-

BTC has declined by 3.64% in 24 hours.

An analysts predicts a further decline, if $55355 support fails to hold.

After spending the better part of my career closely monitoring and analyzing the cryptocurrency market, I can confidently say that the recent decline in Bitcoin (BTC) is cause for concern, but not panic. With over two decades of experience under my belt, I’ve seen many ups and downs in this ever-evolving digital frontier.

Bucking usual market patterns, Bitcoin (BTC) had a positive September. Lately, though, it’s taken a steep downward turn. At the moment of writing, each Bitcoin was being traded at $61,407, which represents a 4.31% drop in its weekly performance.

As a researcher, I previously observed Bitcoin (BTC) steadily climbing by 5.99% in monthly charts. Yet, following its peak at $66,508, there’s been a noticeable downturn, with the price dropping to as low as $60,164.

The current fluctuations in cryptocurrency prices have ignited numerous debates across the digital currency sector. Notably, well-known crypto analyst, Man of Bitcoin, has proposed a possible price drop based on the ABC pattern within Elliott’s wave -B structure.

What the analysis shows

The analyst posited that BTC has broken a micro support which could result in further decline.

According to this analysis, the market is bearish which would result in two scenarios.

In the initial situation, Bitcoin might follow an ABC correction pattern with Wave-A already underway and prices dropping. The crucial point is that Wave-B won’t manage to push the price beyond the earlier peak levels. As a result, in this case, Bitcoin would maintain its support level above $55,355.

In the alternative situation, Bitcoin might fall beneath the $55,355 resistance level, forming a pattern of five waves that suggests a more dramatic descent is likely to follow.

According to ManofBitcoin’s analysis, there may be a possible negative outcome due to the latest price trend. Yet, it’s crucial to explore what other factors might indicate as well.

Initially, it’s important to note that Bitcoin’s DAA (Daily Adjusted Added) price discrepancy has stayed below zero for the last seven days. In simpler terms, this means the recent increase in BTC prices might not be backed by strong fundamentals since on-chain activities have decreased.

This market situation suggests that the price increase cannot continue, as it indicates dwindling trust and waning enthusiasm.

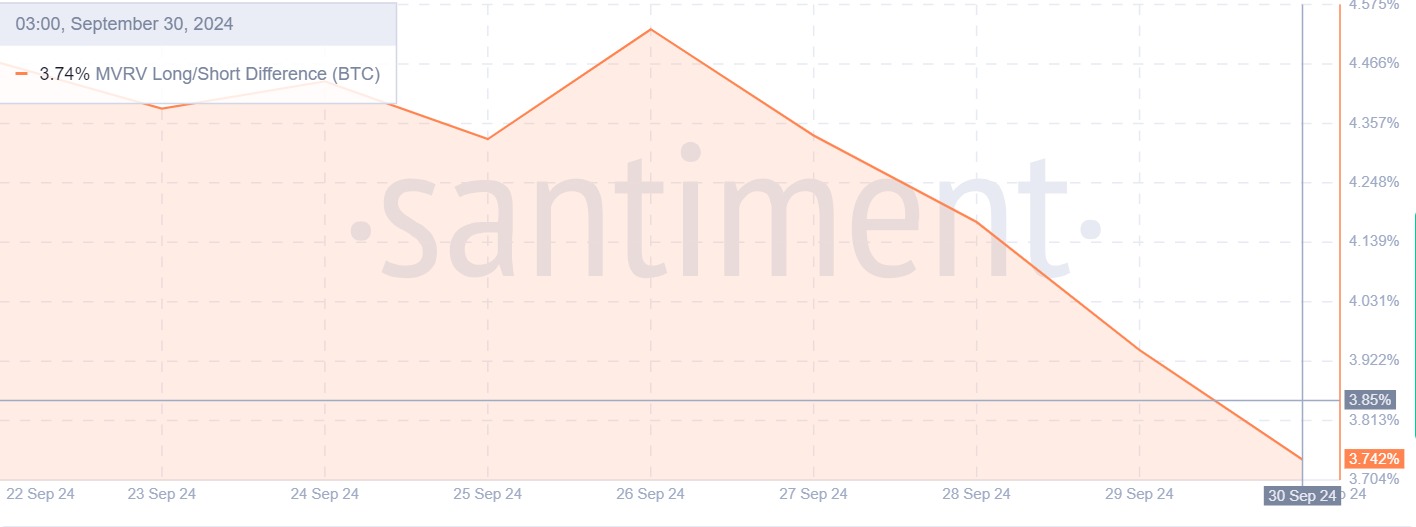

Over the last seven days, the MVRV’s long/short gap has diminished, dropping from 4.5% to 3.7%. This decrease implies that long-term investors may be less inclined to keep their holdings, while short-term ones might be offloading to prevent potential losses.

