-

XMR, at press time, was facing selling pressure in the market due to Kraken’s delisting announcement

RSI and MACD readings on XMR/USD’s 4-hour chart pointed to a downtrend continuation

As a seasoned researcher with years of experience in the crypto market, I have seen my fair share of bearish trends and market volatility. Monero (XMR) has been no exception to this rule, as it faces renewed selling pressure following Kraken’s delisting announcement and the ongoing bearish sentiment in the market.

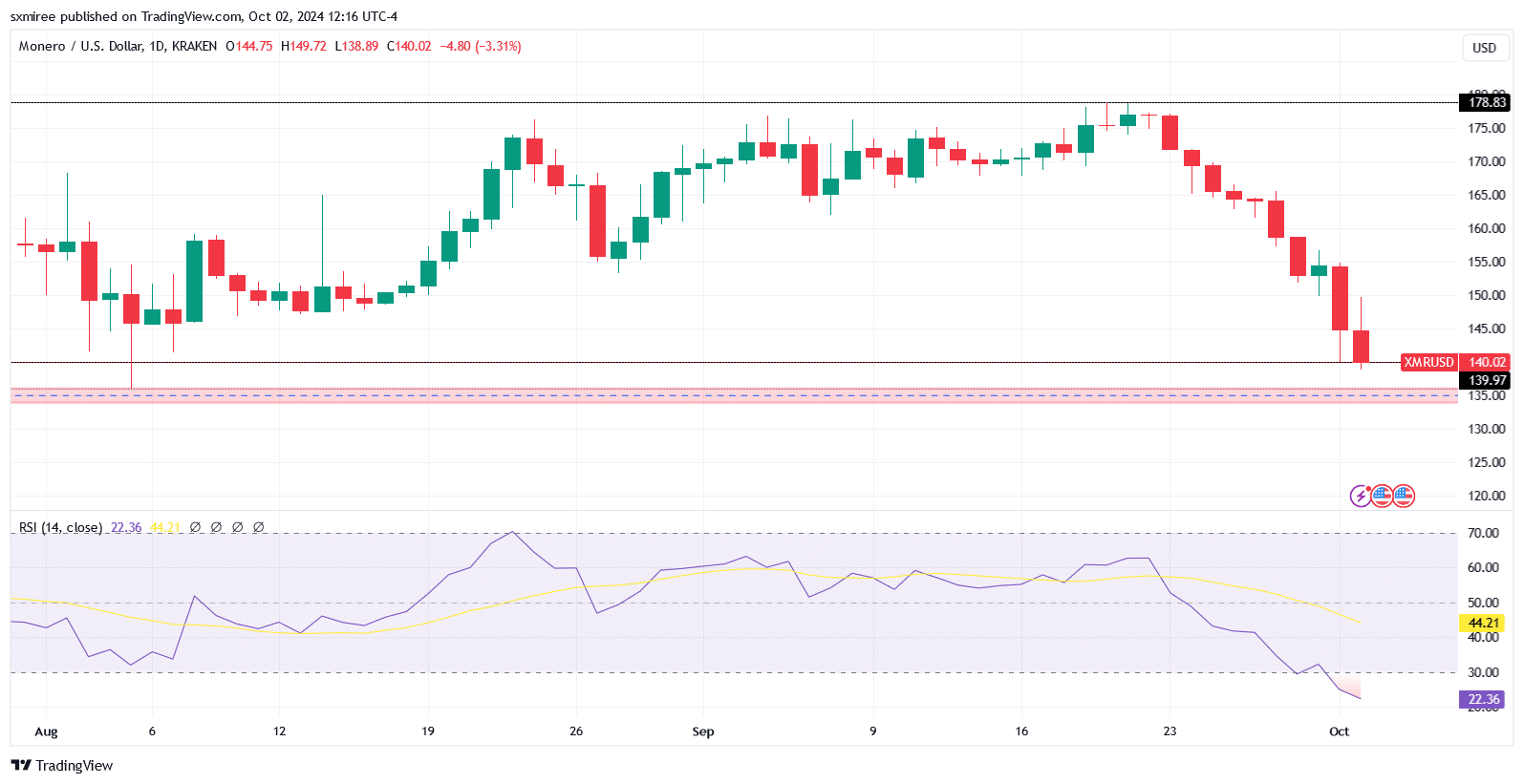

This week, Monero (XMR) has faced stronger resistance in the market, falling below its previous long-term support level of approximately $146 on October 1st. Earlier today, the privacy-centric cryptocurrency continued to dip and reached a low of $139 on the price charts.

Based on an analysis of its price chart, XMR appears to be heading towards a series of consecutive daily red candles. This follows a stretch of eight days with progressively decreasing closing prices from September 23rd to October 1st.

Currently, Monero (XMR) is being traded at approximately $140, marking a decrease of 16% over the past week. This recent bearish trend in the last few days has undone the progress seen since early August, when XMR was close to its $146 support level.

Exchange delisting setbacks

Experts linked the significant drop in prices on Tuesday mainly to a widespread negative outlook, also triggered by escalating conflicts in the Middle East and Kraken’s decision to remove XMR from their platform.

To users residing within the European Economic Area (EEA), Kraken announced they will stop providing Monero (XMR) support by the end of this month. This move by the exchange is due to increasing regulatory scrutiny towards coins that offer privacy, which are often utilized for illegal transactions.

Kraken’s decision to halt trading and deposits for all XMR markets in Europe mirrors similar moves by other exchanges, adding to the pessimistic outlook towards the coin.

A bearish outlook

The technical analysis suggests a potentially gloomy future for Monero (XMR), indicating it might approach the support zone of around $134 to $136 again.

In these specified periods around early July and August, this area aligns with past price bottoms, acting as a significant mental barrier that investors will monitor closely to determine whether buyers will enter the market.

If the price of XMR drops below the current level, it could place XMR in a uncertain region, possibly leading to additional decreases approaching around $112. Earlier, this level had provided significant support in the middle of April.

Currently, the 4-hour chart’s Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) suggest a very bearish trend for XMR. In particular, today’s RSI reading has dipped into the oversold zone, implying that XMR is still subject to intense selling pressure as it moves within significant downward trends.

According to MACD analysis, the advantage in terms of momentum clearly lies with the bearish trend as the MACD line dropped beneath the signal line on October 1st, hinting at a strengthening downward push which might prolong the downtrend.

At the time of this writing, the MACD and Signal lines remained below zero, indicating that the downward trend, or bear market, was persisting.

Market sentiment and short positions

Ultimately, prolonged market instability suggests that it’s more likely for the trend to continue moving downward. This might encourage speculators to explore short-selling opportunities.

A move slightly above the 200-day Simple Moving Average (SMA) at $151 could suggest a change in trend direction and potentially indicate an upcoming reversal.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

2024-10-03 11:04