-

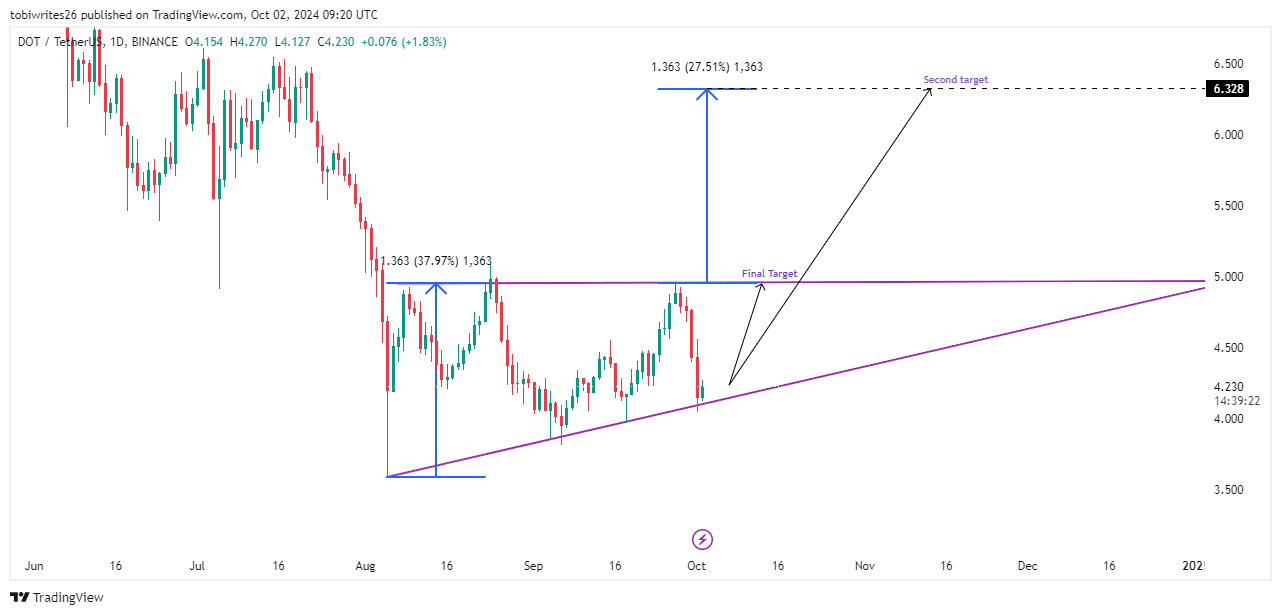

DOT was trading within a pronounced ascending triangle pattern and has recently bounced off the support line.

The likelihood of DOT rising to $4.995 and subsequently to $6.328 is supported by several key metrics.

As a seasoned researcher with a knack for deciphering cryptocurrency market trends, I find myself intrigued by the current state of Polkadot (DOT). Despite the recent 6.13% dip, which initially made me wince like an old-timer seeing their grandkid’s toy get run over, emerging data suggests this might be just a temporary hiccup before the anticipated increases.

Despite a 6.13% drop over the past day for Polkadot [DOT], which at first seemed to mirror the overall market’s uncertainty, recent data indicates that this dip might serve as a precursor to the expected price rises.

Support level could propel DOT to $4.9

Polkadot’s chart structure has evolved from a smaller upward-pointing triangular formation into a larger one. This type of pattern is recognized by a flat upper boundary acting as resistance and a sloping lower boundary functioning as support. Such a configuration indicates that the prices are accumulating, hinting at an impending breakout.

At the moment I’m checking in, Polkadot (DOT) seems to have bounced back from its lower support line – a historical pattern often associated with an uptrend. If things go as expected, DOT might regain its footing and challenge the $4.995 resistance level again.

If the demand for purchasing DOT surpasses the supply at this resistance point, DOT is poised to move upwards towards the $6.328 level. However, if this momentum isn’t maintained, DOT may drop back down to its 2024 low of $3.590, and potentially even lower to $3.562 if market conditions worsen.

Positive developments predict upswing for DOT

AMBCrypto’s recent analysis indicates a likely uptick for DOT from its current trading position.

