- Flare crypto bulls attempted a breakout but faced rejection.

- The clues from the volume trends showed a sustained upward move and recovery was yet unlikely.

As a seasoned researcher with over a decade of experience in the cryptosphere, I’ve seen my fair share of bull runs and bear markets. The recent attempt by Flare [FLR] bulls to break out of their range was indeed promising, but alas, it seemed more like a dance than a leap.

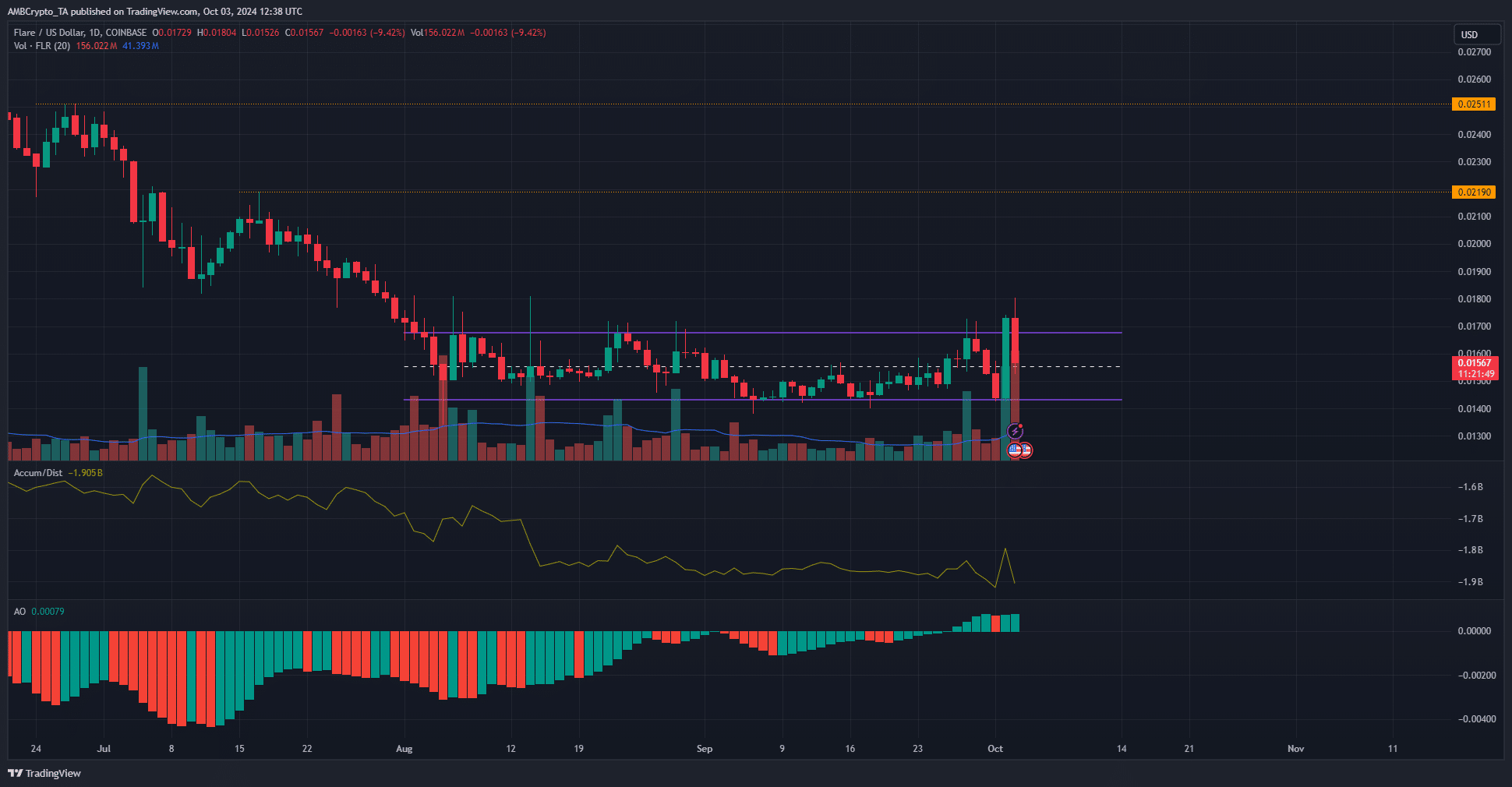

Since early August, FLR [FLR] has been moving within a defined price range. This range spans from approximately $0.0143 to $0.0167, with the middle point being at around $0.0155. Notably, on the 2nd of October, there was a significant increase in trading activity for this token.

This increase occurred together with a significant rise in costs. FLR soared from its lowest range to break out on the very same day, however, it has fallen further down since then.

