-

UNI dropped by 8% in 24 hours as it succumbed to bearish pressure across the broader cryptocurrency market.

Despite an increase in exchange inflows, UNI’s long/short ratio showed traders are still bullish.

As a seasoned analyst with years of experience navigating the volatile crypto market, I see UNI‘s recent 8% drop as a temporary setback rather than a sign of impending doom. While the broader market is reacting to geopolitical tensions, UNI’s long/short ratio suggests that traders are still bullish.

At the moment of reporting, Uniswap [UNI] was trading at $7.21, representing an 8% decrease over the past 24 hours. This price drop aligns with a general bearish trend across the crypto market, as most cryptocurrencies dipped due to traders’ reactions to the geopolitical situation in the Middle East.

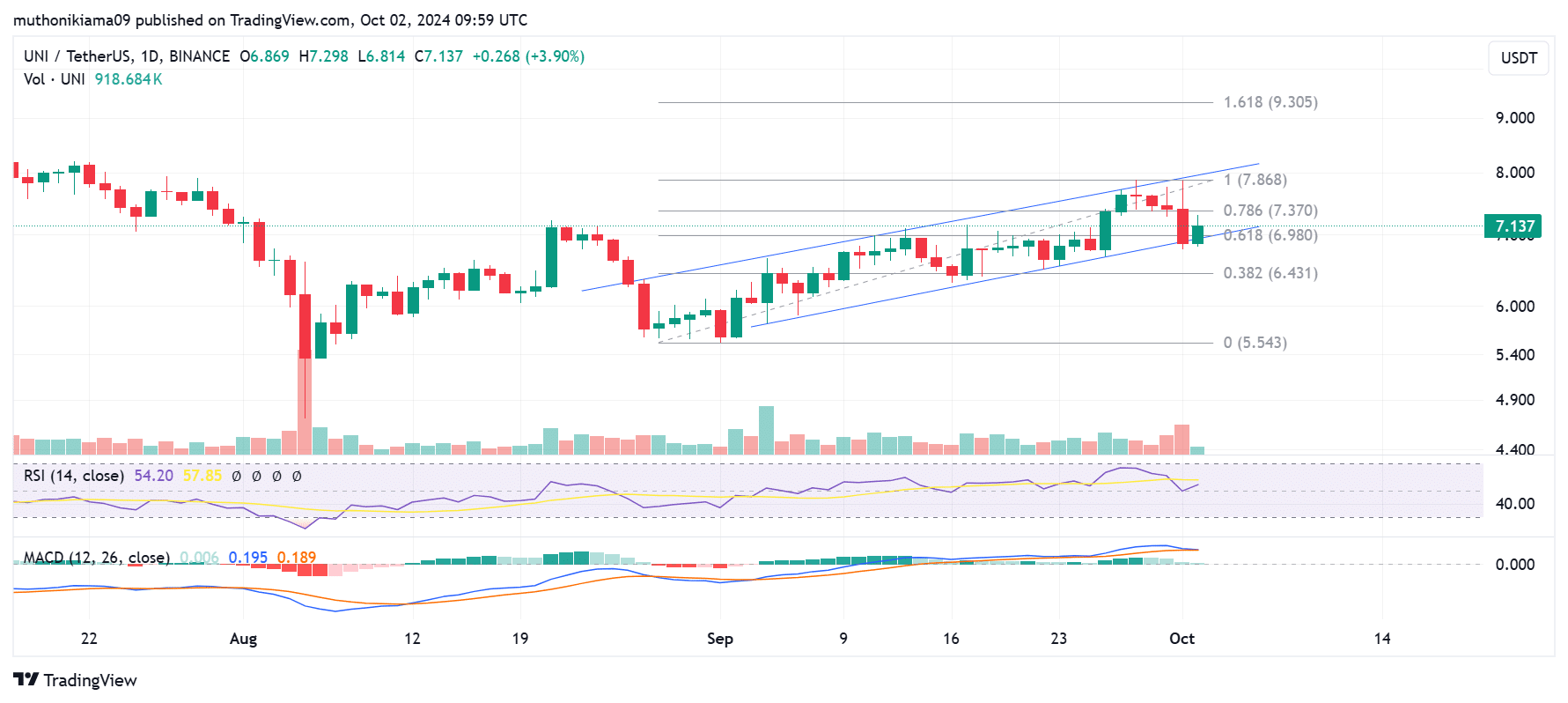

On a day-to-day graph, UNI displayed conflicting indications when its price touched the lower limit of the rising diagonal channel. Dropping beneath this channel could imply that the purchasing momentum has diminished and the direction might be shifting.

