-

The performance in September compared to BTC was subpar

The higher timeframe outlook was firmly bullish and large gains were likely

As a researcher with extensive experience in the cryptocurrency market, I have witnessed the ebb and flow of numerous digital assets. The performance of TRON [TRX] in September compared to BTC was subpar, but this should not be interpreted as a sign of weakness. In fact, TRX’s higher timeframe outlook remains firmly bullish, with large gains likely on the horizon.

TRON (TRX) failed to match the overall market’s bullish trend during the second half of September. Yet, it doesn’t mean that the buying power isn’t strong; it just indicates a temporary pause in its short-term upward momentum.

From my perspective as an analyst, I’ve noticed a strikingly positive trend in TRX‘s performance over the past few months. Contrary to Bitcoin [BTC] and many other altcoins that have experienced a downturn since April and May, TRX has remarkably outperformed those highs.

Range breakout and consolidation for TRON (TRX)

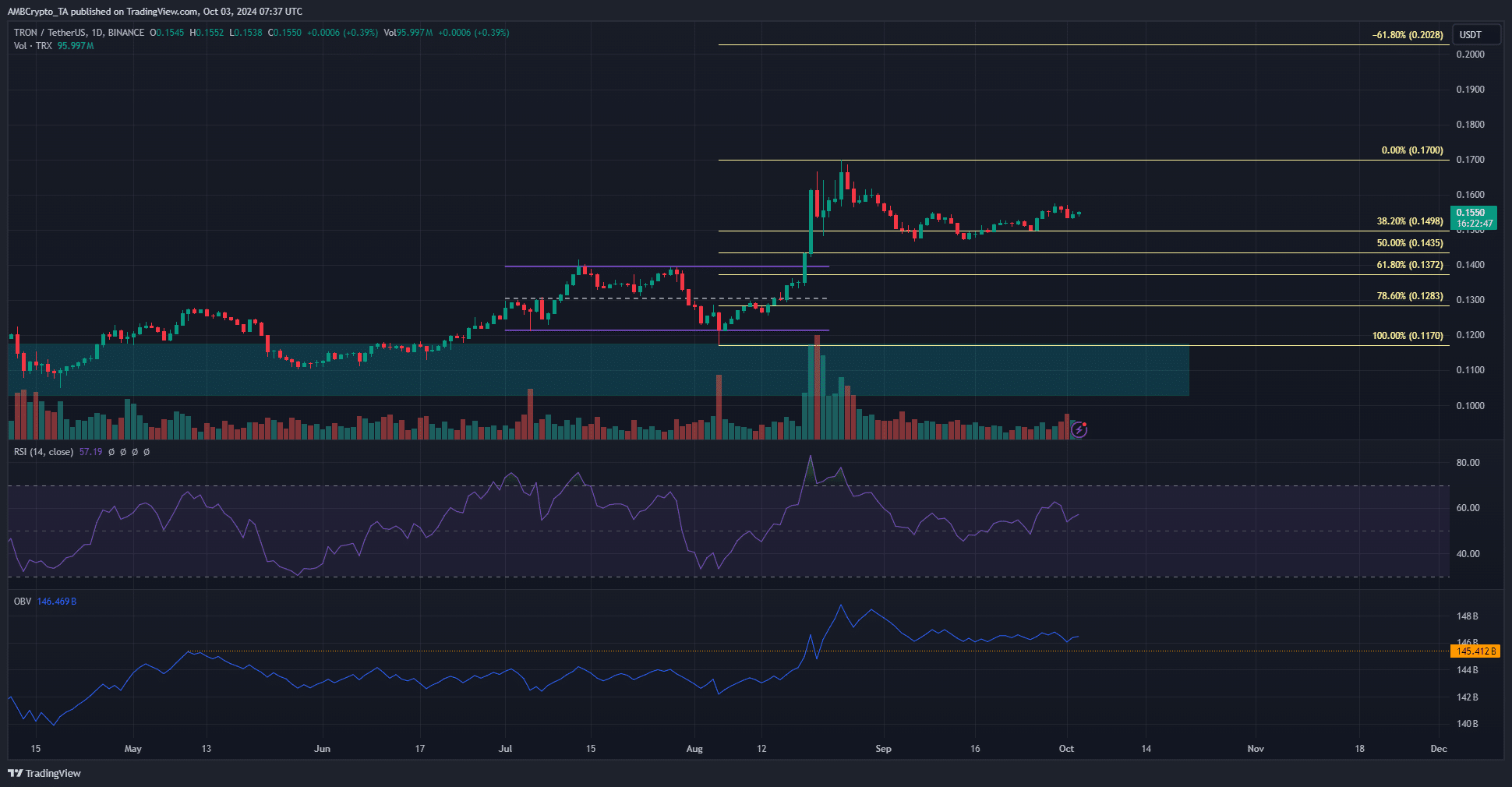

Around mid-August, TRON’s prices surged beyond a nearby pattern of movement, climbing approximately 22% above the local highs that were in place then. Since that point, the price has retreated to a level representing a 38.2% pullback at $0.15 and has been holding steady within this area.

