-

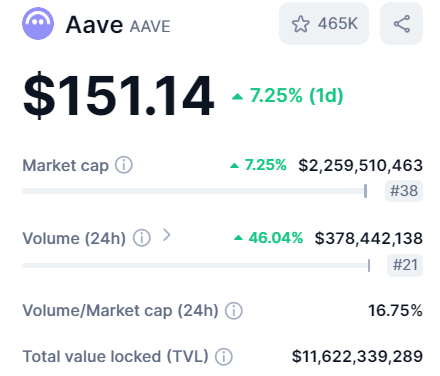

At press time, AAVE was up by more than 7% in the last 24 hours

Altcoin seemed to form a double bottom as longs flipped shorts accounts

As a seasoned researcher with years of experience under my belt, I have seen the crypto market evolve and adapt like no other. And let me tell you, Aave (AAVE) is one of those rare gems that has consistently shown resilience and growth.

Aave (AAVE) is currently one of the leading decentralized finance (DeFi) platforms, demonstrating considerable power recently. In fact, earlier this year, AAVE managed to break free from a certain price range, and at present, it’s among the largest increases, rising more than 7% in the last day.

This increase also boosted its total value on the stock market by the same proportion. Furthermore, the number of shares traded jumped by 46%, causing a volume-to-market cap ratio of approximately 16.75%.

This ratio points to a strong investment opportunity, especially as it suggests that AAVE has sufficient liquidity to prevent frequent price swings. The total value locked (TVL) on the platform has been impressive too, with $11 billion in assets secured within Aave.

