-

Bitwise filed an XRP ETF in Delaware.

The update hasn’t stirred much for XRP price amid rising geopolitical tensions.

As a seasoned crypto investor with a knack for deciphering market trends and understanding regulatory dynamics, I find myself intrigued by the recent move by Bitwise to file an XRP ETF application. While the filing might not have stirred much for XRP’s price in the immediate term due to escalating geopolitical tensions, it certainly has piqued my interest.

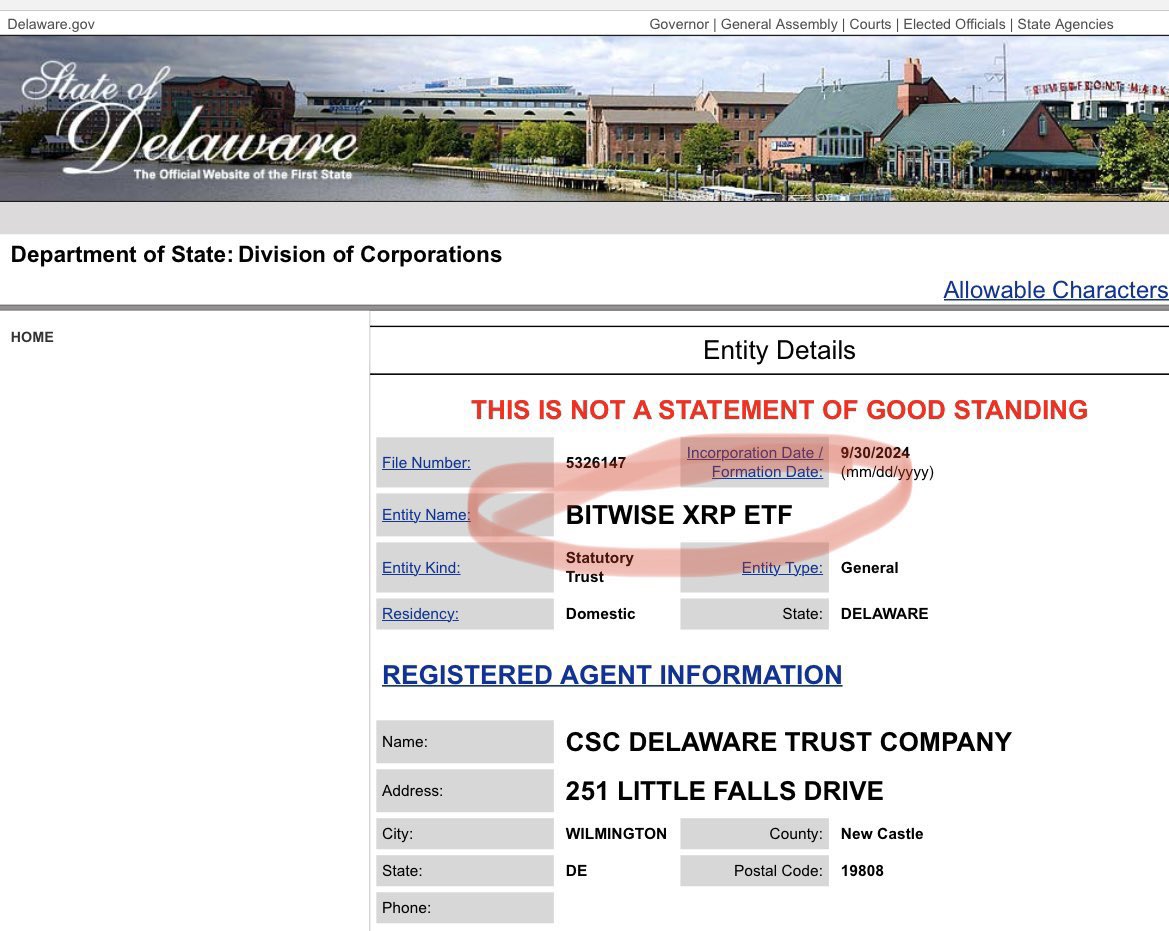

According to reports, digital asset management company Bitwise has submitted an application for a Ripple [XRP] Exchange-Traded Fund (ETF) in the state of Delaware.

According to the records from the Delaware Division of Corporations, the company, Bitwise XRP ETF, was established on the 30th of September.

Experts on exchange-traded funds (ETFs) have verified the app’s legitimacy, however, they emphasized that using this app does not equate to registering with the United States Securities and Exchange Commission (SEC).

However, market pundits have deemed an XRP ETF as ‘inevitable.’

Community reacts to XRP ETF application

According to Nate Geraci, a seasoned ETF specialist and the president of ETF Store, the filing for the Bitwise XRP ETF is considered a strategic move, which could potentially provide insights into the results of the upcoming U.S. election in November. In his own words, he stated…

“Placing a bitwise application for an XRP ETF is quite significant in my opinion…To put it simply, this could be seen as a bet on the upcoming November election’s outcome…This move appears to be strategic.

In general, many experts and industry players anticipate that there will be greater regulatory certainty within the sector following the U.S. elections.

If this is the case, it could potentially lead to an official clarification on the nature of numerous tokens, previously regarded by the SEC as securities.

Geraci’s assertion was further strengthened by the fact that the inevitability of the ETF became clear after the election, suggesting that Bitwise had indeed been an early player in this field.

The main idea is that an XRP ETF may appear eventually, with Bitwise possibly leading the way. In the near term, politics seem to play a significant role, but I believe this development is unavoidable in the long run.

SEC vs. Ripple Labs lawsuit

Since 2020, Ripple Labs, the company responsible for the XRP digital token, has found itself embroiled in a contentious legal dispute with the U.S. Securities and Exchange Commission (SEC). This prolonged court case, which is closely monitored by crypto enthusiasts, stands as one of the most significant cryptocurrency-related lawsuits to date.

The regulator claimed the firm violated securities laws by selling XRP tokens to investors without prior registration. The agency sought $2 billion as a fine.

However, federal judge Analisa Torres found that XRP was only a security when sold to institutional investors, not the public. In doing so, she ordered the firm to pay only $125 million for failing to register the institutional sale with the agency.

In simpler terms, they consider this outcome as a step forward but not a complete victory, because the regulatory body still has time, up until October 7th, to overturn the judge’s ruling.

Currently, each XRP is worth approximately $0.60, representing a drop of almost 10% from its value on October 1st. This decline comes as part of a broader market trend, with prices falling due to increasing tensions in the Middle East.

The recent Bitwise update seemed to have less impact amid the risk-off approach from investors.

Read More

- Hut 8 ‘self-mining plans’ make it competitive post-halving: Benchmark

- Jujutsu Kaisen Reveals New Gojo and Geto Image That Will Break Your Heart Before the Movie!

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- We Ranked All of Gilmore Girls Couples: From Worst to Best

- Shundos in Pokemon Go Explained (And Why Players Want Them)

- Kylie & Timothée’s Red Carpet Debut: You Won’t BELIEVE What Happened After!

- S.T.A.L.K.E.R. 2 Major Patch 1.2 offer 1700 improvements

- Why Tina Fey’s Netflix Show The Four Seasons Is a Must-Watch Remake of a Classic Romcom

- How to Get to Frostcrag Spire in Oblivion Remastered

2024-10-02 16:08