-

AVAX flips the bull market support bands as Q4 kicks in.

Avalanche could outperform Bitcoin in the final quarter of the year.

As a seasoned analyst with over a decade of experience in the cryptocurrency market, I have seen my fair share of bull runs and bear markets. The current Q4 is shaping up to be an exciting period, especially for projects like Avalanche [AVAX].

Avalanche, represented by [AVAX], is renowned as a versatile platform for creating smart contracts that can handle infinite scaling and confirm transactions in under a second, providing a dynamic environment for developers.

Lately, the cryptocurrency sector has displayed encouraging trends that hint at a bull market, but international conflicts have cast a shadow over this optimism. However, despite these hurdles, Avalanche has managed to turn the tables by surpassing the line of resistance in a bull market.

As a researcher, I’m observing that at present, the price of AVAX is hovering above not just one, but two key technical indicators: the 20-week Simple Moving Average (SMA) and the 21-week Exponential Moving Average (EMA). These trends are typically considered optimistic signs for a long-term perspective.

Some investors are pondering if Avalanche (AVAX) might experience substantial increases, perhaps even surpassing Bitcoin (BTC) in terms of performance, during the last three months of this year.

AVAX shows strength against BTC in valuation

Over the last two months, it’s evident that Avalanche has outperformed Bitcoin in terms of value growth.

At present, the value of AVAX relative to BTC is approximately 0.000450, demonstrating AVAX’s continuous growth over the past two months. The graph depicts a gradual increase, but so far, AVAX hasn’t surpassed a short-term peak that would entirely overshadow Bitcoin.

If Bitcoin experiences a strong upward trend in the coming quarter, Avalanche might struggle to sustain its advantage. Yet, AVAX has taken an early lead over Bitcoin, but it’s still unclear if this position will be maintained.

Over the last seven days, a month, and a quarter, AVAX has experienced growth rates of 2.81%, 1.79%, and 20.23% relative to Bitcoin respectively. This trend suggests that AVAX could possibly excel in the fourth quarter.

The 365-day running ROI

A significant measurement is Avalanche’s annual return on investment (ROI) over a period of 365 days, which is currently at 3.067%. This means that the year-to-date returns for AVAX have been positive and have surpassed the average performance for the year.

A significant number of AVAX investors are currently experiencing a profit, which discourages them from selling their shares. Instead, they prefer to keep their investments, hoping to gain even more returns.

The ongoing momentum might boost Avalanche’s cost even more, lending credence to an optimistic outlook for its fourth-quarter growth.

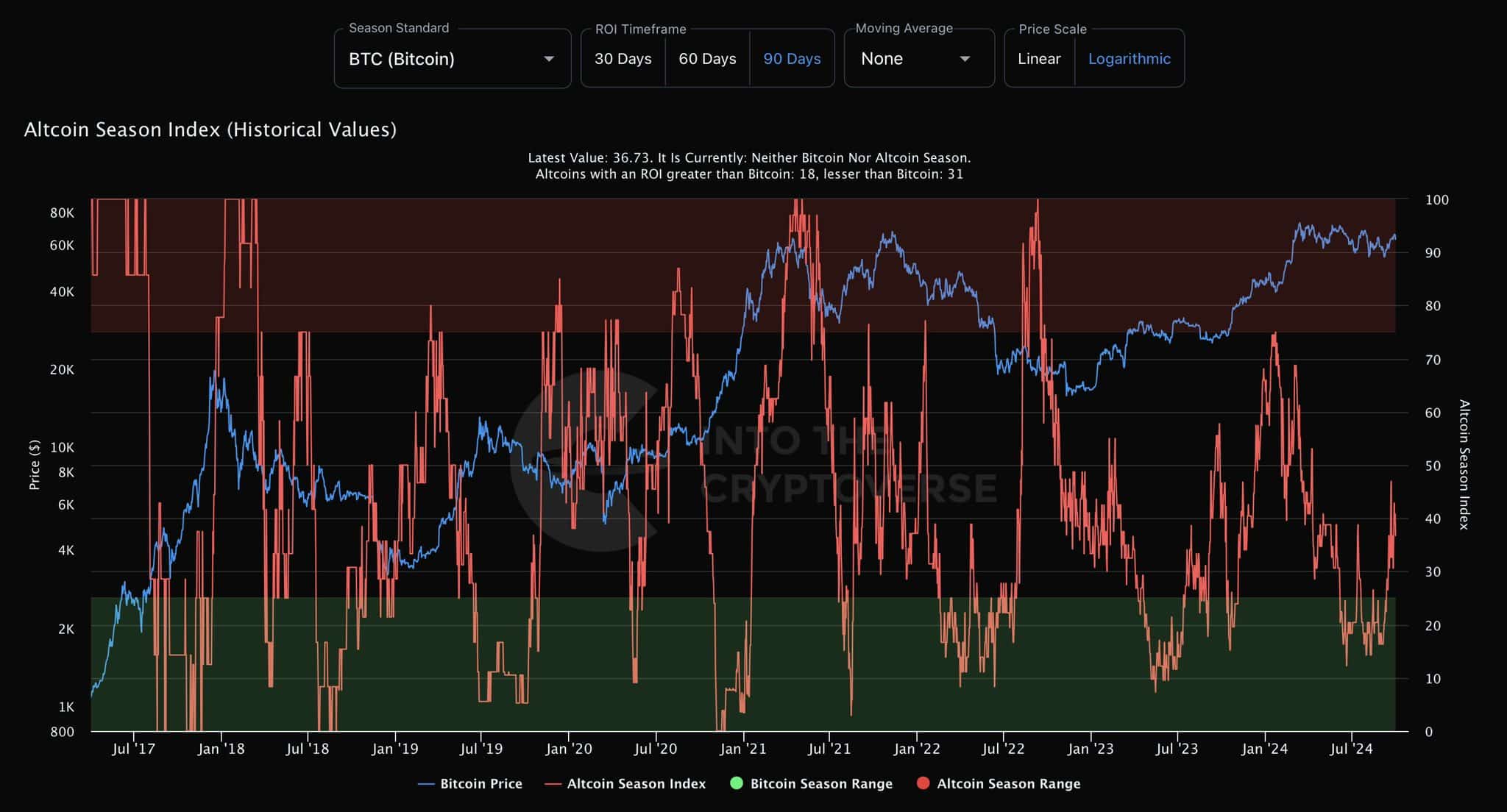

Altcoin Season Index

The Altcoin Season Index presents an alternative viewpoint regarding Avalanche’s possibility of surpassing Bitcoin in performance. This tool monitors the number of top 50 altcoins that have yielded a return on investment (ROI) over a 90-day period which is higher than that of Bitcoin.

Currently, the current reading shows 36.73, suggesting that neither Bitcoin nor altcoin dominance is particularly strong at this moment. In fact, only about 18 out of the top 50 altcoins are performing better than Bitcoin, which means fewer than three-quarters of altcoins are currently outperforming the leading cryptocurrency.

Read Avalanche’s [AVAX] Price Prediction 2024–2025

In Q4, it appears that Bitcoin (BTC) and alternative coins such as AVAX are engaged in a struggle for supremacy, given the high levels of BTC’s dominance. A change in BTC’s dominance might spark a turnaround, possibly leading to an increase in AVAX’s price.

An avalanche could potentially experience a strong upward trend in the fourth quarter, yet it’s unclear if it will surpass Bitcoin in this period. Its success relative to Bitcoin is contingent upon various market conditions.

Read More

- Gold Rate Forecast

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- PI PREDICTION. PI cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Rick and Morty Season 8: Release Date SHOCK!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-10-02 20:40