- Solana and Ethereum have both held significant milestones while fostering a competitive rivalry

- However, a recent event may exacerbate tensions between the two

As a seasoned analyst with over two decades of experience in the tech and finance industries, I have witnessed countless rivalries that have shaped markets and disrupted established norms. The competition between Solana (SOL) and Ethereum (ETH), two pioneering blockchain platforms, is one such spectacle that has captured my attention.

According to its latest report, Swiss cryptocurrency bank Sygnum spotlighted Solana (SOL) as the strongest competitor to Ethereum (ETH) within the financial industry, offering a promising replacement for multiple deployments and advancement milestones.

Frequently known as a potential rival to Ethereum, Solana has been making strides by capitalizing on Ethereum’s vulnerabilities to carve out its own niche and compete effectively.

Despite a substantial market capitalization disparity of approximately $218 billion, Ether consistently outperforms Solana. Interestingly, Solana’s price in relation to Ether has increased by an impressive 300% over the past year. So, what factors might have caused this growth spurt?

Solana’s strong foothold in the finance sector

Approximately two years ago, a comparable competition between Solana (SOL) and Ethereum (ETH) started to unfold following Solana’s collaboration with Visa. At that point, Solana had been adopted for handling USD Coin transactions, boasting its high transaction speed and low costs.

Lately, the positive trend received additional support with the news that Franklin Templeton plans to introduce a mutual fund focused on the Solana blockchain platform.

Due to Solana’s increasing prowess in the financial industry, the Swiss bank views the blockchain as a significant competitor that could potentially outmatch Ethereum in the future.

Although it’s uncertain exactly when this transition will take place, Solana is definitely narrowing the difference between itself and Ethereum in numerous aspects.

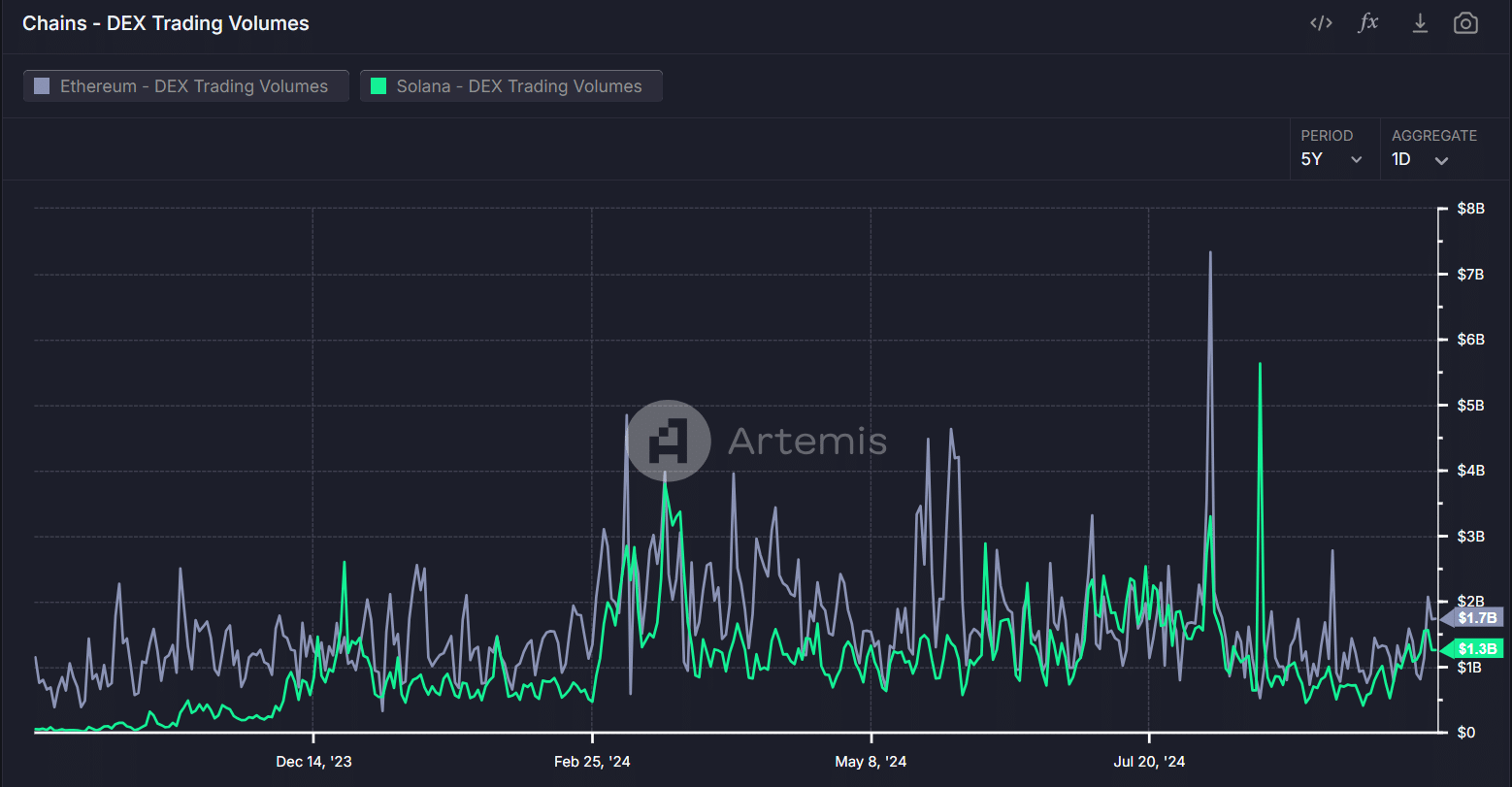

Initially, the trading volume on Ethereum’s decentralized exchanges (DEX) decreased from $2 billion in August to approximately $1.7 billion currently. However, it’s worth noting that Solana’s DEX volume has remained consistent and even shown growth over the same period.