Examining the green bars of the volume histogram indicates a predominance of buyers over sellers. Furthermore, the Relative Strength Index (RSI), currently at 56, and its upward-trending line imply that some traders might be taking advantage of price dips to buy.

Should the Relative Strength Index (RSI) surpass its signal line, such an occurrence might trigger a buy signal, potentially pushing UNI prices upward. If this occurs, UNI may ascend to challenge resistance at the 0.786 Fibonacci level, which translates to approximately $7.37.

On the other hand, the Moving Average Convergence Divergence (MACD) line presents an opposing picture. When the MACD line merges with the signal line and subsequently drops beneath it, this indicates a shift in the overall momentum towards a bearish trend.

Due to increased selling, possibly driven by negative sentiment (bearish pressure), the price of UNI might decrease further and reach a significant support point near the 0.382 Fibonacci level, which is approximately $6.43.

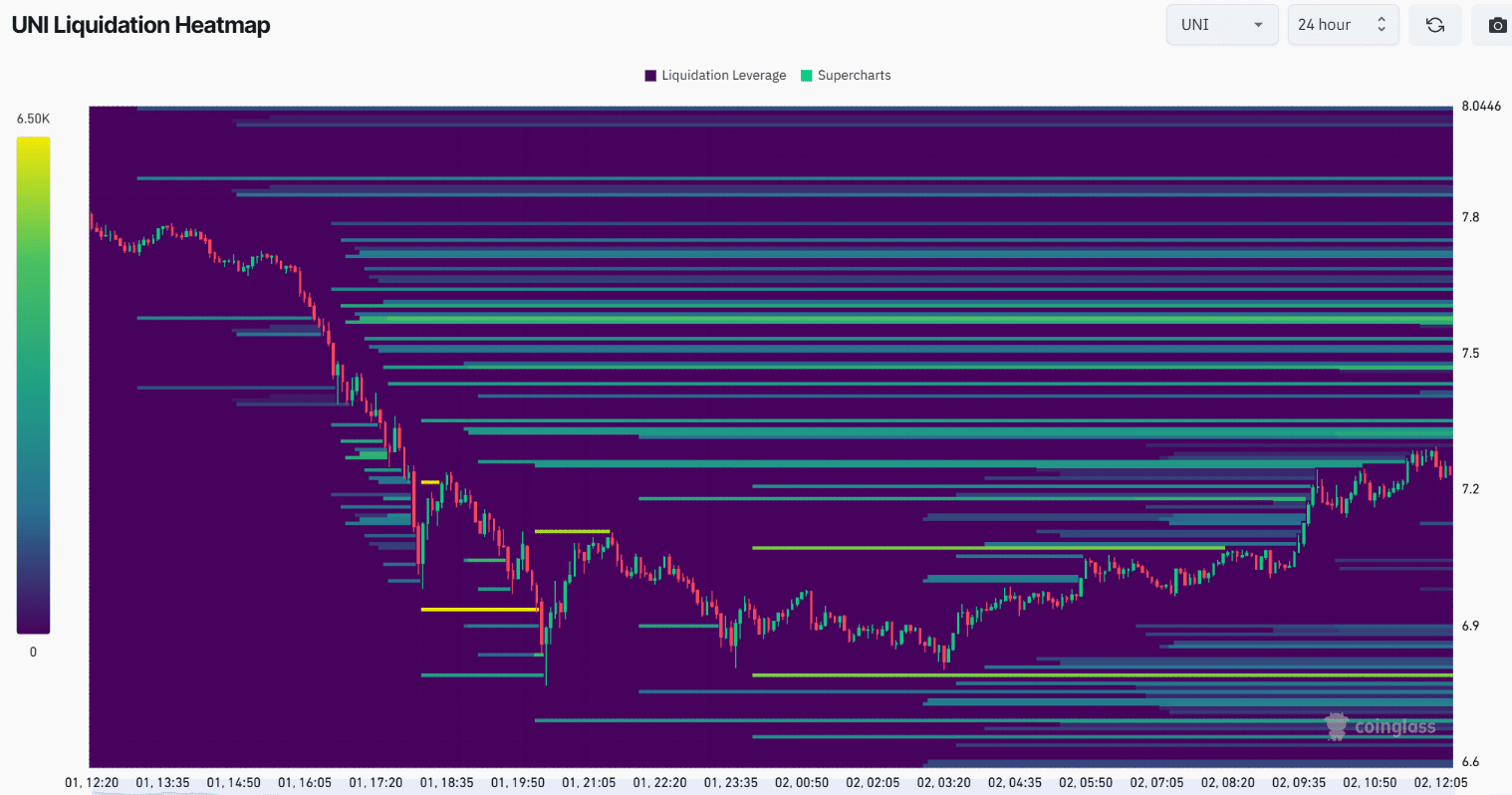

Glancing at Uniswap’s liquidation map indicates a concentration of liquidations at prices higher than the current one. This implies that the range between $7.30 and $7.80 functions as a robust barrier to price increase, acting as a significant resistance level.

If UNI surges and reaches the specified liquidation thresholds, it may compel short-position holders to exit their trades. This could result in a ‘short-squeeze’ scenario where increased buying pressure propels the price upward.