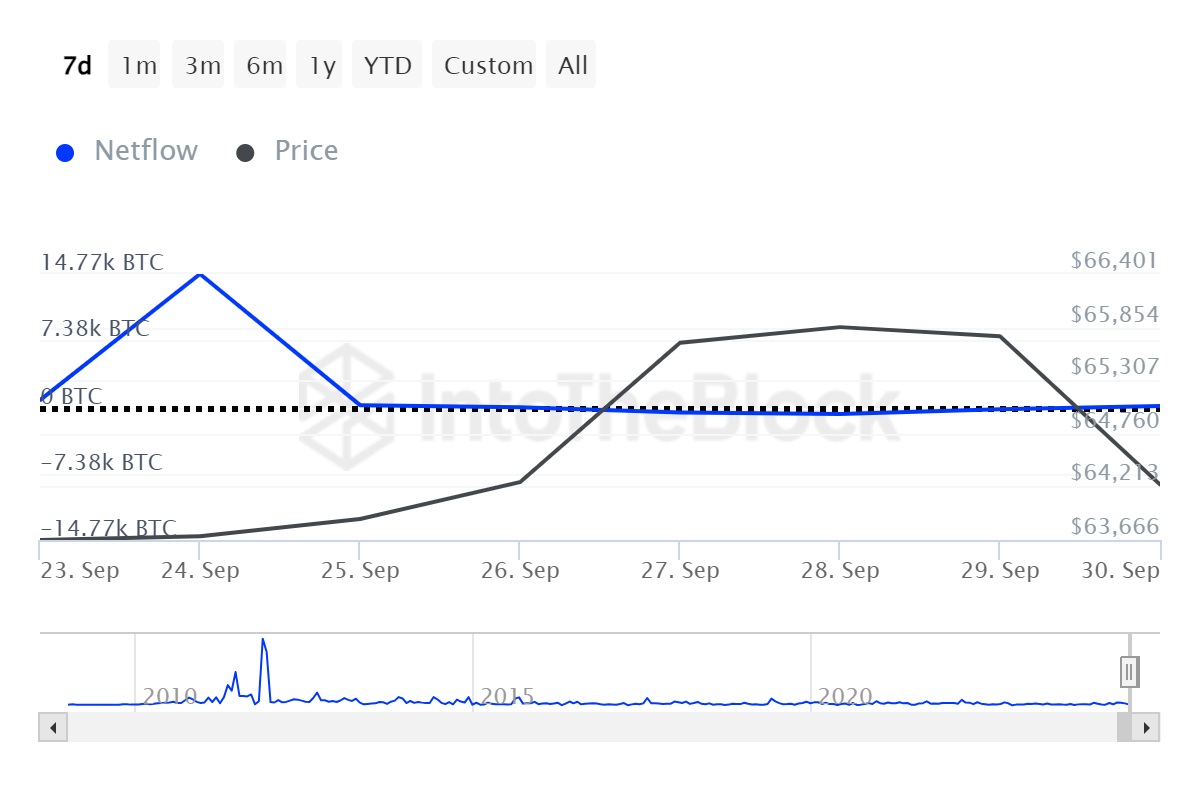

In summary, it appears that big Bitcoin holders have been closing more positions than opening new ones since September 25th, indicating a decrease in their overall investment activity.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Lowered money transfers from significant investors indicates a negative market mood, as substantial outflows suggest that investors are cashing out their profits or trying to minimize additional losses.

Essentially, Bitcoin’s current trend shows pessimism among investors, as they try to dominate the market. If this trend continues, Bitcoin might drop to approximately $59,899. But if there’s a change in direction, Bitcoin could regain its value close to $62,675.

Read More

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- Jujutsu Kaisen Reveals New Gojo and Geto Image That Will Break Your Heart Before the Movie!

- Hut 8 ‘self-mining plans’ make it competitive post-halving: Benchmark

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- First U.S. Born Pope: Meet Pope Leo XIV Robert Prevost

- Kylie & Timothée’s Red Carpet Debut: You Won’t BELIEVE What Happened After!

- S.T.A.L.K.E.R. 2 Major Patch 1.2 offer 1700 improvements

- Quick Guide: Finding Garlic in Oblivion Remastered

- Shundos in Pokemon Go Explained (And Why Players Want Them)

- We Ranked All of Gilmore Girls Couples: From Worst to Best

2024-10-02 15:35