Source : Artemis Terminal

To put it simply, partnering with big-name financial entities like Visa has boosted Solana’s exposure, attracting potential new investors and posing a competitive challenge to Ethereum’s current market dominance.

In addition to these partnerships, the continued analysis of Solana versus Ethereum is bolstered by a thoughtfully designed approach. This methodology intends to surpass the five-year senior Ethereum blockchain.

Solana capitalizes on Ethereum’s shortcomings

As a keen observer, I can’t help but note the allure of Solana’s infrastructure, which effectively delivers high transaction speeds at minimal costs. This appealing combination makes it an enticing choice for both users and developers.

Instead, it’s worth noting that Ethereum encounters issues with expensive transaction fees, or ‘gas costs’, which may discourage some users from interacting within its system.

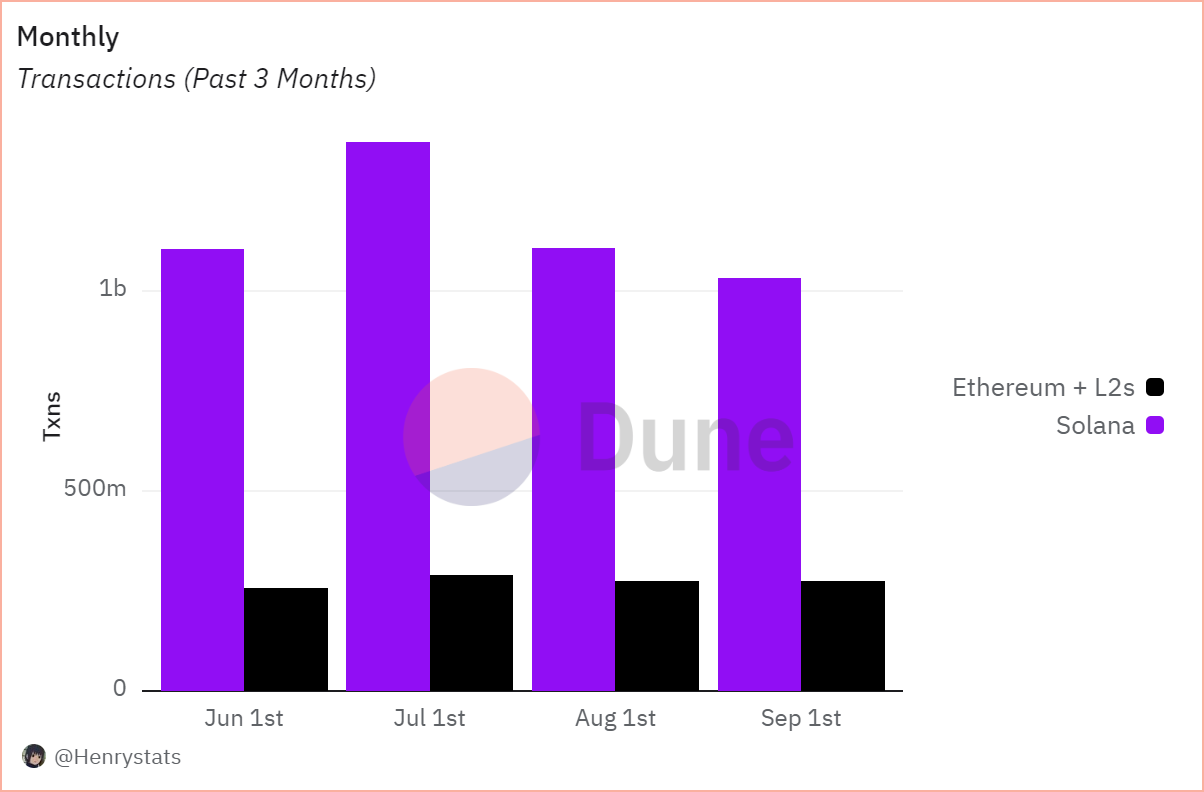

Source : Dune

As a researcher, I’ve noticed an intriguing contrast between the two networks: Solana and Ethereum. While my studies show that Solana’s monthly transactions have soared beyond the billion mark, Ethereum appears to be experiencing relatively low network activity, with transactional volume barely reaching 200 million.

It’s evident that the expensive transaction fees on Ethereum have encouraged many users to switch over to Solana, which offers quicker transactions at more affordable rates.

Read Solana’s [SOL] Price Prediction 2024–2025

To sum up, Solana has made impressive strides in the four years since it began operation. Yet, although Solana shines in certain aspects, Ethereum continues to hold its ground and is leading in other areas.

In essence, to establish a real challenge against Ethereum, Solana needs to create groundbreaking decentralized apps that foster mass acceptance – an aspect where Ethereum is now dominant.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Solo Leveling Arise Tawata Kanae Guide

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- Planet Coaster 2 Interview – Water Parks, Coaster Customization, PS5 Pro Enhancements, and More

- New Mickey 17 Trailer Highlights Robert Pattinson in the Sci-Fi “Masterpiece”

2024-10-05 09:12