- Bitcoin flashes multiple signs indicating that it is back on a bearish leg at least in the short term.

- Can Bitcoin align with market expectations despite kicking off October with some profit-taking?

As a seasoned crypto investor with a decade-long experience navigating the rollercoaster ride of Bitcoin [BTC], I must admit I’m cautiously optimistic about October’s prospects. Uptober has been trending, and the historical performance of BTC in this month has often been bullish. However, recent signs suggest that we might be heading for a short-term bearish leg.

Investors in Bitcoin [BTC] seem quite hopeful about the cryptocurrency during October, a sentiment reflected by the term “Uptober” gaining popularity. This optimism could be attributed to several factors including reduced interest rates, strong historical performance in October, and Bitcoin’s recent bullish trends.

Despite optimistic predictions about Bitcoin’s performance in October, there are indications suggesting a potential divergence from these expectations. For instance, an examination by CryptoQuant indicates that the recent peaks Bitcoin reached at the end of September may represent its current local peak.

The analysis was based on BTC’s NVT golden cross and its recent push above 2.2. Another analysis suggests that Bitcoin will likely struggle to maintain bullish momentum in October based on historic performance.

Following a significant interest rate reduction in 2019, Bitcoin saw a two-week surge. However, this was later followed by a bearish trend lasting approximately two months.

The data indicates that Bitcoin might continue experiencing selling activity, as suggested by its recent market behavior.

The digital currency has started shedding some of its September advancements, suggesting that certain investors may be cashing out their earnings.

Bitcoin sell pressure accelerates

On October 1st, the value of Bitcoin showed signs of dipping slightly below $60,000. Currently, it’s trading at approximately $61,430. Compared to its peak price in September, it has experienced a decrease of around 7.8%.

Based on Fibonacci retracement, it seems likely that the price will drop within the range of approximately $59,580 to $57,940.

After the rate cut announcement, it appears the excitement or hype around it has subsided, which suggests a pullback. Yet, this leaves us with more queries than solutions. Could demand return if the price once again reaches the Fibonacci level?

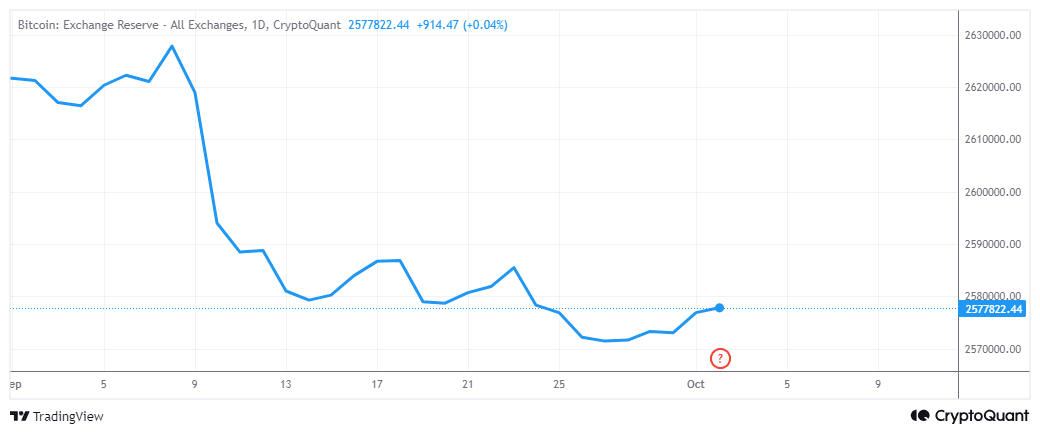

The data recorded on the blockchain supported a pessimistic prediction. To illustrate, the reserves held by Bitcoin exchanges have generally decreased over the past few months, with occasional small increases.

As an analyst, I observed an increase – or uptick – in Bitcoin exchange reserves towards the end of September. This suggests that some Bitcoins were transferred from personal wallets to exchanges, possibly indicating increased selling activity over the past few days.

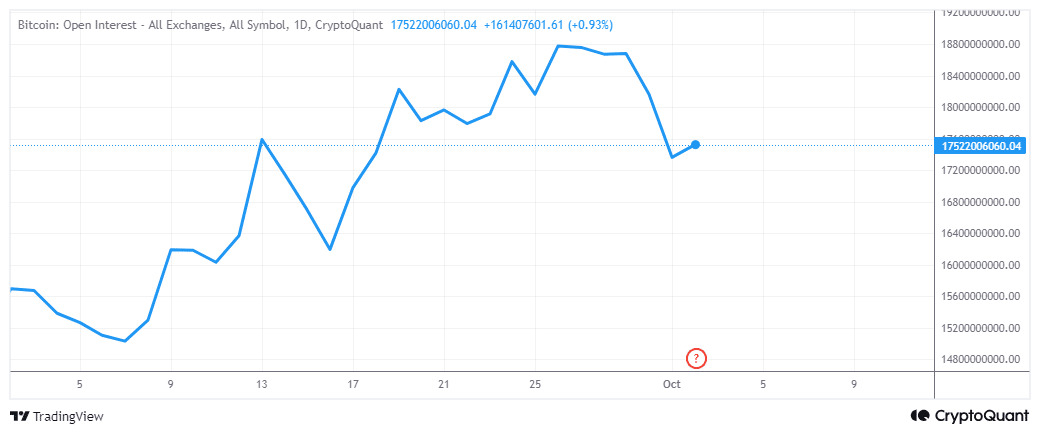

The increase in the exchange reserve was also in line with a decrease in Bitcoin’s open interest since September 26th. This suggests that the desire for Bitcoin within the derivatives market has likewise diminished.

Read Bitcoin’s [BTC] Price Prediction 2024-25

The research indicates a strong likelihood that Bitcoin could encounter increased selling activity in the near future. However, it’s essential to note that this doesn’t automatically give us a specific timeframe for these events.

It could be a brief pullback or turn out to be a longer one depending on how things will unfold.

Read More

- PI PREDICTION. PI cryptocurrency

- How to Get to Frostcrag Spire in Oblivion Remastered

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- How Michael Saylor Plans to Create a Bitcoin Empire Bigger Than Your Wildest Dreams

- Kylie & Timothée’s Red Carpet Debut: You Won’t BELIEVE What Happened After!

- We Ranked All of Gilmore Girls Couples: From Worst to Best

- S.T.A.L.K.E.R. 2 Major Patch 1.2 offer 1700 improvements

- WCT PREDICTION. WCT cryptocurrency

- Florence Pugh’s Bold Shoulder Look Is Turning Heads Again—Are Deltoids the New Red Carpet Accessory?

- PS5 Finally Gets Cozy with Little Kitty, Big City – Meow-some Open World Adventure!

2024-10-03 01:43