Over the past month, the Relative Strength Index (RSI) on the daily chart maintained an optimistic stance, and the On-Balance Volume (OBV) didn’t dip below its peak in May. This suggests that the selling force wasn’t intense enough to predict a possible downward trend.

It was thrilling for long-term investors to see TRX holding steadily above $0.144, a level it last reached in February, as the stable price trend and decreased selling pressure suggested significant returns were on the horizon.

In simpler terms, if you’re following Fibonacci analysis, potential long-term highs could be reached around $0.2 and $0.223. For those who trade on a swing basis, it might be wise to consider purchasing when the price dips to approximately $0.128-$0.137 over the coming weeks.

Price targets for October

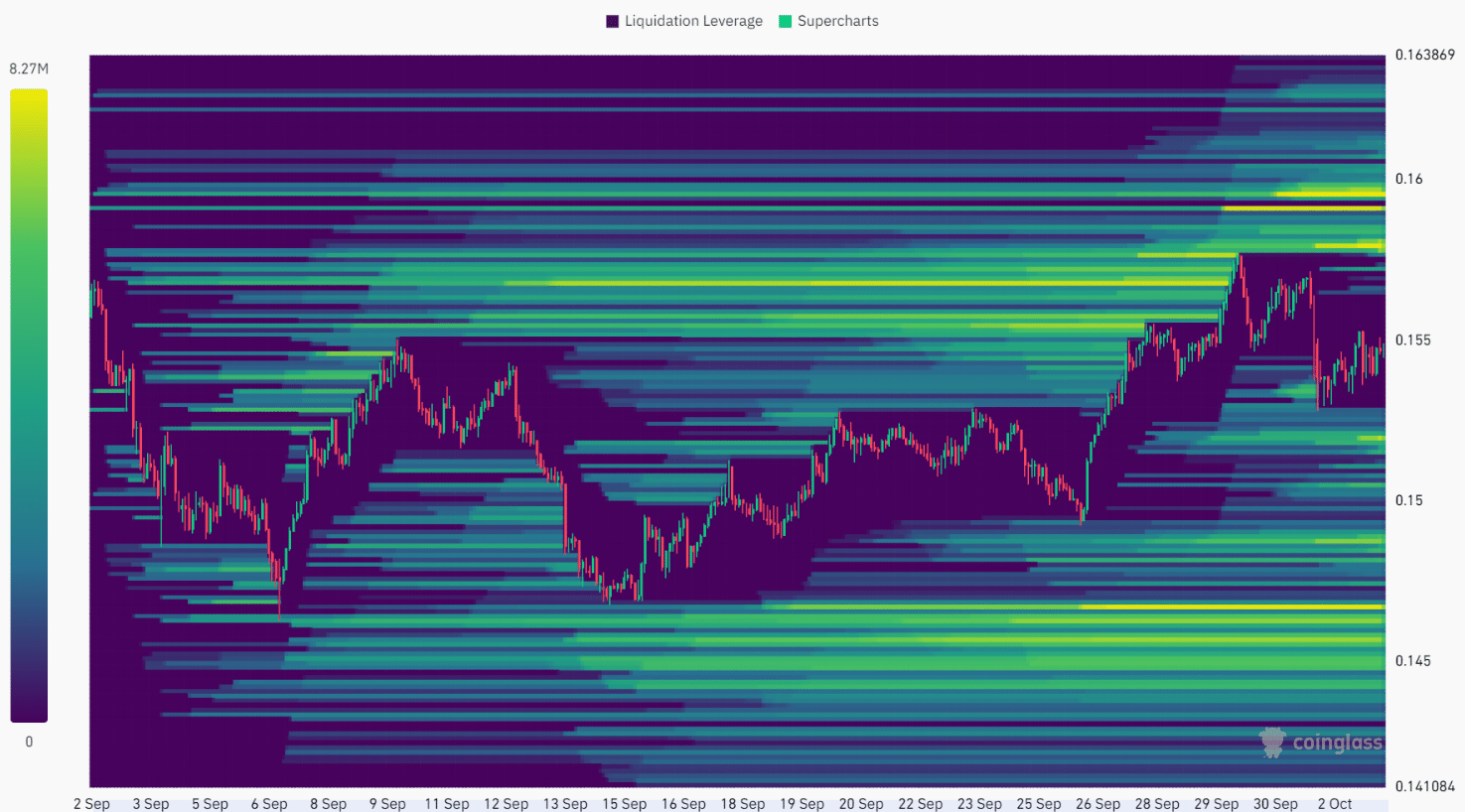

According to the liquidation heatmap, potential turning points for the asset’s price are anticipated at approximately $0.152 and $0.158. Over the next few days, it seems that a bullish trend might reverse around $0.152, while a bearish reversal could occur near $0.158.

Read TRON’s [TRX] Price Prediction 2024-25

Specifically, there seems to be a grouping of potential selling points near the $0.16 price point. These might draw prices towards them before a possible shift in the immediate trend’s direction occurs.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Gold Rate Forecast

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Solo Leveling Arise Tawata Kanae Guide

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- Jack Dorsey’s Block to use 10% of Bitcoin profit to buy BTC every month

- Elden Ring Nightreign Recluse guide and abilities explained

2024-10-03 20:07