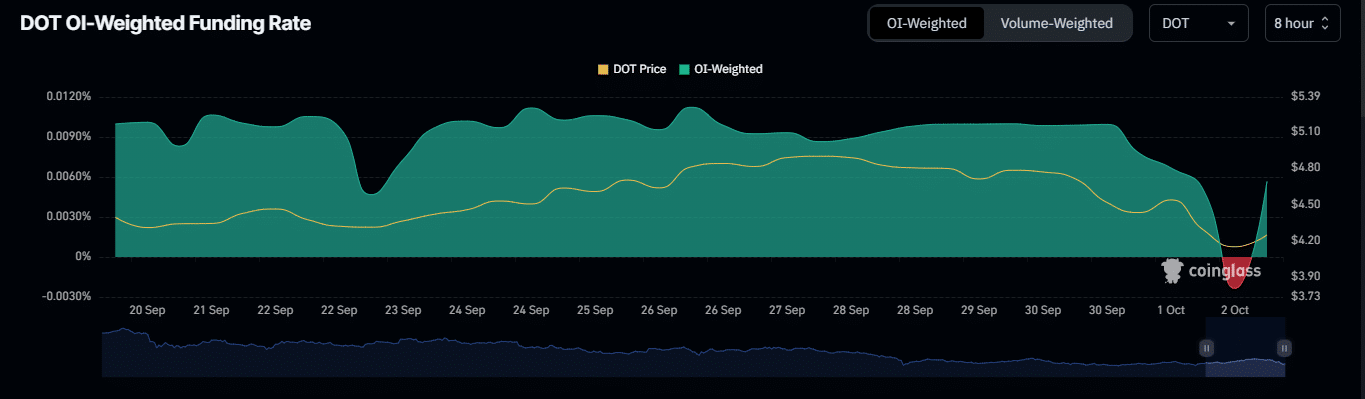

The Open Interest Weighted Funding Rate (OI) on Coinglass, a key indicator for short-term market trends, has been on the rise, signaling a bullish market sentiment.

This measurement examines market trends by looking at the quantity and movement of trader positions, which are presently indicating a bullish trend for DOT, suggesting it may head upwards.

Sources: Coinglass

Additionally, it’s worth noting that the funding rate, which plays a crucial role in keeping future prices aligned with current prices, stays above zero at 0.0024%. In simpler terms, this means that traders who are long (holding a futures contract) are paying a small fee to those who are short (selling a futures contract). This helps maintain the balance between the two markets.

In contrast to a negative rate, a positive rate often requires long position holders to compensate short sellers, thereby discouraging overly optimistic investment strategies. This positive rate, however, can also signify a predominantly bullish market outlook.

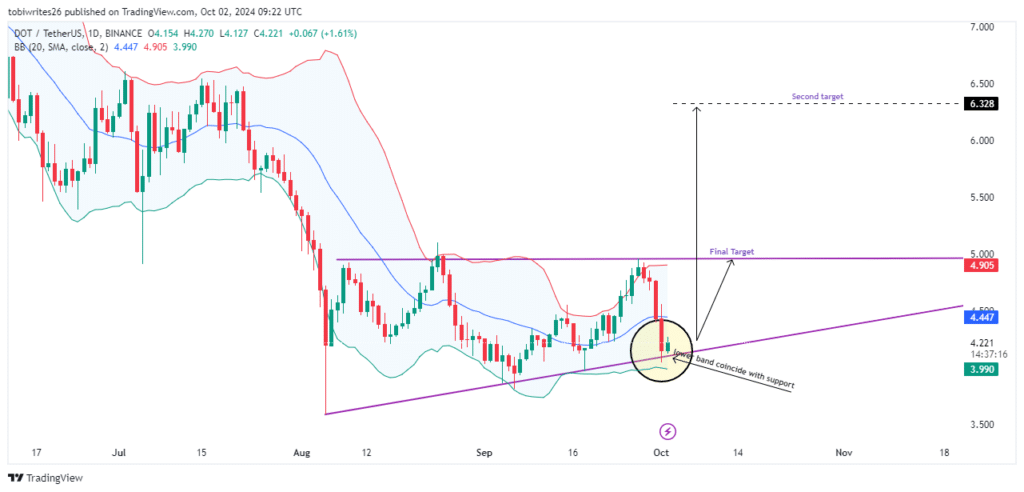

Bollinger band reinforces bullish sentiment

Using the Bollinger Band (BB) AMBCrypto found DOT remains rally-ready.

The Bollinger Band is a key technical analysis tool, that measures market volatility and price levels. It comprises a middle band, which is a moving average, flanked by two outer bands set two standard deviations away.

Read Polkadot’s [DOT] Price Prediction 2024–2025

Lately, the value of DOT has reached the lower limit of its Bollinger Band, which can signal overbought conditions and potentially hint at an impending recovery.

Performing this action aligns with the strength of a currently developing rising triangle chart formation, making it more probable that the price of DOT will rise.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-10-02 22:15