-

Cardano broke from a falling wedge, indicating a potential bullish reversal toward $0.380.

Indicators showed growing bullish momentum for ADA, with key resistance and support levels in focus.

As a seasoned analyst with over two decades of experience under my belt, I must say that the recent breakout from a falling wedge pattern by Cardano [ADA] has piqued my interest. This bullish reversal could potentially signal the beginning of an uptrend towards $0.380, a level last tested in mid-September.

In simpler terms, the cryptocurrency Cardano (ADA) has burst free from a “falling wedge” chart pattern, which is often a sign of a bullish turnaround. This pattern, marked by lower peaks and troughs, has been a significant clue suggesting an approaching uptrend might be on the horizon.

This sudden surge in ADA‘s price could indicate the conclusion of a lengthy downtrend, hinting that it may be transitioning into a more optimistic period.

Previously, when a falling wedge pattern broke out, it usually resulted in significant upward movement. If the current breakout resembles these historical trends, we can expect Cardano (ADA) to experience substantial price rises in the near future.

After a prolonged period of price decrease, a sudden increase (or “breakout”) might suggest that the selling pressure has lessened, allowing more buyers to re-enter the market.

Retest phase and critical support levels

After the surge past its previous high, ADA is currently in a period of reassessment, with its price slightly retreating to verify the breakout. This stage is significant because it frequently decides whether the breakout is genuine and if the price will continue to move upwards.

As a researcher, I can affirm that a successful retest will lend credence to the bullish momentum and boost the chances of additional upward price movements.

If ADA undergoes another test, it might lead to a significant surge in its value, possibly pushing the price up towards more challenging resistance points.

If the current support isn’t maintained, there’s a possibility of reverting back to earlier prices, causing further price stabilization. The significant resistance level for ADA lies approximately at $0.380, a level that was previously challenged around mid-September.

A breach of this level would signal the continuation of bullish momentum.

Large transactions and address activity decline

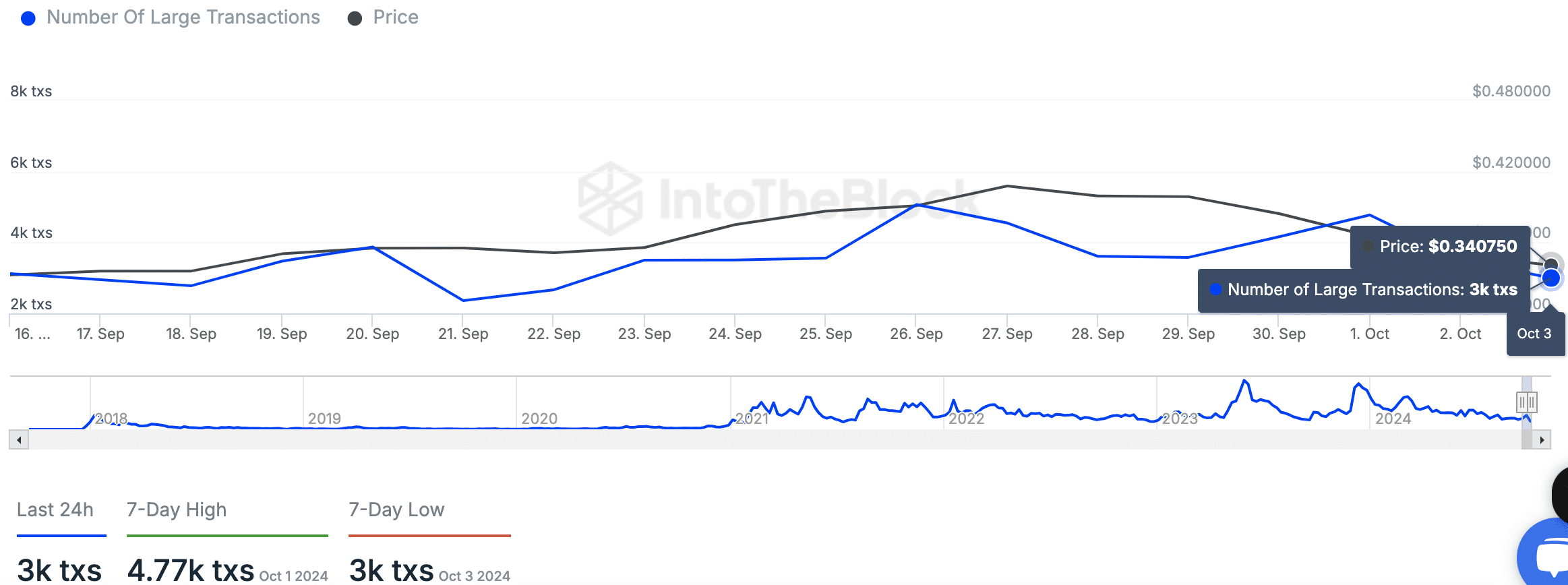

Based on information from IntoTheBlock, there were approximately 3,000 large transactions on Cardano as of late, which is lower than the 4,770 large transactions that occurred on October 1st, representing a seven-day low.

A decrease in big transactions might signal a short-term drop in whale involvement or institutional interest.

In many cases, price consolidation occurs after a significant decrease in major deals, making it an essential aspect to monitor as the market progresses.

As for network usage statistics, it’s worth noting that by October 3rd, a total of approximately 37,120 ADA addresses had been identified. Among these, 5,740 are newly created addresses, 24,370 are active addresses currently holding some amount of ADA, and 7,010 are accounts with no balance.

Read Cardano’s [ADA] Price Prediction 2024-25

Over the past week, every category has experienced a drop. Specifically, new addresses saw a decrease of 28.43%, while active addresses dipped by 19.32%. Additionally, the number of zero-balance addresses dropped by 27.34%.

This data indicates a short-term drop in total user interaction and system usage across the platform, potentially affecting immediate price fluctuations.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

2024-10-04 20:08