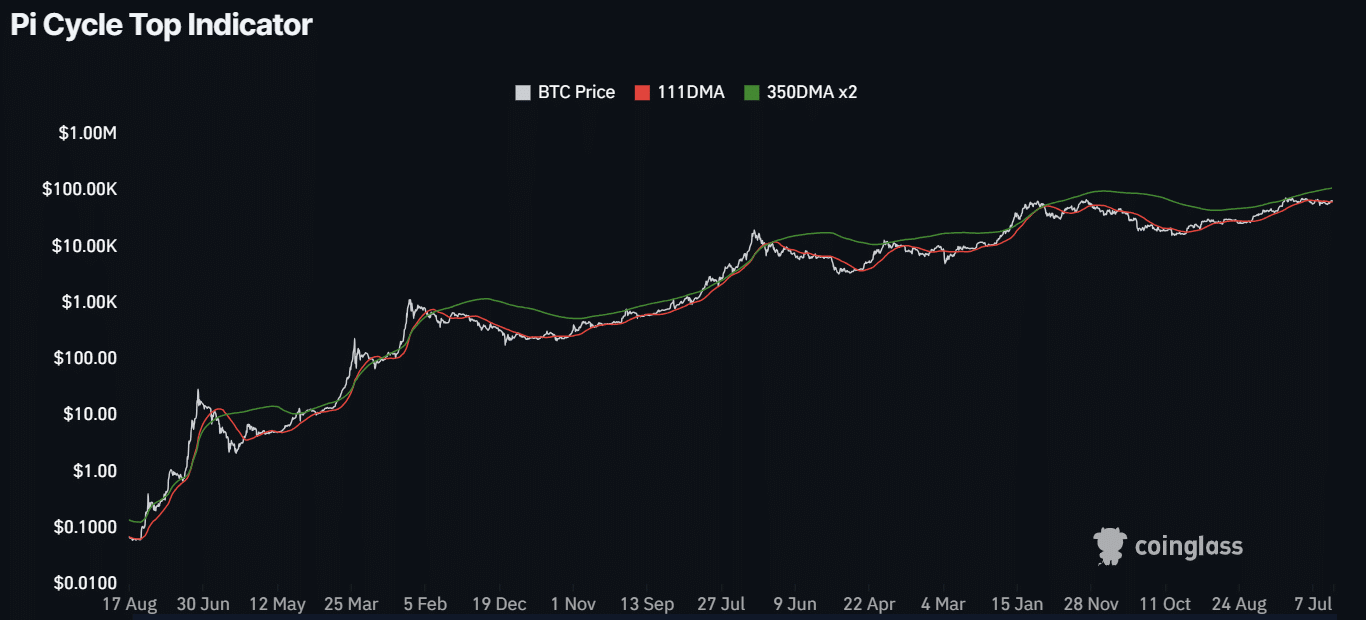

Based on the Pi Cycle Top indicator, Bitcoin was yet to reach its peak for this cycle. This is evident from the significant space separating the 111-day moving average and the double of the 350-day moving average.

To those less acquainted, the Pi Cycle Top metric has shown remarkable precision in predicting Bitcoin’s market peaks, with an impressive 3-day accuracy. Traditionally, market peaks have occurred following a surge in the 111-day moving average (DMA) and its subsequent crossing of the product of twice the 350-day moving average.

The wide gap at press time meant BTC’s bull run could extend.

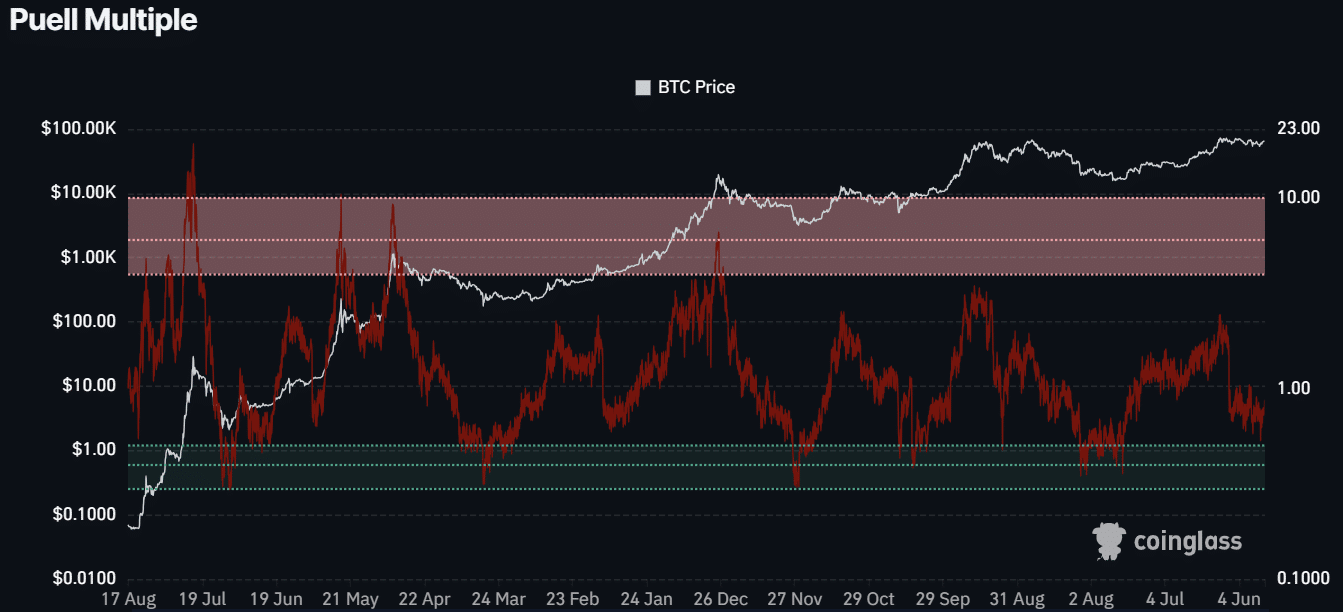

At the moment, Bitcoin seemed to be underpriced compared to its actual value. This perception was also reflected in the Puell Multiple, a tool that determines if Bitcoin is overvalued based on the profitability of Bitcoin miners.

As a crypto investor, I consider the “green zone” to represent Bitcoin that’s priced below its fair value, and the “overhead zone” indicates a market that’s running hot, where the price is inflated beyond reasonable expectations.

According to the current market reading, BTC appears significantly undervalued, indicating a promising investment opportunity for buyers.

In addition to the mentioned appraisal methods, notable industry influencers and businesses have set substantial Bitcoin price predictions for late 2024 and 2025. For instance, Standard Chartered Bank forecasts that the value of this asset could reach as high as $250,000 by 2025.

Regardless of the outcome of the US elections, CK Zheng, the founder of cryptocurrency-centric investment firm ZX Squared Capital, predicts that Bitcoin (BTC) will reach its all-time high in Q4 2024 on his account.

The executive pointed out rising U.S. government debts and budget gaps as factors that could make Bitcoin more appealing during periods when the Federal Reserve reduces interest rates.

If the forecasts prove accurate, Bitcoin (BTC) could yield substantial gains in Q4 2024 and throughout 2025, possibly surpassing its existing 7-month price ceiling. In such a scenario, one might argue that the current BTC value is significantly undervalued.

Read More

2024-10-02 05:11