Range breakout was denied emphatically

This price drop measured 12.42% from the local high of $0.018. It took FLR back into the range formation, retesting the mid-range level as support.

To determine if the price trend was expected to continue its upward surge, AMBCrypto examined the Accumulation/Distinction (A/D) indicator.

The A/D has been gradually decreasing since mid-August, and the rise observed yesterday failed to surpass the peaks reached in August.

Based on the signals I’ve observed from this volume indicator, it seems we’re looking at a bearish trend. It appears that Flare may not be preparing for a recovery to the levels seen in March.

Instead, we could say that the attempt to breach the price range was unsuccessful because the previous high prices within the range didn’t switch from being resistance (difficulty for the price to rise) to support (minimum price the price can hold).

There’s a chance that FLR bulls might succeed next time, but it’s crucial for both traders and long-term investors to exercise caution until the trading volume shows an uptrend.

Social activity swells following price activity

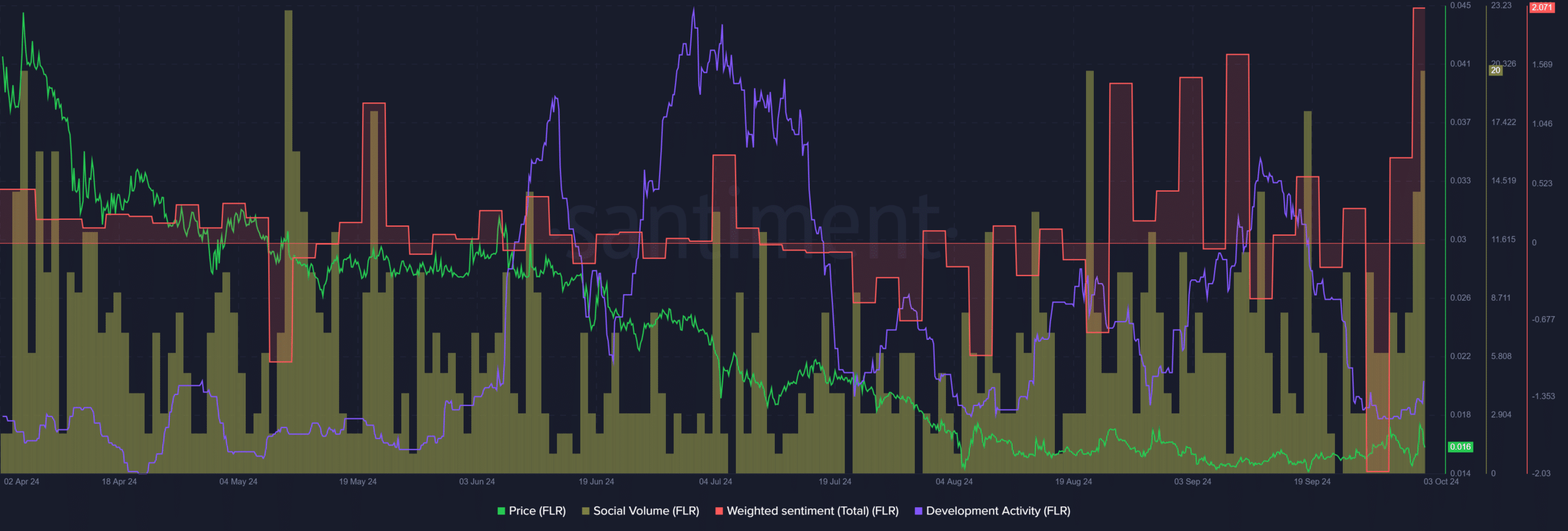

As a crypto investor, I’ve noticed an uptick in the positive sentiment surrounding our digital assets, soaring to levels last seen in January. This surge can be attributed to the overwhelmingly optimistic chatter on social media platforms following the successful Flare range breakout.

Realistic or not, here’s FLR’s market cap in BTC’s terms

The social volume also saw a noticeable growth.

In the past few weeks, the pace of growth has slowed significantly compared to its peak in July and September. This dip might concern long-term investors, hinting at potential future issues.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Florence Pugh’s Bold Shoulder Look Is Turning Heads Again—Are Deltoids the New Red Carpet Accessory?

- Quick Guide: Finding Garlic in Oblivion Remastered

- Katy Perry Shares NSFW Confession on Orlando Bloom’s “Magic Stick”

- BLUR PREDICTION. BLUR cryptocurrency

- Elon Musk’s Wild Blockchain Adventure: Is He the Next Digital Wizard?

- How Michael Saylor Plans to Create a Bitcoin Empire Bigger Than Your Wildest Dreams

- This School Girl Street Fighter 6 Anime Could Be the Hottest New Series of the Year

- Unforgettable Deaths in Middle-earth: Lord of the Rings’ Most Memorable Kills Ranked

2024-10-04 06:15