AAVE’s potential bottom and prediction

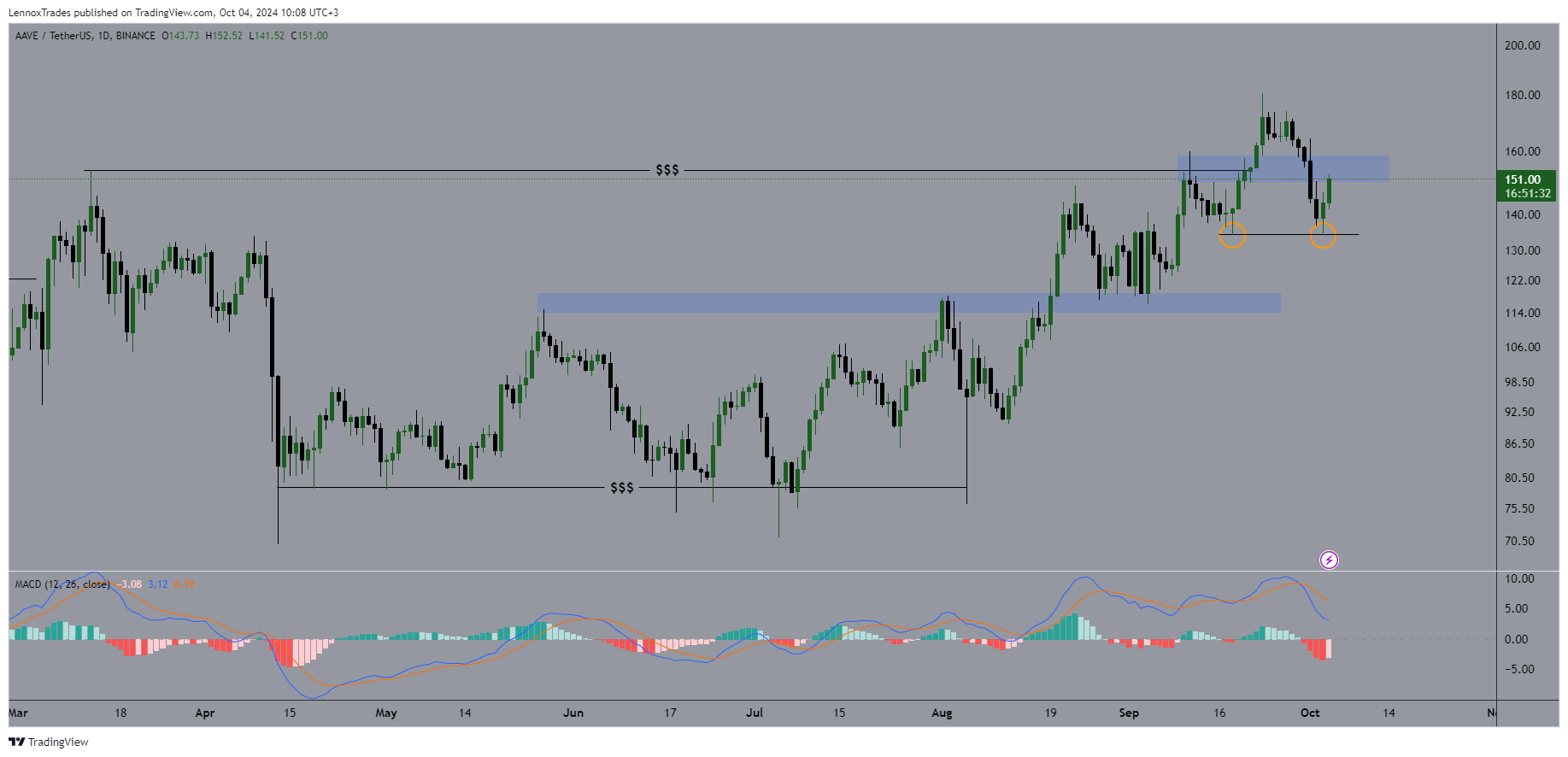

Considering the recent advancements, it’s clear that the price action for AAVE/USDT has been predominantly bullish this year. Notably, the altcoin’s value has persistently formed new highs and new highs, indicating a steady upward trajectory since escaping its previous price range.

At the $140 price point, a double base has developed, implying the possibility of additional growth for the cryptocurrency. In Q4 this year, it may even regain the $200 price range.

Currently exceeding $150 in value, traders are increasingly hopeful that it will surpass its latest high points. If it does, this breakthrough could significantly boost the chances of hitting the projected $200 mark, given the ongoing positive trends in the broader market scenario.

AAVE’s Long/Short account flips bullish

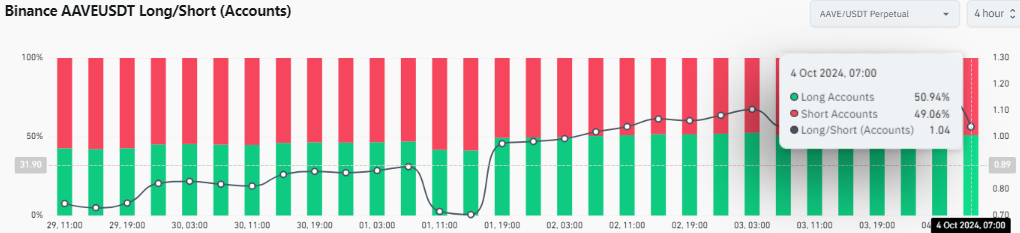

Let’s delve deeper into the altcoin’s prospects by examining the balance between long and short positions. As I type this, it appears that about 51% of investors are holding long positions, whereas short positions account for around 49%.

As a crypto investor, I’ve noticed a significant change – it seems like the balance is tilting back in favor of the buyers, following a phase where short positions held sway during market corrections.

As shorts begin to lose influence, the ratio will likely to continue favoring longs, reinforcing the idea that AAVE is on track to hit the $200 target the next time it moves up.

