-

BTC fell by 6.31% over the past week.

An analyst noted further downside, citing the Pi Cycle MA.

As a seasoned researcher with years of experience in the crypto market, I have seen my fair share of price fluctuations and market trends. The recent decline in Bitcoin (BTC) over the past week has caught my attention, particularly considering October’s historical uptrend.

Typically, October sees a rise in Bitcoin‘s price, but contrary to this pattern, Bitcoin’s [BTC] recent fluctuations don’t seem to follow suit. Instead, it has undergone a steep drop over the last week. At the moment of writing, the value of Bitcoin stands at approximately $61,436.

This marked a 6.31% decline in weekly charts.

Over the last day, there’s been a modest increase of 0.92% in Bitcoin prices. On a broader monthly scale, Bitcoin has actually been rising, with a gain of 8.18%.

As a result, the ambiguity about price fluctuations within the cryptocurrency community has sparked discussions. One voice in this conversation is Rekt Capital, a well-known crypto analyst, who proposes that Bitcoin might continue to trend downwards.

A look at the market sentiment

According to Rekt Capital’s interpretation, Bitcoin appears to be consistently being turned away by the Moving Average (MA) based on the PI Cycle.

Based on this examination, if the PI Cycle MA is maintaining its role as resistance, Bitcoin (BTC) is likely to sustain a descending trend. This downward pattern will be reinforced if BTC touches the light blue downward trendline, particularly if the present trend remains consistent.

On the other hand, the analyst pointed out that despite the falling prices, investors appear to be stockpiling more Bitcoin. This is evidenced by the emergence of a 4-hour bullish divergence in its chart.

In this scenario, continual refusals at this stage suggest that buyers find it challenging to drive the price beyond the resistance level.

Consequently, each refusal I observe seems to strengthen the downward trend, underscoring the present challenge Bitcoin encounters in overcoming a resistance level, which in turn, momentarily halts its progression.

Given this scenario, it seems likely that Bitcoin’s price will continue dropping if the current market mood remains the same.

What do BTC charts suggest?

It’s worth noting that the analysis presented suggests a pessimistic view on Bitcoin. Yet, it’s crucial to consider what other market signals might be suggesting as well.

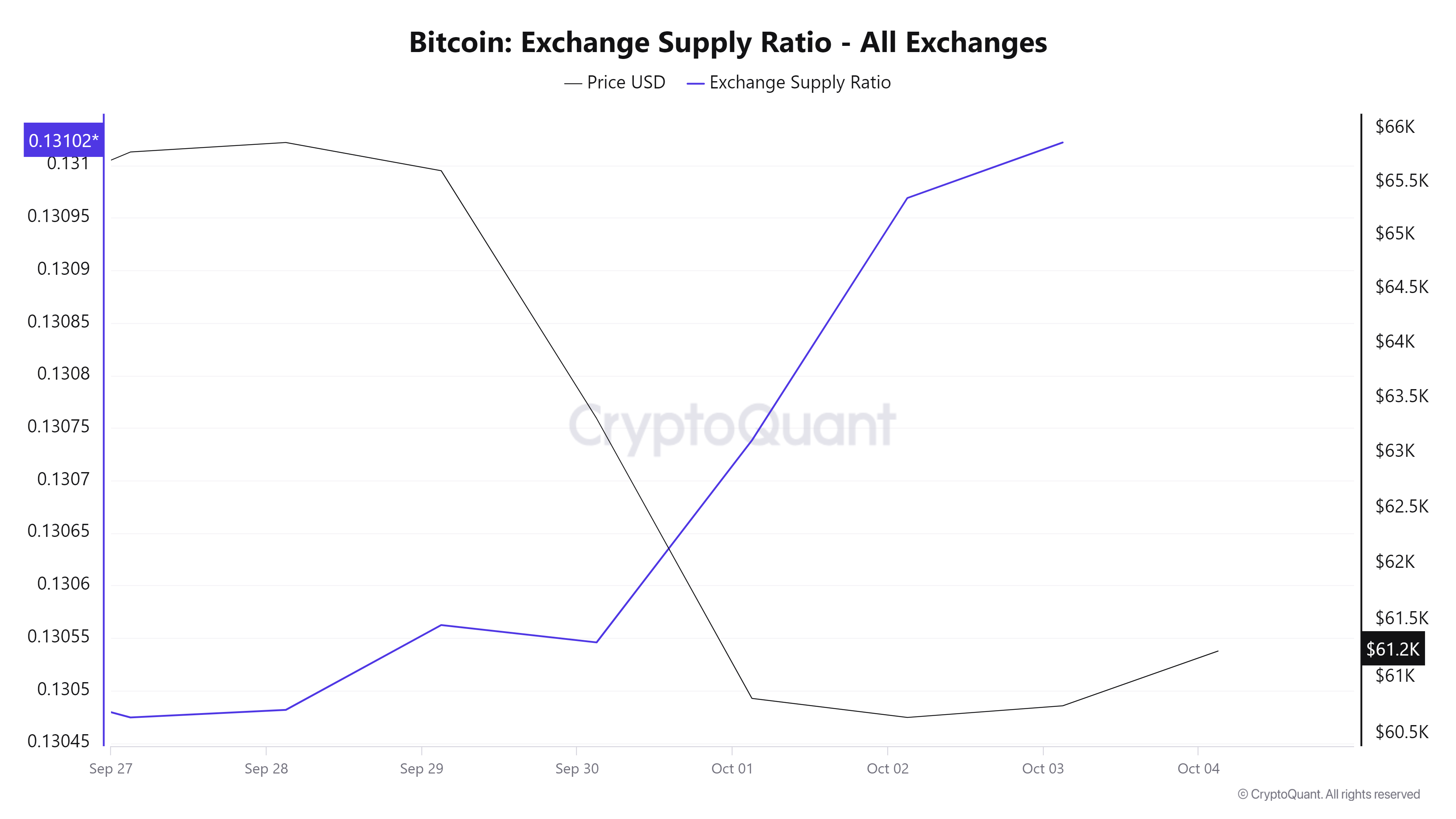

Over the last few days, the ratio of Bitcoins being traded has significantly increased, rising from 0.1304 to 0.131.

An increase in the availability of exchanges suggests that investors are transferring their holdings to these platforms with the intention of selling. This kind of investor activity can lead to a decrease in prices, particularly if selling becomes more frequent or aggressive.

Furthermore, the MVRV Long/Short gap for Bitcoin has been decreasing over the last week, falling from a peak of 4.3% down to 3.2%.

This drop indicates that long-term investors are becoming less confident, as their potential earnings decrease. The change implies a negative outlook, as these investors have fewer reasons to keep holding onto their investments.

Additionally, the hesitancy among investors is clearly demonstrated through a decrease in the number of active contracts, or Open Interest (OI), per exchange. The OI has dropped from $6.1 billion to $5.2 billion, indicating that investors are choosing to close their existing positions rather than opening new ones.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

Simply put, the current market sentiment is bearish.

Given these circumstances, it’s likely that Bitcoin will encounter its next potential support near the $58,272 resistance point. If there’s a shift in the trend, Bitcoin could regain the $62,700 level.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-10-04 23:04