Uniswap exchange inflows spike

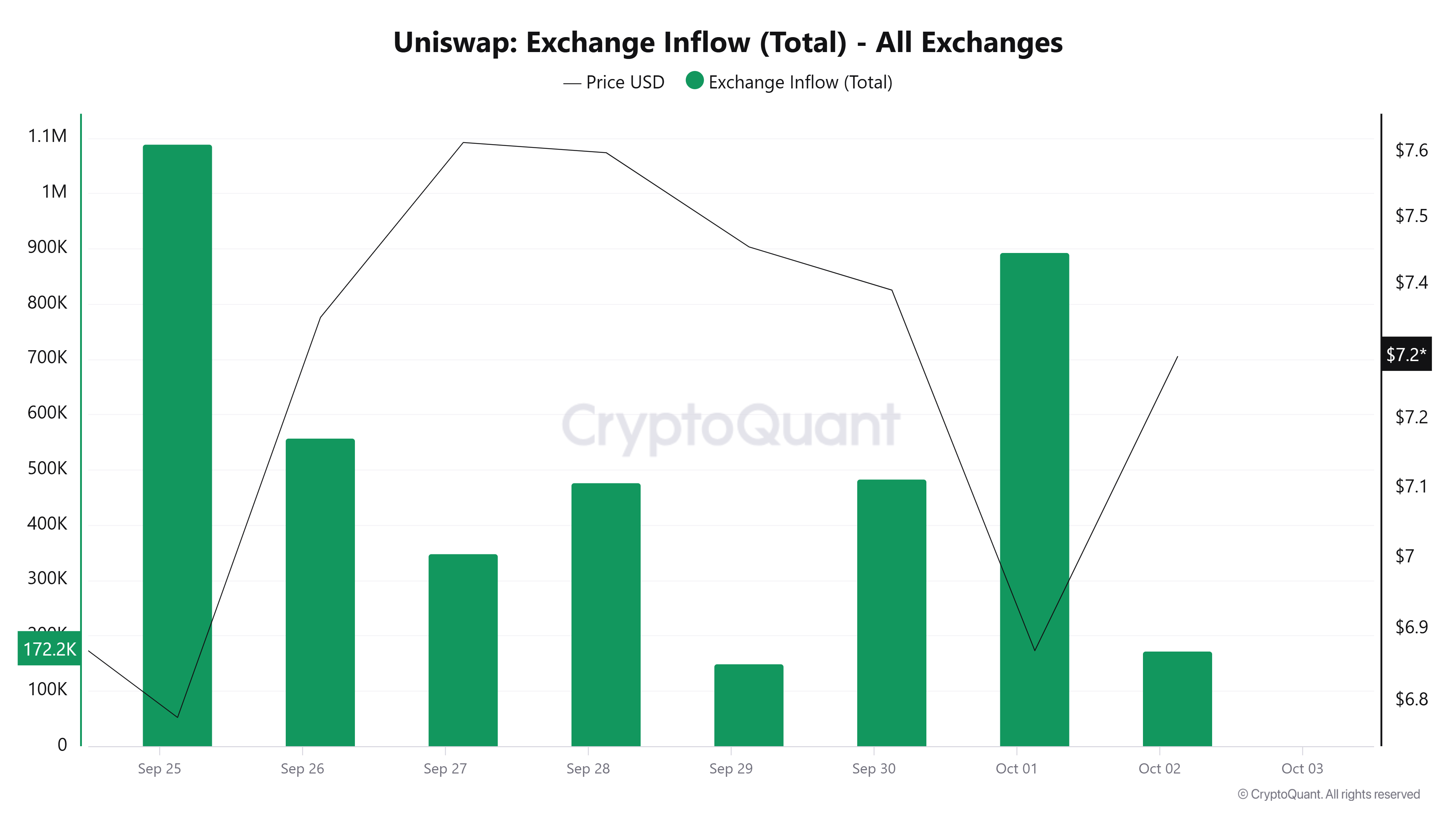

Data from CryptoQuant shows that on 1st October, the amount of UNI deposited to exchanges approached a weekly high.

The inflows into the Uniswap exchange soared to approximately 893,000, representing almost a doubling of the inflows observed the day before.

Depositing a large amount of UNI tokens onto exchanges can boost the urge to sell, thereby reinforcing the idea that the market trend might be downward (bearish).

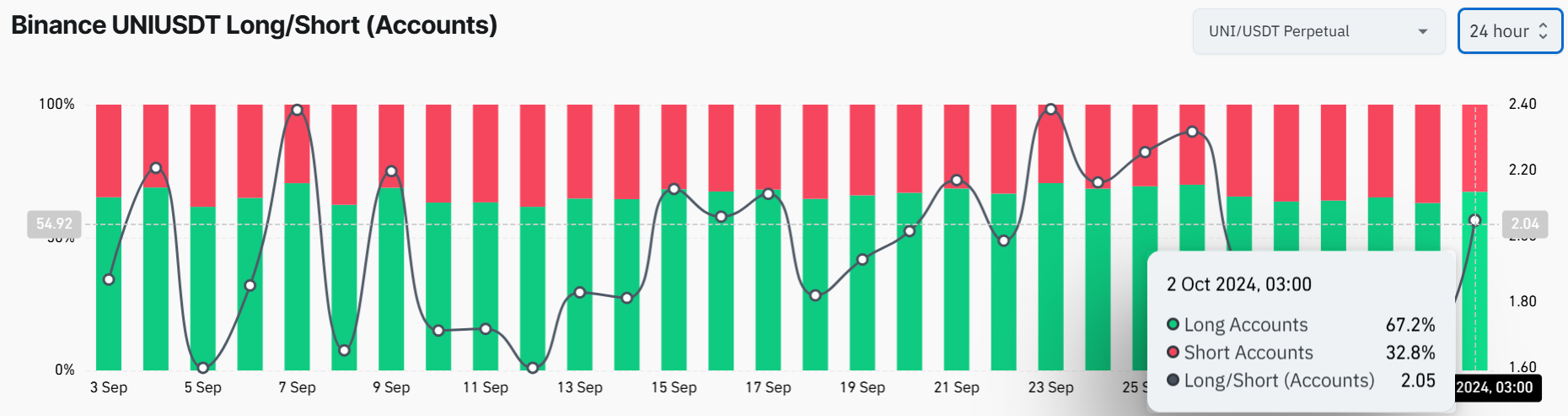

On Binance, about 2 out of every 3 traders have opted for long positions on Uniswap, whereas just over 1 out of 3 are short-selling it according to Coinglass. This trend indicates a significant bullish sentiment among traders regarding Uniswap’s potential price increases in the future.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Quick Guide: Finding Garlic in Oblivion Remastered

- Florence Pugh’s Bold Shoulder Look Is Turning Heads Again—Are Deltoids the New Red Carpet Accessory?

- Katy Perry Shares NSFW Confession on Orlando Bloom’s “Magic Stick”

- How Michael Saylor Plans to Create a Bitcoin Empire Bigger Than Your Wildest Dreams

- BLUR PREDICTION. BLUR cryptocurrency

- Unforgettable Deaths in Middle-earth: Lord of the Rings’ Most Memorable Kills Ranked

- Disney Quietly Removes Major DEI Initiatives from SEC Filing

- How to Get to Frostcrag Spire in Oblivion Remastered

2024-10-02 23:35