-

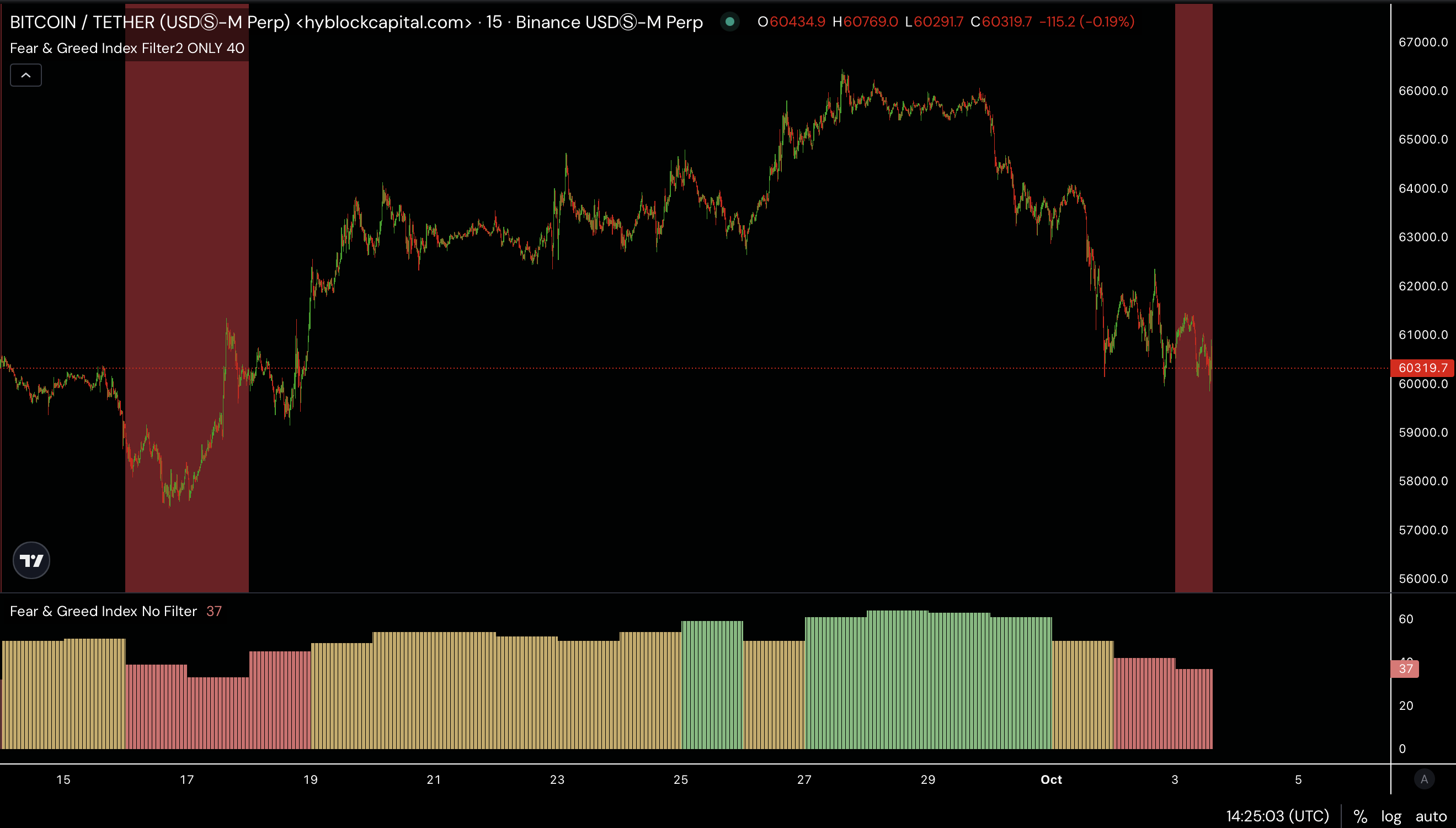

The market sentiment is back to fear for Bitcoin.

BTC holding above the mean threshold of the channel.

As a seasoned researcher with over two decades of experience in the financial markets, I’ve seen plenty of market cycles and learned to read between the lines.

The behavior of the cryptocurrency market is strongly influenced by worldwide occurrences, particularly Bitcoin [BTC], as emotions such as fear and greed frequently sway opinions within it.

Lately, tensions in global politics, especially in the Middle East, have caused concern among investors, leading them to view Bitcoin negatively and move it into a ‘fear’ category.

Historically, Bitcoin’s entry into what’s known as the “fear zone” has often presented a chance for investors to capitalize on fear by buying low and later selling high during times of greed. As we near the end of the year, the question on many minds is: could this be the right moment to invest in Bitcoin?

By the end of September, Bitcoin surpassed the $66K price point, causing a shift towards a neutral outlook. Yet, the escalating political conflicts between Israel and Iran have since undone this advancement, pulling Bitcoin back into the ‘fear zone’.

Although it’s currently facing challenges, the overall cryptocurrency market, encompassing Bitcoin, continues to hold above crucial support thresholds. This has led certain analysts to suggest that now could be an opportune moment to invest in Bitcoin, given expectations for potential growth over the next few months.

Bid-ask ratio insights

Examining the balance between bids and asks in the market can help identify if there are more buyers or sellers active. The latest figures suggest that offers to buy Bitcoin (spot bids) exceed requests to sell it (asks), suggesting that traders have been purchasing Bitcoin as the market has contracted, implying an accumulation trend.

It appears that the drop in price, primarily due to geopolitical conflicts, has created a short-term minimum near the $60,000 mark.