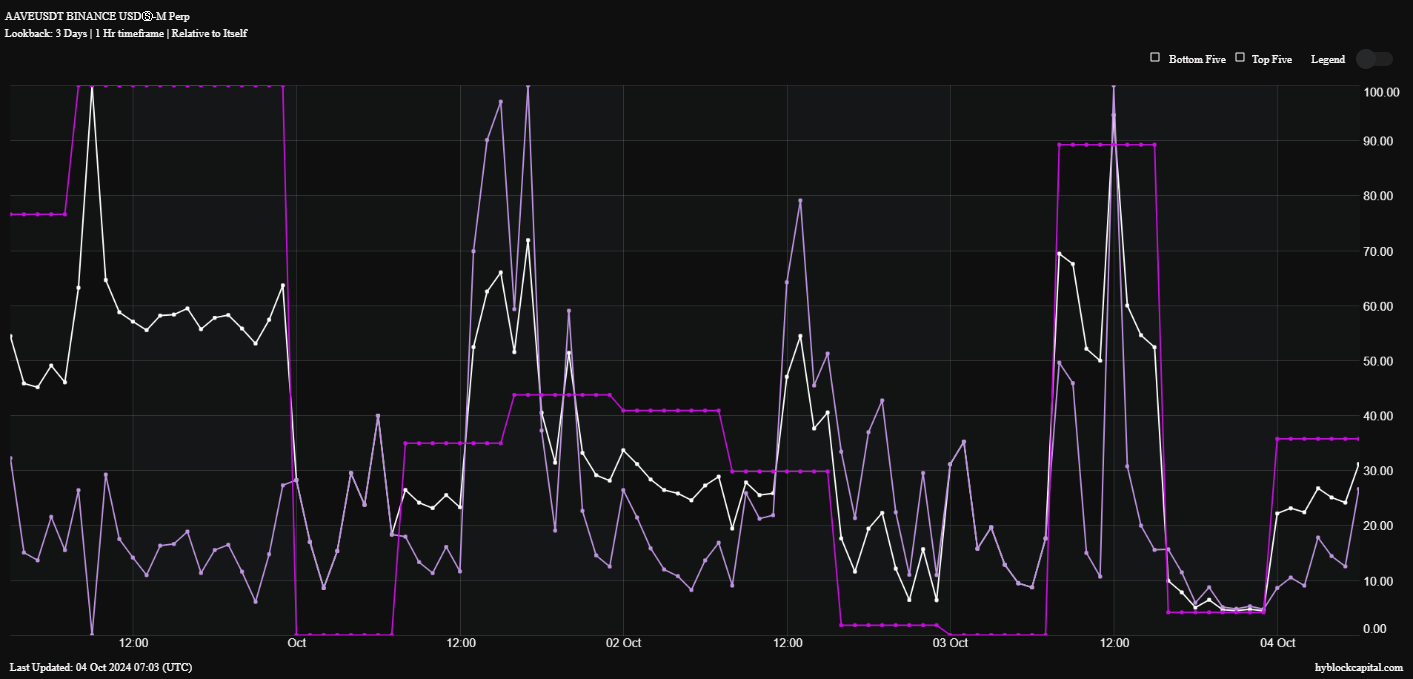

Buy volume and funding rates in recovery

Ultimately, it appears that purchase activity and financing costs have been increasing, moving away from their recent lows following market adjustments. Interestingly, these figures seem to be nearing the 30th percentile, contributing significantly to a worldwide average of around 30%.

The enhancement in these statistics bolsters the idea of a rising trend, potentially allowing AAVE to regain the $200 mark. Given its current performance and crucial factors, it seems that the crypto could be well-positioned for significant development in the near future.

Given adequate funds, an optimistic market trend, and favorable balances in long and short positions, AAVE seems poised for potential growth and reaching higher price milestones in the coming days.

As always, investors should remain cautious, keeping an eye on market conditions and broader trends to make informed decisions.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Clarkson’s Farm Season 5: What We Know About the Release Date and More!

- Planet Coaster 2 Interview – Water Parks, Coaster Customization, PS5 Pro Enhancements, and More

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

2024-10-05 10:15