Bitcoin has been holding steady around this point, battling against selling pressure. As BTC begins to reclaim key moving averages, this could be a sign that now is the right time to buy.

BTC holding above the trend channel equilibrium

Bitcoin’s value has proven resilient even amidst obstacles, surging past $66K only to encounter pushback, yet persists in trading close to significant price points.

For more than seven months, Bitcoin’s price movement has been confined within a long-term channel. Lately, it appears to have found support close to the average boundary of this channel. If Bitcoin successfully breaks and maintains levels above the upper boundary of this channel, it may be on track to set new record highs.

If BTC doesn’t manage to breach the crucial resistance, it might continue to trade within a range for the remainder of the year instead.

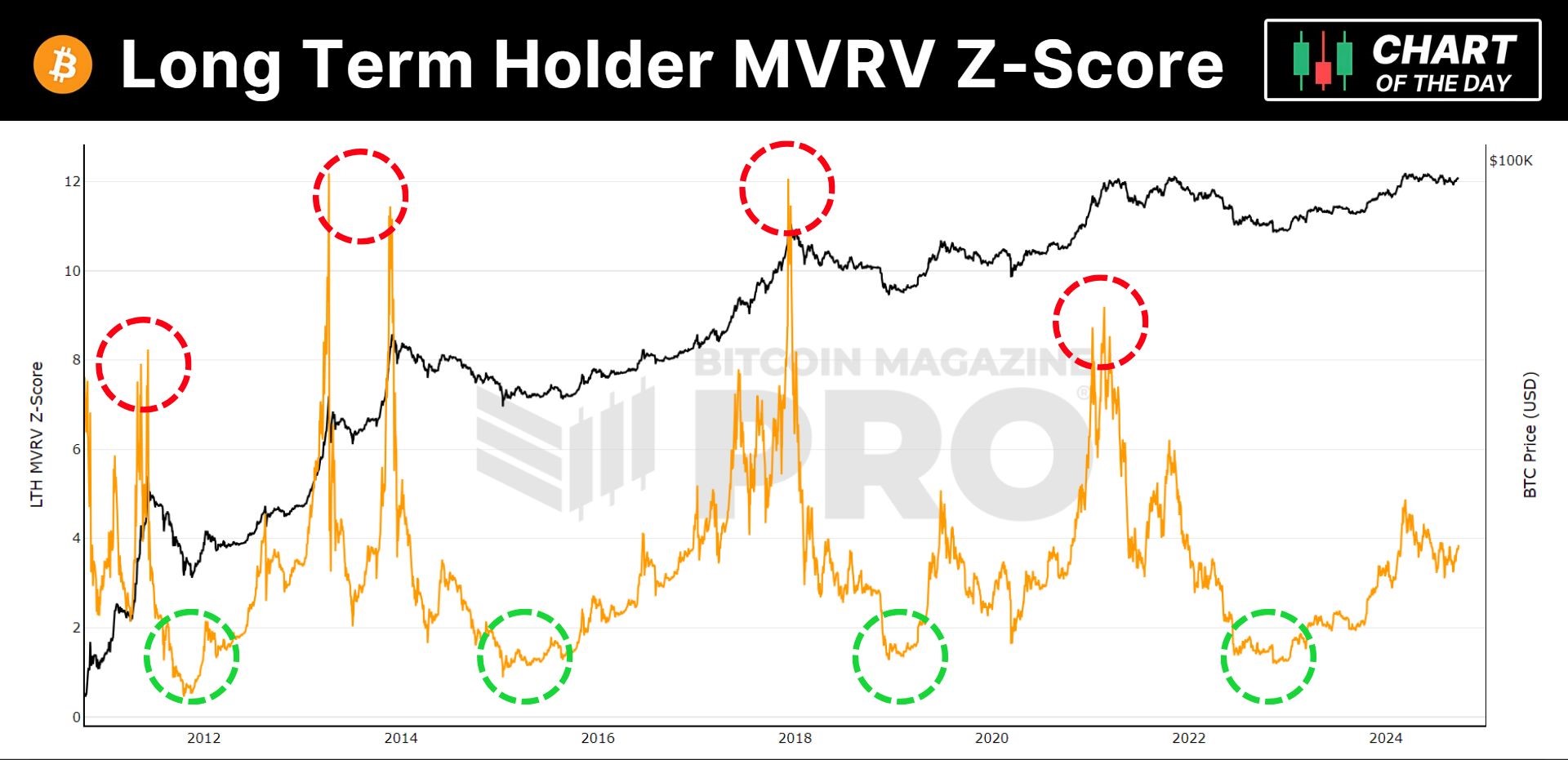

Long-Term holder MVRV Z-Score

One key metric that has proven effective in predicting Bitcoin market cycles is the Long-Term Holder MVRV Z-Score. This indicator highlights whether Bitcoin is overvalued or undervalued, offering insight into potential bottoms and peaks.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

At present, the Z-Score indicates that Bitcoin (BTC) may have a significant potential for price increase, implying that it might be opportune to invest, particularly since the market mood is largely fearful.

In light of widespread market anxiety, it could be an optimal moment to amass Bitcoins, as the current situation seems to point towards a possible rise in value. The trends, price movements, and the bid-ask spread all hint at potential growth, suggesting that now might be a good time for investors to ponder over purchasing Bitcoin before its price escalates further.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Solo Leveling Arise Tawata Kanae Guide

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- Planet Coaster 2 Interview – Water Parks, Coaster Customization, PS5 Pro Enhancements, and More

- New Mickey 17 Trailer Highlights Robert Pattinson in the Sci-Fi “Masterpiece”

2024-10-05 08:08